With a MoneyGeek score of 4.25, Hiscox ranks ninth in our analysis of 10 national business insurance carriers across 79 industries. Hiscox shows financial stability and good customer service standards, but is limited in comprehensive coverage.

Hiscox Business Insurance Review

Hiscox ranks ninth in MoneyGeek's study with a score of 4.25 out of 5. It's excellent for affordability and service, but offers limited coverage.

Discover if Hiscox is the best business insurance option for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Small businesses pay $109 monthly ($1,305 annually) for Hiscox business insurance, placing ninth for affordability in our analysis

Hiscox ranks sixth nationally for customer experience, showing average performance in service quality and claims processing

Hiscox places tenth for coverage options, offering a more limited selection of policy customization choices compared to other providers

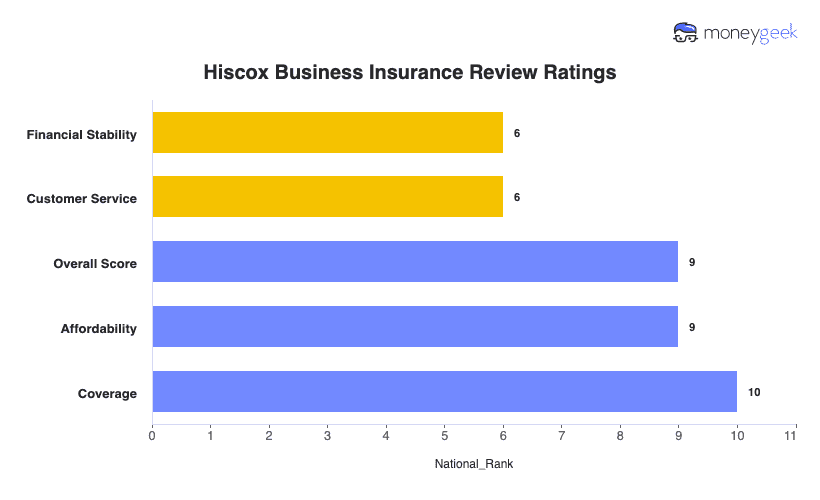

Hiscox Business Insurance Ratings

| Overall Score | 4.25 | 9 |

| Financial Stability | 4.84 | 6 |

| Customer Service | 4.34 | 6 |

| Coverage | 4.09 | 10 |

| Affordability | 4.2 | 9 |

How Did We Determine These Scores?

These scores are for small businesses with two employees across 79 major industries or business types and focus on four coverage types: general liability, professional liability or errors and omissions (E&O), workers' comp and business owner's policy.

Get Matched To The Best Business Insurer For You

Select your industry and state to get a customized business insurance match.

To ensure you're making the right choice for your business, we've linked our reviews to Hiscox's competitors so you can compare:

Hiscox Business Insurance Ratings by Industry

Hiscox ranks among the top providers in our analysis of 79 industries. It offers the most affordable coverage for accountants, ad agencies, and automotive businesses. The company shows strong performance across all categories, ranking first in financial stability and maintaining top positions in customer service and coverage options.

| Accountants | 4.40 | 4 | 4 | 7 | 3 |

| Ad Agency | 4.40 | 4 | 4 | 6 | 2 |

| Automotive | 4.40 | 4 | 4 | 6 | 2 |

| Auto Repair | 4.30 | 5 | 4 | 6 | 2 |

| Bakery | 4.30 | 5 | 4 | 6 | 2 |

| Barber | 4.40 | 5 | 4 | 6 | 2 |

| Beauty Salon | 4.30 | 6 | 4 | 6 | 2 |

| Bounce House | 4.20 | 5 | 4 | 6 | 2 |

| Candle | 4.40 | 5 | 4 | 6 | 2 |

| Cannabis | 4.20 | 5 | 4 | 6 | 2 |

| Catering | 4.40 | 5 | 4 | 6 | 2 |

| Cleaning | 4.10 | 6 | 4 | 6 | 2 |

| Coffee Shop | 4.30 | 5 | 4 | 6 | 2 |

| Computer Programming | 4.40 | 3 | 4 | 6 | 2 |

| Computer Repair | 4.40 | 3 | 4 | 6 | 2 |

| Construction | 4.60 | 1 | 4 | 6 | 2 |

| Consulting | 4.40 | 3 | 4 | 6 | 2 |

| Contractor | 4.10 | 6 | 4 | 6 | 2 |

| Courier | 4.30 | 5 | 4 | 6 | 2 |

| Daycare | 4.30 | 5 | 4 | 6 | 2 |

| Dental | 4.30 | 3 | 4 | 6 | 2 |

| DJ | 4.40 | 5 | 4 | 6 | 2 |

| Dog Grooming | 4.20 | 5 | 4 | 6 | 2 |

| Drone | 4.30 | 4 | 4 | 6 | 2 |

| Ecommerce | 4.10 | 6 | 4 | 6 | 2 |

| Electrical | 4.10 | 5 | 4 | 6 | 2 |

| Engineering | 4.20 | 6 | 4 | 6 | 2 |

| Excavation | 4.30 | 6 | 4 | 6 | 2 |

| Florist | 4.10 | 7 | 4 | 6 | 2 |

| Food | 4.30 | 6 | 4 | 6 | 2 |

| Food Truck | 4.40 | 5 | 4 | 6 | 2 |

| Funeral Home | 4.40 | 4 | 4 | 6 | 2 |

| Gardening | 4.10 | 7 | 4 | 6 | 2 |

| Handyman | 4.40 | 5 | 4 | 6 | 2 |

| Home-based | 4.40 | 3 | 4 | 6 | 2 |

| Home-based business | 4.40 | 3 | 4 | 6 | 2 |

| Hospitality | 4.40 | 5 | 4 | 6 | 2 |

| HVAC | 4.10 | 5 | 4 | 6 | 2 |

| Janitorial | 4.10 | 6 | 4 | 6 | 2 |

| Jewelry | 4.30 | 4 | 4 | 6 | 2 |

| Junk Removal | 4.10 | 6 | 4 | 6 | 2 |

| Lawn/Landscaping | 4.10 | 6 | 4 | 6 | 2 |

| Lawyers | 4.40 | 3 | 4 | 6 | 2 |

| Manufacturing | 4.30 | 6 | 4 | 6 | 2 |

| Marine | 4.40 | 4 | 4 | 6 | 2 |

| Massage | 4.40 | 4 | 4 | 6 | 2 |

| Mortgage Broker | 4.40 | 4 | 4 | 6 | 2 |

| Moving | 4.30 | 5 | 4 | 6 | 2 |

| Nonprofit | 4.30 | 4 | 4 | 6 | 2 |

| Painting | 4.10 | 5 | 4 | 6 | 2 |

| Party Rental | 4.30 | 5 | 4 | 6 | 2 |

| Personal Training | 4.50 | 2 | 4 | 6 | 2 |

| Pest Control | 4.30 | 5 | 4 | 6 | 2 |

| Pet | 4.30 | 5 | 4 | 6 | 2 |

| Pharmacy | 4.30 | 6 | 4 | 6 | 2 |

| Photography | 4.30 | 4 | 4 | 6 | 2 |

| Physical Therapy | 4.30 | 4 | 4 | 6 | 2 |

| Plumbing | 4.40 | 4 | 4 | 6 | 2 |

| Pressure Washing | 4.20 | 5 | 4 | 6 | 2 |

| Real Estate | 4.50 | 3 | 4 | 6 | 2 |

| Restaurant | 4.20 | 5 | 4 | 6 | 2 |

| Retail | 4.10 | 7 | 4 | 6 | 2 |

| Roofing | 4.30 | 4 | 4 | 6 | 2 |

| Security | 4.60 | 2 | 4 | 6 | 2 |

| Snack Bars | 4.40 | 3 | 4 | 6 | 2 |

| Software | 4.40 | 4 | 4 | 6 | 2 |

| Spa/Wellness | 4.20 | 5 | 4 | 6 | 2 |

| Speech Therapist | 4.40 | 4 | 4 | 6 | 2 |

| Startup | 4.50 | 3 | 4 | 6 | 2 |

| Tech/IT | 4.30 | 5 | 4 | 6 | 2 |

| Transportation | 4.40 | 4 | 4 | 6 | 2 |

| Travel | 4.40 | 4 | 4 | 6 | 2 |

| Tree Service | 4.30 | 6 | 4 | 6 | 2 |

| Trucking | 4.30 | 5 | 4 | 6 | 2 |

| Tutoring | 4.30 | 5 | 4 | 6 | 2 |

| Veterinary | 4.30 | 4 | 4 | 6 | 2 |

| Wedding Planning | 4.30 | 4 | 4 | 6 | 2 |

| Welding | 4.30 | 4 | 4 | 6 | 2 |

| Wholesale | 4.30 | 5 | 4 | 6 | 2 |

| Window Cleaning | 4.30 | 5 | 4 | 6 | 2 |

How Did We Determine These Scores?

These scores are for small businesses with two employees across 79 major industries or business types and focus on four coverage types: general liability, professional liability (E&O), workers' comp and business owner's policy.

Hiscox Business Insurance Ratings by State

Hiscox provides business insurance coverage across 49 states and is in sixth place in one market. The company typically ranks in the middle to lower third of insurers nationwide. Hiscox is in fifth place in five states for pricing.

| Alabama | 4.27 | 9 | 4 | 6 | 4 |

| Arizona | 4.26 | 9 | 4 | 6 | 4 |

| Arkansas | 4.27 | 9 | 4 | 6 | 4 |

| California | 4.28 | 9 | 4 | 6 | 4 |

| Colorado | 4.27 | 9 | 4 | 6 | 4 |

| Connecticut | 4.29 | 8 | 4 | 6 | 4 |

| Delaware | 4.29 | 8 | 4 | 6 | 4 |

| Florida | 4.27 | 9 | 4 | 6 | 4 |

| Georgia | 4.26 | 9 | 4 | 6 | 4 |

| Hawaii | 4.27 | 6 | 3 | 4 | 2 |

| Idaho | 4.28 | 9 | 4 | 6 | 4 |

| Illinois | 4.28 | 7 | 4 | 6 | 4 |

| Indiana | 4.29 | 8 | 4 | 6 | 4 |

| Iowa | 4.28 | 8 | 4 | 6 | 4 |

| Kansas | 4.27 | 9 | 4 | 6 | 4 |

| Kentucky | 4.27 | 8 | 4 | 6 | 4 |

| Louisiana | 4.30 | 8 | 3 | 5 | 4 |

| Maine | 4.28 | 9 | 4 | 6 | 4 |

| Maryland | 4.28 | 7 | 4 | 6 | 4 |

| Massachusetts | 4.27 | 9 | 4 | 6 | 4 |

| Michigan | 4.27 | 9 | 4 | 6 | 4 |

| Minnesota | 4.27 | 9 | 4 | 6 | 4 |

| Mississippi | 4.28 | 9 | 4 | 6 | 4 |

| Missouri | 4.26 | 9 | 4 | 6 | 4 |

| Montana | 4.28 | 8 | 4 | 6 | 4 |

| Nebraska | 4.27 | 8 | 4 | 6 | 4 |

| Nevada | 4.28 | 8 | 4 | 6 | 4 |

| New Hampshire | 4.28 | 9 | 4 | 6 | 4 |

| New Jersey | 4.27 | 8 | 4 | 6 | 4 |

| New Mexico | 4.27 | 9 | 4 | 6 | 4 |

| New York | 4.30 | 9 | 4 | 6 | 4 |

| North Carolina | 4.28 | 9 | 4 | 6 | 4 |

| North Dakota | 4.28 | 9 | 4 | 6 | 4 |

| Ohio | 4.28 | 9 | 4 | 6 | 4 |

| Oklahoma | 4.27 | 8 | 4 | 6 | 4 |

| Oregon | 4.26 | 9 | 4 | 6 | 4 |

| Pennsylvania | 4.28 | 8 | 4 | 6 | 4 |

| Rhode Island | 4.27 | 9 | 4 | 6 | 4 |

| South Carolina | 4.28 | 9 | 4 | 6 | 4 |

| South Dakota | 4.27 | 9 | 4 | 6 | 4 |

| Tennessee | 4.27 | 9 | 4 | 6 | 4 |

| Texas | 4.27 | 9 | 4 | 6 | 4 |

| Utah | 4.27 | 8 | 4 | 6 | 4 |

| Vermont | 4.27 | 9 | 4 | 6 | 4 |

| Virginia | 4.27 | 9 | 4 | 6 | 4 |

| Washington | 4.27 | 9 | 4 | 6 | 4 |

| West Virginia | 4.26 | 9 | 4 | 6 | 4 |

| Wisconsin | 4.26 | 8 | 4 | 6 | 4 |

| Wyoming | 4.28 | 9 | 4 | 6 | 4 |

How Did We Determine These Scores?

These scores are for small businesses with two employees across 79 major industries or business types and focus on four coverage types: general liability, professional liability (E&O), workers' comp and business owner's policy.

How Much Does Hiscox Business Insurance Cost?

Hiscox business insurance costs around $109 per month ($1,305 annually). When you get business insurance, prices vary by coverage types. The most affordable option is workers' compensation at $72 monthly, while business owner's policies cost about $169 per month.

| Business Owners Policies | $169 | $2,023 |

| General Liability | $114 | $1,371 |

| Professional Liability (E&O) | $77 | $928 |

| Workers Compensation | $72 | $861 |

How Did We Determine These Rates?

These rates are based on MoneyGeek's 2025 analysis of quotes for small businesses with two employees, $300,000 annual revenue and $150,000 payroll across four core coverage types.

How Much Does Hiscox Business Insurance Cost by Industry?

The average cost of business insurance through Hiscox varies from $25 monthly for home-based businesses to $657 monthly for pressure washing services. Business insurance costs reflect risk levels, with service-based home operations paying less than businesses involving equipment and property damage risks.

| Accountants | $57 | $682 |

| Ad Agency | $53 | $633 |

| Auto Repair | $164 | $1,971 |

| Automotive | $81 | $976 |

| Bakery | $87 | $1,047 |

| Barber | $40 | $479 |

| Beauty Salon | $68 | $820 |

| Bounce House | $74 | $893 |

| Candle | $57 | $686 |

| Cannabis | $98 | $1,181 |

| Catering | $86 | $1,026 |

| Cleaning | $154 | $1,852 |

| Coffee Shop | $87 | $1,044 |

| Computer Programming | $48 | $572 |

| Computer Repair | $50 | $597 |

| Construction | $106 | $1,268 |

| Consulting | $47 | $566 |

| Contractor | $238 | $2,862 |

| Courier | $196 | $2,351 |

| DJ | $28 | $338 |

| Daycare | $54 | $643 |

| Dental | $56 | $671 |

| Dog Grooming | $73 | $870 |

| Drone | $45 | $535 |

| Ecommerce | $84 | $1,006 |

| Electrical | $196 | $2,358 |

| Engineering | $58 | $693 |

| Excavation | $362 | $4,347 |

| Florist | $60 | $720 |

| Food | $116 | $1,398 |

| Food Truck | $126 | $1,516 |

| Funeral Home | $68 | $819 |

| Gardening | $157 | $1,885 |

| HVAC | $227 | $2,729 |

| Handyman | $198 | $2,373 |

| Home-based | $25 | $298 |

| Hospitality | $81 | $969 |

| Janitorial | $202 | $2,418 |

| Jewelry | $41 | $495 |

| Junk Removal | $165 | $1,980 |

| Lawn/Landscaping | $157 | $1,880 |

| Lawyers | $65 | $775 |

| Manufacturing | $47 | $566 |

| Marine | $77 | $919 |

| Massage | $89 | $1,067 |

| Mortgage Broker | $61 | $732 |

| Moving | $167 | $2,001 |

| Nonprofit | $44 | $534 |

| Painting | $173 | $2,072 |

| Party Rental | $76 | $914 |

| Personal Training | $37 | $440 |

| Pest Control | $63 | $753 |

| Pet | $56 | $674 |

| Pharmacy | $60 | $718 |

| Photography | $35 | $423 |

| Physical Therapy | $44 | $533 |

| Plumbing | $260 | $3,114 |

| Pressure Washing | $657 | $7,889 |

| Real Estate | $67 | $801 |

| Restaurant | $137 | $1,647 |

| Retail | $85 | $1,024 |

| Roofing | $481 | $5,774 |

| Security | $56 | $671 |

| Snack Bars | $104 | $1,247 |

| Software | $43 | $519 |

| Spa/Wellness | $107 | $1,283 |

| Speech Therapist | $49 | $588 |

| Startup | $34 | $413 |

| Tech/IT | $46 | $551 |

| Transportation | $103 | $1,239 |

| Travel | $39 | $471 |

| Tree Service | $162 | $1,947 |

| Trucking | $163 | $1,960 |

| Tutoring | $33 | $400 |

| Veterinary | $63 | $758 |

| Wedding Planning | $41 | $487 |

| Welding | $155 | $1,856 |

| Wholesale | $54 | $649 |

| Window Cleaning | $184 | $2,203 |

How Did We Determine These Rates?

These rates are based on MoneyGeek's 2025 analysis of quotes for small businesses with two employees, $300,000 annual revenue and $150,000 payroll across four core coverage types.

How Much Does Hiscox Business Insurance Cost by State?

State regulations, natural disaster risks and local legal environments affect business insurance rates across the country. Hiscox offers its cheapest business insurance in Maine at $93 per month, while business owners in Washington state pay $136 monthly for coverage.

| Alabama | $105 | $1,264 |

| Arizona | $103 | $1,235 |

| Arkansas | $104 | $1,249 |

| California | $120 | $1,436 |

| Colorado | $107 | $1,285 |

| Connecticut | $117 | $1,399 |

| Delaware | $116 | $1,390 |

| Florida | $116 | $1,398 |

| Georgia | $109 | $1,311 |

| Hawaii | $113 | $1,356 |

| Idaho | $102 | $1,227 |

| Illinois | $118 | $1,411 |

| Indiana | $105 | $1,261 |

| Iowa | $103 | $1,234 |

| Kansas | $105 | $1,256 |

| Kentucky | $101 | $1,212 |

| Louisiana | $123 | $1,475 |

| Maine | $93 | $1,116 |

| Maryland | $103 | $1,234 |

| Massachusetts | $113 | $1,357 |

| Michigan | $102 | $1,227 |

| Minnesota | $101 | $1,213 |

| Mississippi | $108 | $1,296 |

| Missouri | $107 | $1,288 |

| Montana | $107 | $1,282 |

| Nebraska | $102 | $1,227 |

| Nevada | $122 | $1,464 |

| New Hampshire | $107 | $1,285 |

| New Jersey | $122 | $1,464 |

| New Mexico | $108 | $1,299 |

| New York | $123 | $1,474 |

| North Carolina | $94 | $1,123 |

| North Dakota | $104 | $1,247 |

| Ohio | $111 | $1,336 |

| Oklahoma | $102 | $1,222 |

| Oregon | $100 | $1,205 |

| Pennsylvania | $123 | $1,475 |

| Rhode Island | $118 | $1,420 |

| South Carolina | $111 | $1,331 |

| South Dakota | $101 | $1,212 |

| Tennessee | $105 | $1,255 |

| Texas | $109 | $1,307 |

| Utah | $103 | $1,233 |

| Vermont | $103 | $1,239 |

| Virginia | $98 | $1,181 |

| Washington | $136 | $1,633 |

| West Virginia | $113 | $1,359 |

| Wisconsin | $106 | $1,271 |

| Wyoming | $111 | $1,333 |

How Did We Determine These Rates?

These rates are based on MoneyGeek's 2025 analysis of quotes for small businesses with two employees, $300,000 annual revenue and $150,000 payroll across four core coverage types.

Hiscox Business Insurance Customer Experience Ratings

Based on our analysis of more than 1,100 customer reviews, we evaluated how Hiscox measures up against other small business insurance providers. The company ranks tenth nationally with an overall customer score of 4.01. Hiscox has competitive pricing and user-friendly digital tools, but customer service response times and claims processing efficiency need improvement.

| Affordability | 4.20 | 7 |

| Claims Process | 3.80 | 6 |

| Customer Service | 3.90 | 9 |

| Digital Experience | 4.10 | 7 |

| Policy Management | 4.00 | 9 |

| Recommend to Others | 4.10 | 9 |

Hiscox Business Insurance Customer Reviews and Sentiment

Recent feedback for Hiscox highlights strong satisfaction with its digital tools and niche coverages for small businesses, alongside some concerns about billing and claims handling.

Official Website Reviews | Hiscox’s site displays hundreds of small business customer reviews, averaging 4.7/5, with frequent praise for simple online quoting, fast certificate delivery, and knowledgeable representatives. |

Better Business Bureau (U.S.) | BBB-accredited with an A+ rating. Recent reviews are mixed—positive comments focus on responsive agents and quick policy issuance, while negative ones mention rate increases, claim denials, and challenges reaching claims adjusters. |

Trustpilot | Holds a 1.6/5 TrustScore from over 900 reviews. Many reviewers highlight affordability, user-friendly purchasing, and helpful customer service; some cite slow claims processing and policy cancellations without adequate explanation. |

Reddit | Recent posts from small business owners describe Hiscox as convenient for freelancers, consultants, and other low-risk professions. However, some caution about premium hikes at renewal and difficulties with claims approvals, particularly for professional liability policies. |

Hiscox is well-regarded for serving microbusinesses and solo professionals with fast, affordable coverage and strong digital capabilities. Still, potential customers should be aware of recurring complaints about claims processing speed and renewal pricing.

Hiscox Business Insurance Industry Ratings

Industry ratings show how well Hiscox handles customer needs when they file a claim. These independent assessments confirm the company's ability to process claims and provide reliable customer service.

Hiscox doesn't appear in recent J.D. Power U.S. small commercial or property claims studies.

NAIC data for Hiscox Insurance Company Inc. shows complaint indices for commercial liability below the industry average, indicating fewer regulator-filed complaints than expected for its size.

Hiscox is A+ accredited, signaling strong adherence to BBB standards, although individual complaint resolution times vary.

Hiscox Business Insurance Financial Strength Ratings

Hiscox Insurance Company Inc. holds an A (Excellent) rating from AM Best, reflecting strong claims-paying ability. S&P Global Ratings assigns an A (Strong) financial strength rating, and Fitch Ratings lists Hiscox Ltd. entities at A as well.

Hiscox Business Insurance Coverage Options and Add-ons

Hiscox specializes in small business coverages, with a focus on professional liability and industry-specific policies.

Core | Covers negligence, errors and omissions for service providers | |

Core | Third-party bodily injury, property damage and advertising injury coverage | |

Core | Bundles general liability with commercial property | |

Core | Protects business-owned buildings, contents and equipment | |

Core | Covers employee injuries and illness on the job | |

Specialized | Covers data breaches, cyber extortion and related costs | |

Short-Term Liability | Specialized | Flexible general liability coverage for short-term projects or events |

Industry-Specific Policies | Specialized | Custom coverage for consultants, therapists, IT professionals and more |

Disclaimer

Deductibles, coverage limits and specific terms vary by policy and business type. Contact Hiscox for detailed coverage information, including deductibles.

Coverage availability varies by state, business type and revenue size. Hiscox provides customized coverage, but customers with complex claims may find its service slower than that of other insurers.

Hiscox Business Insurance: Bottom Line

Hiscox small business coverage starts at $109 per month, higher than many competitors. It has user-friendly digital tools and online account management. Coverage selection is more limited compared to other insurers.

Hiscox Business Insurance: FAQ

Based on our comprehensive analysis of Hiscox business insurance, we provide clear answers to common questions about policy coverage, pricing and service experience.

How much can I expect to pay for Hiscox business insurance?

Hiscox business insurance costs an average of $109 per month ($1,305 annually) for small businesses. Coverage costs range from $72 per month for workers' compensation to $169 per month for business owners policies.

How much does Hiscox business insurance cost by industry?

Hiscox business insurance costs range from $25 per month for home-based businesses to $657 per month for pressure washing companies. Service-based operations carry lower premiums than businesses with physical property risks. Insurance rates directly correspond to each industry's specific risk factors.

What industries does Hiscox rank best for?

Hiscox doesn't lead overall across the industries evaluated, performing strongest for accountants, ad agencies and automotive businesses.

Which states offer the cheapest Hiscox business insurance rates?

Maine offers the lowest Hiscox business insurance rates at $93 per month, while Washington has higher rates at $136 per month. Hiscox tends to have mid-range pricing.

What are Hiscox's biggest weaknesses compared to competitors?

Hiscox ranks tenth for coverage options, offering fewer policy customization choices than competitors. The company also places ninth for customer service and policy management.

How We Rated Hiscox Business Insurance

Small business owners need reliable information to choose the right insurance provider. We analyzed how Hiscox compares to other carriers based on what matters most to companies like yours:

- Affordability (50% of score): We compared Hiscox insurance rates against nine other national carriers to find the best value across all coverage types.

- Customer experience (30% of score): We analyzed customer feedback, complaints data and J.D. Power ratings to assess how well Hiscox handles claims and supports its clients.

- Coverage options (15% of score): We evaluated Hiscox's available policies, coverage limits and optional add-ons to determine how well they meet various business needs.

- Financial strength (5% of score): We reviewed financial stability ratings and company reports to confirm Hiscox can reliably pay claims.

Our research covered 79 different industries and four types of coverage. We based our analysis on quotes for a business with two employees, $300,000 in yearly revenue and $150,000 in payroll. This thorough review reveals both the strengths and limitations of Hiscox for your business insurance needs.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "Hiscox Insurance Company Inc. - Company Profile - Best's Credit Rating Center." Accessed September 1, 2025.

- Better Business Bureau. "Hiscox Inc. | BBB Business Profile | Better Business Bureau." Accessed September 1, 2025.

- Hiscox. "Hiscox: Get a Commercial Business Insurance Quote." Accessed September 1, 2025.

- Hiscox. "Business Insurance Reviews | Hiscox." Accessed September 1, 2025.

- Fitch Ratings. "Hiscox Ltd Credit Ratings :: Fitch Ratings." Accessed September 1, 2025.

- Trustpilot. "Hiscox Reviews." Accessed September 1, 2025.