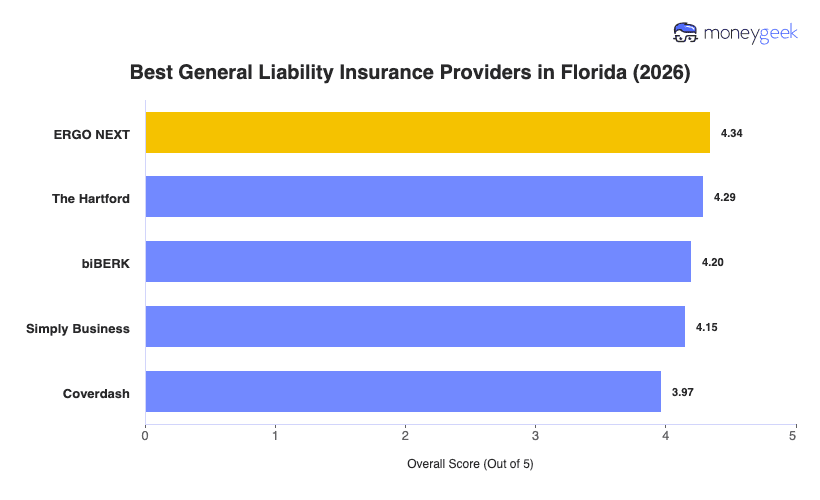

Whether you're operating a food truck in Fort Lauderdale, managing a cleaning service in Orlando or running a photography business in Sarasota, the best general liability insurance options deliver value without forcing you into one-size-fits-all policies. These four general liability providers rank highest for Florida small businesses:

- ERGO NEXT: Best Overall, Best for Hands-On and Service Industries

- The Hartford: Best Cheap General Liability Insurance

- biBERK: Best for Service and Activity Businesses

- Simply Business: Best for Comparing Multiple Carriers

- Coverdash: Strong for Comprehensive Coverage Needs

These providers perform well across the key factors for Florida businesses navigating hurricane season liability risks and varied industry exposures. The profiles below break down where each insurer excels and how they stack up against one another for different business types.