We researched general liability insurance options to help Rhode Island business owners find the best business insurance coverage. These are MoneyGeek’s answers to common questions about general liability insurance in Rhode Island:

Best General Liability Insurance in Rhode Island

The Hartford leads Rhode Island as both the best and most affordable general liability insurer, with coverage starting at $90 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Rhode Island: Fast Answers

Which company offers the best general liability insurance in Rhode Island?

The Hartford is the best general liability insurance company in Rhode Island, earning a 4.62 overall score out of 5. It offers the lowest rates at $90 per month and delivers reliable claims processing. ERGO NEXT follows closely with a 4.56 score and provides strong digital tools and customer service for $113 per month.

Who offers the cheapest general liability insurance in Rhode Island?

The cheapest general liability insurance companies in Rhode Island are:

- The Hartford: $90 per month

- Simply Business: $105 per month

- Nationwide: $107 per month

- Progressive: $110 per month

- ERGO NEXT: $113 per month

Do Rhode Island businesses legally need general liability insurance?

Rhode Island doesn't legally require most businesses to carry general liability insurance at the state level. However, certain licensed professionals like contractors and electricians may need specific coverage amounts. Additionally, many landlords and clients require proof of insurance before signing contracts or leases.

How much does general liability insurance cost in Rhode Island?

General liability insurance costs between $18 and $1,011 per month for small Rhode Island businesses with two employees. The drone industry has the lowest rates, while pressure washing businesses receive the highest premiums. Your actual costs depend on your specific industry, business location, coverage limits, and employee count.

Best General Liability Insurance Companies in Rhode Island

The Hartford is our top choice for general liability insurance in Rhode Island, offering a strong balance of affordability and customer service. ERGO NEXT ranks as a solid alternative with excellent customer support, while Nationwide delivers reliable stability and competitive pricing for small businesses seeking dependable coverage.

| The Hartford | 4.62 | $90 |

| ERGO NEXT | 4.56 | $113 |

| Nationwide | 4.52 | $107 |

| Simply Business | 4.48 | $105 |

| Coverdash | 4.37 | $114 |

| Thimble | 4.35 | $118 |

| biBERK | 4.30 | $125 |

| Progressive Commercial | 4.27 | $110 |

| Chubb | 4.27 | $131 |

| Hiscox | 4.19 | $125 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Rhode Island General Liability Insurer

Select your industry and state to get a customized Rhode Island general liability insurance quote.

General liability insurance protects Rhode Island businesses from customer injury and property damage claims, but most companies still need additional coverage for full financial protection. Explore these related insurance guides for Rhode Island:

Best Rhode Island General Liability Insurance Reviews

Finding the right general liability insurance in Rhode Island means looking beyond just affordable rates. Coverage quality and customer service matter too. Our research reveals the top business insurers worth considering in the state.

Best Rhode Island General Liability Insurer

Average Monthly General Liability Premium

$90These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Ranks first statewide with top overall customer satisfaction

Handles claims quickly and efficiently with excellent processing

Maintains A+ AM Best financial stability rating

Provides outstanding customer service and support experience

consRequires agent interaction for policy purchases versus online options

Digital experience ranks last among surveyed providers

The Hartford leads Rhode Island's general liability market with exceptional customer service and strong financial stability, backed by an A+ AM Best rating. The company excels in claims processing and customer support, making it ideal for businesses prioritizing reliable service over digital platforms. Rhode Island contractors, professional services and retail businesses benefit from The Hartford's comprehensive coverage and industry expertise.

Overall Score 4.62 1 Affordability Score 4.59 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 The Hartford offers general liability coverage at $90 per month, ranking among Rhode Island's most cost-effective providers. The company shows competitive pricing for construction, electrical work and professional services, with strong affordability ratings across 26 different business categories including consulting, manufacturing and retail.

Data filtered by:AccountantsAccountants $18 2 The Hartford stands out for customer service quality and claims processing efficiency in Rhode Island, earning top national rankings in both categories. Customer feedback consistently highlights the company's responsive support team and fair claims settlements, though digital services receive more modest reviews.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford provides general liability coverage with limits from $300,000 to $2 million per occurrence, offering aggregate limits up to twice that amount. Businesses can enhance protection with product liability coverage and broad form contractual liability options. The company also offers data breach protection through business owner's policy bundling, providing comprehensive coverage solutions for Rhode Island enterprises.

Best Rhode Island Commercial General Liability: Runner-Up

Average Monthly General Liability Premium

$113These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first in affordability with competitive commercial liability rates

Offers superior digital experience for online policy management

Maintains A- AM Best financial stability rating

Customers highly likely to recommend to other businesses

consNewer insurer with shorter industry history than established competitors

Online-only platform without local agent support available

ERGO NEXT ranks as a top general liability insurance provider in Rhode Island, distinguished by its excellent customer service and comprehensive coverage options. With an A- rating from AM Best, ERGO NEXT offers reliable financial protection well-suited for tech companies, professional services and contractors. The provider excels in serving businesses that value digital-first insurance management and streamlined claims processing.

Overall Score 4.56 2 Affordability Score 4.28 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT offers general liability coverage in Rhode Island at $113 per month on average, ranking among the most cost-effective providers. The company shows competitive pricing for dental practices, tech companies and home-based businesses, while also offering affordable rates across professional services and contracting industries.

Data filtered by:AccountantsAccountants $19 3 Rhode Island customers consistently praise ERGO NEXT's digital experience and policy management capabilities. The provider earns top marks for customer satisfaction, with businesses appreciating the streamlined online platform and renewal process. Customer feedback highlights the ease of managing policies and submitting claims through ERGO NEXT's digital tools.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT provides general liability coverage with limits up to $2 million per claim and $4 million aggregate in Rhode Island. The company offers specialized features including contractor E&O insurance and endorsements for completed work protection through CG2010. Businesses can customize their coverage with additional protections for ongoing operations and specific industry needs.

Cheapest General Liability Insurance Companies in Rhode Island

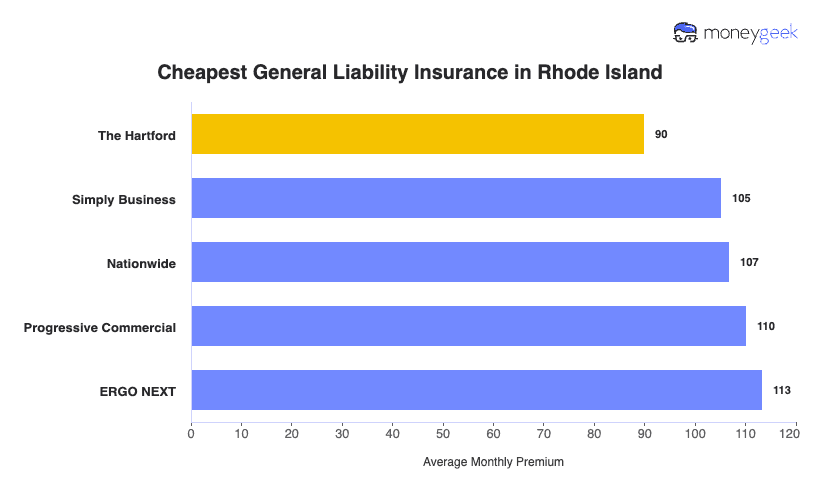

The Hartford offers the cheapest general liability insurance in Rhode Island at $90 per month, saving businesses $23 or 20% compared to the state average. Simply Business and Nationwide also provide affordable coverage options.

| The Hartford | $90 | $1,080 |

| Simply Business | $105 | $1,262 |

| Nationwide | $107 | $1,281 |

| Progressive Commercial | $110 | $1,322 |

| ERGO NEXT | $113 | $1,359 |

| Coverdash | $114 | $1,363 |

| Thimble | $118 | $1,411 |

| Hiscox | $125 | $1,501 |

| biBERK | $125 | $1,502 |

| Chubb | $131 | $1,567 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Rhode Island by Industry

MoneyGeek's research identifies the most affordable general liability insurance providers across Rhode Island industries.

- The Hartford wins affordability in 18 industries, leading in service sectors like electrical work, pest control, trucking and welding.

- Simply Business offers cheap coverage in 16 industries, performing strongest for professional services including accountants, consulting firms and law practices.

- Thimble ranks as the most affordable provider across 12 industries, excelling in tech and creative businesses like computer programming, software development and advertising agencies.

- Nationwide and biBerk each dominate 10 industries for general liability rates. Nationwide leads in construction and manufacturing, while biBerk offers the cheapest coverage for personal service businesses like salons, bakeries and veterinary practices.

- Chubb rounds out the top five with affordable rates in five industries, specializing in retail, hospitality and cannabis businesses.

| Accountants | Simply Business | $16 | $190 |

Average Cost of General Liability Insurance in Rhode Island

Most small businesses in Rhode Island pay around $113 per month for general liability insurance. The average cost of general liability insurance coverage depends on your industry, business size, location and coverage limits.

Manufacturing companies often receive higher premiums due to increased risk exposure, while accounting firms usually pay less because of their lower risk profile. Sole proprietors generally pay less than businesses with employees since they have fewer liability exposures.

Average Cost of General Liability Insurance in Rhode Island by Industry

Rhode Island businesses pay between $18 and $1,011 monthly for general liability coverage, depending on their industry. Drone businesses get the most affordable rates at $18 per month, while pressure washing companies see the highest costs at $1,011 monthly. Review this table to find rates specific to your business type.

| Accountants | $24 | $292 |

| Ad Agency | $39 | $468 |

| Automotive | $59 | $706 |

| Auto Repair | $168 | $2,012 |

| Bakery | $100 | $1,197 |

| Barber | $49 | $587 |

| Beauty Salon | $74 | $885 |

| Bounce House | $78 | $931 |

| Candle | $61 | $728 |

| Cannabis | $74 | $888 |

| Catering | $97 | $1,160 |

| Cleaning | $146 | $1,755 |

| Coffee Shop | $99 | $1,189 |

| Computer Programming | $32 | $385 |

| Computer Repair | $53 | $631 |

| Construction | $194 | $2,323 |

| Consulting | $24 | $290 |

| Contractor | $281 | $3,377 |

| Courier | $216 | $2,589 |

| Daycare | $36 | $435 |

| Dental | $24 | $285 |

| DJ | $28 | $335 |

| Dog Grooming | $70 | $841 |

| Drone | $18 | $221 |

| Ecommerce | $81 | $969 |

| Electrical | $124 | $1,489 |

| Engineering | $44 | $528 |

| Excavation | $514 | $6,169 |

| Florist | $47 | $567 |

| Food | $119 | $1,426 |

| Food Truck | $157 | $1,878 |

| Funeral Home | $67 | $800 |

| Gardening | $124 | $1,489 |

| Handyman | $270 | $3,234 |

| Home-based | $26 | $315 |

| Home-based | $51 | $606 |

| Hospitality | $72 | $864 |

| HVAC | $271 | $3,250 |

| Janitorial | $151 | $1,816 |

| Jewelry | $44 | $533 |

| Junk Removal | $179 | $2,152 |

| Lawn/Landscaping | $133 | $1,592 |

| Lawyers | $25 | $302 |

| Manufacturing | $71 | $846 |

| Marine | $31 | $371 |

| Massage | $106 | $1,269 |

| Mortgage Broker | $25 | $303 |

| Moving | $137 | $1,643 |

| Nonprofit | $40 | $475 |

| Painting | $159 | $1,905 |

| Party Rental | $88 | $1,053 |

| Personal Training | $26 | $316 |

| Pest Control | $36 | $427 |

| Pet | $62 | $743 |

| Pharmacy | $68 | $818 |

| Photography | $27 | $320 |

| Physical Therapy | $122 | $1,458 |

| Plumbing | $399 | $4,790 |

| Pressure Washing | $1,011 | $12,129 |

| Real Estate | $59 | $705 |

| Restaurant | $160 | $1,921 |

| Retail | $72 | $866 |

| Roofing | $428 | $5,141 |

| Security | $154 | $1,843 |

| Snack Bars | $130 | $1,556 |

| Software | $29 | $349 |

| Spa/Wellness | $118 | $1,414 |

| Speech Therapist | $34 | $414 |

| Startup | $32 | $379 |

| Tech/IT | $29 | $350 |

| Transportation | $42 | $498 |

| Travel | $23 | $276 |

| Tree Service | $143 | $1,720 |

| Trucking | $113 | $1,359 |

| Tutoring | $33 | $401 |

| Veterinary | $49 | $594 |

| Wedding Planning | $31 | $367 |

| Welding | $182 | $2,185 |

| Wholesale | $49 | $592 |

| Window Cleaning | $176 | $2,110 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Rhode Island General Liability Insurance Costs?

General liability insurance costs for Rhode Island businesses depend on several important factors.

Rhode Island Healthcare and Economic Costs

Rhode Island experienced 20% growth in medical and drug costs from 2023 to 2024, directly impacting bodily injury claim payouts. The state's cost of living runs approximately 12% higher than the national average, affecting settlement amounts and jury awards. When someone gets injured at your business, insurers cover medical bills, lost wages and legal settlements.

Rhode Island’s elevated healthcare costs mean injuries are more expensive to settle than in many other states. Insurers price these regional expenses directly into general liability premiums.

Rhode Island Legal and Regulatory Environment

Rhode Island was the first state to file a climate damage lawsuit against fossil fuel companies in 2018, demonstrating willingness to pursue large-scale litigation. The state's minimum wage increased to $15.00 per hour on January 1, 2025, with plans to reach $17.00 in 2026, increasing payroll-based premium calculations. Rhode Island's plaintiff-friendly legal environment signals higher lawsuit risk to insurers. Rising minimum wages directly increase premium bases since general liability costs are calculated using payroll factors. Both elements contribute to elevated rates for Rhode Island businesses.

Rhode Island Geographic and Population Density

Insurance agencies raise rates more in Rhode Island than other states due to dense population and busy roads. Rhode Island has nearly 400 miles of coastline and welcomes over 28 million visitors annually. Dense urban areas and coastal locations create constant foot traffic, increasing slip-and-fall incidents and premises liability claims. Seasonal tourism brings large customer volume spikes during the summer months. Each additional visitor represents potential liability exposure that insurers factor into higher premiums for Rhode Island businesses.

Rhode Island Industry Concentration and Risk Profile

Rhode Island has a $5.3 billion ocean economy, $4 billion food economy and major manufacturing presence. Tourism generated $5.6 billion in visitor spending in 2023. The state's economy concentrates heavily in inherently risky sectors (restaurants, hospitality, marine operations and manufacturing) all facing above-average claim frequencies. When insurers evaluate Rhode Island's business landscape dominated by high-risk industries, they establish elevated baseline rates to account for expected higher losses. This concentration affects premiums regardless of individual business type.

How Much General Liability Insurance Do I Need in Rhode Island?

Rhode Island sets general liability insurance requirements by profession rather than imposing universal mandates. Requirements for commercial general liability range from $500,000 for registered contractors to $1.5 million for commercial roofers, depending on your trade and licensing needs.

Commercial leases and client contracts create additional coverage expectations across most industries. Know your profession's specific requirements to maintain compliance and secure adequate financial protection.

Rhode Island requires all registered contractors (residential and commercial) to carry at least $500,000 in general liability coverage. You must name the Rhode Island Contractors' Registration and Licensing Board as the certificate holder on your policy.

These contractors must carry higher coverage than general contractors, needing $1 million in liability insurance to obtain state licensing. The elevated minimum reflects increased risks from installing, repairing, or replacing sewer lines, water lines, and storm drainage systems.

Rhode Island mandates $1.5 million in general liability insurance for commercial roofing contractors. This elevated requirement reflects substantial risks involved in commercial roofing projects and potential property damage claims.

Sidewalk contractors working in Providence need at least $100,000 in general liability coverage. This municipal requirement renews annually each December 31st.

Note: Insurance requirements in Rhode Island change regularly. Check with the Rhode Island Department of Business Regulation, Division of Insurance or a licensed agent to confirm the latest coverage rules.

How to Choose the Best General Liability Insurance in Rhode Island

Getting business insurance in Rhode Island starts with understanding your industry's liability risks and state-specific coverage requirements. Compare policies based on coverage limits, premium costs, insurer financial strength and claims handling to find the right protection for your business.

- 1Determine Coverage Needs

Rhode Island doesn’t require general liability insurance for most businesses, though many landlords and clients ask for proof of coverage. Standard business insurance coverage often includes $1 million per occurrence and $2 million aggregate, while construction companies and other high-risk industries may need higher limits.

Review your lease agreements and client contracts to determine the coverage amounts that fit your business.

- 2Prepare Business Information

Collect essential details insurers need: annual revenue, employee count, business address and your NAICS code. Rhode Island carriers consider your claims history and years in business when calculating premiums. Have your EIN, business registration and recent tax returns ready to speed up quotes.

- 3Compare Multiple Quotes

Request quotes from at least three Rhode Island-licensed insurers to compare the cost of your coverage. Premiums vary by 30% or more between carriers for identical limits and deductibles. Compare annual costs, deductible amounts and whether legal defense expenses fall within or outside policy limits.

- 4Look Beyond Price

Choosing affordable business insurance means understanding policy exclusions, not just finding low premiums. Standard general liability policies exclude professional errors, employee injuries and cyber liability. Review exclusions and confirm whether defense costs count toward your policy limit or receive separate coverage.

- 5Verify Insurer Credentials

Check insurer licensing through the Rhode Island Department of Business Regulation's Insurance Division website. Review AM Best financial strength ratings, looking for A- or higher to ensure the company can pay claims. Research complaint ratios through NAIC to identify carriers with poor claims-handling records.

- 6Ask About Discounts

Rhode Island insurers offer 15% to 25% discounts for bundling general liability with commercial property or workers' compensation. Carriers reduce rates for safety training programs, security systems or claims-free histories spanning three years. Paying annually instead of monthly also lowers your total cost.

- 7Obtain Certificate of Insurance

Your certificate proves coverage to Rhode Island landlords, contractors and clients before contracts begin. Most insurers issue certificates digitally within hours, though some take one to two business days. Keep multiple copies accessible and store your agent's contact for immediate certificate requests.

- 8Review Coverage Annually

Reassess general liability coverage yearly, especially after hiring employees, launching services or relocating. Start comparing renewal quotes 60 to 90 days before your policy expires to allow time for switching carriers. Regular reviews prevent coverage gaps and ensure policy limits match current operations.

Top General Liability Insurance in Rhode Island: Bottom Line

Finding the right general liability insurance in Rhode Island starts with understanding your specific business needs and comparing providers carefully. The Hartford, ERGO NEXT and Nationwide represent strong options in the market, but your best choice depends on your industry, company size and budget. Compare quotes from multiple insurers and verify their credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- ERI Economic Research Institute. "Cost of Living in Rhode Island." Accessed February 7, 2026.

- Rhode Island Attorney General's Office. "U.S. Supreme Court Clears the Way for Rhode Island's Climate Lawsuit to Proceed in State Court." Accessed February 7, 2026.

- Rhode Island Commerce Corporation. "Rhode Island Announces Record Number of Visitors in 2023." Accessed February 7, 2026.

- Rhode Island Current. "R.I. Health Insurance Rates Are Going Up Next Year, but Not as Much as Insurers Wanted." Accessed February 7, 2026.

- Rhode Island Department of Labor and Training. "Minimum Wage." Accessed February 7, 2026.

- USAFacts. "What Is the Average Wage in Rhode Island?." Accessed February 7, 2026.