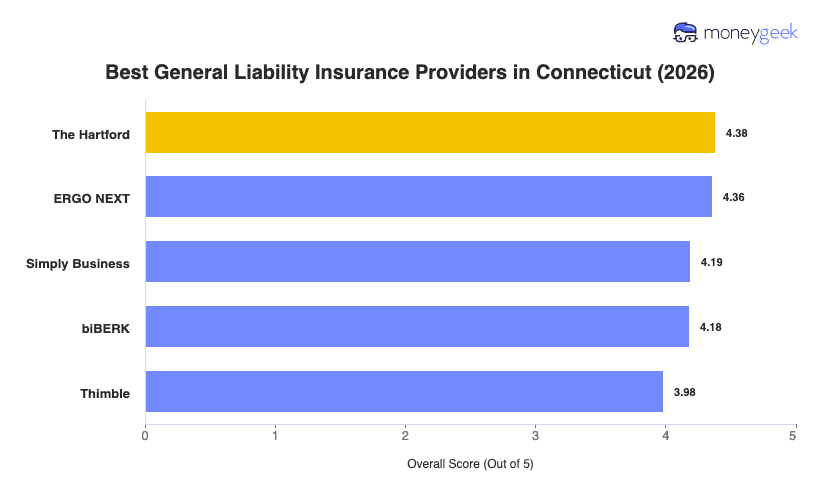

The best general liability insurance balances your specific risk profile with competitive pricing and responsive claims support. Whether you're a hospitality venue near the coast, in the insurance and finance sector in Hartford, or a manufacturing plant in Naugatuck Valley, our analysis showed that these five providers excel at serving Connecticut's diverse small business community:

- The Hartford: Best Overall, Best for Professional Services

- ERGO NEXT: Best for Customer Experience

- Simply Business: Best for Comparing Multiple Carriers

- biBERK: Best for Service Businesses with Straightforward Needs

- Thimble: Best for Short-Term and On-Demand Coverage

The top insurers understand Connecticut's regulatory environment and business needs. The comparison below shows what sets each one apart: