With a MoneyGeek score of 4.4, Coverdash places seventh among national providers in our analysis of 10 insurers across 79 industries. Coverdash offers extensive coverage options, but it could be better in financial stability. While offering competitive rates, its customer service experience could be better.

Coverdash Business Insurance Review

Coverdash ranks seventh in MoneyGeek's study with a score of 4.4 out of 5. It's excellent for affordability and service, but has limited coverage.

Discover cheap business insurance options from Coverdash below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Small businesses pay $102 monthly ($1,220 yearly) for Coverdash business insurance, placing fifth nationally for affordability

Coverdash ranks ninth for customer experience, showing room for improvement in service quality and claims processing

With a second-place ranking for coverage options, Coverdash offers strong policy variety and customization choices for business owners

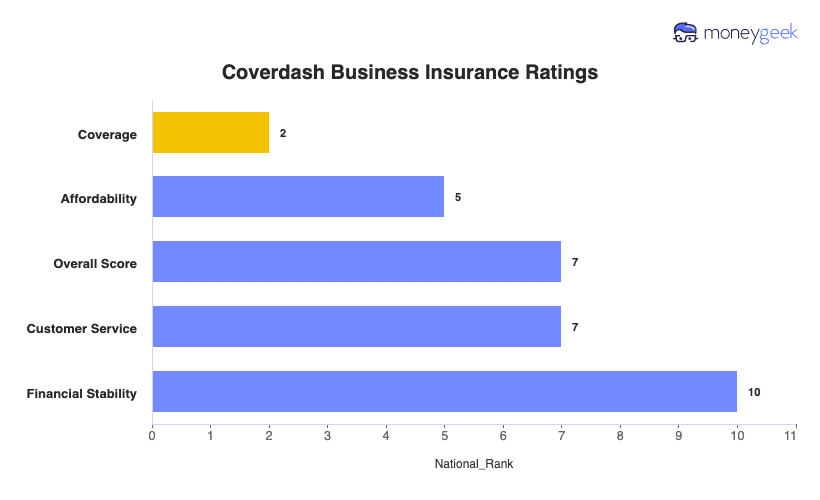

Coverdash Business Insurance Ratings

| Overall Score | 4.4 | 7 |

| Financial Stability | 4.7 | 10 |

| Customer Service | 4.15 | 7 |

| Coverage | 4.8 | 2 |

| Affordability | 4.34 | 5 |

How Did We Determine These Scores?

These scores are for small businesses with two employees across 79 major industries or business types and focus on four coverage types: general liability, professional liability or errors and omissions (E&O), workers' comp and business owner's policy.

Get Matched To The Best Business Insurer For You

Select your industry and state to get a customized company match and get quotes.

To ensure you're making the best choice for your business, we've linked our reviews to Coverdash's competitors so you can compare:

Coverdash Business Insurance Ratings by Industry

Coverdash ranks first overall in 2 of 79 industries, leading in coffee shops and food businesses. It offers the most affordable coverage for auto repair, bakery and wholesale businesses. Coverdash ranks high in customer service, coverage and financial stability.

| Accountants | 4.50 | 4 | 6 | 3 | 5 |

| Ad Agency | 4.50 | 4 | 6 | 3 | 4 |

| Automotive | 4.20 | 7 | 6 | 3 | 4 |

| Auto Repair | 4.60 | 3 | 6 | 3 | 4 |

| Bakery | 4.50 | 3 | 6 | 3 | 4 |

| Barber | 4.50 | 5 | 6 | 3 | 4 |

| Beauty Salon | 4.70 | 2 | 6 | 3 | 4 |

| Bounce House | 4.40 | 3 | 6 | 3 | 4 |

| Candle | 4.50 | 4 | 6 | 3 | 4 |

| Cannabis | 4.30 | 5 | 6 | 3 | 4 |

| Catering | 4.50 | 4 | 6 | 3 | 4 |

| Cleaning | 4.40 | 4 | 6 | 3 | 4 |

| Coffee Shop | 4.70 | 2 | 6 | 3 | 4 |

| Computer Programming | 4.50 | 4 | 6 | 3 | 4 |

| Computer Repair | 4.40 | 4 | 6 | 3 | 4 |

| Construction | 4.20 | 7 | 6 | 3 | 4 |

| Consulting | 4.20 | 5 | 6 | 3 | 4 |

| Contractor | 4.40 | 4 | 6 | 3 | 4 |

| Courier | 4.50 | 3 | 6 | 3 | 4 |

| Daycare | 4.40 | 5 | 6 | 3 | 4 |

| Dental | 4.30 | 5 | 6 | 3 | 4 |

| DJ | 4.20 | 8 | 6 | 3 | 4 |

| Dog Grooming | 4.40 | 3 | 6 | 3 | 4 |

| Drone | 4.50 | 3 | 6 | 3 | 4 |

| Ecommerce | 4.30 | 4 | 6 | 3 | 4 |

| Electrical | 4.50 | 3 | 6 | 3 | 4 |

| Engineering | 4.20 | 7 | 6 | 3 | 4 |

| Excavation | 4.50 | 4 | 6 | 3 | 4 |

| Florist | 4.40 | 5 | 6 | 3 | 4 |

| Food | 4.70 | 2 | 6 | 3 | 4 |

| Food Truck | 4.50 | 4 | 6 | 3 | 4 |

| Funeral Home | 4.50 | 4 | 6 | 3 | 4 |

| Gardening | 4.50 | 3 | 6 | 3 | 4 |

| Handyman | 4.50 | 5 | 6 | 3 | 4 |

| Home-based | 4.20 | 7 | 6 | 3 | 4 |

| Home-based business | 4.50 | 4 | 6 | 3 | 4 |

| Hospitality | 4.60 | 3 | 6 | 3 | 4 |

| HVAC | 4.30 | 4 | 6 | 3 | 4 |

| Janitorial | 4.50 | 3 | 6 | 3 | 4 |

| Jewelry | 4.30 | 5 | 6 | 3 | 4 |

| Junk Removal | 4.40 | 2 | 6 | 3 | 4 |

| Lawn/Landscaping | 4.50 | 3 | 6 | 3 | 4 |

| Lawyers | 4.50 | 4 | 6 | 3 | 4 |

| Manufacturing | 4.20 | 7 | 6 | 3 | 4 |

| Marine | 4.50 | 3 | 6 | 3 | 4 |

| Massage | 4.40 | 5 | 6 | 3 | 4 |

| Mortgage Broker | 4.50 | 4 | 6 | 3 | 4 |

| Moving | 4.40 | 4 | 6 | 3 | 4 |

| Nonprofit | 4.30 | 5 | 6 | 3 | 4 |

| Painting | 4.20 | 5 | 6 | 3 | 4 |

| Party Rental | 4.50 | 3 | 6 | 3 | 4 |

| Personal Training | 4.20 | 4 | 6 | 3 | 4 |

| Pest Control | 4.40 | 5 | 6 | 3 | 4 |

| Pet | 4.20 | 7 | 6 | 3 | 4 |

| Pharmacy | 4.70 | 2 | 6 | 3 | 4 |

| Photography | 4.20 | 6 | 6 | 3 | 4 |

| Physical Therapy | 4.30 | 6 | 6 | 3 | 4 |

| Plumbing | 4.20 | 7 | 6 | 3 | 4 |

| Pressure Washing | 4.30 | 5 | 6 | 3 | 4 |

| Real Estate | 4.50 | 5 | 6 | 3 | 4 |

| Restaurant | 4.60 | 3 | 6 | 3 | 4 |

| Retail | 4.40 | 4 | 6 | 3 | 4 |

| Roofing | 4.40 | 3 | 6 | 3 | 4 |

| Security | 4.40 | 4 | 6 | 3 | 4 |

| Snack Bars | 4.50 | 3 | 6 | 3 | 4 |

| Software | 4.20 | 6 | 6 | 3 | 4 |

| Spa/Wellness | 4.50 | 3 | 6 | 3 | 4 |

| Speech Therapist | 4.40 | 5 | 6 | 3 | 4 |

| Startup | 4.40 | 6 | 6 | 3 | 4 |

| Tech/IT | 4.20 | 7 | 6 | 3 | 4 |

| Transportation | 4.60 | 2 | 6 | 3 | 4 |

| Travel | 4.20 | 6 | 6 | 3 | 4 |

| Tree Service | 4.40 | 7 | 6 | 3 | 4 |

| Trucking | 4.50 | 3 | 6 | 3 | 4 |

| Tutoring | 4.20 | 8 | 6 | 3 | 4 |

| Veterinary | 4.40 | 4 | 6 | 3 | 4 |

| Wedding Planning | 4.20 | 6 | 6 | 3 | 4 |

| Welding | 4.40 | 3 | 6 | 3 | 4 |

| Wholesale | 4.70 | 2 | 6 | 3 | 4 |

| Window Cleaning | 4.50 | 3 | 6 | 3 | 4 |

How Did We Determine These Scores?

These scores are for small businesses with two employees across 79 major industries or business types and focus on four coverage types: general liability, professional liability (E&O), workers' comp and business owner's policy.

Coverdash Business Insurance Ratings by State

Coverdash provides business insurance across 50 states, with a third-place ranking in two markets. It offers competitive rates in several markets, ranking fourth for pricing in eight states and fifth in 27 others.

| Alabama | 4.41 | 6 | 6 | 2 | 8 |

| Alaska | 4.41 | 3 | 4 | 2 | 6 |

| Arizona | 4.41 | 5 | 6 | 2 | 8 |

| Arkansas | 4.42 | 5 | 6 | 2 | 8 |

| California | 4.41 | 5 | 6 | 2 | 8 |

| Colorado | 4.41 | 5 | 6 | 2 | 8 |

| Connecticut | 4.42 | 5 | 6 | 2 | 8 |

| Delaware | 4.42 | 5 | 6 | 2 | 8 |

| Florida | 4.41 | 5 | 6 | 2 | 8 |

| Georgia | 4.40 | 5 | 6 | 2 | 8 |

| Hawaii | 4.40 | 3 | 5 | 2 | 6 |

| Idaho | 4.41 | 5 | 6 | 2 | 8 |

| Illinois | 4.42 | 4 | 6 | 2 | 8 |

| Indiana | 4.42 | 4 | 6 | 2 | 8 |

| Iowa | 4.43 | 5 | 6 | 2 | 8 |

| Kansas | 4.41 | 5 | 6 | 2 | 8 |

| Kentucky | 4.41 | 4 | 6 | 2 | 8 |

| Louisiana | 4.41 | 5 | 5 | 2 | 8 |

| Maine | 4.41 | 5 | 6 | 2 | 8 |

| Maryland | 4.42 | 4 | 6 | 2 | 8 |

| Massachusetts | 4.41 | 5 | 6 | 2 | 8 |

| Michigan | 4.41 | 5 | 6 | 2 | 8 |

| Minnesota | 4.41 | 5 | 6 | 2 | 8 |

| Mississippi | 4.42 | 5 | 6 | 2 | 8 |

| Missouri | 4.41 | 5 | 6 | 2 | 8 |

| Montana | 4.42 | 4 | 6 | 2 | 8 |

| Nebraska | 4.42 | 4 | 6 | 2 | 8 |

| Nevada | 4.42 | 4 | 6 | 2 | 8 |

| New Hampshire | 4.42 | 5 | 6 | 2 | 8 |

| New Jersey | 4.40 | 5 | 6 | 2 | 8 |

| New Mexico | 4.41 | 5 | 6 | 2 | 8 |

| New York | 4.41 | 6 | 6 | 2 | 8 |

| North Carolina | 4.42 | 5 | 6 | 2 | 8 |

| North Dakota | 4.42 | 5 | 6 | 2 | 8 |

| Ohio | 4.42 | 5 | 6 | 2 | 8 |

| Oklahoma | 4.41 | 4 | 6 | 2 | 8 |

| Oregon | 4.41 | 5 | 6 | 2 | 8 |

| Pennsylvania | 4.40 | 5 | 6 | 2 | 8 |

| Rhode Island | 4.41 | 5 | 6 | 2 | 8 |

| South Carolina | 4.42 | 5 | 6 | 2 | 8 |

| South Dakota | 4.41 | 5 | 6 | 2 | 8 |

| Tennessee | 4.40 | 5 | 6 | 2 | 8 |

| Texas | 4.42 | 5 | 6 | 2 | 8 |

| Utah | 4.41 | 5 | 6 | 2 | 8 |

| Vermont | 4.41 | 5 | 6 | 2 | 8 |

| Virginia | 4.40 | 5 | 6 | 2 | 8 |

| Washington | 4.41 | 5 | 6 | 2 | 8 |

| West Virginia | 4.40 | 5 | 6 | 2 | 8 |

| Wisconsin | 4.41 | 4 | 6 | 2 | 8 |

| Wyoming | 4.42 | 5 | 6 | 2 | 8 |

How Did We Determine These Scores?

These scores are for small businesses with two employees across 79 major industries or business types and focus on four coverage types: general liability, professional liability (E&O), workers' comp and business owner's policy.

How Much Does Coverdash Business Insurance Cost?

Coverdash business insurance costs around $102 monthly ($1,220 yearly). You can get business insurance at different price points based on your coverage types. Monthly rates start at $73 for workers' compensation and go up to $150 for business owner's policies.

| Business Owners Policies | $150 | $1,801 |

| General Liability | $104 | $1,242 |

| Professional Liability (E&O) | $78 | $933 |

| Workers Compensation | $73 | $875 |

How Did We Determine These Rates?

These rates are based on MoneyGeek's 2025 analysis of quotes for small businesses with two employees, $300,000 annual revenue and $150,000 payroll across four core coverage types.

How Much Does Coverdash Business Insurance Cost by Industry?

The average cost of business insurance through Coverdash ranges from $33 monthly for home-based businesses to $628 monthly for pressure washing services. Business insurance costs reflect risk levels, with service-based operations paying less than businesses involving physical work or equipment.

| Accountants | $62 | $749 |

| Ad Agency | $51 | $613 |

| Auto Repair | $129 | $1,545 |

| Automotive | $116 | $1,387 |

| Bakery | $77 | $925 |

| Barber | $40 | $477 |

| Beauty Salon | $42 | $509 |

| Bounce House | $68 | $814 |

| Candle | $53 | $636 |

| Cannabis | $97 | $1,164 |

| Catering | $77 | $928 |

| Cleaning | $110 | $1,316 |

| Coffee Shop | $62 | $748 |

| Computer Programming | $55 | $654 |

| Computer Repair | $51 | $610 |

| Construction | $219 | $2,634 |

| Consulting | $56 | $669 |

| Contractor | $215 | $2,585 |

| Courier | $183 | $2,196 |

| DJ | $36 | $435 |

| Daycare | $53 | $636 |

| Dental | $40 | $475 |

| Dog Grooming | $67 | $802 |

| Drone | $43 | $521 |

| Ecommerce | $67 | $805 |

| Electrical | $109 | $1,308 |

| Engineering | $56 | $670 |

| Excavation | $318 | $3,815 |

| Florist | $50 | $603 |

| Food | $64 | $768 |

| Food Truck | $120 | $1,437 |

| Funeral Home | $66 | $797 |

| Gardening | $81 | $976 |

| HVAC | $205 | $2,456 |

| Handyman | $203 | $2,434 |

| Home-based | $33 | $396 |

| Hospitality | $59 | $706 |

| Janitorial | $108 | $1,301 |

| Jewelry | $44 | $526 |

| Junk Removal | $150 | $1,796 |

| Lawn/Landscaping | $82 | $983 |

| Lawyers | $71 | $849 |

| Manufacturing | $50 | $603 |

| Marine | $74 | $894 |

| Massage | $96 | $1,149 |

| Mortgage Broker | $65 | $781 |

| Moving | $165 | $1,978 |

| Nonprofit | $46 | $555 |

| Painting | $156 | $1,867 |

| Party Rental | $69 | $830 |

| Personal Training | $45 | $539 |

| Pest Control | $63 | $755 |

| Pet | $63 | $751 |

| Pharmacy | $41 | $497 |

| Photography | $43 | $516 |

| Physical Therapy | $47 | $565 |

| Plumbing | $357 | $4,279 |

| Pressure Washing | $628 | $7,536 |

| Real Estate | $80 | $958 |

| Restaurant | $98 | $1,174 |

| Retail | $69 | $823 |

| Roofing | $448 | $5,379 |

| Security | $125 | $1,495 |

| Snack Bars | $71 | $856 |

| Software | $52 | $621 |

| Spa/Wellness | $79 | $944 |

| Speech Therapist | $45 | $538 |

| Startup | $42 | $503 |

| Tech/IT | $53 | $635 |

| Transportation | $99 | $1,185 |

| Travel | $48 | $575 |

| Tree Service | $170 | $2,045 |

| Trucking | $155 | $1,857 |

| Tutoring | $42 | $499 |

| Veterinary | $63 | $753 |

| Wedding Planning | $49 | $586 |

| Welding | $153 | $1,832 |

| Wholesale | $46 | $556 |

| Window Cleaning | $149 | $1,788 |

How Did We Determine These Rates?

These rates are based on MoneyGeek's 2025 analysis of quotes for small businesses with two employees, $300,000 annual revenue and $150,000 payroll across four core coverage types.

How Much Does Coverdash Business Insurance Cost by State?

State regulations, natural disaster risks and legal environments influence business insurance rates across the country. Coverdash offers the cheapest business insurance in North Carolina at $87 per month, while business owners in Washington state pay around $125 monthly.

| Alabama | $99 | $1,190 |

| Alaska | $92 | $1,108 |

| Arizona | $96 | $1,152 |

| Arkansas | $97 | $1,159 |

| California | $113 | $1,351 |

| Colorado | $100 | $1,201 |

| Connecticut | $110 | $1,315 |

| Delaware | $109 | $1,306 |

| Florida | $109 | $1,310 |

| Georgia | $103 | $1,233 |

| Hawaii | $106 | $1,277 |

| Idaho | $96 | $1,148 |

| Illinois | $111 | $1,329 |

| Indiana | $98 | $1,180 |

| Iowa | $96 | $1,153 |

| Kansas | $98 | $1,175 |

| Kentucky | $94 | $1,131 |

| Louisiana | $118 | $1,411 |

| Maine | $87 | $1,046 |

| Maryland | $96 | $1,154 |

| Massachusetts | $106 | $1,271 |

| Michigan | $95 | $1,145 |

| Minnesota | $95 | $1,135 |

| Mississippi | $101 | $1,214 |

| Missouri | $100 | $1,196 |

| Montana | $100 | $1,201 |

| Nebraska | $95 | $1,145 |

| Nevada | $115 | $1,378 |

| New Hampshire | $100 | $1,202 |

| New Jersey | $115 | $1,374 |

| New Mexico | $102 | $1,220 |

| New York | $118 | $1,412 |

| North Carolina | $87 | $1,042 |

| North Dakota | $95 | $1,143 |

| Ohio | $102 | $1,228 |

| Oklahoma | $95 | $1,146 |

| Oregon | $94 | $1,125 |

| Pennsylvania | $117 | $1,407 |

| Rhode Island | $111 | $1,331 |

| South Carolina | $104 | $1,246 |

| South Dakota | $94 | $1,133 |

| Tennessee | $99 | $1,182 |

| Texas | $102 | $1,222 |

| Utah | $96 | $1,157 |

| Vermont | $97 | $1,160 |

| Virginia | $92 | $1,103 |

| Washington | $125 | $1,503 |

| West Virginia | $106 | $1,271 |

| Wisconsin | $99 | $1,188 |

| Wyoming | $102 | $1,226 |

How Did We Determine These Rates?

These rates are based on MoneyGeek's 2025 analysis of quotes for small businesses with two employees, $300,000 annual revenue and $150,000 payroll across four core coverage types.

Coverdash Business Insurance Customer Experience Ratings

After analyzing more than 1,100 customer reviews of small business insurance providers, we found that Coverdash ranks ninth nationally with a customer score of 4.03. It has a user-friendly digital platform and competitive rates.

| Affordability | 4.40 | 5 |

| Claims Process | 3.50 | 10 |

| Customer Service | 3.80 | 10 |

| Digital Experience | 4.50 | 4 |

| Policy Management | 3.90 | 10 |

| Recommend to Others | 4.10 | 10 |

Coverdash Business Insurance Customer Reviews and Sentiment

Coverdash is a digital-first insurance brokerage focused on embedded insurance solutions for small businesses and startups. Feedback from recent reviews and discussions highlights its speed and ease of use, but also notes the limitations of its broker model.

Official Website Reviews | Coverdash doesn't have a dedicated customer review section on its website. Its marketing materials emphasize instant quotes and simplified purchasing. |

Better Business Bureau (U.S.) | Coverdash currently has no BBB accreditation and no substantial review or complaint volume. |

Trustpilot | Holds a 3.8/5 TrustScore from recent reviews. Customers praise the smooth, fast online process, the ability to get coverage in minutes, and competitive pricing. A small number of negative reviews mention limited live support and the need to go through partner carriers for claims. |

Reddit | Coverdash is a promising option for quick, affordable coverage, especially for startups and e-commerce sellers. |

Coverdash has fast, digital-first policy issuance and competitive pricing, particularly for entrepreneurs. Its broker model means claims handling and some service functions depend entirely on partner insurers.

Coverdash Business Insurance Industry Ratings

Because Coverdash is a brokerage and not a direct insurer, it has no NAIC complaint index or J.D. Power ranking. Instead, the quality of customer service and claims handling is determined by the underwriting carriers.

Coverdash Business Insurance Financial Strength Ratings

Coverdash itself doesn't carry a financial strength rating, as it is not an insurer. Policies are issued by partner carriers, many of which hold strong AM Best ratings.

Coverdash Business Insurance Coverage Options and Add-ons

Coverdash offers coverage from multiple partner carriers, with a focus on small business essentials and fast issuance.

Core | Protects against third-party bodily injury, property damage and advertising injury | |

Core | Covers service providers against claims of mistakes or negligence | |

Core | Combines general liability and commercial property coverage | |

Core | Pays for employee medical care and lost wages after a workplace injury | |

Specialized | Covers data breaches, cyberattacks and related expenses | |

Specialized | Liability and physical damage coverage for business vehicles | |

Inland Marine | Specialized | Protects tools, equipment and property in transit |

Specialized | Protects against claims of injury or damage caused by products sold or supplied | |

Employment Practices | Specialized | Wrongful termination, harassment claims coverage |

Commercial Flood | Specialized | Flood damage protection through the National Flood Insurance Program |

Management Liability | Specialized | Executive team protection against management-related claims |

Multinational Choice | Specialized | International business coverage for overseas operations |

Home-Based Business | Specialized | Coverage for businesses operating from residential locations |

Disclaimer

Deductibles, coverage limits and specific terms vary by policy and business type. Contact Coverdash for detailed coverage information, including deductibles.

Coverage availability, limits, and pricing depend on the underwriting carrier and the applicant’s location, business type, and risk profile. Claims must be handled directly with the carrier that issued the policy.

Coverdash Business Insurance: Bottom Line

Coverdash provides small business insurance at $102 per month, offering competitive rates for most operations. The company offers comprehensive coverage options and user-friendly digital tools that simplify policy management. However, customers may experience longer wait times during the claims process compared to other providers.

Coverdash Business Insurance: FAQ

Based on our analysis of Coverdash's business insurance offerings, these answers cover the key questions about coverage types, insurance costs and what to expect as a customer.

How much can I expect to pay for Coverdash business insurance?

Coverdash business insurance costs an average of $102 per month ($1,220 annually). Coverage prices range from $73 per month for workers compensation to $150 per month for business owners policies.

How much does Coverdash business insurance cost by industry?

Coverdash business insurance costs range from $33 per month for home-based businesses to $628 per month for pressure washing operations. Service businesses operating from home face fewer risks and pay lower premiums than field service companies. Insurance rates directly correspond to each industry's exposure to potential claims and damages.

What industries does Coverdash rank best for?

Coverdash ranks first in 2 of 79 industries, specifically coffee shops and food businesses. While competitive on price in many industries, it ranks second for affordability in several sectors, including accountants, ad agencies and automotive businesses.

Which states offer the cheapest Coverdash business insurance rates?

North Carolina offers the lowest Coverdash business insurance rates at $87 per month, while Washington rates are higher at $125 monthly. Coverdash typically offers mid-range pricing across states due to varying regulations, natural disaster risks and local legal environments.

What are Coverdash's biggest weaknesses compared to competitors?

Limited claims processing capabilities rank among Coverdash's main weaknesses, with lower customer satisfaction scores. The company also shows gaps in policy management and customer service. Small businesses prioritizing efficient claims handling should explore carriers with stronger track records in these areas.

How We Rated Coverdash Business Insurance

Small business owners need reliable information to compare insurance providers like Coverdash. Our analysis focuses on what matters most to your business protection:

- Affordability (50% of score): We analyzed Coverdash's pricing across all coverage types against nine other national carriers to determine value for small businesses.

- Customer experience (30% of score): We examined complaint records, J.D. Power results and customer feedback to understand how Coverdash handles claims and supports clients.

- Coverage options (15% of score): We assessed Coverdash's insurance offerings, coverage limits and optional add-ons to evaluate flexibility for business needs.

- Financial strength (5% of score): We reviewed financial stability ratings and company reports to confirm Coverdash's ability to meet claim obligations.

We collected quotes from 79 industries across four coverage types, using a standard business profile of two employees, $300,000 in annual revenue and a $150,000 payroll. Our analysis reveals both the strengths and limitations of Coverdash for your business requirements.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Coverdash. "Coverdash | Business Insurance Online Instantly." Accessed September 1, 2025.

- Coverdash. "Small Business." Accessed September 1, 2025.

- Coverdash. "About Us." Accessed September 1, 2025.

- Trustpilot. "Coverdash Reviews." Accessed September 1, 2025.