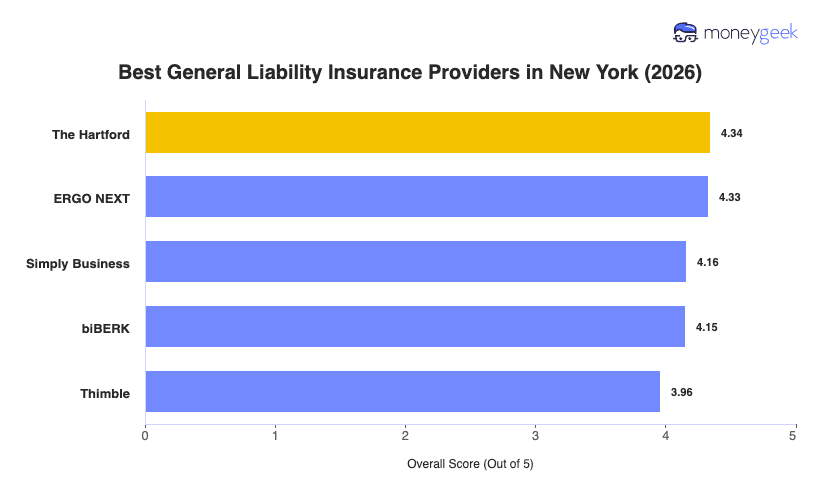

Finding the best general liability insurance means identifying providers that handle New York's regulatory requirements while keeping costs reasonable. These five companies rank highest for businesses from Buffalo to the Bronx based on affordability, service quality and coverage options.

- The Hartford: Best Overall, Best for Professional Services

- ERGO NEXT: Best for Customer-Facing Service Businesses

- Simply Business: Best for Coverage Options

- biBERK: Best for Service-Based Businesses

- Thimble: Best for Freelancers and Gig Workers

Each of these insurers offers solid performance across price and customer experience for New York businesses. The analysis below shows where they rank in specific categories and what makes each one worth considering for your operation.