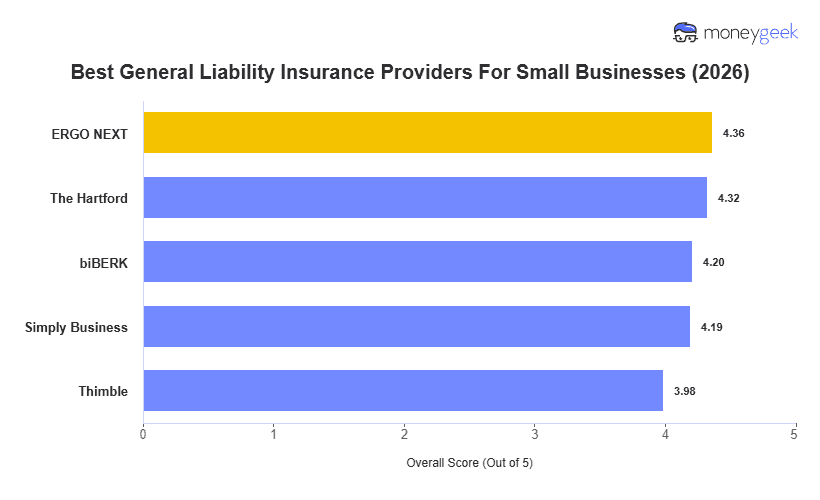

While there is no single best general liability insurance option for every small business, many companies can find strong coverage with the following companies:

- ERGO NEXT: Best Overall, Best For Hands-on and Complex Businesses

- The Hartford: Best Cheap General Liability Insurance

- biBERK: Best For Lower-risk Service Businesses

- Simply Business: Best For Coverage Selection

- Thimble: Best For Gig and Event-based Workers

These insurance providers offer a strong balance of affordability, customer experience, and coverage options, making them reliable choices for covering common small business risks. Below, we summarize why each insurer made our top five general liability insurers and where their strengths stand out.