Our research-backed guide to best business insurance includes these frequently asked questions about Utah general liability coverage, providing clear answers based on MoneyGeek's comprehensive analysis:

Best General Liability Insurance in Utah

The Hartford offers the best general liability coverage in Utah, while ERGO NEXT provides the lowest rates starting at $84 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Utah: Fast Answers

Which company offers the best general liability insurance in Utah?

The Hartford leads as the best general liability insurance company in Utah with an overall score of 4.60 out of 5, known for superior claims handling and competitive rates at $86 per month. ERGO NEXT ranks second with a 4.57 score, offering an excellent digital platform and slightly lower premiums at $84 per month.

Who offers the cheapest general liability insurance in Utah?

The cheapest general liability insurance companies in Utah are:

- ERGO NEXT: $84 per month

- The Hartford: $86 per month

- Simply Business: $92 per month

- Nationwide: $93 per month

- Progressive: $96 per month

Do Utah businesses legally need general liability insurance?

Utah doesn't mandate general liability insurance for most businesses statewide. However, licensed professionals like contractors and electricians often need specific coverage amounts for their permits. Local municipalities may impose their own requirements, and most landlords and clients demand proof of insurance before signing contracts.

How much does general liability insurance cost in Utah?

General liability insurance costs between $16 and $871 per month for small Utah businesses with two employees. The drone industry sees the lowest rates at $16 per month, while pressure washing businesses pay the highest at $871 per month. Your actual premium depends on your industry, location, coverage limits, and business size.

Best General Liability Insurance Companies in Utah

The Hartford is our top choice for general liability insurance in Utah, offering a strong mix of affordable rates and reliable customer service. ERGO NEXT also performs well for small businesses, with good customer support and flexible coverage options. Nationwide completes our recommendations by delivering solid financial stability and competitive pricing for Utah business owners.

| The Hartford | 4.60 | $86 |

| ERGO NEXT | 4.57 | $84 |

| Nationwide | 4.53 | $93 |

| Simply Business | 4.48 | $92 |

| Coverdash | 4.38 | $99 |

| Thimble | 4.35 | $103 |

| biBERK | 4.30 | $109 |

| Progressive Commercial | 4.28 | $96 |

| Chubb | 4.27 | $114 |

| Hiscox | 4.19 | $109 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Utah General Liability Insurer

Select your industry and state to get a customized Utah general liability insurance quote.

General liability insurance covers customer injuries and property damage for Utah businesses, but it won't protect against every risk. Explore these additional coverage options:

Best Utah General Liability Insurance Reviews

Finding the best general liability insurance in Utah requires looking beyond price alone. Our research identifies the top business insurers based on coverage quality and customer service.

Best Utah General Liability Insurer

Average Monthly General Liability Premium

$86These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Handles claims quickly and efficiently with top processing speeds

Delivers exceptional customer service with knowledgeable representatives

Maintains A+ AM Best rating for superior financial stability

Ranks first overall among general liability providers statewide

consWeakest digital experience among major insurance providers surveyed

Most policies require agent interaction rather than online purchasing

The Hartford leads Utah's general liability market through exceptional customer service and strong financial stability, backed by an A+ AM Best rating. The insurer excels in serving construction, food service and professional service businesses, ranking first in claims processing and customer support.

Utah business owners who value personalized service and reliable claims handling will find The Hartford's traditional approach beneficial.

Overall Score 4.60 1 Affordability Score 4.52 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 The Hartford offers general liability coverage in Utah at an average rate of $86 monthly. The provider ranks especially competitive for food service, construction and professional service industries, with strong pricing for contractors, restaurants and cleaning services.

Data filtered by:AccountantsAccountants $17.53 3 The Hartford ranks first nationally for claims processing and customer service in Utah, with business owners consistently praising their efficient claim resolutions and knowledgeable support staff. While digital tools may lag behind competitors, the company's traditional service model delivers superior results in claims handling and overall satisfaction.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford provides general liability coverage with limits from $300,000 to $2 million per occurrence, offering aggregate limits up to double the occurrence amount. Businesses can enhance protection with product liability coverage and broad form contractual liability options.

The provider allows bundling with data breach protection through a business owner's policy, creating comprehensive coverage solutions for Utah companies.

Best Utah Commercial General Liability Customer Experience

Average Monthly General Liability Premium

$84These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first for digital experience with streamlined online tools

Maintains strong A- AM Best financial stability rating

Ranks first for customer service responsiveness and support

Competitive pricing ranks among most affordable options available

consNewer company with limited operating history compared to competitors

Online-only platform lacks local agent support and guidance

Financial stability ranking falls behind more established insurers

ERGO NEXT performs well in Utah’s general liability market thanks to its excellent customer service and comprehensive coverage options. With an A- financial strength rating from AM Best, it offers reliable protection suited for tech companies, contractors, and professional services.

Utah businesses that prefer a digital-first insurance experience will also appreciate ERGO NEXT’s strong online tools and easy-to-use platform.

Overall Score 4.57 2 Affordability Score 4.30 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 At $84 per month on average, ERGO NEXT offers competitive general liability coverage in Utah. The company shows strong pricing for tech businesses, consulting firms and contractors, ranking as the most affordable option across 34 different industries including auto repair, cleaning services and professional services.

Data filtered by:AccountantsAccountants $14 2 Customer feedback highlights ERGO NEXT's exceptional digital experience and policy management capabilities. The provider earns top marks for customer satisfaction, with businesses praising the straightforward online platform and renewal process.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT provides general liability coverage with limits up to $2 million per claim and $4 million aggregate. Policies include contractor E&O insurance and optional endorsements for completed operations coverage through CG2010 forms. The digital-first platform allows for instant coverage with no waiting periods, making it efficient for Utah businesses needing immediate protection.

Cheapest General Liability Insurance Companies in Utah

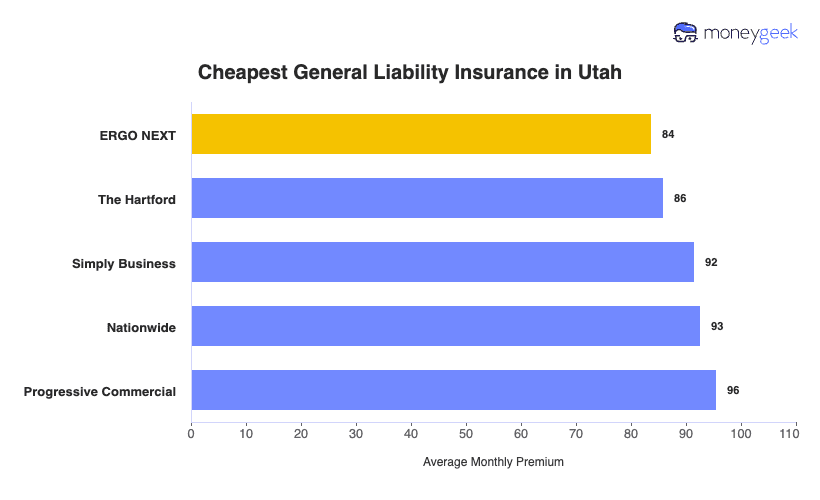

ERGO NEXT offers the most affordable general liability insurance in Utah at $84 per month, saving businesses $14 or 15% compared to the state average. The Hartford and Simply Business also provide budget-friendly coverage options for Utah companies.

| ERGO NEXT | $84 | $1,005 |

| The Hartford | $86 | $1,031 |

| Simply Business | $92 | $1,098 |

| Nationwide | $93 | $1,113 |

| Progressive Commercial | $96 | $1,147 |

| Coverdash | $99 | $1,186 |

| Thimble | $103 | $1,231 |

| Hiscox | $109 | $1,310 |

| biBERK | $109 | $1,311 |

| Chubb | $114 | $1,363 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Utah by Industry

Based on MoneyGeek's research, these five providers offer the cheapest general liability insurance across Utah industries:

- ERGO NEXT dominates affordability in 34 industries statewide. The insurer performs especially well for tech companies, manufacturing businesses, consulting firms and healthcare providers.

- Thimble ranks as the most affordable option in 10 industries. This provider excels with construction companies, HVAC contractors, computer programming firms and roofing businesses.

- Simply Business offers cheap coverage for nine Utah industries. The company shows strong results for professional services including accountants, lawyers, startups and ecommerce businesses.

- The Hartford provides affordable rates across eight industries. This insurer leads in food service, trucking, spa and wellness businesses.

- biBerk secures cheapest rates in seven industries, performing best for contractors, engineering firms, hospitality businesses and veterinary practices.

| Accountants | Simply Business | $14 | $165 |

Average Cost of General Liability Insurance in Utah

Most small businesses in Utah pay around $98 monthly for general liability insurance. The average cost of general liability coverage changes based on your industry type, business size, location and policy limits.

Manufacturing companies often pay higher premiums because of greater liability risks, while accounting firms tend to pay less due to lower exposure. Businesses with sole proprietors generally see cheaper rates compared to companies with several employees.

Average Cost of General Liability Insurance in Utah by Industry

Utah businesses pay between $16 and $871 monthly for general liability coverage, depending on industry type. Drone operations represent the most affordable option at $16 per month, while pressure washing businesses see the highest rates at $871 monthly. Review this table to find typical costs for your specific business type.

| Accountants | $21 | $253 |

| Ad Agency | $34 | $403 |

| Automotive | $51 | $614 |

| Auto Repair | $145 | $1,745 |

| Bakery | $86 | $1,028 |

| Barber | $43 | $511 |

| Beauty Salon | $64 | $767 |

| Bounce House | $67 | $805 |

| Candle | $53 | $632 |

| Cannabis | $64 | $769 |

| Catering | $84 | $1,008 |

| Cleaning | $127 | $1,521 |

| Coffee Shop | $85 | $1,021 |

| Computer Programming | $28 | $334 |

| Computer Repair | $46 | $547 |

| Construction | $166 | $1,989 |

| Consulting | $21 | $252 |

| Contractor | $243 | $2,915 |

| Courier | $187 | $2,243 |

| Daycare | $31 | $377 |

| Dental | $21 | $247 |

| DJ | $24 | $292 |

| Dog Grooming | $61 | $728 |

| Drone | $16 | $191 |

| Ecommerce | $70 | $841 |

| Electrical | $107 | $1,288 |

| Engineering | $38 | $454 |

| Excavation | $446 | $5,355 |

| Florist | $41 | $492 |

| Food | $102 | $1,222 |

| Food Truck | $136 | $1,634 |

| Funeral Home | $58 | $694 |

| Gardening | $108 | $1,294 |

| Handyman | $230 | $2,762 |

| Home-based | $23 | $276 |

| Home-based | $37 | $448 |

| Hospitality | $62 | $748 |

| HVAC | $234 | $2,806 |

| Janitorial | $131 | $1,574 |

| Jewelry | $39 | $464 |

| Junk Removal | $155 | $1,865 |

| Lawn/Landscaping | $114 | $1,363 |

| Lawyers | $22 | $262 |

| Manufacturing | $61 | $736 |

| Marine | $27 | $322 |

| Massage | $92 | $1,100 |

| Mortgage Broker | $22 | $263 |

| Moving | $119 | $1,424 |

| Nonprofit | $34 | $412 |

| Painting | $137 | $1,646 |

| Party Rental | $76 | $912 |

| Personal Training | $23 | $274 |

| Pest Control | $31 | $370 |

| Pet | $53 | $642 |

| Pharmacy | $59 | $709 |

| Photography | $23 | $278 |

| Physical Therapy | $106 | $1,270 |

| Plumbing | $343 | $4,115 |

| Pressure Washing | $871 | $10,451 |

| Real Estate | $51 | $614 |

| Restaurant | $138 | $1,656 |

| Retail | $63 | $751 |

| Roofing | $372 | $4,463 |

| Security | $133 | $1,597 |

| Snack Bars | $111 | $1,335 |

| Software | $25 | $303 |

| Spa/Wellness | $102 | $1,225 |

| Speech Therapist | $30 | $354 |

| Startup | $27 | $324 |

| Tech/IT | $25 | $304 |

| Transportation | $36 | $432 |

| Travel | $20 | $240 |

| Tree Service | $124 | $1,490 |

| Trucking | $98 | $1,178 |

| Tutoring | $29 | $349 |

| Veterinary | $43 | $512 |

| Wedding Planning | $27 | $319 |

| Welding | $158 | $1,893 |

| Wholesale | $43 | $511 |

| Window Cleaning | $150 | $1,801 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Utah General Liability Insurance Costs?

Several factors influence what Utah businesses pay for general liability insurance coverage.

Utah's Legal and Regulatory Environment

Utah's modified comparative negligence rule bars recovery for plaintiffs 50% or more at fault. Punitive damages require clear and convincing evidence, with awards split between the injured party and state. Utah abolished joint and several liability in 1986, meaning businesses only pay their proportionate share of fault.

Utah courts uphold liability waivers if clear and unambiguous. These tort reforms lower premiums by 15% to 25% by reducing claim frequency (fewer successful lawsuits) and severity (capped damages). Insurers charge less because expected payouts decrease.

Utah's Medical and Healthcare Costs

Utah has the nation's lowest per capita healthcare spending at $7,522, about 26% below the national average of $10,191. Bodily injury claims (slip-and-falls, customer injuries, premises accidents) make up most general liability payouts. Lower medical treatment costs reduce premiums by 20% to 30%.

A knee surgery costing $20,000 in Utah might cost $40,000 in New York, letting insurers charge proportionally less. Healthcare spending rose 6.6% from 2022 to 2023, outpacing income growth. This creates upward pressure on future rates despite current advantages.

Utah's Economic and Industry Composition

Utah’s 4.5% GDP growth led the nation in 2024. Insurers calculate general liability rates using your business’s gross sales, and strong economic growth pushes premiums higher because businesses generate more revenue, increasing the premium calculation base even when actual risk stays the same.

The state’s 325,000 small businesses create strong competition among insurers, which helps moderate price increases. Utah’s industry mix includes low-risk software and IT companies alongside higher-risk outdoor recreation (growing 15.5%) and construction, creating mixed effects on overall market pricing.

Utah's Geographic and Climate Conditions

Insurers analyze crime statistics, weather patterns and local court award amounts by ZIP code. Businesses in regions with harsh winter conditions pay higher base rates because environmental factors increase premises liability exposure. Utah's varied geography creates divergent risk profiles.

Mountain regions with heavy snowfall see 15% to 30% higher premiums due to increased slip-and-fall frequency. Southern areas with mild winters see 10% to 15% lower rates. Identical businesses operating in Park City versus St. George experience substantial premium variations solely due to location-specific weather hazards and historical claims patterns.

How Much General Liability Insurance Do I Need in Utah?

Utah's general liability insurance requirements apply specifically to licensed contractors and construction trades. Most businesses don't need coverage by law, but contractors must carry minimum limits to get licensed through the Division of Occupational and Professional Licensing (DOPL). Coverage amounts vary by trade: electrical and HVAC specialists need higher limits than general contractors. Here are the mandatory coverage requirements for each licensed profession in Utah:

- General Building Contractors (B100): Utah requires $100,000 per occurrence and $300,000 aggregate to get and keep your contractor license. You'll list DOPL as certificate holder on your policy.

- Residential Contractors (R100): Minimum coverage is $100,000 per occurrence with $300,000 aggregate. The state won't issue your license until you provide proof of insurance.

- Specialty Contractors: You need $100,000 per occurrence and $300,000 total coverage. List the Division of Occupational and Professional Licensing as certificate holder on your insurance.

- Licensed Electricians (Contractor Level): Coverage requirements jump to $300,000 per occurrence and $600,000 aggregate for electrical contractors. Your policy needs to include completed operations coverage.

- Electrical Sign Contractors: These specialists carry the same limits as electricians—$300,000 per occurrence with $600,000 annual aggregate. Utah won't approve licenses without meeting these minimums.

You'll need $100,000 per occurrence and $300,000 aggregate for licensing. DOPL verifies your coverage before issuing contractor credentials.

Most HVAC work needs $300,000 per occurrence and $600,000 aggregate, but basic licensing starts at $100,000/$300,000. Your specific limits depend on classification and work scope.

Jobs under $3,000 require $100,000 per occurrence and $300,000 aggregate. Submit your insurance certificate when you file the handyman exemption form with DOPL.

Note: State insurance requirements change regularly. Always verify current Utah requirements with the Utah Insurance Department or a licensed insurance agent before purchasing coverage.

How to Choose the Best General Liability Insurance in Utah

Smart business owners compare multiple insurers when getting business insurance to find the right balance between coverage and cost. Look for carriers licensed in Utah with strong financial ratings and experience in your specific industry.

- 1Determine Coverage Needs

Utah doesn't require general liability insurance for most businesses, but licensed contractors must carry at least $100,000 per occurrence and $300,000 aggregate. Electricians and certain specialty trades have higher minimums of $300,000 per occurrence and $600,000 aggregate.

Check with your local municipality and industry licensing board, since cities like Salt Lake City and Park City may set additional business insurance coverage requirements.

- 2Prepare Business Information

Collect your EIN, Utah business registration, annual revenue and employee count before requesting quotes. Utah insurers assess risk based on your industry classification, location and claims history. Having your Department of Occupational and Professional Licensing documentation ready helps insurers provide accurate premium calculations.

- 3Compare Multiple Quotes

Request quotes from at least three insurers licensed by the Utah Insurance Department, as premiums can vary by several hundred dollars annually. Compare deductibles, coverage limits and whether defense costs count toward or outside your liability limits. Understanding business insurance costs helps you identify the best protection without overpaying.

- 4Look Beyond Price

Affordable business insurance shouldn't mean inadequate coverage, so read policy exclusions carefully to avoid gaps when filing claims. Verify whether legal defense costs reduce your coverage limits or get paid separately. Professional errors, pollution claims and employee injuries require separate policies, so understanding exclusions prevents expensive surprises.

- 5Verify Insurer Credentials

Confirm your insurer holds a valid license through the Utah Insurance Department and check AM Best financial ratings for stability. Review complaint ratios published annually by the department to identify insurers with problematic claims handling. Strong financial backing ensures your carrier can pay large claims when your Utah business needs protection most.

- 6Ask About Discounts

Bundle general liability with commercial property or workers' compensation to reduce premiums by 10% to 25% with most Utah insurers. Annual payment plans, claims-free histories and documented safety programs qualify for additional discounts. Utah businesses with employee safety training and loss prevention systems demonstrate lower risk, earning premium reductions.

- 7Obtain Certificate of Insurance

Commercial landlords, clients and general contractors in Utah require certificates of insurance before signing contracts or approving leases. Most insurers issue digital certificates instantly through online portals, though some take 24 to 48 hours. Keep your agent's contact information ready for rush certificate requests to avoid project delays.

- 8Review Coverage Annually

Review your general liability limits each year after hiring employees, expanding to new Utah locations or increasing revenue. Compare renewal quotes 60 to 90 days before your policy expires to secure better rates or adjust coverage for business changes. Annual reviews prevent compliance gaps with Utah licensing requirements and avoid audit premium adjustments.

Top General Liability Insurance in Utah: Bottom Line

Finding the right general liability insurance in Utah starts with understanding your specific business needs and comparing providers thoroughly. The Hartford, ERGO NEXT and Nationwide represent strong options in the market, but your ideal choice depends on your industry, company size, and budget. Get quotes from multiple insurers and verify their credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Centers for Medicare & Medicaid Services. "NHE Fact Sheet." Accessed February 7, 2026.

- Kem C. Gardner Policy Institute. "Utah Leads the Nation in GDP Growth, Reflecting a Strong Overall 2024 Economy." Accessed February 7, 2026.

- One Utah Health Collaborative. "First-Ever Statewide Study Finds Healthcare Spending Growth in Utah Outpaced Income Increases from 2022-2023." Accessed February 7, 2026.

- Utah State Legislature. "Utah Code § 78B-5-818 - Comparative Negligence." Accessed February 7, 2026.

- Utah State Legislature. "Utah Code § 78B-8-201 - Basis for Punitive Damages Awards." Accessed February 7, 2026.