Get answers about general liability insurance in Indiana and explore the best business insurance coverage for your needs. Our research-backed FAQ section addresses common questions Indiana business owners have about protecting their companies:

Best General Liability Insurance in Indiana

The Hartford leads Indiana as both the best and cheapest general liability insurance provider, with rates starting at $80 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: January 29, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Indiana: Fast Answers

Which company offers the best general liability insurance in Indiana?

The Hartford ranks as the best general liability insurance company in Indiana with an overall score of 4.57 out of 5. It provides affordable coverage at $80 per month and excels in claims handling. ERGO NEXT follows closely as the runner-up with a 4.56 rating, offering excellent digital tools and customer service for $100 per month.

Who offers the cheapest general liability insurance in Indiana?

The cheapest general liability insurance companies in Indiana are:

- The Hartford: $80 per month

- Simply Business: $93 per month

- Nationwide: $95 per month

- Progressive: $98 per month

- ERGO NEXT: $100 per month

Do Indiana businesses legally need general liability insurance?

Indiana doesn't legally require most businesses to carry general liability insurance at the state level. However, certain licensed professionals like contractors and electricians may need coverage to maintain their licenses. Local municipalities can also set their own insurance requirements. Even when not legally mandated, most landlords and clients require proof of coverage before signing contracts or leases.

How much does general liability insurance cost in Indiana?

General liability insurance costs between $16 and $897 per month for small Indiana businesses with two employees. Drone businesses often get the lowest rates at $16 per month, while pressure washing companies land at the higher end at $897 per month. Your actual premium depends on your industry, location, coverage limits and business size.

Best General Liability Insurance Companies in Indiana

The Hartford is our top choice for general liability insurance in Indiana, offering a strong mix of affordability and customer service for small businesses. ERGO NEXT delivers impressive customer experience and coverage quality, while Nationwide offers solid pricing and dependable protection. All three providers give Indiana business owners reliable options for coverage.

| The Hartford | 4.57 | $80 |

| ERGO NEXT | 4.56 | $100 |

| Nationwide | 4.54 | $95 |

| Simply Business | 4.49 | $93 |

| Coverdash | 4.39 | $101 |

| Thimble | 4.35 | $105 |

| biBERK | 4.31 | $111 |

| Progressive Commercial | 4.29 | $98 |

| Chubb | 4.28 | $116 |

| Hiscox | 4.20 | $111 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Indiana General Liability Insurer

Select your industry and state to get a customized Indiana general liability insurance quote.

General liability insurance covers customer injuries and property damage for Indiana businesses, but it won't protect against every risk your company may encounter. Comprehensive coverage requires additional policies tailored to your specific needs:

Best Indiana General Liability Insurance Reviews

Finding the best general liability insurance in Indiana requires looking beyond price alone. Coverage quality and customer service matter too. Our research analyzed top business insurers to help you make the right choice.

Best Indiana General Liability Insurer

Average Monthly General Liability Premium

$80These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Handles claims quickly and efficiently with top-rated processing

Maintains A+ AM Best financial stability rating

Delivers exceptional customer service with highest satisfaction scores

Ranks first overall among general liability providers statewide

consWeakest digital experience among major insurance providers surveyed

Requires agent consultation rather than direct online purchasing options

The Hartford leads Indiana's general liability market with exceptional customer service and strong financial stability, backed by an A+ rating from AM Best. Its comprehensive coverage and efficient claims processing make it suitable for construction, professional services and retail businesses in Indiana. The Hartford excels in personalized support, making it ideal for business owners who value direct agent interaction over digital-only service.

Overall Score 4.57 1 Affordability Score 4.46 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 The Hartford offers general liability coverage at $80 monthly, ranking among Indiana's most cost-effective providers. It delivers competitive rates for construction, cleaning and professional services businesses, with strong affordability rankings across 47 different industries.

Data filtered by:AccountantsAccountants $16 2 Indiana customers consistently praise The Hartford's claims processing and customer service quality, ranking it first nationally in both categories. The company excels in customer satisfaction and renewal likelihood, though digital services lag behind competitors. Business owners appreciate the personalized support from knowledgeable agents.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford provides general liability coverage with limits from $300,000 to $2 million per occurrence, offering aggregate limits up to double that amount. Businesses can enhance protection with product liability coverage and broad form contractual liability options. The Hartford also offers data breach protection through business owner's policy bundling, providing comprehensive coverage for Indiana businesses.

Best Indiana Commercial General Liability Customer Experience

Average Monthly General Liability Premium

$100These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Offers exceptional digital experience for policy management and claims

Provides highly competitive and affordable premium rates

Maintains A- AM Best financial stability rating

Customers frequently recommend to other business owners

consNewer insurer with limited operating history compared to competitors

Online-only platform without local agent support available

ERGO NEXT is a leading general liability insurance provider in Indiana, offering excellent customer service and comprehensive coverage options. With an A- rating from AM Best and top rankings for customer experience and coverage quality, ERGO NEXT works well for tech-savvy business owners who prefer digital convenience.

The provider is a strong fit for contractors, retail operations and professional service firms that want streamlined policy management.

Overall Score 4.56 2 Affordability Score 4.28 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT offers general liability coverage at competitive rates around $100 monthly for Indiana businesses. The provider shows strong pricing for automotive, cleaning and professional services industries, ranking among the most affordable options for these sectors. Tech companies, contractors and retail businesses also benefit from ERGO NEXT's cost-effective coverage options.

Data filtered by:AccountantsAccountants $17 3 Indiana customers consistently praise ERGO NEXT's digital experience, policy management capabilities and overall satisfaction levels. The provider earns top marks for its user-friendly online platform and efficient policy administration. Customer feedback highlights ERGO NEXT's straightforward claims process and responsive support team.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT provides general liability coverage with limits up to $2 million per claim and $4 million aggregate. The provider includes contractor E&O insurance and offers endorsements protecting against completed work damage claims through CG2010 endorsements. Businesses can customize their coverage with industry-specific add-ons and enjoy the flexibility of managing their policies entirely online.

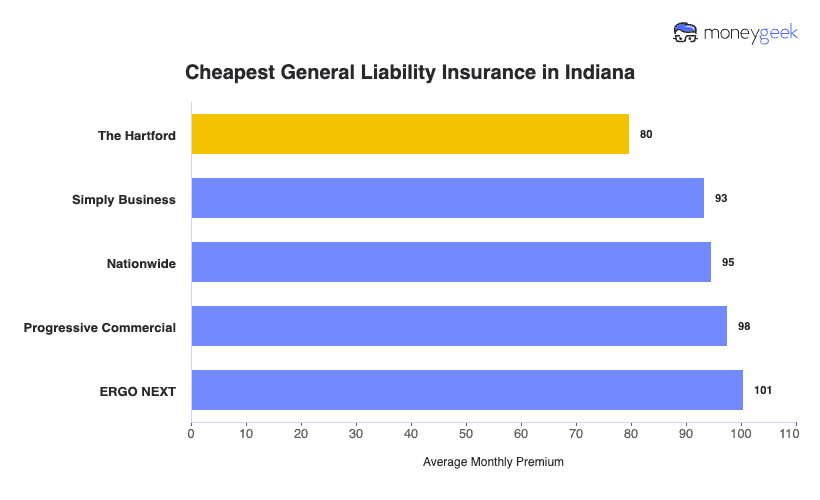

Cheapest General Liability Insurance Companies in Indiana

The Hartford offers the cheapest general liability insurance in Indiana at $80 per month, saving businesses $20 or 20% compared to the state average. Simply Business and Nationwide also provide affordable coverage options.

| The Hartford | $80 | $957 |

| Simply Business | $93 | $1,120 |

| Nationwide | $95 | $1,135 |

| Progressive Commercial | $98 | $1,171 |

| ERGO NEXT | $101 | $1,206 |

| Coverdash | $101 | $1,210 |

| Thimble | $105 | $1,255 |

| Hiscox | $111 | $1,335 |

| biBERK | $111 | $1,336 |

| Chubb | $116 | $1,391 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Indiana by Industry

MoneyGeek's research identifies the cheapest general liability insurance providers by industry across Indiana businesses.

- The Hartford dominates with the lowest rates in 21 industries, including construction, cleaning, food trucks and transportation companies.

- Simply Business and Thimble tie for second place, each winning 11 industries. Simply Business excels with professional services like accountants, lawyers and consulting firms.

- Thimble also covers 11 industries, focusing on service businesses such as barbers, dog grooming, HVAC and tutoring services.

- biBerk ranks as the most affordable provider in nine industries, performing strongest with contractors, engineering firms and veterinary practices.

- Nationwide rounds out the top five with cheapest rates across 8 industries, including electrical, manufacturing and real estate businesses.

| Accountants | Simply Business | $14 | $169 |

Average Cost of General Liability Insurance in Indiana

Most small businesses in Indiana pay around $100 monthly for general liability insurance. The average cost of general liability coverage depends on your industry, business size, location and coverage limits.

Manufacturing companies often pay higher premiums because of increased risk exposure, while accounting firms tend to have lower costs due to fewer liability risks. Sole proprietors generally pay less than businesses with employees since they have fewer risk factors.

Average Cost of General Liability Insurance in Indiana by Industry

General liability insurance costs in Indiana vary widely across industries, ranging from $16 monthly for drone businesses to $897 for pressure washing companies. Your specific business type impacts your general liability coverage rates. Review this table to find typical costs for your industry.

| Accountants | $22 | $259 |

| Ad Agency | $35 | $416 |

| Automotive | $52 | $627 |

| Auto Repair | $149 | $1,787 |

| Bakery | $89 | $1,062 |

| Barber | $43 | $521 |

| Beauty Salon | $65 | $786 |

| Bounce House | $69 | $826 |

| Candle | $54 | $646 |

| Cannabis | $66 | $788 |

| Catering | $86 | $1,031 |

| Cleaning | $130 | $1,558 |

| Coffee Shop | $88 | $1,055 |

| Computer Programming | $28 | $342 |

| Computer Repair | $47 | $560 |

| Construction | $172 | $2,062 |

| Consulting | $22 | $258 |

| Contractor | $250 | $2,997 |

| Courier | $192 | $2,298 |

| Daycare | $32 | $387 |

| Dental | $21 | $253 |

| DJ | $25 | $298 |

| Dog Grooming | $62 | $746 |

| Drone | $16 | $196 |

| Ecommerce | $72 | $861 |

| Electrical | $110 | $1,322 |

| Engineering | $39 | $469 |

| Excavation | $456 | $5,476 |

| Florist | $42 | $504 |

| Food | $106 | $1,266 |

| Food Truck | $139 | $1,667 |

| Funeral Home | $59 | $710 |

| Gardening | $110 | $1,322 |

| Handyman | $239 | $2,871 |

| Home-based | $23 | $279 |

| Home-based | $45 | $538 |

| Hospitality | $64 | $767 |

| HVAC | $240 | $2,885 |

| Janitorial | $134 | $1,613 |

| Jewelry | $39 | $474 |

| Junk Removal | $159 | $1,911 |

| Lawn/Landscaping | $118 | $1,414 |

| Lawyers | $22 | $268 |

| Manufacturing | $63 | $752 |

| Marine | $27 | $330 |

| Massage | $94 | $1,127 |

| Mortgage Broker | $22 | $269 |

| Moving | $122 | $1,459 |

| Nonprofit | $35 | $422 |

| Painting | $141 | $1,691 |

| Party Rental | $78 | $935 |

| Personal Training | $23 | $281 |

| Pest Control | $32 | $379 |

| Pet | $55 | $659 |

| Pharmacy | $61 | $727 |

| Photography | $24 | $284 |

| Physical Therapy | $108 | $1,297 |

| Plumbing | $354 | $4,252 |

| Pressure Washing | $897 | $10,766 |

| Real Estate | $52 | $625 |

| Restaurant | $142 | $1,705 |

| Retail | $64 | $769 |

| Roofing | $380 | $4,563 |

| Security | $136 | $1,636 |

| Snack Bars | $115 | $1,381 |

| Software | $26 | $310 |

| Spa/Wellness | $105 | $1,255 |

| Speech Therapist | $31 | $367 |

| Startup | $28 | $337 |

| Tech/IT | $26 | $311 |

| Transportation | $37 | $442 |

| Travel | $20 | $245 |

| Tree Service | $127 | $1,526 |

| Trucking | $101 | $1,207 |

| Tutoring | $30 | $356 |

| Veterinary | $44 | $527 |

| Wedding Planning | $27 | $326 |

| Welding | $162 | $1,939 |

| Wholesale | $44 | $526 |

| Window Cleaning | $156 | $1,873 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Indiana General Liability Insurance Costs?

Many factors influence what Indiana businesses pay for general liability insurance coverage.

Indiana's Comparative Fault Legal Framework

Indiana law bars injured parties from recovering damages when they're 51% or more at fault for an accident. If you're 50% or less responsible, your compensation drops by your fault percentage. This rule protects Indiana businesses from excessive payouts compared to states with pure comparative negligence. Your insurer accounts for this more favorable legal climate when setting your premiums, though you still need strong liability protection for your business.

Indiana Severe Weather Risk

Indiana battles frequent tornadoes, severe thunderstorms and damaging hail throughout spring and summer. The 2024 season brought multiple EF-2 and EF-3 tornadoes that required federal disaster assistance. These storms damage your property and create liability hazards like broken walkways, scattered debris and flooding on your premises.

Your insurer prices this storm risk into your premiums, especially if customers regularly visit your business. Restaurants, retail shops and hotels see this impact most directly.

Indiana Tourism and Customer Volume

Indiana welcomed record tourism numbers in 2024, fueled by the Indianapolis Motor Speedway, major conventions and sports events. More visitors walking through your doors means more slip-and-fall exposure and premises liability risk. Your insurer calculates premiums based on customer volume and interaction levels.

Restaurants, hotels and retail businesses pay higher rates because constant foot traffic increases your chance of facing injury claims. This tourism boom directly affects what you'll pay for coverage.

Indiana Construction Liability Standards

Indiana gives property owners 10 years from project completion to file construction defect claims against you. The state Supreme Court ruled that general liability policies can cover unintentional faulty workmanship, expanding what insurers may be responsible for paying. This decade-long exposure window can raise premiums for construction businesses.

The notice-and-cure process offers some protection, but insurers still price coverage with extended liability periods for contractors and subcontractors in mind.

Indiana Jury Verdict Trends

Indiana juries side with injured plaintiffs 57% of the time, beating the 48% national average. Your median jury award runs about $25,000, lower than the $40,000 national figure. Recent cases show verdicts can reach tens of millions for serious injuries.

Insurers know Indiana juries favor plaintiffs more often than juries elsewhere, so they factor this higher win rate into your premiums. The lower typical awards help offset some costs, but expect insurers to price cautiously given jury patterns.

How Much General Liability Insurance Do I Need in Indiana?

Indiana doesn't mandate general liability insurance for most businesses. However, specific licensed professions must carry coverage to operate legally. Understanding these requirements helps you determine if your Indiana business needs coverage by law or for practical reasons like client contracts and lease agreements.

We've broken down the general liability insurance requirements for different professions in Indiana:

Home inspectors must maintain at least $100,000 in general liability coverage to obtain or renew their Indiana license. The state requires this protection as part of the licensing process managed by the Home Inspectors Licensing Board.

Private investigator firms need general liability coverage of at least $100,000. Your certificate must list the State of Indiana as an additional insured party.

Manufactured home installers have higher requirements: $100,000 per occurrence plus $1 million aggregate. You can substitute a surety bond for the insurance requirement if preferred.

Contractors working in Indianapolis need $500,000 per occurrence coverage to get licensed. This local requirement exceeds what most other Indiana municipalities mandate.

Note: State insurance rules change regularly. Check with the Indiana Department of Insurance or a licensed agent to confirm current requirements before purchasing coverage.

How to Choose the Best General Liability Insurance in Indiana

Getting business insurance in Indiana requires balancing coverage needs with your budget. General liability covers customer injuries and property damage claims, but you'll want to evaluate additional protections based on your industry risks and contractual obligations.

- 1Determine Coverage Needs

Insurers need your annual revenue, staff count, physical address and NAICS classification code to calculate accurate premiums for your business insurance coverage. Having your EIN, business registration and tax permits ready streamlines the application process and helps carriers provide precise quotes.

Your location within Indiana also affects pricing since rates differ between Indianapolis, Fort Wayne and rural communities based on local claim frequency and litigation costs.

- 2Prepare Business Information

Collect your annual revenue, employee headcount, business location and classification code before requesting quotes. Insurers calculate premiums based on your industry risk level, company size and where you operate within Indiana, with rates varying between Indianapolis, Fort Wayne and smaller communities.

Having your EIN, business registration and tax permits ready streamlines the application process and helps insurers provide accurate pricing.

- 3Compare Multiple Quotes

Request estimates from at least three carriers authorized to sell coverage in Indiana, since business insurance costs fluctuate by hundreds of dollars yearly between companies. Examine how each policy handles deductibles, coverage ceilings and legal defense expenses. Some insurers include attorney fees above your policy limit, while others count defense costs against your total coverage amount.

- 4Look Beyond Price

Don't select a provider based solely on affordable business insurance rates, since restricted coverage often leaves you exposed during claims. Review what each general liability policy excludes, such as damage from faulty workmanship, certain types of property damage or specific business operations unique to your industry.

Verify whether legal defense fees count against your coverage maximum or get paid separately, since this distinction affects how much protection you actually have when facing a lawsuit.

- 5Verify Insurer Credentials

Confirm your carrier holds proper authorization through the Indiana Department of Insurance's online license verification system before buying coverage. Check AM Best ratings to ensure the company maintains strong financial reserves for paying claims. Review complaint data since the Indiana Department of Insurance tracks consumer grievances and publishes records showing which insurers deny legitimate claims or stall payments.

- 6Ask About Discounts

Carriers operating in Indiana reduce premiums for businesses that bundle multiple policies, maintain clean claims records and implement documented safety protocols. Combining your general liability with commercial property through a Business Owner's Policy usually costs 15% to 25% less than purchasing separate coverage.

Indiana insurers also discount premiums when you complete safety certifications that municipalities or industry groups require for your specific trade.

- 7Obtain Certificate Documentation

Your clients, landlords and general contractors throughout Indiana will request certificates proving you carry active coverage. Most insurance companies issue digital certificates within minutes of binding your policy, though some carriers require one to two business days for processing.

Store your agent's contact details somewhere accessible since Indiana contractors and commercial property owners often demand proof of insurance before allowing you to start work.

- 8Review Coverage Annually

Your insurance needs change as you hire employees, add service offerings or increase annual revenue. Begin shopping for competitive quotes two to three months before your policy renews to lock in better rates or adjust your coverage limits. Indiana's evolving business environment means the protection you bought when opening may no longer match your current operations or contractual obligations.

Top General Liability Insurance in Indiana: Bottom Line

Finding the right general liability insurance in Indiana starts with knowing your specific business needs and comparing providers carefully. The Hartford, ERGO NEXT and Nationwide lead our analysis, but your best option depends on your industry, company size and budget constraints. Smart business owners get multiple quotes and check each insurer's credentials before making their final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Indiana Department of Homeland Security. "Get Prepared: Tornadoes." Accessed February 7, 2026.

- Indiana Destination Development Corporation. "IDDC Releases 2022 Contribution of Travel & Tourism to the Indiana Economy." Accessed February 7, 2026.

- Justia. "Indiana Code Title 34, Article 51, Chapter 2." Accessed February 7, 2026.

- Justia. "Indiana Code Title 32, Article 27, Chapter 3." Accessed February 7, 2026.

- Justia. "Indiana Code Title 32, Article 30, Chapter." Accessed February 7, 2026.

- National Weather Service Indianapolis. "Summary of March 14th 2024 Severe Storms." Accessed February 7, 2026.

- National Weather Service Indianapolis. "Tornado and Severe Storms of July 29, 2024." Accessed February 7, 2026.

- U.S. Small Business Administration. "SBA Offers Disaster Assistance to Businesses and Residents of Indiana Affected by Severe Storms and Tornadoes." Accessed February 7, 2026.