We answer common questions about Delaware general liability insurance and best business insurance options:

Best General Liability Insurance in Delaware

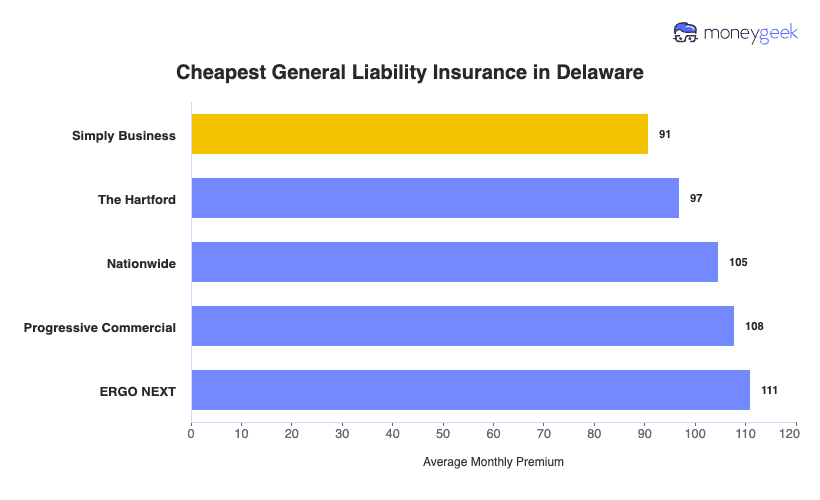

The Hartford leads Delaware general liability insurance, while Simply Business offers the lowest rates at $91 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 18, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Delaware: Fast Answers

Which company offers the best general liability insurance in Delaware?

The Hartford ranks as the best general liability insurance company in Delaware, earning a 4.61 overall score out of 5. The company combines affordable coverage at $97 per month with strong claims handling. ERGO NEXT follows in second place with a 4.58 score, offering excellent digital tools and customer support for $111 per month.

Who offers the cheapest general liability insurance in Delaware?

The cheapest general liability insurance companies in Delaware are:

- Simply Business: $91 per month

- The Hartford: $97 per month

- Nationwide: $105 per month

- Progressive: $108 per month

- ERGO NEXT: $111 per month

Do Delaware businesses legally need general liability insurance?

Delaware doesn't legally require most businesses to carry general liability insurance at the state level. However, certain licensed professionals like contractors and electricians may need specific coverage amounts to maintain their licenses. Local municipalities can also set their own requirements. Even without legal mandates, most landlords and clients demand proof of coverage before signing contracts or leases.

How much does general liability insurance cost in Delaware?

General liability insurance ranges from $18 to $990 per month for small Delaware businesses with two employees. Drone businesses often get the lowest rates at $18 per month, while pressure washing companies land at the high end with $990 per month. Your premium depends on factors such as industry risk, location, coverage limits and number of employees.

Best General Liability Insurance Companies in Delaware

The Hartford is our top pick for Delaware general liability insurance with affordable rates and strong customer service. NEXT has excellent customer support and coverage options. Nationwide provides stability and competitive pricing for small businesses.

| The Hartford | 4.61 | $97 |

| ERGO NEXT | 4.58 | $111 |

| Nationwide | 4.52 | $105 |

| Simply Business | 4.47 | $91 |

| Coverdash | 4.37 | $111 |

| Thimble | 4.35 | $115 |

| biBERK | 4.30 | $123 |

| Chubb | 4.28 | $128 |

| Progressive Commercial | 4.27 | $108 |

| Hiscox | 4.19 | $123 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Delaware General Liability Insurer

Select your industry and state to get a customized Delaware general liability insurance quote.

General liability insurance covers customer injuries and property damage for Delaware businesses, but it won't protect against every risk your business encounters. Explore these related coverage options to build complete financial protection:

Best Delaware General Liability Insurance Reviews

Finding the best general liability insurance in Delaware requires looking beyond price alone. Our research reveals which business insurers offer the strongest combination of coverage and service.

The Hartford

Best Delaware General Liability Insurer

Average Monthly General Liability Premium

$97These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Fast claims processing

Strong customer service

A+ AM Best rating

Top customer satisfaction scores

consRequires agent interaction (no online-only buying)

Digital experience lags competitors

The Hartford leads Delaware general liability insurance with strong customer service and an A+ AM Best rating. It processes claims fast and provides excellent support.

Construction, professional services and retail businesses get the most from The Hartford's coverage and track record.

Overall Score 4.61 1 Affordability Score 4.56 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 The Hartford charges competitive rates starting at $97 monthly. It's affordable for construction, professional services and retail.

Service businesses like consulting, landscaping and contractors get competitive rates.

Data filtered by:AccountantsAccountants $20 3 Delaware customers rate The Hartford highest for claims processing and customer service. It gets top marks for satisfaction and renewal likelihood. Digital tools lag competitors, but personal service delivers reliable support.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford provides general liability coverage with limits from $300,000 to $2 million per occurrence. Aggregate limits go up to twice that amount. Add product liability coverage and broad form contractual liability for more protection.

The company sells data breach protection through business owner's policy bundling.

ERGO NEXT

Best Delaware Commercial General Liability: Runner Up

Average Monthly General Liability Premium

$111These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first for customer service with responsive support teams

Leads in digital experience with user-friendly online platform

Most affordable rates among top general liability providers

Has A- AM Best rating indicating strong financial stability

consNewer insurer with limited operating history compared to competitors

Online-only model lacks local agents for personalized service

Ranks lowest in stability among surveyed providers

ERGO NEXT ranks among Delaware's top general liability providers, combining excellent customer service with comprehensive coverage options. With an A- financial strength rating from AM Best, ERGO NEXT delivers reliable protection and ranks first in customer service among Delaware insurers.

The provider suits tech-savvy business owners in industries like tech, consulting and professional services who value digital convenience and streamlined policy management.

Overall Score 4.58 2 Affordability Score 4.33 5 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT offers general liability coverage in Delaware at competitive rates averaging $111 monthly. The provider shows particular strength in affordability for technology companies, professional services and home-based businesses, ranking among the most cost-effective options for these sectors.

Data filtered by:AccountantsAccountants $19 2 Delaware customers consistently praise ERGO NEXT's digital experience, policy management capabilities and likelihood to recommend the provider to others. The company's online platform and automated claims processing earn high marks for efficiency and ease of use, though some customers note room for improvement in claims handling speed.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT provides general liability coverage with limits up to $2 million per occurrence and $4 million aggregate. The provider offers valuable add-ons including contractor E&O insurance and endorsements protecting completed work through CG2010 coverage.

These flexible policy options make ERGO NEXT suitable for Delaware contractors and professional service providers seeking comprehensive protection.

Cheapest General Liability Insurance Companies in Delaware

Simply Business offers the cheapest general liability insurance in Delaware at $91 per month, saving businesses $19 or 18% compared to the state average. The Hartford and Nationwide also provide affordable coverage options for Delaware businesses.

| Simply Business | $91 | $1,088 |

| The Hartford | $97 | $1,164 |

| Nationwide | $105 | $1,254 |

| Progressive Commercial | $108 | $1,295 |

| ERGO NEXT | $111 | $1,332 |

| Coverdash | $111 | $1,336 |

| Thimble | $115 | $1,383 |

| Hiscox | $123 | $1,471 |

| biBERK | $123 | $1,472 |

| Chubb | $128 | $1,535 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries for general liability policies only. Your premium depends on location, industry, coverage amount and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Delaware by Industry

We identified the five most affordable providers across Delaware industries.

- biBerk has the cheapest rates in 15 industries including contractors, engineering, veterinary services and bakeries.

- NEXT, Simply Business and Thimble each lead in 14 industries. NEXT is cheapest for tech/IT, trucking and cannabis. Simply Business leads for accounting, consulting and legal. Thimble has the best rates for cleaning, HVAC and software.

- Nationwide is cheapest in nine industries, especially construction, manufacturing and restaurants.

- The Hartford has the cheapest coverage for five industries: electrical, gardening and painting.

| Accountants | Simply Business | $14 | $164 |

Average Cost of General Liability Insurance in Delaware

Most small businesses in Delaware pay around $110 monthly for general liability insurance. The average general liability insurance cost for you depends on your industry, business size, location and coverage limits.

Manufacturing companies tend to have higher premiums due to increased risk exposure, while accounting firms often pay less because of lower liability risks. Sole proprietors generally pay less than businesses with employees since they have fewer risk factors.

Average Cost of General Liability Insurance in Delaware by Industry

Delaware businesses pay between $18 and $990 monthly for general liability insurance, with drone companies getting the most affordable rates and pressure washing businesses coming in at the highest costs. Review this table to find typical general liability coverage rates for your specific industry.

| Accountants | $24 | $286 |

| Ad Agency | $38 | $459 |

| Automotive | $57 | $689 |

| Auto Repair | $164 | $1,964 |

| Bakery | $97 | $1,168 |

| Barber | $48 | $574 |

| Beauty Salon | $72 | $866 |

| Bounce House | $76 | $908 |

| Candle | $59 | $703 |

| Cannabis | $72 | $867 |

| Catering | $95 | $1,135 |

| Cleaning | $143 | $1,716 |

| Coffee Shop | $97 | $1,161 |

| Computer Programming | $31 | $376 |

| Computer Repair | $51 | $616 |

| Construction | $189 | $2,268 |

| Consulting | $24 | $285 |

| Contractor | $275 | $3,299 |

| Courier | $211 | $2,529 |

| Daycare | $35 | $425 |

| Dental | $23 | $277 |

| DJ | $27 | $329 |

| Dog Grooming | $68 | $818 |

| Drone | $18 | $215 |

| Ecommerce | $78 | $942 |

| Electrical | $122 | $1,462 |

| Engineering | $43 | $513 |

| Excavation | $500 | $5,998 |

| Florist | $46 | $556 |

| Food | $116 | $1,396 |

| Food Truck | $154 | $1,842 |

| Funeral Home | $65 | $780 |

| Gardening | $121 | $1,456 |

| Handyman | $263 | $3,159 |

| Home-based | $26 | $308 |

| Home-based | $49 | $594 |

| Hospitality | $70 | $843 |

| HVAC | $265 | $3,175 |

| Janitorial | $148 | $1,775 |

| Jewelry | $44 | $523 |

| Junk Removal | $175 | $2,099 |

| Lawn/Landscaping | $130 | $1,560 |

| Lawyers | $25 | $296 |

| Manufacturing | $69 | $828 |

| Marine | $30 | $363 |

| Massage | $103 | $1,241 |

| Mortgage Broker | $25 | $296 |

| Moving | $134 | $1,604 |

| Nonprofit | $39 | $464 |

| Painting | $155 | $1,855 |

| Party Rental | $85 | $1,025 |

| Personal Training | $26 | $309 |

| Pest Control | $35 | $417 |

| Pet | $60 | $721 |

| Pharmacy | $67 | $799 |

| Photography | $26 | $313 |

| Physical Therapy | $119 | $1,428 |

| Plumbing | $391 | $4,687 |

| Pressure Washing | $990 | $11,882 |

| Real Estate | $57 | $688 |

| Restaurant | $156 | $1,874 |

| Retail | $70 | $843 |

| Roofing | $419 | $5,027 |

| Security | $148 | $1,781 |

| Snack Bars | $127 | $1,518 |

| Software | $28 | $341 |

| Spa/Wellness | $116 | $1,393 |

| Speech Therapist | $34 | $405 |

| Startup | $31 | $372 |

| Tech/IT | $28 | $341 |

| Transportation | $41 | $486 |

| Travel | $22 | $270 |

| Tree Service | $138 | $1,658 |

| Trucking | $111 | $1,326 |

| Tutoring | $33 | $392 |

| Veterinary | $48 | $579 |

| Wedding Planning | $30 | $359 |

| Welding | $178 | $2,130 |

| Wholesale | $48 | $577 |

| Window Cleaning | $172 | $2,063 |

How Did We Determine These Rates?

These rates cover small businesses with two employees across 79 industries and apply to general liability policies only. What you pay depends on your location, industry, coverage amount and other factors insurers weigh. Plan options vary by state.

What Factors Affect Delaware General Liability Insurance Costs?

Many factors influence what Delaware businesses pay for general liability insurance coverage.

Delaware's Coastal Geography and Limited Insurance Market

Location matters more in Delaware than most states. Coastal geography creates challenges with hurricanes, nor'easters and year-round flooding. These increase premises liability risks. Storm-damaged walkways and hazardous conditions lead to customer injury claims.

Delaware covers just 1,982 square miles. Carriers can't spread risk across a large territory. Limited geography reduces competition and pushes premiums higher.

Delaware's High Population Density and Customer Traffic

Small businesses see more claims in Delaware due to concentrated customer traffic. The state hit 1 million people in 2024. Density runs high in Wilmington and coastal areas. More foot traffic means more slip-and-falls and customer injuries.

Coastal tourism increases risk during peak season. Unfamiliar visitors crowd restaurants, shops and service businesses. Small businesses make up 98% of Delaware's companies. Most involve direct customer contact, not office work. That concentrates liability exposure.

Delaware's Rising Construction and Claim Costs

Construction cost inflation hits your general liability expenses when claims involve property damage. Construction costs rose 3% to 7% annually through 2024. Repairs cost more for customer vehicles, damaged belongings and completed work that causes harm.

Coastal properties need specialized materials and techniques. Contractors charge premium rates for repairs meeting strict coastal building codes. Higher replacement values mean larger claim settlements and legal costs. Juries award based on current replacement values, not original costs.

How Much General Liability Insurance Do I Need in Delaware?

Delaware doesn't require general liability insurance for most businesses. Workers' compensation and commercial auto coverage are required. Some licensed trades must carry specific coverage limits. Review the commercial general liability insurance requirements below to see what your profession needs.

Delaware requires specific general liability coverage minimums for certain licensed professionals:

- Class A contractors: Need $500,000 per occurrence with $1 million aggregate for larger commercial projects.

- Class B contractors: Require $300,000 per occurrence and $600,000 aggregate for smaller-scale work.

Must maintain $300,000 per occurrence and $600,000 annual aggregate, with completed operations coverage included in the policy.

Coverage requirements vary based on your contractor classification and the scope of work you perform.

Have the strictest requirements at $1 million per occurrence and $2 million aggregate due to high-risk exposure.

Must carry $300,000 per occurrence and $600,000 aggregate, plus completed operations protection.

Most Delaware businesses purchase $1 million per occurrence and $2 million aggregate coverage, which satisfies typical client expectations and commercial lease requirements. Your actual coverage needs depend on your industry risks, annual revenue and specific client contracts. Review your profession's licensing requirements first, then factor in what clients expect before signing project agreements or leasing commercial space.

Note: State insurance requirements in Delaware change regularly. Always verify the latest requirements with the Delaware Department of Insurance or a licensed insurance agent before purchasing coverage.

How to Choose the Best General Liability Insurance in Delaware

Getting business insurance requires comparing providers, evaluating policy terms and confirming your coverage protects against the common risks your business encounters. The right policy combines adequate liability limits with additional coverages that match your specific operations.

- 1Determine Coverage Needs

Delaware doesn't mandate general liability for most businesses, though licensed electricians, HVAC contractors and fire safety companies must carry specific minimums. Most businesses select $1 million per occurrence with $2 million aggregate limits to meet commercial lease and client contract requirements.

Review your profession’s licensing rules and client agreements to confirm your business insurance coverage meets both legal and contractual expectations.

- 2Prepare Business Information

Insurers calculate your premium using your business classification, annual revenue, employee count and Delaware location. Gather your Federal Employer Identification Number, Delaware business registration and recent tax documents before requesting quotes. Having these ready streamlines the application and ensures accurate pricing.

- 3Compare Multiple Quotes

Get quotes from at least three insurers licensed in Delaware, since business insurance costs can differ by hundreds of dollars yearly between carriers. Compare deductibles, limits and whether defense costs apply toward or outside your policy cap. This reveals both competitive pricing and exactly what protection each policy delivers.

- 4Evaluate Beyond Price

Choosing coverage based solely on cheap business insurance rates can expose your Delaware business to major coverage gaps. Read exclusions carefully since standard policies exclude professional errors, pollution and employee injuries that need separate coverage. Know what your policy won't cover before claims happen.

- 5Verify Insurer Credentials

Check insurer licensing through the Delaware Department of Insurance and review AM Best ratings for financial strength. Research complaint ratios and customer reviews to find the best insurance for your business with solid claims-handling records. Strong financials matter when large claims threaten your operations.

- 6Explore Available Discounts

Delaware insurers offer premium cuts for bundling general liability with property or auto coverage, saving 10% to 25%. Safety programs, clean claims histories and annual payment plans can reduce rates substantially. Ask about industry-specific discounts when getting quotes.

- 7Obtain Certificate Documentation

Landlords, contractors and clients across Delaware require insurance certificates before contracts begin. Most insurers provide digital certificates instantly, while others take up to 48 hours. Keep your agent's contact handy for urgent requests that could delay projects.

- 8Schedule Annual Reviews

Review coverage yearly before renewal, especially after hiring staff, expanding services or boosting revenue. Compare quotes 60 to 90 days before renewal to spot better rates or adjust limits. Annual reviews prevent gaps and surprise audit charges from outdated business details.

Top General Liability Insurance in Delaware: Bottom Line

Finding the right general liability insurance in Delaware starts with understanding your specific business needs and comparing providers thoroughly. The Hartford, ERGO NEXT and Nationwide lead the market, but your best choice depends on your industry, company size and budget. Get multiple quotes and verify each insurer's credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Delaware Department of Natural Resources and Environmental Control. "Flooding – What You Can Do." Accessed February 27, 2026.

- State of Delaware News. "DSB Highlights Activities for National Small Business Week/Month 2024." Accessed February 27, 2026.

- U.S. Census Bureau. "Delaware Population Estimates Program." Accessed February 27, 2026.

- U.S. Small Business Administration Office of Advocacy. "Delaware 2025 Small Business Profile." Accessed February 27, 2026.