We researched best business insurance options to bring you reliable answers about general liability coverage in Iowa. These frequently asked questions draw from MoneyGeek's detailed analysis and research:

Best General Liability Insurance in Iowa

The Hartford leads Iowa's general liability market as both the best and cheapest option, with coverage starting at $78 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: January 30, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Iowa: Fast Answers

Which company offers the best general liability insurance in Iowa?

The Hartford ranks as the best general liability insurance company in Iowa with an overall score of 4.64 out of 5. It provides affordable coverage at $78 per month and processes claims efficiently. ERGO NEXT follows closely as the runner-up, offering strong digital tools and customer service for $98 per month.

Who offers the cheapest general liability insurance in Iowa?

The cheapest general liability insurance companies in Iowa are:

- The Hartford: $78 per month

- Simply Business: $91 per month

- Nationwide: $92 per month

- Progressive: $95 per month

- ERGO NEXT: $98 per month

Do Iowa businesses legally need general liability insurance?

Iowa doesn't require most businesses to carry general liability insurance. Contractors and electricians need coverage to maintain licenses. Cities can require insurance, and landlords and clients usually demand proof of coverage before signing contracts or leases.

How much does general liability insurance cost in Iowa?

General liability insurance costs between $16 and $876 per month for small Iowa businesses with two employees. Drone businesses often have the lowest rates at $16 per month, while pressure washing companies land at the high end at $876 per month. Your actual premium depends on your industry, location, coverage limits, and business size.

Best General Liability Insurance Companies in Iowa

The Hartford is our top pick for general liability insurance in Iowa, combining affordable rates and quality customer service. ERGO NEXT also performs well with reliable customer support and coverage options for small businesses. Nationwide completes the top contenders with dependable service and an A+ AM Best rating.

| The Hartford | 4.64 | $78 |

| ERGO NEXT | 4.56 | $98 |

| Nationwide | 4.53 | $92 |

| Simply Business | 4.49 | $91 |

| Thimble | 4.40 | $102 |

| Coverdash | 4.38 | $98 |

| biBERK | 4.29 | $109 |

| Progressive Commercial | 4.28 | $95 |

| Chubb | 4.27 | $113 |

| Hiscox | 4.19 | $109 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Iowa General Liability Insurer

Select your industry and state to get a customized Iowa general liability insurance quote.

General liability insurance covers customer injuries and property damage for Iowa businesses, but most companies need additional protection. Explore these related coverage options:

Best Iowa General Liability Insurance Reviews

Choose Iowa general liability insurance based on coverage quality and customer service, not just rates. Our analysis covered top business insurers statewide.

The Hartford

Best Iowa General Liability Insurer

Average Monthly General Liability Premium

$78These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Ranked first for overall satisfaction among Iowa general liability insurers

Processes claims faster than competitors

Holds A+ AM Best rating

Earned highest national customer service ranking

consDigital platform rated lowest among Iowa insurers surveyed

No online purchasing; must work with an agent to buy policies

The Hartford leads Iowa's general liability market with high-rated customer service, backed by an A+ AM Best rating. The company processes claims efficiently and serves construction, professional services and retail industries.

Iowa business owners who value personalized support and reliable claims handling will benefit from The Hartford's traditional service approach.

Overall Score 4.64 1 Affordability Score 4.63 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 The Hartford charges an average of $78 monthly for general liability coverage in Iowa. The insurer ranks among the cheapest for construction, cleaning services, accounting and consulting. It also charges competitive rates for retail and food service businesses.

Data filtered by:AccountantsAccountants $16 2 The Hartford ranks first nationally for claims processing and customer service. Iowa customers rated the company highly for efficient claim resolutions. The company provides personalized support, though digital tools ranked lowest among Iowa insurers surveyed.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford sells general liability policies with limits from $300,000 to $2 million per occurrence and double aggregate limits. Businesses can add product liability coverage and broad form contractual liability. Business owners can bundle general liability with business owner policies, including data breach protection.

ERGO NEXT

Best Iowa Commercial General Liability Customer Experience

Average Monthly General Liability Premium

$98Rates based on small businesses with two employees across 79 industries, general liability policies only.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Iowa's cheapest general liability at $98 monthly

User-friendly digital platform for online policy management

A- AM Best financial stability rating

Fast quote process and instant policy access

consFounded recently with shorter track record than established insurers

No local agents; all service happens online

ERGO NEXT works for Iowa businesses that handle insurance online. The company holds an A- AM Best rating and ranked highly for customer service in MoneyGeek's survey. Business owners manage policies through ERGO NEXT's digital platform without agent support.

The company insures tech businesses, professional services and construction companies.

Overall Score 4.56 2 Affordability Score 4.27 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT charges $98 monthly for general liability coverage in Iowa. The insurer ranked cheapest for tech businesses, professional services and contractors. ERGO NEXT offers competitive rates across 25 service industries, including automotive, cleaning and real estate.

Data filtered by:AccountantsAccountants $16 3 ERGO NEXT earned a 4.8 out of 5 rating for digital experience in MoneyGeek's survey. Iowa businesses rated the online platform and renewal process highly. Claims processing scored 3.9 out of 5. The company works best for businesses comfortable managing insurance online.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT covers general liability claims up to $2 million per occurrence and $4 million aggregate. The insurer includes contractor E&O insurance and offers the CG2010 endorsement for completed operations. Iowa contractors can add industry-specific protections to policies.

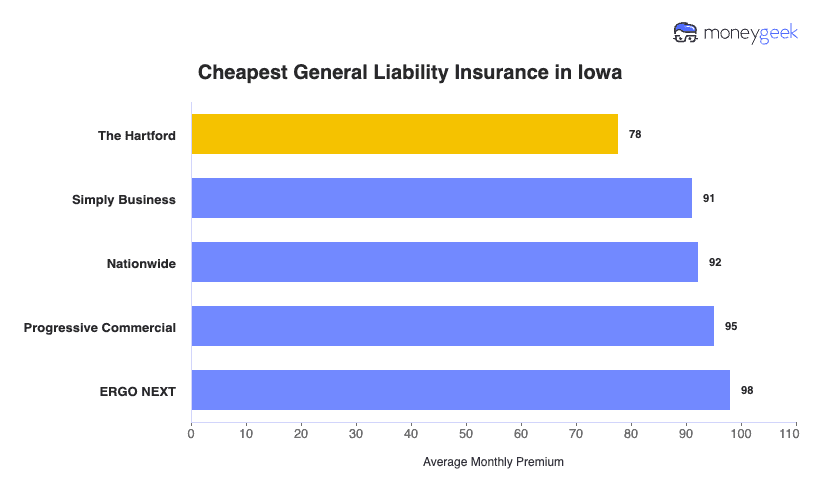

Cheapest General Liability Insurance Companies in Iowa

The Hartford sells the cheapest general liability insurance in Iowa at $78 monthly, $20 less than the state average. Simply Business and Nationwide also charge below-average rates for Iowa businesses.

| The Hartford | $78 | $933 |

| Simply Business | $91 | $1,093 |

| Nationwide | $92 | $1,108 |

| Progressive Commercial | $95 | $1,142 |

| ERGO NEXT | $98 | $1,177 |

| Coverdash | $98 | $1,181 |

| Thimble | $102 | $1,226 |

| Hiscox | $109 | $1,304 |

| biBERK | $109 | $1,305 |

| Chubb | $113 | $1,357 |

How Did We Determine These Rates?

Rates reflect small businesses with two employees across 79 industries, general liability policies only. Your premium depends on location, industry, coverage amount and claims history. Coverage options vary by state.

Cheapest General Liability Insurance in Iowa by Industry

MoneyGeek found these insurers charge the lowest rates across Iowa industries:

- The Hartford: Cheapest in 23 industries, including construction, cleaning, food trucks and transportation.

- Simply Business: Cheapest in 11 industries, including accountants, lawyers and software companies.

- Thimble: Cheapest in 10 industries, including barbershops, coffee shops and HVAC contractors.

- biBerk: Cheapest in nine industries, including catering, engineering and veterinary practices.

- ERGO NEXT and Progressive: Each ranked cheapest in seven industries. ERGO NEXT costs least for dental and tech businesses. Progressive costs least for retail and beauty services.

| Accountants | Simply Business | $14 | $164 |

Average Cost of General Liability Insurance in Iowa

Most small businesses in Iowa pay around $98 monthly for general liability insurance. The average cost of general liability coverage depends on your industry, business size, location and coverage limits. Manufacturing companies pay higher premiums due to equipment and product risks, while accounting firms pay less due to office-based operations. Sole proprietors pay less than businesses with employees.

Average Cost of General Liability Insurance in Iowa by Industry

General liability insurance costs in Iowa vary widely by industry, ranging from $16 monthly for drone businesses to $876 for pressure washing companies. Your industry determines your rate more than any other factor. Review the table below to find typical general liability coverage costs for your business type.

| Accountants | $21 | $253 |

| Ad Agency | $34 | $406 |

| Automotive | $51 | $612 |

| Auto Repair | $145 | $1,744 |

| Bakery | $86 | $1,037 |

| Barber | $42 | $509 |

| Beauty Salon | $64 | $767 |

| Bounce House | $67 | $806 |

| Candle | $53 | $631 |

| Cannabis | $64 | $769 |

| Catering | $84 | $1,006 |

| Cleaning | $127 | $1,521 |

| Coffee Shop | $86 | $1,030 |

| Computer Programming | $28 | $334 |

| Computer Repair | $46 | $547 |

| Construction | $168 | $2,014 |

| Consulting | $21 | $252 |

| Contractor | $244 | $2,926 |

| Courier | $187 | $2,244 |

| Daycare | $31 | $377 |

| Dental | $21 | $247 |

| DJ | $24 | $291 |

| Dog Grooming | $61 | $728 |

| Drone | $16 | $191 |

| Ecommerce | $70 | $840 |

| Electrical | $108 | $1,291 |

| Engineering | $38 | $457 |

| Excavation | $445 | $5,346 |

| Florist | $41 | $492 |

| Food | $103 | $1,236 |

| Food Truck | $136 | $1,627 |

| Funeral Home | $58 | $693 |

| Gardening | $108 | $1,291 |

| Handyman | $234 | $2,802 |

| Home-based | $23 | $273 |

| Home-based | $44 | $525 |

| Hospitality | $62 | $749 |

| HVAC | $235 | $2,816 |

| Janitorial | $131 | $1,574 |

| Jewelry | $39 | $463 |

| Junk Removal | $155 | $1,865 |

| Lawn/Landscaping | $115 | $1,380 |

| Lawyers | $22 | $262 |

| Manufacturing | $61 | $734 |

| Marine | $27 | $322 |

| Massage | $92 | $1,100 |

| Mortgage Broker | $22 | $263 |

| Moving | $119 | $1,424 |

| Nonprofit | $34 | $412 |

| Painting | $138 | $1,651 |

| Party Rental | $76 | $912 |

| Personal Training | $23 | $274 |

| Pest Control | $31 | $370 |

| Pet | $54 | $643 |

| Pharmacy | $59 | $710 |

| Photography | $23 | $277 |

| Physical Therapy | $106 | $1,266 |

| Plumbing | $346 | $4,150 |

| Pressure Washing | $876 | $10,509 |

| Real Estate | $51 | $610 |

| Restaurant | $139 | $1,665 |

| Retail | $63 | $751 |

| Roofing | $371 | $4,455 |

| Security | $133 | $1,597 |

| Snack Bars | $112 | $1,348 |

| Software | $25 | $302 |

| Spa/Wellness | $102 | $1,225 |

| Speech Therapist | $30 | $358 |

| Startup | $27 | $328 |

| Tech/IT | $25 | $303 |

| Transportation | $36 | $432 |

| Travel | $20 | $239 |

| Tree Service | $124 | $1,490 |

| Trucking | $98 | $1,178 |

| Tutoring | $29 | $348 |

| Veterinary | $43 | $514 |

| Wedding Planning | $27 | $318 |

| Welding | $158 | $1,893 |

| Wholesale | $43 | $513 |

| Window Cleaning | $152 | $1,828 |

How Did We Determine These Rates?

Rates reflect small businesses with two employees across 79 industries, general liability policies only. Your premium depends on location, industry, coverage amount and claims history. Coverage options vary by state.

What Factors Affect Iowa General Liability Insurance Costs?

General liability insurance costs for Iowa businesses vary by industry, location, business size and coverage limits.

Iowa's Tort Reform Legislation

Iowa passed tort reform in 2023 capping lawsuit damages. The law limits non-economic damages to $5 million for trucking accidents, $1 million for medical malpractice and $250,000 for dram shop cases.

These damage caps lower insurers' maximum payouts on liability claims. The caps may stabilize general liability premiums as Iowa's insurance market adjusts.

Iowa's Agricultural Economy

Agriculture contributes $44 billion annually to Iowa's economy and affects liability insurance pricing statewide. Farming operations risk equipment injuries, contaminated products and customer accidents on agricultural property.

Insurers factor Iowa's agricultural concentration into general liability rates for all businesses, not just farms.

Iowa's Economic Inflation Trends

Inflation raises general liability costs. Medical expenses for injuries keep climbing. Property damage repair costs surged since the pandemic. Supply chain problems and labor shortages increased costs further.

Insurers pay more to settle liability claims today than two years ago. To cover higher claim costs, insurers raised premiums. Iowa businesses now pay higher rates.

Iowa's Comparative Negligence Law

Iowa uses modified comparative fault, adopted in 1982. Injured parties recover damages if they're 50% or less responsible for their injuries.

Iowa businesses pay all economic damages when courts find them 50% or more at fault. This rule increases businesses' liability exposure. Insurers charge higher premiums to cover this risk.

How Much General Liability Insurance Do I Need in Iowa?

Iowa doesn't mandate general liability insurance for most businesses, but specific licensed trades must carry coverage. Understanding the requirements for commercial general liability insurance ensures compliance. Licensed electricians must carry the highest coverage amounts. Below are Iowa's profession-specific general liability requirements:

- Standard electrical contractors and those specializing in residential work must maintain $1 million in general liability coverage under Iowa Code Chapter 103.

- Professionals installing irrigation systems, electrical signs, and HVAC disconnects must have at least $1 million in contractor liability insurance. You need this coverage to maintain your specialized license.

Need at least $1 million per occurrence for both property damage and public liability. The state sets this threshold to protect property owners from installation errors.

Can choose between two coverage options—$100,000 each for property damage and public liability separately, or $100,000 per occurrence with $300,000 annual aggregate. Your license depends on maintaining one of these minimum levels.

*State insurance rules change frequently. Verify current requirements with the Iowa Insurance Division or a licensed insurance agent before selecting coverage.

How to Choose the Best General Liability Insurance in Iowa

Get general liability insurance by assessing your Iowa business risks and budget. Compare quotes from multiple insurers to find coverage that protects against lawsuits without overpaying.

- 1Determine Your Coverage Needs

Iowa doesn't require general liability insurance for most businesses. Electrical contractors and certain licensed trades need at least $1 million in business insurance coverage.

Most Iowa businesses buy $500,000 to $2 million per occurrence limits based on industry risk and client contracts. Review lease agreements and vendor requirements—Iowa landlords and large contractors often require specific coverage amounts.

- 2Prepare Business Information

Gather your Iowa business registration number, federal EIN, annual revenue and employee count before requesting quotes. Insurers price premiums based on industry classification, Iowa location and claims history. Have tax documents and Iowa contractor registration (if applicable) ready; this speeds quotes and improves rate accuracy.

- 3Compare Multiple Quotes

Request quotes from at least three Iowa-licensed insurers. Premiums vary between carriers for identical coverage. Compare policy limits, deductibles and whether legal defense costs count toward your coverage limit or stay separate. Iowa businesses save hundreds annually by comparing quotes.

- 4Look Beyond Price

Buying the cheapest policy can leave coverage gaps. Read policy exclusions to understand what's not covered—professional errors, pollution liability and cyber incidents are common exclusions. Iowa businesses sometimes find their low-cost policies excluded needed protections after filing claims.

- 5Verify Insurer Credentials

Verify insurers hold active Iowa licenses at iid.iowa.gov. Check the company's AM Best financial strength rating and complaint ratio. Iowa businesses benefit from insurers with low complaint records — the Iowa Insurance Division tracks complaints and intervenes in disputes.

- 6Ask About Discounts

Iowa insurers discount bundled policies, and combining general liability with property or commercial auto coverage cuts premiums 10% to 25%. Claims-free histories, safety programs and annual payments reduce costs further. Security systems and employee training programs qualify Iowa businesses for additional discounts.

- 7Get Certificate of Insurance

Iowa contractors, vendors and landlords require insurance certificates before starting work or signing leases. Most insurers issue digital certificates instantly through online portals. Some take 48 hours. Keep your agent's contact information handy for urgent requests, as missing or expired certificates delay Iowa projects.

- 8Review Coverage Annually

Review general liability coverage yearly, especially after hiring employees, expanding to new Iowa cities or adding services. Compare renewal quotes against competitor rates 60 to 90 days before your policy expires. Iowa businesses that skip coverage updates risk audit violations or insufficient protection when revenue grows.

Top General Liability Insurance in Iowa: Bottom Line

Choose general liability insurance in Iowa by understanding your business needs and comparing providers thoroughly. The Hartford, ERGO NEXT and Nationwide lead our analysis, but your ideal choice depends on your industry, company size and budget. Get quotes from multiple insurers and verify their credentials.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Iowa Capital Dispatch. "Gov. Kim Reynolds Signs New Medical Malpractice Liability Limits Into Law." Accessed February 27, 2026.

- Iowa Capital Dispatch. "Legislature Approves Cap on Noneconomic Damages in Malpractice Lawsuits." Accessed February 27, 2026.

- Iowa Department of Agriculture and Land Stewardship. "USDA NASS Census Proves Agriculture Is Vital to Iowa's Economy." Accessed February 27, 2026.

- Iowa Legislature. "Iowa Code Chapter 668 - Liability in Tort — Comparative Fault." Accessed February 27, 2026.

- Iowa Legislature. "Senate File 228." Accessed February 27, 2026.

- Iowa State Bar Association. "Statutory Modifications to Iowa Tort Law 1982 - 2023." Accessed February 27, 2026.

- USDA National Agricultural Statistics Service. "Iowa." Accessed February 27, 2026.