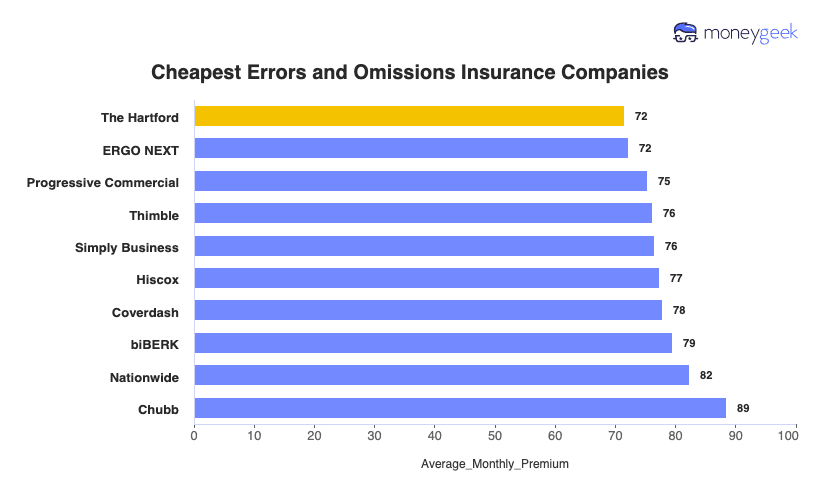

Our research found that The Hartford offers the cheapest errors and omissions insurance coverage, with a monthly rate of $72 ($858 annually). Considering that the average cost of E&O insurance is $78 monthly, that saves you $6. Other low-cost options include ERGO NEXT, Progressive Commercial and Thimble, all offering rates below $77 monthly.

Cheapest Errors and Omissions Insurance

MoneyGeek can get you cheap errors and omissions insurance starting at $26/mo from affordable providers like The Hartford and ERGO NEXT.

Get matched to the most affordable E&O insurance provider for your business.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Cheapest Errors and Omissions Insurance Companies

| The Hartford | $72 | $858 |

| ERGO NEXT | $72 | $867 |

| Progressive Commercial | $75 | $904 |

| Thimble | $76 | $914 |

| Simply Business | $76 | $917 |

| Hiscox | $77 | $928 |

| Coverdash | $78 | $933 |

| biBERK | $79 | $953 |

| Nationwide | $82 | $987 |

| Chubb | $89 | $1,062 |

How We Determined The Cheapest E&O Insurance

After checking rates from 10 insurers, we found costs vary widely by business type and history. Get quotes directly from insurers to see what you'd actually pay.

The Hartford: Cheapest Errors and Omissions Insurer Overall

Most affordable E&O insurance provider nationally

Ranks first in claims process, agent service and overall customer satisfaction

A+ (Superior) AM Best financial strength rating

More than 200 years of insurance experience

Coverage options rank lower than other providers

Digital experience ranks last nationally among carriers

With the highest rated customer experiences for agents and claims, the most affordable rates and ideal tailored options, The Hartford is the cheapest and best errors and omissions insurer in the nation. The company is a business insurance provider you can trust with over 200+ years of experience and tailored service teams segmented by industry area to ensure your experience is ideal. If you are in the law, financial, tech and manufacturing fields, The Hartford also offers tailored E&O plans designed to protect you for risks specific to profession that many other insurers won't provide.

Cheapest Errors and Omissions Insurance Companies by Industry

Our analysis shows that The Hartford has the cheapest E&O rates by industry, winning for affordability in 71 out of 78 business areas we studied. ERGO NEXT offers the lowest errors and omissions rates overall for the food industry with massive $84 savings compared to the $110 industry average. Chubb, Nationwide, Simply Business and Coverdash also have low rates in select professions as well.

| Accountants | The Hartford | $130 |

How We Determined The Cheapest E&O Insurance By Industry

We gathered quotes from 10 providers for small businesses with two employees across 79 industries. Your actual rate depends on your specific situation and claims history, so contact insurers directly to see what you'll pay.

Cheapest Errors and Omissions Insurance Companies by State

At the state level, The Hartford is the most affordable errors and omissions insurance provider in 39 states with rates starting at $62 a month. ERGO NEXT is a runnerup for the lowest rates for the coverage type for the rest of the United States, particularly those in the west and central regions.

| Alabama | The Hartford | $70 |

How We Determined The Cheapest E&O Insurance By State

We gathered quotes from 10 providers for small businesses with two employees across 79 industries. Your actual rate depends on your specific situation and claims history, so contact insurers directly to see what you'll pay.

How to Get The Cheapest Errors and Omissions Insurance

Getting affordable E&O coverage starts with understanding your actual needs, then applying professional liability-specific cost-reduction strategies. Follow these steps to secure the right financial protection at the best price:

- 1

Determine if you need E&O insurance

You need E&O coverage if your professional advice, recommendations or services affect client finances or operations. If you sell physical products or provide basic services without giving advice, you generally don't need professional liability coverage, though you need it for real estate, insurance or health care licensing in some states.

- 2

Calculate the right coverage amount for your profession

Base your coverage on the biggest loss you could cause a client, not how much money you make. Solo practitioners working with small businesses usually get $500,000 coverage. Consultants with mid-size company clients often choose $1 million. Financial planners and similar professionals handling major business decisions generally need $2 million coverage. Lawyers, architects and others whose mistakes could cost clients millions should consider $5 million.

- 3

Target insurers that specialize in your profession

Insurers focused on your profession often offer you better rates than general business insurance companies. These specialized carriers understand your specific risks and can price your coverage more accurately.

- 4

Choose higher E&O deductibles strategically

E&O claims tend to be larger but less frequent than general liability claims, making higher deductibles more practical. Consider $2,500 to $5,000 deductibles since professional liability disputes often cost thousands to defend, even if you win.

- 5

Pay annually to avoid installment fees

Paying your full E&O premium upfront eliminates monthly installment fees, which add hundreds to your yearly cost.

- 6

Bundle with other business insurance

Many insurers offer discounts when you combine E&O coverage with general liability or other business insurance policies. Bundling can reduce your total insurance costs and simplify your coverage management at the same time.

- 7

Leverage your clean claims record

E&O insurers offer you substantial discounts if you have no past professional liability claims. Maintain your record by documenting client communications, establishing clear project boundaries and addressing concerns before they escalate.

Get Cheap Errors and Omissions Insurance Quotes

MoneyGeek can provide you with cheap E&O insurance quotes through our partners by matching you to the right fit based on your industry and state. Use our tool below to find your best and most cost-effective errors and omissions policy provider and get tailored quotes.

Get Matched To The Best Cheap E&O Insurer For You

Select your industry and state to get a customized cheap errors and omissions insurer match and get tailored quotes.

Cheapest Errors and Omissions Insurance: Bottom Line

E&O insurance doesn't have to break your budget. Our study found The Hartford most affordable at $72 monthly, though your actual rate depends on your industry and coverage needs. To maximize your savings, shop smart by comparing multiple insurers, considering higher deductibles and bundling policies.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Upgrades Issuer Credit Ratings of The Hartford Insurance Group, Inc. and Its Subsidiaries." Accessed September 4, 2025.