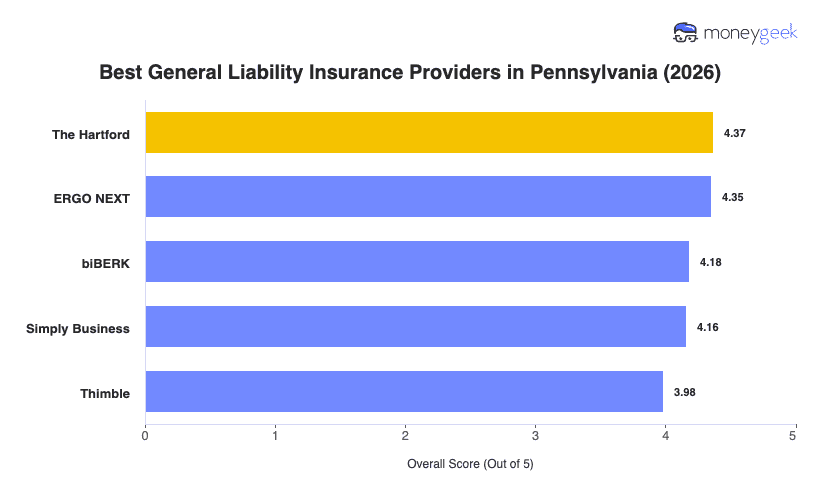

The best general liability insurance provider balances strong rates with exceptional customer service and flexible coverage options. These five providers topped our analysis of 10 major business insurance carriers in Pennsylvania for over 400 business types:

- The Hartford: Best for Professional Services and Office-Based Businesses

- ERGO NEXT: Best for Digital Buying Experience

- biBERK: Best for Service-Based Businesses

- Simply Business: Best for Comparing Multiple Carriers

- Thimble: Best for Flexible, On-Demand Coverage Terms

Each insurer handles the liability risks Pennsylvania businesses face daily, from slip-and-falls in Pittsburgh retail spaces to property damage during construction projects in Erie, or advertising claims for Philadelphia marketing agencies. The profiles below show how these providers compare across pricing, claims experience, and coverage flexibility for businesses throughout the state.