We answer frequently asked questions about general liability insurance in Texas based on our research and analysis:

Best General Liability Insurance for Small Businesses in Texas

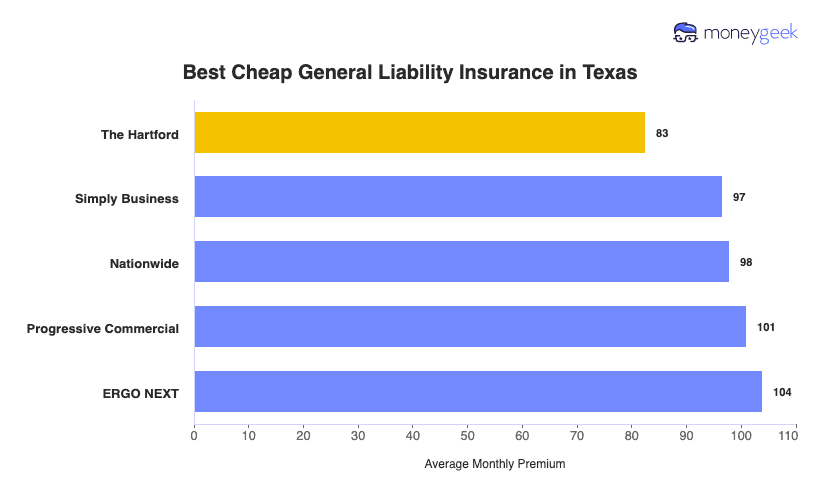

The Hartford is the best and cheapest general liability insurance provider in Texas, with rates starting at $83 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Texas: Fast Answers

Which company offers the best general liability insurance in Texas?

The Hartford is the best general liability insurance company, with a MoneyGeek score of 4.63 out of 5, excellent claims processing and the lowest rate at $83 monthly. ERGO NEXT follows as second-best, excelling in customer service and digital experience for $104 monthly.

Who offers the cheapest general liability insurance in Texas?

The cheapest general liability insurance companies in Texas and their average monthly rates are:

- The Hartford: $83

- Simply Business: $97

- Nationwide: $98

- Progressive Commercial: $101

- ERGO NEXT: $104

Do Texas businesses legally need general liability insurance?

Texas doesn't require general liability for most businesses, but local cities and counties can set their own rules. Licensed trades must carry specific coverage: electricians need $300,000 per incident plus $600,000 yearly, electrical sign contractors have identical requirements and fire safety companies need $100,000 per incident. Most landlords and clients also require coverage.

How much does general liability insurance cost in Texas?

General liability costs range from $17 to $928 monthly for small Texas businesses with two employees, based on MoneyGeek's analysis. Actual costs depend on industry, location, coverage limits and business size.

What does general liability insurance cover for Texas businesses?

General liability covers bodily injury to customers, property damage you cause to others and legal defense costs. If a customer slips in your Austin shop or you damage a client's fence in Fort Worth, your policy pays medical bills, repairs and legal fees. It won't cover professional errors, employee injuries or damage to your own property.

What general liability coverage limits should Texas businesses choose?

Most Texas businesses should choose $1 million per claim and $2 million aggregate limits. If possible, choose a per-occurrence policy that covers you when an incident happens, even if the damage extends beyond the policy period.

Best General Liability Insurance Companies for Small Businesses in Texas

The Hartford is the best general liability insurance company in Texas, balancing affordability and quality service. ERGO NEXT and Nationwide also rank well for customer service.

| The Hartford | 4.63 | $83 |

| ERGO NEXT | 4.58 | $104 |

| Nationwide | 4.53 | $98 |

| Simply Business | 4.49 | $97 |

| Coverdash | 4.38 | $104 |

| Thimble | 4.35 | $108 |

| biBERK | 4.30 | $115 |

| Progressive Commercial | 4.28 | $101 |

| Chubb | 4.27 | $120 |

| Hiscox | 4.19 | $115 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Texas General Liability Insurer

Select your industry and state to get a customized Texas general liability insurance quote.

General liability insurance protects your Texas business from customer injury and property damage claims, but you'll likely need additional coverage. Check out our other guides:

Best Texas General Liability Insurance for Small Businesses Reviews

Choosing the right general liability provider involves more than finding the cheapest option. Here's what we found about the best business insurers in Texas.

Best Texas General Liability Insurer

Average Monthly General Liability Premium

$83These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Ranks first overall among the public liability providers

Has an A+ AM Best rating

Most affordable rates for commercial general liability

Over 200 years of experience and second overall ranking for customer experience

consRequires agent interaction for most policy purchases vs. online-only options

Digital experience ranks last among providers surveyed

The Hartford tops MoneyGeek's Texas commercial general liability study with quality service for $83 monthly and leads nationally in claims processing.

Founded in 1810, The Hartford combines an AM Best A+ rating with second-place affordability rankings and proven reliability. It's best for Texas businesses prioritizing superior claims handling and personal service over modern online tools.

Overall Score 4.63 1 Affordability Score 4.59 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 The Hartford provides financial protection through public liability insurance in Texas for an average of $83 monthly ($990 annually), ranking second in affordability among the providers in our study.

The Hartford ranks first in 21 Texas industries, including construction and electrical work. It offers low-cost coverage for contractors and cleaning services, ranking second. You'll likely save money regardless of your industry.

Data filtered by:AccountantsAccountants $17 2 The Hartford ranks first for claims processing and customer service, meaning faster claim resolutions and knowledgeable support when Texas businesses need help most. Its digital experience ranks last, indicating challenges with online policy management.

Trustpilot reviews show mixed experiences, with some customers praising claims handling while others report unreturned calls and delayed responses. Business owners who prefer speaking with agents rather than buying online will find The Hartford's personal service approach worthwhile.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford offers general liability coverage with policy limits from $300,000 to $2 million per occurrence, with aggregate limits twice the occurrence amount. If you manufacture or sell products, including food, you can add product liability coverage to this policy.

Beyond standard public liability, bodily injury and property damage protection, you can add broad form contractual liability coverage or bundle data breach protection through a business owner's policy.

Best Texas Commercial General Liability Customer Experience

Average Monthly General Liability Premium

$104These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first in customer service and second for coverage among Texas providers

Provides instant quotes and coverage in 10 minutes

Has an A- AM Best rating with backing from Munich Re

Covers 1,300+ business types with AI-driven customization

consCosts more than five other Texas providers

Newer insurer with less history than competitors

No local agents; everything's online

ERGO NEXT tops Texas insurers for customer service and places second for coverage options. Munich Re backs this 2016 startup, which now serves over 600,000 customers online.

ERGO NEXT uses AI technology to provide instant quotes and coverage in 10 minutes, with 24/7 access to certificates and policy management. It's best for Texas business owners who prioritize speed, convenience and digital experiences over traditional agent relationships and low costs.

Overall Score 4.58 2 Affordability Score 4.32 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT provides general liability insurance in Texas for an average of $104 monthly ($1,247 annually). Among the providers in our study, ERGO NEXT ranks sixth for affordability but offers the most affordable option in nine industries.

Dental and tech/IT services pay the lowest rates with ERGO NEXT. Automotive shops and personal trainers also save money, with ERGO NEXT ranking second cheapest for those businesses.

Data filtered by:AccountantsAccountants $18 3 ERGO NEXT excels in Texas customer experience, ranking first in digital experience and policy management. Customers most often recommend ERGO NEXT to others. Its digital-first approach lets you instantly generate certificates of insurance and manage your policy 24/7 without waiting for agent callbacks.

Claims processing ranks fourth, meaning longer waits when filing claims. On Trustpilot, customers rave about "extremely fair" pricing and "seamless" setup, while others are frustrated by "horrible customer service" and claim denials.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT offers flexible Texas general liability coverage with limits up to $2 million per claim and $4 million aggregate. Its policies also include contractor E&O insurance, making it attractive for construction and other contract-based businesses.

ERGO NEXT offers endorsements protecting you from damage claims on completed work through its CG2010 or ongoing operations endorsement.

Cheapest Small Business General Liability Insurance Companies in Texas

The Hartford is the cheapest general liability insurance company in Texas at $83 monthly, saving you $21 monthly or 20% compared to the state average. Simply Business, Nationwide and Progressive Commercial also offer low rates.

| The Hartford | $83 | $990 |

| Simply Business | $97 | $1,159 |

| Nationwide | $98 | $1,175 |

| Progressive Commercial | $101 | $1,212 |

| ERGO NEXT | $104 | $1,247 |

| Coverdash | $104 | $1,251 |

| Thimble | $108 | $1,297 |

| Hiscox | $115 | $1,380 |

| biBERK | $115 | $1,381 |

| Chubb | $120 | $1,438 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest Small Business General Liability Insurance in Texas by Industry

These providers offer the cheapest commercial general liability insurance in Texas by industry, based on MoneyGeek's study:

- The Hartford wins for affordability in 21 of 78 Texas industries, making it the cheapest provider overall.

- Thimble offers the cheapest coverage in 11 of 78 industries, particularly for pet and cleaning services.

- Simply Business and biBerk each win 10 of 78 industries. Simply Business works best for professionals like lawyers and retail businesses, while biBerk performs well in construction and contracting.

- ERGO NEXT ranks as the most affordable insurer in nine of 78 industries, performing strongly in tech and home-based categories.

- Nationwide earns the fifth most affordable spot overall with the cheapest rates in seven industries. Manufacturing and moving are its best-performing categories.

| Accountants | Simply Business | $15 | $174 |

Average Cost of General Liability Insurance in Texas

Texas general liability insurance costs an average of $104 monthly for most small businesses and $76 for sole proprietors. Average costs vary based on industry, business size, location and coverage limits. If you're in construction, expect to pay more than if you run a consulting firm due to different risk levels.

Average Cost of General Liability Insurance in Texas by Industry

In Texas, general liability insurance costs range from $21 monthly for travel agencies to $928 for pressure washing businesses. Check the table below to see what you can expect to pay for general liability coverage in your industry.

| Accountants | $22 | $268 |

| Ad Agency | $36 | $430 |

| Automotive | $54 | $648 |

| Auto Repair | $154 | $1,848 |

| Bakery | $92 | $1,099 |

| Barber | $45 | $539 |

| Beauty Salon | $68 | $812 |

| Bounce House | $71 | $855 |

| Candle | $56 | $668 |

| Cannabis | $68 | $815 |

| Catering | $89 | $1,066 |

| Cleaning | $134 | $1,611 |

| Coffee Shop | $91 | $1,091 |

| Computer Programming | $29 | $353 |

| Computer Repair | $48 | $579 |

| Construction | $178 | $2,133 |

| Consulting | $22 | $267 |

| Contractor | $258 | $3,100 |

| Courier | $198 | $2,377 |

| Daycare | $33 | $400 |

| Dental | $22 | $261 |

| DJ | $26 | $308 |

| Dog Grooming | $64 | $772 |

| Drone | $17 | $203 |

| Ecommerce | $74 | $890 |

| Electrical | $114 | $1,368 |

| Engineering | $40 | $485 |

| Excavation | $472 | $5,664 |

| Florist | $43 | $521 |

| Food | $109 | $1,310 |

| Food Truck | $144 | $1,724 |

| Funeral Home | $61 | $734 |

| Gardening | $114 | $1,367 |

| Handyman | $247 | $2,969 |

| Home-based | $24 | $289 |

| Home-based | $46 | $557 |

| Hospitality | $66 | $793 |

| HVAC | $249 | $2,984 |

| Janitorial | $139 | $1,668 |

| Jewelry | $41 | $490 |

| Junk Removal | $165 | $1,976 |

| Lawn/Landscaping | $122 | $1,462 |

| Lawyers | $23 | $277 |

| Manufacturing | $65 | $777 |

| Marine | $28 | $341 |

| Massage | $97 | $1,166 |

| Mortgage Broker | $23 | $278 |

| Moving | $126 | $1,509 |

| Nonprofit | $36 | $436 |

| Painting | $146 | $1,749 |

| Party Rental | $81 | $967 |

| Personal Training | $24 | $290 |

| Pest Control | $33 | $392 |

| Pet | $57 | $682 |

| Pharmacy | $63 | $752 |

| Photography | $24 | $293 |

| Physical Therapy | $112 | $1,340 |

| Plumbing | $366 | $4,397 |

| Pressure Washing | $928 | $11,135 |

| Real Estate | $54 | $647 |

| Restaurant | $147 | $1,764 |

| Retail | $66 | $795 |

| Roofing | $393 | $4,720 |

| Security | $141 | $1,692 |

| Snack Bars | $119 | $1,428 |

| Software | $27 | $320 |

| Spa/Wellness | $108 | $1,298 |

| Speech Therapist | $32 | $380 |

| Startup | $29 | $348 |

| Tech/IT | $27 | $321 |

| Transportation | $38 | $458 |

| Travel | $21 | $254 |

| Tree Service | $132 | $1,579 |

| Trucking | $104 | $1,248 |

| Tutoring | $31 | $368 |

| Veterinary | $45 | $545 |

| Wedding Planning | $28 | $337 |

| Welding | $167 | $2,006 |

| Wholesale | $45 | $543 |

| Window Cleaning | $161 | $1,937 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Texas General Liability Insurance Costs?

These factors specific to Texas businesses affect general liability insurance costs:

Texas Legal and Regulatory Environment

Texas maintains a relatively business-friendly tort climate with reforms that help moderate litigation costs. The state's comparative negligence system allows plaintiffs to recover damages if they're less than 51% at fault, affecting how insurers assess and price liability risks. Certain regions, particularly along the Gulf Coast, have historically experienced higher litigation rates that drive up premiums for businesses in those areas.

Texas Geographic and Environmental Risks

Texas experiences weather risks, including hailstorms, flooding and hurricanes. Hurricane Harvey alone caused $180 billion in damage statewide and over 200,000 damaged structures. These weather events increase premises liability risks, such as storm-damaged walkways causing customer injuries and business interruption exposures.

Texas Economic and Industry Factors

Insurers calculate liability rates using gross sales, gross payroll, square footage of premises and subcontractor exposures. Texas' oil and gas concentration creates specialized liability exposures for energy-related businesses. Construction booms in major metros like Austin, Dallas-Fort Worth and Houston elevate risks from contractor operations and development-related injuries.

Texas Health Care and Medical Costs

Health insurance companies requested an average 24% premium increase for Texas plans in 2026, citing projected increases in medical service and prescription drug costs. Rising medical costs directly impact bodily injury claim settlements in general liability cases. Urban areas have particularly high medical costs that translate to larger settlement amounts for injuries on business premises.

How Much General Liability Insurance Do I Need in Texas?

Texas doesn't mandate general liability insurance for most industries, but electricians, electrical sign contractors, HVAC contractors and fire safety companies must carry coverage by law. Even without legal requirements, many clients require coverage in contracts, and landlords and property sellers commonly require it. In any case, we recommend a $1 million per claim and $2 million aggregate general liability policy.

Texas-specific commercial general liability requirements:

- Class A licensees must maintain at least $300,000 per occurrence (combined for property damage and bodily injury), $600,000 aggregate for total property damage and bodily injury coverage, and $300,000 aggregate for products and completed operations.

- Class B licensees must maintain at least $100,000 per occurrence (combined for property damage and bodily injury), $200,000 aggregate for total property damage and bodily injury coverage, and $100,000 aggregate for products and completed operations.

You need at least $300,000 coverage per incident, plus $600,000 total yearly general liability coverage and extra protection for completed work in Texas

Same requirements as Texas electricians for general liability policies: $300,000 per incident, $600,000 yearly total, plus completed work coverage

Texas general liability coverage requirements depend on your license class. Both need public liability policies, but with different minimum amounts:

Your Texas fire safety business needs $100,000 per incident and $300,000 total yearly commercial general liability coverage to register with the state.

*State insurance requirements change frequently. Verify current requirements with the Texas Department of Insurance or consult a licensed agent before making coverage decisions.

How to Choose the Best General Liability Insurance in Texas

Choosing general liability insurance in Texas requires determining what coverage you need and can afford. While general liability protects your business against accidents and property damage, the best business insurance in Texas includes additional financial protection.

- 1Figure out how much coverage you need

Texas doesn't mandate general liability insurance for most businesses, but certain industries and contracts require specific minimums. Common business insurance coverage amounts in Texas range from $500,000 to $2 million per occurrence, with electricians in Dallas needing a minimum of $300,000 by city ordinance. Review your client contracts and industry standards to determine adequate coverage levels.

- 2Get your business details ready

Texas insurers will request your annual revenue, employee count, business classification and physical location within the state. Your rates depend on your industry risk profile and whether you operate in major metro areas like Houston, Dallas or San Antonio. When requesting quotes, have your EIN, business entity documents and Texas sales tax permit information available.

- 3Compare at least three quotes

Request quotes from multiple Texas-licensed insurers to compare pricing and coverage terms. Based on our research, rates vary widely, and you can save up to $21 monthly compared to the state average. Compare policy limits, deductibles, exclusions and whether legal defense costs apply within or outside your coverage limit.

- 4Look beyond the premium

Coverage exclusions and limitations matter, so don't just pick the cheapest business insurer when selecting Texas general liability insurance. Some policies include legal defense costs separate from your limit, while others count defense expenses against your total coverage. Review what's excluded, such as professional errors, pollution or employee injuries, which require separate policies.

- 5Check insurers and agents

Verify each insurer's license through the Texas Department of Insurance website at tdi.texas.gov. Check each company's financial strength ratings with AM Best and review complaint ratios to avoid companies with poor claims handling. High complaint ratios relative to market share often indicate future problems when filing claims.

- 6Ask about discounts

Texas insurers discount premiums for safety programs, claims-free history and bundled policies. Combining general liability with commercial property or auto coverage can cut your total cost by 10% to 25% compared to separate policies. Other discounts apply for annual payments, security systems and safety training programs.

- 7Get your certificate of insurance

You'll receive certificates of insurance (COIs) when your coverage starts. Provide these to Texas clients, landlords and general contractors who request proof of insurance. Most Texas insurers provide instant digital certificates through online portals, though some require 24 to 48 hours of processing. Keep your agent's contact information handy for rush certificate requests when bidding on new projects.

- 8Review and renew annually

Your Texas general liability policy requires annual renewal, providing a good time to reassess your coverage needs based on business growth or changes. Shop competitor quotes 60 to 90 days before renewal since your revenue, employee count or claims history may qualify you for better rates elsewhere. Update your coverage limits if you've expanded operations, hired more employees or taken on larger projects than your current policy covers.

Top General Liability Insurance in Texas for Small Businesses: Bottom Line

Choosing quality general liability insurance in Texas requires knowing your business needs and researching providers carefully. The Hartford, ERGO NEXT and Nationwide lead the market based on our analysis, but the best choice depends on your industry requirements, business size and budget. Review multiple quotes and verify each insurer's credentials before deciding.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Upgrades Issuer Credit Ratings of The Hartford Insurance Group, Inc. and Its Subsidiaries." Accessed February 7, 2026.

- Texas Department of Insurance. "Certificate of Liability Insurance Requirements." Accessed February 7, 2026.

- Texas Department of Insurance. "Commercial General Liability Insurance." Accessed February 7, 2026.

- Texas Department of Licensing and Regulation. "Apply for a New Electrical Contractor License." Accessed February 7, 2026.

- Texas Department of Licensing and Regulation. "Apply for a New Electrical Sign Contractor License." Accessed February 7, 2026.

- Texas Department of Licensing and Regulation. "Apply for an Air Conditioning and Refrigeration Contractor License." Accessed February 7, 2026.

- The Hartford. "What Does General Liability Insurance Cover?." Accessed February 7, 2026.

- The Hartford. "When Is Liability Insurance Needed?." Accessed February 7, 2026.

- Trustpilot. "Next Insurance Reviews." Accessed February 7, 2026.

- Trustpilot. "The Hartford Reviews." Accessed February 7, 2026.