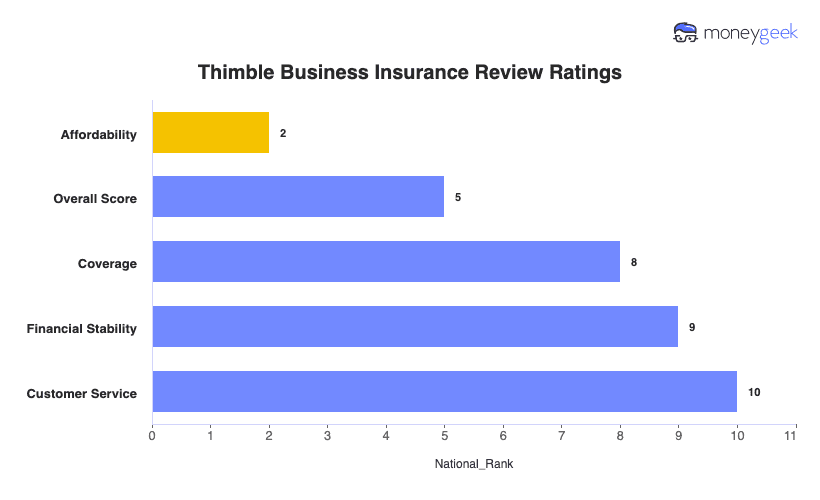

Thimble scores 4.45 in our MoneyGeek rating system, placing fifth among national providers in our analysis of 10 carriers across 79 industries. It has affordable pricing but could improve customer service, financial stability and coverage options.

Thimble Business Insurance Review

Thimble ranks fifth in our study with a score of 4.45 out of 5. It's excellent for affordability and service but has limited coverage.

Discover if Thimble is the best business insurer for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Small businesses pay an average of $94 monthly ($1,130 annually) for Thimble business insurance, making it the second most affordable provider in our analysis.

Thimble ranks eighth in customer service quality compared to some insurers, indicating room for improvement in its claims processing and support systems.

In terms of coverage options, Thimble places eighth nationally, offering a more limited selection of policy customization options.

Thimble Business Insurance Ratings

| Overall Score | 4.45 | 5 |

| Financial Stability | 4.75 | 9 |

| Customer Service | 4.05 | 10 |

| Coverage | 4.34 | 8 |

| Affordability | 4.55 | 2 |

How Did We Determine These Scores?

These scores are for small businesses with two employees across 79 major industries or business types and focus on four coverage types: general liability, professional liability or errors and omissions (E&O), workers' comp and business owner's policy.

Get Matched To The Best Business Insurer For You

Select your industry and state to get a customized business insurance match.

To ensure you're making the right choice for your business, we've linked our reviews to Thimble's competitors so you can compare:

Thimble Business Insurance Ratings by Industry

Thimble offers the most affordable coverage for accountants, ad agencies and automotive businesses. It has good customer service and coverage while providing financial stability across all industries.

| Accountants | 4.40 | 3 | 8 | 6 | 4 |

| Ad Agency | 4.40 | 3 | 7 | 5 | 3 |

| Automotive | 4.50 | 2 | 7 | 5 | 3 |

| Auto Repair | 4.30 | 5 | 7 | 5 | 3 |

| Bakery | 4.30 | 5 | 7 | 5 | 3 |

| Barber | 4.50 | 4 | 7 | 5 | 3 |

| Beauty Salon | 4.30 | 4 | 7 | 5 | 3 |

| Bounce House | 4.20 | 5 | 7 | 5 | 3 |

| Candle | 4.50 | 3 | 7 | 5 | 3 |

| Cannabis | 4.20 | 4 | 7 | 5 | 3 |

| Catering | 4.60 | 2 | 7 | 5 | 3 |

| Cleaning | 4.50 | 2 | 7 | 5 | 3 |

| Coffee Shop | 4.30 | 5 | 7 | 5 | 3 |

| Computer Programming | 4.40 | 4 | 7 | 5 | 3 |

| Computer Repair | 4.40 | 2 | 7 | 5 | 3 |

| Construction | 4.40 | 2 | 7 | 5 | 3 |

| Consulting | 4.30 | 4 | 7 | 5 | 3 |

| Contractor | 4.40 | 3 | 7 | 5 | 3 |

| Courier | 4.30 | 4 | 7 | 5 | 3 |

| Daycare | 4.30 | 5 | 7 | 5 | 3 |

| Dental | 4.30 | 3 | 7 | 5 | 3 |

| DJ | 4.20 | 6 | 7 | 5 | 3 |

| Dog Grooming | 4.60 | 2 | 7 | 5 | 3 |

| Drone | 4.30 | 4 | 7 | 5 | 3 |

| Ecommerce | 4.50 | 2 | 7 | 5 | 3 |

| Electrical | 4.50 | 3 | 7 | 5 | 3 |

| Engineering | 4.40 | 3 | 7 | 5 | 3 |

| Excavation | 4.30 | 6 | 7 | 5 | 3 |

| Florist | 4.60 | 2 | 7 | 5 | 3 |

| Food | 4.40 | 4 | 7 | 5 | 3 |

| Food Truck | 4.50 | 3 | 7 | 5 | 3 |

| Funeral Home | 4.40 | 4 | 7 | 5 | 3 |

| Gardening | 4.50 | 2 | 7 | 5 | 3 |

| Handyman | 4.40 | 4 | 7 | 5 | 3 |

| Home-based | 4.20 | 5 | 7 | 5 | 3 |

| Home-based business | 4.40 | 3 | 7 | 5 | 3 |

| Hospitality | 4.30 | 4 | 7 | 5 | 3 |

| HVAC | 4.50 | 1 | 7 | 5 | 3 |

| Janitorial | 4.50 | 2 | 7 | 5 | 3 |

| Jewelry | 4.40 | 3 | 7 | 5 | 3 |

| Junk Removal | 4.10 | 5 | 7 | 5 | 3 |

| Lawn/Landscaping | 4.50 | 3 | 7 | 5 | 3 |

| Lawyers | 4.40 | 3 | 7 | 5 | 3 |

| Manufacturing | 4.30 | 5 | 7 | 5 | 3 |

| Marine | 4.40 | 3 | 7 | 5 | 3 |

| Massage | 4.30 | 5 | 7 | 5 | 3 |

| Mortgage Broker | 4.40 | 3 | 7 | 5 | 3 |

| Moving | 4.30 | 4 | 7 | 5 | 3 |

| Nonprofit | 4.20 | 5 | 7 | 5 | 3 |

| Painting | 4.50 | 1 | 7 | 5 | 3 |

| Party Rental | 4.30 | 5 | 7 | 5 | 3 |

| Personal Training | 4.10 | 4 | 7 | 5 | 3 |

| Pest Control | 4.30 | 4 | 7 | 5 | 3 |

| Pet | 4.50 | 2 | 7 | 5 | 3 |

| Pharmacy | 4.30 | 6 | 7 | 5 | 3 |

| Photography | 4.30 | 4 | 7 | 5 | 3 |

| Physical Therapy | 4.30 | 4 | 7 | 5 | 3 |

| Plumbing | 4.50 | 4 | 7 | 5 | 3 |

| Pressure Washing | 4.50 | 2 | 7 | 5 | 3 |

| Real Estate | 4.40 | 4 | 7 | 5 | 3 |

| Restaurant | 4.20 | 5 | 7 | 5 | 3 |

| Retail | 4.30 | 4 | 7 | 5 | 3 |

| Roofing | 4.50 | 2 | 7 | 5 | 3 |

| Security | 4.30 | 5 | 7 | 5 | 3 |

| Snack Bars | 4.40 | 3 | 7 | 5 | 3 |

| Software | 4.30 | 5 | 7 | 5 | 3 |

| Spa/Wellness | 4.20 | 5 | 7 | 5 | 3 |

| Speech Therapist | 4.40 | 3 | 7 | 5 | 3 |

| Startup | 4.20 | 7 | 7 | 5 | 3 |

| Tech/IT | 4.30 | 6 | 7 | 5 | 3 |

| Transportation | 4.40 | 3 | 7 | 5 | 3 |

| Travel | 4.40 | 4 | 7 | 5 | 3 |

| Tree Service | 4.60 | 2 | 7 | 5 | 3 |

| Trucking | 4.30 | 4 | 7 | 5 | 3 |

| Tutoring | 4.30 | 5 | 7 | 5 | 3 |

| Veterinary | 4.30 | 4 | 7 | 5 | 3 |

| Wedding Planning | 4.30 | 5 | 7 | 5 | 3 |

| Welding | 4.10 | 6 | 7 | 5 | 3 |

| Wholesale | 4.30 | 5 | 7 | 5 | 3 |

| Window Cleaning | 4.50 | 2 | 7 | 5 | 3 |

How Did We Determine These Scores?

These scores are for small businesses with two employees across 79 major industries or business types and focus on four coverage types: general liability, professional liability (E&O), workers' comp and business owner's policy.

Thimble Business Insurance Ratings by State

Thimble ranks as the most affordable option in 17 states and maintains second-best pricing in 33 others. Its overall performance could be improved, with its highest ranking at fifth place in two states. While Thimble provides budget-friendly coverage, customers should think about their needs.

| Alabama | 4.45 | 5 | 8 | 5 | 7 |

| Alaska | 4.31 | 6 | 6 | 3 | 5 |

| Arizona | 4.34 | 7 | 8 | 5 | 7 |

| Arkansas | 4.33 | 8 | 8 | 5 | 7 |

| California | 4.31 | 8 | 8 | 5 | 7 |

| Colorado | 4.30 | 8 | 8 | 5 | 7 |

| Connecticut | 4.33 | 7 | 8 | 5 | 7 |

| Delaware | 4.33 | 7 | 8 | 5 | 7 |

| Florida | 4.31 | 8 | 8 | 5 | 7 |

| Georgia | 4.31 | 8 | 8 | 5 | 7 |

| Hawaii | 4.30 | 5 | 6 | 3 | 5 |

| Idaho | 4.31 | 8 | 8 | 5 | 7 |

| Illinois | 4.33 | 6 | 8 | 5 | 7 |

| Indiana | 4.33 | 7 | 8 | 5 | 7 |

| Iowa | 4.34 | 7 | 8 | 5 | 7 |

| Kansas | 4.29 | 8 | 8 | 5 | 7 |

| Kentucky | 4.29 | 7 | 8 | 5 | 7 |

| Louisiana | 4.31 | 7 | 7 | 4 | 7 |

| Maine | 4.33 | 7 | 8 | 5 | 7 |

| Maryland | 4.34 | 6 | 8 | 5 | 7 |

| Massachusetts | 4.30 | 8 | 8 | 5 | 7 |

| Michigan | 4.31 | 8 | 8 | 5 | 7 |

| Minnesota | 4.30 | 8 | 8 | 5 | 7 |

| Mississippi | 4.33 | 8 | 8 | 5 | 7 |

| Missouri | 4.30 | 8 | 8 | 5 | 7 |

| Montana | 4.33 | 7 | 8 | 5 | 7 |

| Nebraska | 4.33 | 7 | 8 | 5 | 7 |

| Nevada | 4.34 | 6 | 8 | 5 | 7 |

| New Hampshire | 4.33 | 8 | 8 | 5 | 7 |

| New Jersey | 4.31 | 7 | 8 | 5 | 7 |

| New Mexico | 4.31 | 8 | 8 | 5 | 7 |

| New York | 4.34 | 7 | 8 | 5 | 7 |

| North Carolina | 4.31 | 8 | 8 | 5 | 7 |

| North Dakota | 4.31 | 8 | 8 | 5 | 7 |

| Ohio | 4.31 | 8 | 8 | 5 | 7 |

| Oklahoma | 4.30 | 7 | 8 | 5 | 7 |

| Oregon | 4.30 | 8 | 8 | 5 | 7 |

| Pennsylvania | 4.33 | 6 | 8 | 5 | 7 |

| Rhode Island | 4.34 | 7 | 8 | 5 | 7 |

| South Carolina | 4.31 | 8 | 8 | 5 | 7 |

| South Dakota | 4.31 | 8 | 8 | 5 | 7 |

| Tennessee | 4.30 | 8 | 8 | 5 | 7 |

| Texas | 4.33 | 8 | 8 | 5 | 7 |

| Utah | 4.33 | 7 | 8 | 5 | 7 |

| Vermont | 4.30 | 8 | 8 | 5 | 7 |

| Virginia | 4.30 | 8 | 8 | 5 | 7 |

| Washington | 4.30 | 8 | 8 | 5 | 7 |

| West Virginia | 4.31 | 8 | 8 | 5 | 7 |

| Wisconsin | 4.30 | 7 | 8 | 5 | 7 |

| Wyoming | 4.31 | 8 | 8 | 5 | 7 |

How Did We Determine These Scores?

These scores are for small businesses with two employees across 79 major industries or business types and focus on four coverage types: general liability, professional liability (E&O), workers' comp and business owner's policy.

How Much Does Thimble Business Insurance Cost?

You can get business insurance from Thimble for an average of $94 per month ($1,130 annually). Coverage types vary in cost, with workers' compensation starting at $71 monthly and business owner's policies reaching $121 monthly.

| Business Owners Policies | $121 | $1,450 |

| General Liability | $107 | $1,286 |

| Professional Liability (E&O) | $76 | $914 |

| Workers Compensation | $71 | $847 |

How Did We Determine These Rates?

These rates are based on MoneyGeek's 2025 analysis of quotes for small businesses with two employees, $300,000 annual revenue and $150,000 payroll across four core coverage types.

How Much Does Thimble Business Insurance Cost by Industry?

The average cost of business insurance from Thimble ranges from $28 monthly for home-based businesses to $360 monthly for excavation work. Insurance costs reflect each industry's risk level, with physical labor businesses paying more than desk-based operations.

| Accountants | $56 | $670 |

| Ad Agency | $74 | $885 |

| Auto Repair | $162 | $1,943 |

| Automotive | $73 | $870 |

| Bakery | $88 | $1,051 |

| Barber | $49 | $588 |

| Beauty Salon | $62 | $741 |

| Bounce House | $74 | $883 |

| Candle | $49 | $590 |

| Cannabis | $97 | $1,162 |

| Catering | $101 | $1,217 |

| Cleaning | $62 | $750 |

| Coffee Shop | $87 | $1,042 |

| Computer Programming | $68 | $813 |

| Computer Repair | $46 | $550 |

| Construction | $122 | $1,462 |

| Consulting | $50 | $598 |

| Contractor | $208 | $2,491 |

| Courier | $198 | $2,381 |

| DJ | $46 | $547 |

| Daycare | $53 | $640 |

| Dental | $33 | $393 |

| Dog Grooming | $52 | $622 |

| Drone | $44 | $532 |

| Ecommerce | $43 | $511 |

| Electrical | $63 | $757 |

| Engineering | $66 | $795 |

| Excavation | $360 | $4,314 |

| Florist | $45 | $545 |

| Food | $72 | $870 |

| Food Truck | $78 | $934 |

| Funeral Home | $68 | $815 |

| Gardening | $53 | $632 |

| HVAC | $105 | $1,256 |

| Handyman | $165 | $1,983 |

| Home-based | $28 | $330 |

| Hospitality | $80 | $956 |

| Janitorial | $51 | $609 |

| Jewelry | $74 | $884 |

| Junk Removal | $163 | $1,959 |

| Lawn/Landscaping | $54 | $643 |

| Lawyers | $64 | $772 |

| Manufacturing | $145 | $1,743 |

| Marine | $76 | $911 |

| Massage | $96 | $1,157 |

| Mortgage Broker | $60 | $722 |

| Moving | $165 | $1,980 |

| Nonprofit | $46 | $552 |

| Painting | $76 | $910 |

| Party Rental | $76 | $909 |

| Personal Training | $47 | $564 |

| Pest Control | $63 | $751 |

| Pet | $42 | $503 |

| Pharmacy | $60 | $718 |

| Photography | $42 | $502 |

| Physical Therapy | $255 | $3,063 |

| Plumbing | $228 | $2,735 |

| Pressure Washing | $312 | $3,747 |

| Real Estate | $74 | $888 |

| Restaurant | $136 | $1,627 |

| Retail | $67 | $801 |

| Roofing | $348 | $4,170 |

| Security | $137 | $1,638 |

| Snack Bars | $102 | $1,226 |

| Software | $60 | $726 |

| Spa/Wellness | $107 | $1,287 |

| Speech Therapist | $48 | $581 |

| Startup | $45 | $535 |

| Tech/IT | $59 | $707 |

| Transportation | $102 | $1,224 |

| Travel | $39 | $472 |

| Tree Service | $100 | $1,203 |

| Trucking | $162 | $1,945 |

| Tutoring | $52 | $628 |

| Veterinary | $63 | $760 |

| Wedding Planning | $57 | $688 |

| Welding | $167 | $2,003 |

| Wholesale | $53 | $640 |

| Window Cleaning | $90 | $1,079 |

How Did We Determine These Rates?

These rates are based on MoneyGeek's 2025 analysis of quotes for small businesses with two employees, $300,000 annual revenue and $150,000 payroll across four core coverage types.

How Much Does Thimble Business Insurance Cost by State?

State insurance regulations, natural disaster risks and local legal environments affect business insurance rates across the country. Thimble offers its cheapest business insurance in North Carolina at $81 per month, while business owners in Washington state pay $115 monthly for coverage.

| Alabama | $92 | $1,100 |

| Alaska | $86 | $1,029 |

| Arizona | $89 | $1,073 |

| Arkansas | $90 | $1,077 |

| California | $104 | $1,250 |

| Colorado | $93 | $1,115 |

| Connecticut | $101 | $1,215 |

| Delaware | $101 | $1,210 |

| Florida | $101 | $1,216 |

| Georgia | $95 | $1,145 |

| Hawaii | $98 | $1,179 |

| Idaho | $89 | $1,071 |

| Illinois | $103 | $1,235 |

| Indiana | $91 | $1,088 |

| Iowa | $89 | $1,071 |

| Kansas | $91 | $1,096 |

| Kentucky | $88 | $1,053 |

| Louisiana | $107 | $1,286 |

| Maine | $81 | $974 |

| Maryland | $89 | $1,069 |

| Massachusetts | $99 | $1,183 |

| Michigan | $89 | $1,064 |

| Minnesota | $88 | $1,055 |

| Mississippi | $94 | $1,131 |

| Missouri | $93 | $1,114 |

| Montana | $93 | $1,120 |

| Nebraska | $89 | $1,064 |

| Nevada | $107 | $1,282 |

| New Hampshire | $93 | $1,117 |

| New Jersey | $106 | $1,270 |

| New Mexico | $94 | $1,132 |

| New York | $107 | $1,286 |

| North Carolina | $81 | $972 |

| North Dakota | $89 | $1,065 |

| Ohio | $94 | $1,127 |

| Oklahoma | $89 | $1,064 |

| Oregon | $87 | $1,045 |

| Pennsylvania | $107 | $1,285 |

| Rhode Island | $102 | $1,229 |

| South Carolina | $96 | $1,156 |

| South Dakota | $87 | $1,046 |

| Tennessee | $91 | $1,095 |

| Texas | $94 | $1,125 |

| Utah | $90 | $1,078 |

| Vermont | $90 | $1,079 |

| Virginia | $86 | $1,030 |

| Washington | $115 | $1,376 |

| West Virginia | $98 | $1,175 |

| Wisconsin | $92 | $1,100 |

| Wyoming | $95 | $1,137 |

How Did We Determine These Rates?

These rates are based on MoneyGeek's 2025 analysis of quotes for small businesses with two employees, $300,000 annual revenue and $150,000 payroll across four core coverage types.

Thimble Business Insurance Customer Experience Ratings

Based on our analysis of more than 1,100 customer reviews, we evaluated how Thimble compares to other small business insurance providers. The company ranks third nationwide with a customer score of 4.21. Thimble has a user-friendly digital platform and competitive pricing, though customer service response times and claims processing could be better.

| Affordability | 4.40 | 4 |

| Claims Process | 3.70 | 7 |

| Customer Service | 3.90 | 8 |

| Digital Experience | 4.70 | 2 |

| Policy Management | 4.20 | 6 |

| Recommend to Others | 4.30 | 5 |

Thimble Business Insurance Customer Reviews and Sentiment

Thimble is known for flexible short-term and monthly business insurance policies, with strong appeal to freelancers, contractors, and small business owners who need coverage on demand.

Official Website Reviews | Thimble displays thousands of customer ratings with an average of 4.4/5. Customers frequently highlight the ease of buying coverage in minutes and the convenience of instantly obtaining Certificates of Insurance (COIs). |

Better Business Bureau (U.S.) | Thimble is BBB-accredited with an A+ rating. Recent reviews are mixed: positive feedback centers on affordable policies and fast setup, while negative comments cite issues with cancellations, unexpected charges, or delays in refunds. |

Trustpilot | Holds a 4.4/5 TrustScore from over 2,600 reviews. Many users praise the speed, convenience, and affordability, especially for short-term needs. Critical reviews focus on auto-renewal policies and customer service response times. |

Reddit | Recent small business owner threads praise Thimble’s ability to issue quick, on-demand policies for gigs and events. Some caution that it may not be ideal for businesses needing complex, long-term coverage, as policy limits and options can be more limited than traditional carriers. |

Thimble excels at fast, flexible coverage for small-scale or short-term needs, making it a strong option for contractors, event vendors, and gig workers. However, its narrower coverage options and occasional billing complaints mean it’s less suited for larger businesses with complex risk profiles.

Thimble Business Insurance Industry Ratings

Independent ratings show how well Thimble handles customer needs when they file a claim. Industry evaluations confirm its ability to process claims and provide reliable customer support.

Thimble doesn't appear in recent J.D. Power small commercial or property claims studies.

Thimble policies are underwritten by partners such as Markel Insurance Company and National Specialty Insurance Company. NAIC complaint indices for these underwriters vary by line of business, but recent data shows generally average-to-below-average complaint volumes.

Thimble is BBB-accredited with an A+ rating, signaling strong adherence to BBB’s ethical standards. However, some customer complaints suggest areas for improvement in billing and customer service.

Thimble maintains an A+ BBB accreditation, giving small businesses confidence in its reliability. As a broker, customer experiences can vary depending on the underwriting carrier and service touch points.

Thimble Business Insurance Financial Strength Ratings

Thimble itself is a managing general agent (MGA) and doesn't carry its own financial strength rating. Its policies are underwritten by highly rated carriers, including Markel Insurance Company (A, Excellent from AM Best) and National Specialty Insurance Company (A, Excellent from AM Best).

Thimble Business Insurance Coverage Options and Add-ons

Thimble focuses on flexible business insurance solutions, allowing customers to purchase policies by the hour, day, month or year.

Core | Covers bodily injury, property damage and advertising injury | |

Core | Protects service providers from claims of professional mistakes or negligence | |

Core | Combines general liability and business property coverage | |

Core | Provides wage and medical benefits for work-related injuries | |

Core | Covers buildings, equipment and inventory | |

Event Liability | Specialized | Short-term coverage for events, markets and festivals |

Drone Insurance | Specialized | Covers commercial drone operations for damage or liability |

Tools & Equipment | Specialized | Protects mobile tools and gear from theft or damage |

Disclaimer

Deductibles, coverage limits and specific terms vary by policy and business type. Contact Thimble for detailed coverage information, including deductibles.

Coverage availability and limits vary by state and profession. Thimble’s offerings are best suited for businesses that prioritize speed, flexibility, and low commitment, but may not meet the needs of larger organizations requiring extensive coverage options.

Thimble Business Insurance: Bottom Line

Thimble provides small business coverage at $94 per month, ranking among the most affordable insurers. Customers value the user-friendly digital tools and online account management features. Claims processing could be faster.

Thimble Business Insurance: FAQ

Based on our analysis of Thimble's business insurance offerings, we provide answers to common questions about insurance coverage options, pricing structures and what customers can expect from their service.

How much can I expect to pay for Thimble business insurance?

Thimble business insurance costs an average of $94 per month ($1,130 annually). Coverage costs range from $71 per month for workers compensation to $121 per month for business owners policies.

How much does Thimble business insurance cost by industry?

Thimble business insurance costs range from $28 per month for home-based businesses to $360 per month for excavation companies. Service-based operations have lower premiums than labor-intensive or property-risk businesses.

What industries does Thimble rank best for?

Thimble doesn't lead overall in the industries evaluated but performs strongly for accountants, automotive businesses and window cleaning services.

Which states offer the cheapest Thimble business insurance rates?

North Carolina offers the lowest Thimble business insurance rates at $81 per month, while Washington has higher rates at $115 monthly. Thimble ranks as the most affordable option in 17 states and second-cheapest in 33 states.

What are Thimble's biggest weaknesses compared to competitors?

Thimble ranks eighth for customer service quality and coverage options.

How We Rated Thimble Business Insurance

Small business owners need reliable information to make smart insurance choices. Our analysis shows how Thimble compares to other providers on the factors that matter most:

- Affordability (50% of score): We compared Thimble's rates across all insurance types against nine other national carriers to find the best values for small businesses.

- Customer experience (30% of score): We analyzed service quality through J.D. Power ratings, complaint records and customer feedback to understand how well Thimble supports businesses when they need help.

- Coverage options (15% of score): We looked at Thimble's available policies, coverage limits and extra protection options to assess how well they meet different business needs.

- Financial strength (5% of score): We reviewed financial stability ratings and company reports to confirm Thimble can reliably pay claims.

We gathered quotes from 79 industries for four types of coverage, using a standard business profile: two employees, $300,000 in yearly revenue and $150,000 in payroll. Our research reveals both the strengths and limitations of Thimble for your business insurance needs.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.