he Hartford earns an overall MoneyGeek score of 4.7 out of 5 and ranks as the best business insurance provider among carriers in our analysis across 79 industries. You'll benefit from affordable rates and excellent customer service, though you'll find fewer add-on options than some competitors offer.

The Hartford Business Insurance Review

The Hartford ranks first in MoneyGeek's study with a score of 4.7 out of 5. It's excellent for affordability and service but has fewer add-on options.

Discover the best cheap business insurance from The Hartford below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Small businesses pay an average of $85 monthly ($1,024 annually) for The Hartford business insurance, ranking first in our study for affordability.

The Hartford ranks second for customer experience, excelling in claims processing and customer service quality.

It offers fewer policy add-ons than competitors, ranking fourth for coverage options.

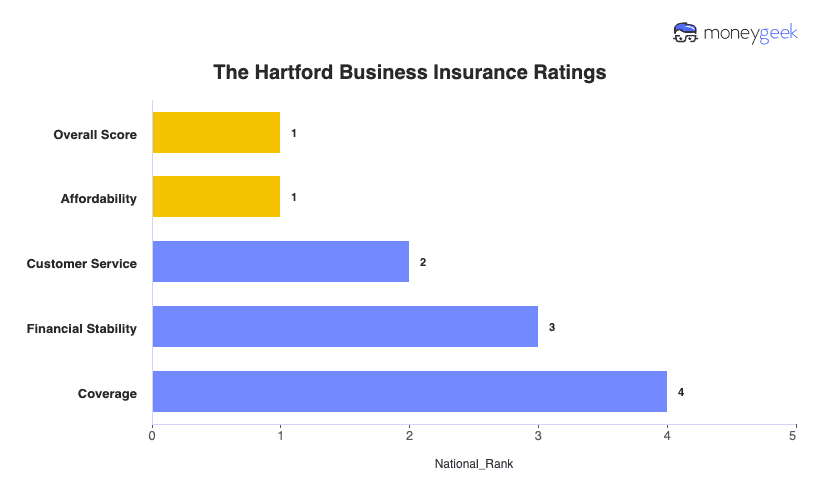

The Hartford Business Insurance Ratings

| Overall Score | 4.7 | 1 |

| Financial Stability | 5 | 3 |

| Customer Service | 4.55 | 2 |

| Coverage | 4.7 | 4 |

| Affordability | 4.8 | 1 |

Note: These scores reflect what you can expect as a small business with two employees. We analyzed 79 industries, focusing on four essential coverage types: general liability, professional liability, workers' compensation and business owner's policies.

Get Matched To The Best Business Insurer For You

Select your industry and state to get a customized company match.

To ensure you're making the right choice for your business, we've linked our reviews to The Hartford's competitors so you can compare:

The Hartford Business Insurance Ratings by Industry

The Hartford ranks first overall in 44 of 79 industries in our study, making it an excellent choice when your comparing different insurance providers for your business. It leads in affordability for most businesses (ranking second only for moving companies, security guards and towing) and excels across the board for customer service, coverage and financial stability.

| Accountants | 4.78 | 1 | 1 | 1 | 1 |

| Ad Agency | 4.78 | 1 | 1 | 1 | 1 |

| Automotive | 4.71 | 1 | 1 | 1 | 1 |

| Auto Repair | 4.69 | 1 | 1 | 1 | 1 |

| Bakery | 4.78 | 1 | 1 | 1 | 1 |

| Barber | 4.73 | 1 | 1 | 1 | 1 |

| Beauty Salon | 4.72 | 1 | 1 | 1 | 1 |

| Bounce House | 4.78 | 1 | 1 | 1 | 1 |

| Candle | 4.74 | 1 | 1 | 1 | 1 |

| Cannabis | 4.78 | 1 | 1 | 1 | 1 |

| Catering | 4.67 | 1 | 1 | 1 | 1 |

| Cleaning | 4.60 | 1 | 1 | 1 | 1 |

| Coffee Shop | 4.67 | 1 | 1 | 1 | 1 |

| Computer Programming | 4.78 | 1 | 1 | 1 | 1 |

| Computer Repair | 4.64 | 1 | 1 | 1 | 1 |

| Construction | 4.57 | 7 | 1 | 1 | 1 |

| Consulting | 4.78 | 1 | 1 | 1 | 1 |

| Contractor | 4.74 | 1 | 1 | 1 | 1 |

| Courier | 4.78 | 1 | 1 | 1 | 1 |

| Daycare | 4.78 | 1 | 1 | 1 | 1 |

| Dental | 4.75 | 1 | 1 | 1 | 1 |

| DJ | 4.73 | 1 | 1 | 1 | 1 |

| Dog Grooming | 4.67 | 1 | 1 | 1 | 1 |

| Drone | 4.78 | 1 | 1 | 1 | 1 |

| Ecommerce | 4.59 | 1 | 1 | 1 | 1 |

| Electrical | 4.70 | 1 | 1 | 1 | 1 |

| Engineering | 4.73 | 1 | 1 | 1 | 1 |

| Excavation | 4.77 | 1 | 1 | 1 | 1 |

| Florist | 4.61 | 1 | 1 | 1 | 1 |

| Food | 4.62 | 1 | 1 | 1 | 1 |

| Food Truck | 4.70 | 1 | 1 | 1 | 1 |

| Funeral Home | 4.78 | 1 | 1 | 1 | 1 |

| Gardening | 4.62 | 1 | 1 | 1 | 1 |

| Handyman | 4.75 | 1 | 1 | 1 | 1 |

| Home-based | 4.68 | 1 | 1 | 1 | 1 |

| Home-based business | 4.78 | 1 | 1 | 1 | 1 |

| Hospitality | 4.66 | 1 | 1 | 1 | 1 |

| HVAC | 4.52 | 5 | 1 | 1 | 1 |

| Janitorial | 4.64 | 1 | 1 | 1 | 1 |

| Jewelry | 4.76 | 1 | 1 | 1 | 1 |

| Junk Removal | 4.78 | 1 | 1 | 1 | 1 |

| Lawn/Landscaping | 4.63 | 1 | 1 | 1 | 1 |

| Lawyers | 4.78 | 1 | 1 | 1 | 1 |

| Manufacturing | 4.78 | 1 | 1 | 1 | 1 |

| Marine | 4.78 | 1 | 1 | 1 | 1 |

| Massage | 4.70 | 1 | 1 | 1 | 1 |

| Mortgage Broker | 4.78 | 1 | 1 | 1 | 1 |

| Moving | 4.78 | 1 | 1 | 1 | 1 |

| Nonprofit | 4.75 | 1 | 1 | 1 | 1 |

| Painting | 4.55 | 5 | 1 | 1 | 1 |

| Party Rental | 4.78 | 1 | 1 | 1 | 1 |

| Personal Training | 4.78 | 1 | 1 | 1 | 1 |

| Pest Control | 4.78 | 1 | 1 | 1 | 1 |

| Pet | 4.74 | 1 | 1 | 1 | 1 |

| Pharmacy | 4.78 | 1 | 1 | 1 | 1 |

| Photography | 4.75 | 1 | 1 | 1 | 1 |

| Physical Therapy | 4.78 | 1 | 1 | 1 | 1 |

| Plumbing | 4.78 | 1 | 1 | 1 | 1 |

| Pressure Washing | 4.61 | 1 | 1 | 1 | 1 |

| Real Estate | 4.71 | 1 | 1 | 1 | 1 |

| Restaurant | 4.68 | 1 | 1 | 1 | 1 |

| Retail | 4.67 | 1 | 1 | 1 | 1 |

| Roofing | 4.65 | 1 | 1 | 1 | 1 |

| Security | 4.60 | 1 | 1 | 1 | 1 |

| Snack Bars | 4.78 | 1 | 1 | 1 | 1 |

| Software | 4.78 | 1 | 1 | 1 | 1 |

| Spa/Wellness | 4.58 | 1 | 1 | 1 | 1 |

| Speech Therapist | 4.78 | 1 | 1 | 1 | 1 |

| Startup | 4.69 | 1 | 1 | 1 | 1 |

| Tech/IT | 4.78 | 1 | 1 | 1 | 1 |

| Transportation | 4.78 | 1 | 1 | 1 | 1 |

| Travel | 4.78 | 1 | 1 | 1 | 1 |

| Tree Service | 4.65 | 1 | 1 | 1 | 1 |

| Trucking | 4.78 | 1 | 1 | 1 | 1 |

| Tutoring | 4.72 | 1 | 1 | 1 | 1 |

| Veterinary | 4.66 | 1 | 1 | 1 | 1 |

| Wedding Planning | 4.74 | 1 | 1 | 1 | 1 |

| Welding | 4.78 | 1 | 1 | 1 | 1 |

| Wholesale | 4.73 | 1 | 1 | 1 | 1 |

| Window Cleaning | 4.60 | 1 | 1 | 1 | 1 |

Note: These scores reflect what you can expect as a small business with two employees. We analyzed 79 industries, focusing on four essential coverage types: general liability, professional liability, workers' compensation and business owner's policies.

The Hartford Business Insurance Ratings by State

The Hartford offers business insurance in 48 states, ranking first in 17 and second for the rest. Our study shows it's the most affordable option in 36 states and the second cheapest in 12. It consistently leads for financial stability across all states, but ranks second for customer service and third for coverage nationwide.

| Alabama | 4.65 | 1 | 2 | 3 | 1 |

| Arizona | 4.61 | 2 | 2 | 3 | 1 |

| Arkansas | 4.62 | 2 | 2 | 3 | 1 |

| California | 4.62 | 2 | 2 | 3 | 1 |

| Colorado | 4.65 | 1 | 2 | 3 | 1 |

| Connecticut | 4.63 | 2 | 2 | 3 | 1 |

| Delaware | 4.61 | 2 | 2 | 3 | 1 |

| Florida | 4.59 | 2 | 2 | 3 | 1 |

| Georgia | 4.62 | 1 | 2 | 3 | 1 |

| Idaho | 4.60 | 2 | 2 | 3 | 1 |

| Illinois | 4.63 | 1 | 2 | 3 | 1 |

| Indiana | 4.64 | 1 | 2 | 3 | 1 |

| Iowa | 4.66 | 1 | 2 | 3 | 1 |

| Kansas | 4.63 | 1 | 2 | 3 | 1 |

| Kentucky | 4.62 | 1 | 2 | 3 | 1 |

| Louisiana | 4.61 | 2 | 2 | 3 | 1 |

| Maine | 4.58 | 2 | 2 | 3 | 1 |

| Maryland | 4.64 | 1 | 2 | 3 | 1 |

| Massachusetts | 4.61 | 2 | 2 | 3 | 1 |

| Michigan | 4.61 | 2 | 2 | 3 | 1 |

| Minnesota | 4.61 | 2 | 2 | 3 | 1 |

| Mississippi | 4.62 | 2 | 2 | 3 | 1 |

| Missouri | 4.59 | 2 | 2 | 3 | 1 |

| Montana | 4.62 | 1 | 2 | 3 | 1 |

| Nebraska | 4.64 | 1 | 2 | 3 | 1 |

| Nevada | 4.63 | 1 | 2 | 3 | 1 |

| New Hampshire | 4.62 | 2 | 2 | 3 | 1 |

| New Jersey | 4.61 | 2 | 2 | 3 | 1 |

| New Mexico | 4.65 | 1 | 2 | 3 | 1 |

| New York | 4.61 | 2 | 2 | 3 | 1 |

| North Carolina | 4.59 | 2 | 2 | 3 | 1 |

| North Dakota | 4.63 | 2 | 2 | 3 | 1 |

| Ohio | 4.63 | 2 | 2 | 3 | 1 |

| Oklahoma | 4.65 | 1 | 2 | 3 | 1 |

| Oregon | 4.61 | 2 | 2 | 3 | 1 |

| Pennsylvania | 4.61 | 2 | 2 | 3 | 1 |

| Rhode Island | 4.62 | 2 | 2 | 3 | 1 |

| South Carolina | 4.61 | 2 | 2 | 3 | 1 |

| South Dakota | 4.60 | 2 | 2 | 3 | 1 |

| Tennessee | 4.60 | 2 | 2 | 3 | 1 |

| Texas | 4.63 | 2 | 2 | 3 | 1 |

| Utah | 4.60 | 2 | 2 | 3 | 1 |

| Vermont | 4.61 | 2 | 2 | 3 | 1 |

| Virginia | 4.61 | 2 | 2 | 3 | 1 |

| Washington | 4.64 | 1 | 2 | 3 | 1 |

| West Virginia | 4.60 | 2 | 2 | 3 | 1 |

| Wisconsin | 4.61 | 1 | 2 | 3 | 1 |

| Wyoming | 4.65 | 1 | 2 | 3 | 1 |

Note: These scores reflect what you can expect as a small business with two employees. We analyzed 79 industries, focusing on four essential coverage types: general liability, professional liability, workers' compensation and business owner's policies.

How Much Does The Hartford Business Insurance Cost?

The cost of business insurance from The Hartford averages $85 monthly ($1,024 annually) for small businesses. Rates vary significantly based on your coverage choices, ranging from $70 to $115 monthly depending on what protection you need.

| Business Owners Policies | $115 | $1,382 |

| General Liability | $83 | $1,001 |

| Professional Liability (E&O) | $72 | $858 |

| Workers Compensation | $70 | $839 |

Note: These rates reflect quotes we gathered for businesses similar to yours: two employees, $300,000 annual revenue and $150,000 payroll across four coverage types.

Business insurance costs vary widely across different coverage types. Our cost guides help you see what affects your premium so you can budget better for your insurance needs:

How Much Does The Hartford Business Insurance Cost by Industry?

Your rates depend on your industry's risk level. The Hartford's business insurance ranges from $22 monthly for low-risk businesses like DJs to $561 monthly for high-risk operations like pressure washing, making it an affordable business insurance choice.

| Accountants | $48 | $577 |

| Ad Agency | $52 | $629 |

| Auto Repair | $127 | $1,519 |

| Automotive | $67 | $807 |

| Bakery | $66 | $792 |

| Barber | $31 | $366 |

| Beauty Salon | $46 | $555 |

| Bounce House | $57 | $680 |

| Candle | $44 | $527 |

| Cannabis | $79 | $953 |

| Catering | $68 | $812 |

| Cleaning | $85 | $1,024 |

| Coffee Shop | $71 | $847 |

| Computer Programming | $40 | $485 |

| Computer Repair | $43 | $513 |

| Construction | $143 | $1,710 |

| Consulting | $41 | $496 |

| Contractor | $176 | $2,114 |

| Courier | $178 | $2,131 |

| DJ | $23 | $271 |

| Daycare | $43 | $521 |

| Dental | $35 | $424 |

| Dog Grooming | $57 | $678 |

| Drone | $38 | $457 |

| Ecommerce | $53 | $632 |

| Electrical | $84 | $1,011 |

| Engineering | $53 | $631 |

| Excavation | $312 | $3,743 |

| Florist | $45 | $534 |

| Food | $89 | $1,067 |

| Food Truck | $92 | $1,109 |

| Funeral Home | $53 | $635 |

| Gardening | $71 | $847 |

| HVAC | $163 | $1,961 |

| Handyman | $144 | $1,722 |

| Home-based | $22 | $259 |

| Hospitality | $64 | $762 |

| Janitorial | $89 | $1,064 |

| Jewelry | $33 | $399 |

| Junk Removal | $125 | $1,494 |

| Lawn/Landscaping | $80 | $963 |

| Lawyers | $56 | $670 |

| Manufacturing | $39 | $472 |

| Marine | $68 | $815 |

| Massage | $72 | $870 |

| Mortgage Broker | $52 | $622 |

| Moving | $136 | $1,635 |

| Nonprofit | $36 | $436 |

| Painting | $115 | $1,376 |

| Party Rental | $62 | $739 |

| Personal Training | $33 | $398 |

| Pest Control | $53 | $635 |

| Pet | $43 | $513 |

| Pharmacy | $44 | $528 |

| Photography | $28 | $341 |

| Physical Therapy | $37 | $442 |

| Plumbing | $206 | $2,477 |

| Pressure Washing | $561 | $6,737 |

| Real Estate | $60 | $718 |

| Restaurant | $101 | $1,218 |

| Retail | $51 | $607 |

| Roofing | $433 | $5,202 |

| Security | $103 | $1,233 |

| Snack Bars | $76 | $917 |

| Software | $37 | $443 |

| Spa/Wellness | $80 | $956 |

| Speech Therapist | $39 | $470 |

| Startup | $34 | $408 |

| Tech/IT | $39 | $462 |

| Transportation | $92 | $1,105 |

| Travel | $33 | $402 |

| Tree Service | $130 | $1,554 |

| Trucking | $135 | $1,617 |

| Tutoring | $27 | $321 |

| Veterinary | $55 | $655 |

| Wedding Planning | $34 | $403 |

| Welding | $127 | $1,522 |

| Wholesale | $47 | $562 |

| Window Cleaning | $140 | $1,679 |

Note: These rates reflect quotes we gathered for businesses like yours: two employees, $300,000 annual revenue and $150,000 payroll across four core coverage types.

How Much Does The Hartford Business Insurance Cost by State?

The Hartford business insurance rates vary by state due to different insurance regulations, natural disaster risks and local lawsuit patterns. You'll pay as little as $73 monthly in North Carolina or up to $102 monthly in Nevada.

| Alabama | $87 | $1,050 |

| Arizona | $84 | $1,006 |

| Arkansas | $81 | $970 |

| California | $94 | $1,122 |

| Colorado | $83 | $993 |

| Connecticut | $92 | $1,099 |

| Delaware | $96 | $1,150 |

| Florida | $91 | $1,090 |

| Georgia | $85 | $1,020 |

| Idaho | $80 | $954 |

| Illinois | $92 | $1,098 |

| Indiana | $82 | $985 |

| Iowa | $80 | $962 |

| Kansas | $82 | $978 |

| Kentucky | $83 | $996 |

| Louisiana | $98 | $1,173 |

| Maine | $74 | $886 |

| Maryland | $80 | $959 |

| Massachusetts | $88 | $1,054 |

| Michigan | $79 | $951 |

| Minnesota | $78 | $941 |

| Mississippi | $84 | $1,013 |

| Missouri | $88 | $1,053 |

| Montana | $83 | $998 |

| Nebraska | $79 | $952 |

| Nevada | $102 | $1,222 |

| New Hampshire | $83 | $1,002 |

| New Jersey | $95 | $1,137 |

| New Mexico | $85 | $1,018 |

| New York | $99 | $1,186 |

| North Carolina | $73 | $881 |

| North Dakota | $78 | $933 |

| Ohio | $82 | $990 |

| Oklahoma | $83 | $1,001 |

| Oregon | $78 | $933 |

| Pennsylvania | $97 | $1,170 |

| Rhode Island | $92 | $1,108 |

| South Carolina | $86 | $1,036 |

| South Dakota | $78 | $940 |

| Tennessee | $82 | $980 |

| Texas | $85 | $1,015 |

| Utah | $85 | $1,021 |

| Vermont | $80 | $965 |

| Virginia | $76 | $914 |

| Washington | $101 | $1,214 |

| West Virginia | $88 | $1,058 |

| Wisconsin | $83 | $991 |

| Wyoming | $82 | $985 |

Note: These rates reflect quotes we gathered for businesses like yours: two employees, $300,000 annual revenue and $150,000 payroll across different coverage types.

The Hartford Business Insurance Customer Experience Ratings

We evaluated over 1,100 customer reviews to determine how The Hartford compares to other small business insurance companies. It comes in second with an overall customer score of 4.38. The Hartford excels in claims processing and customer service, but struggles to provide customers with a positive digital experience.

| Affordability | 4.40 | 2 |

| Claims Process | 4.50 | 1 |

| Customer Service | 4.70 | 1 |

| Digital Experience | 3.80 | 10 |

| Policy Management | 4.20 | 4 |

| Recommend to Others | 4.50 | 2 |

The Hartford Business Insurance Customer Reviews and Sentiment

Based on feedback on review sites, customers have different experiences. These reviews show how The Hartford handles real customer situations when businesses need support.

Official Website Reviews | The Hartford gets 4.8/5 stars from 43,401 reviews on its website for claims experience. Customers praise quick claims processing and helpful service reps. Businesses often mention getting their issues resolved in one phone call, with clear communication when dealing with stressful claims situations. |

Trustpilot | Trustpilot presents a different perspective with just 1.2/5 stars from 298 reviews. Reviews reveal serious customer service issues, particularly with workers' compensation claims processing and communication breakdowns. Negative reviews show months-long processing delays, unresponsive adjusters and inadequate settlement offers across all coverage types. One Texas business owner described waiting "14 months" for claim resolution. |

Reddit | Reddit discussions offer more balanced sentiment. Users generally recommend The Hartford for small businesses, noting it's "small-biz friendly, especially with service-based businesses." Some users report difficulties with its claims system, requiring additional effort from business owners if they want their issues resolved properly. |

The contrast between platforms suggests that The Hartford performs well for many customers while facing challenges in consistently delivering service across all interactions.

The Hartford Business Insurance Industry Ratings

Independent ratings reveal how The Hartford performs when you need to file a claim. These industry-affiliated assessments show its track record with customer service and claims handling.

The Hartford earned third place in J.D. Power's 2025 Property Claims Satisfaction Study, scoring 725 out of 1,000. That puts it right behind industry leaders Chubb (773) and Amica (745), showing it handles property claims well when your business needs them most.

Hartford's complaint index is 0.78, lower than the national average of 1.00. That means it gets 22% fewer complaints than expected for its size. Fewer complaints usually mean happier customers who aren't calling regulators with problems.

The Hartford isn't BBB accredited, but that's common for large insurers. Many solid companies skip BBB accreditation for business reasons. What matters more is how it handles customer issues when they come up.

These ratings show The Hartford handles claims well and keeps customers happier than most insurers. When disaster strikes your business, you want an insurer that will help, not give you the runaround.

The Hartford Business Insurance Financial Strength Ratings

The Hartford gets solid financial ratings from the Big Three agencies: AM Best gives it A+ (Superior), S&P rates it BBB+ (Good), and Moody's scores it Baa1 (Upper Medium Grade). These ratings mean it can cover claims when you need them.

The Hartford Business Insurance Coverage Options and Add-ons

The Hartford lets you start with basic business insurance coverage and add more financial protection as your business grows. Its business owner's policy (BOP) bundles general liability, business income and commercial property insurance into one policy, then you can layer on specialized coverage for your needs.

Core | Bodily injury, property damage, advertising injury | |

Core | Medical expenses, lost wages, rehabilitation for employees | |

Core | Errors & Omissions protection for service providers | |

Core | Building, equipment, inventory protection | |

Core | Lost revenue replacement from covered property damage | |

Core | Vehicle liability and physical damage coverage | |

Core | Excess liability protection beyond underlying limits | |

Specialized | Data breach response and cyber liability protection | |

Employment Practices | Specialized | Wrongful termination, harassment claims coverage |

Commercial Flood | Specialized | Flood damage protection through the National Flood Insurance Program |

Management Liability | Specialized | Executive team protection against management-related claims |

Multinational Choice | Specialized | International business coverage for overseas operations |

Home-Based Business | Specialized | Coverage for businesses operating from residential locations |

Note: The Hartford business insurance isn't available in Alaska, Hawaii or Michigan (business owner's policies only). Coverage details vary by business type and location, so contact The Hartford for specifics. Employment practices liability availability depends on your business class, state and risk factors.

The Hartford Business Insurance: Bottom Line

The Hartford delivers affordable small business coverage at $85 monthly, earning top marks for affordability and second place for customer experience. Customers consistently praise its quick claims processing and responsive service teams. If your business needs extensive policy customization, though, you'll find more add-on choices with other carriers.

The Hartford Business Insurance: FAQ

After analyzing The Hartford's business insurance options, we've answered the most frequently asked questions about coverage, costs and customer experience:

How much can I expect to pay for Hartford business insurance?

Small businesses pay an average of $85 monthly ($1,024 annually), making The Hartford our most affordable option. Costs vary by coverage type, from $70 monthly for workers' compensation to $115 for business owner's policies.

How much does Hartford business insurance cost by industry?

Costs range from $22 monthly for low-risk businesses like DJs to $561 monthly for high-risk pressure washing companies. Service-based businesses typically pay less than those involving manual work or potential property damage. Your industry's risk level determines your premium.

What industries does The Hartford rank best for?

The Hartford ranks first in 44 of 79 industries we studied, excelling for accountants, ad agencies, automotive businesses, bakeries, barbers and beauty salons. It's the most affordable choice for nearly all industries, second only for moving companies, security guards and towing services.

Which states offer the cheapest Hartford business insurance rates?

North Carolina has the lowest rates at $73 monthly, while Nevada costs $102 monthly. The Hartford is the cheapest option in 36 states and the second most affordable in 12 others. States vary based on regulations, disaster risks and local court trends.

What are The Hartford's biggest weaknesses compared to competitors?

The Hartford's main weakness is limited add-ons, ranking fourth for coverage options. It also ranks 10th for digital experience. While it excels in affordability and customer service, businesses wanting extensive customization should consider competitors with more add-on choices.

How We Rated The Hartford Business Insurance

Business owners want straight answers when researching insurance providers. We looked at how The Hartford compares to what matters most for your company's protection and budget:

- Affordability (50% of score): We compared The Hartford's rates across all coverage types against nine other national carriers to see where it offers the best value for small businesses.

- Customer experience (30% of score): We checked J.D. Power ratings, complaint records, online reviews and agency feedback to see how The Hartford handles claims and customer service when businesses need help.

- Coverage options (15% of score): We looked at The Hartford's insurance types, policy limits and add-ons to see how well it fits changing business needs.

- Financial strength (5% of score): We reviewed financial ratings and company reports to make sure The Hartford can pay claims when businesses file them.

We studied quotes from 79 industries across four coverage types for a two-employee firm with $300,000 annual revenue and $150,000 payroll. Our findings show where The Hartford works well and where it doesn't for your business needs.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Revises Issuer Credit Rating Outlook to Positive for The Hartford Financial Services Group, Inc. and Its Subsidiaries." Accessed February 7, 2026.

- Better Business Bureau. "The Hartford Financial Services Group, Inc." Accessed February 7, 2026.

- J.D. Power. "2025 US Property Claims Satisfaction Study." Accessed February 7, 2026.

- National Association of Insurance Commissioners. "Hartford Cas Ins Co National Complaint Index Report." Accessed February 7, 2026.

- Reddit. ""Business Insurance?" r/smallbusiness." Accessed August 1, 2025.

- Reddit. ""THE HARTFORD" r/Insurance." Accessed February 7, 2026.

- The Hartford. "Business Insurance for Liability and Commercial Needs." Accessed February 7, 2026.

- The Hartford. "Business Insurance Types." Accessed February 7, 2026.

- The Hartford. "Customer Claims Ratings and Reviews." Accessed February 7, 2026.

- The Hartford Financial Services Group. "Financial Ratings." Accessed August 1, 2025.

- Trustpilot. "The Hartford Reviews." Accessed February 7, 2026.