Choosing business insurance coverage means knowing which options cover your costs when accidents, injuries or property damage happen. Our research team compiled answers to common questions about general liability insurance:

Best General Liability Insurance in Alaska

ERGO NEXT leads Alaska general liability insurance, while The Hartford has the most affordable rates starting at $75 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 25, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Alaska: Fast Answers

Which company offers the best general liability insurance in Alaska?

ERGO NEXT ranks as the best general liability insurance company in Alaska with a 4.58 overall score out of 5. The provider excels in digital experience and reliable claims handling at $94 per month. Simply Business follows closely as runner-up with competitive rates at $88 per month and strong customer service.

Who offers the cheapest general liability insurance in Alaska?

The cheapest general liability insurance companies in Alaska are:

- The Hartford: $75 per month

- Simply Business: $88 per month

- Nationwide: $89 per month

- Progressive: $92 per month

- ERGO NEXT: $94 per month

Do Alaska businesses legally need general liability insurance?

Alaska doesn't legally require most businesses to carry general liability insurance. But certain licensed professionals (contractors and electricians, for example) need set coverage amounts to maintain their licenses. Local municipalities can impose their own requirements, and most landlords and clients demand proof of coverage before signing contracts.

How much does general liability insurance cost in Alaska?

General liability insurance costs between $15 and $809 per month for small Alaska businesses with two employees. The drone industry often sees the lowest rates at $15 per month, while pressure washing businesses land at the higher end at $809 per month. Your actual premium depends on your industry risk level, business location, coverage limits and employee count.

Best General Liability Insurance Companies in Alaska

ERGO NEXT is our top choice for general liability insurance in Alaska because of its strong customer service and solid pricing for small businesses. Simply Business and Thimble are also good options. Simply Business ranks high for affordability and coverage variety, while Thimble has some of the lowest rates for Alaska business owners.

| ERGO NEXT | 4.58 | $94 |

| Simply Business | 4.49 | $88 |

| Thimble | 4.40 | $98 |

| Coverdash | 4.38 | $95 |

| biBERK | 4.29 | $105 |

| Progressive Commercial | 4.28 | $92 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Alaska General Liability Insurer

Select your industry and state to get a customized Alaska general liability insurance quote.

General liability insurance covers customer injuries and property damage for Alaska businesses, but it does not cover every type of risk. Explore these additional coverage options to build comprehensive financial protection:

Best Alaska General Liability Insurance Reviews

Our research team scored Alaska general liability insurers on affordability, customer experience and coverage options to find the best fit for small businesses.

ERGO NEXT

Best Alaska General Liability Insurer

Average Monthly General Liability Premium

$94These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first among Alaska providers for digital experience and online usability

Earned an A- AM Best financial strength rating

Ranks first for policy management and account controls

Has high customer retention, with strong renewal and referral rates

consClaims handling ranks fourth, which can mean slower resolution times

Shorter operating history than established insurers

No local agents; service is online only

ERGO NEXT ranks first for general liability insurance in Alaska, with high customer satisfaction scores and strong digital performance backing that position. Its A- AM Best rating pairs with an online-first platform that makes policy setup and day-to-day management straightforward.

ERGO NEXT works well for service-based businesses (cleaning companies, tech services and consulting firms) that want to manage coverage without going through an agent.

Overall Score 4.58 1 Affordability Score 4.32 4 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 4 ERGO NEXT's general liability coverage averages $94 per month in Alaska, making it one of the lowest-cost providers in the state. Rates are especially competitive for cleaning services, computer repair and professional consulting. Contractors and retail businesses also get solid pricing relative to coverage limits and policy terms.

Data filtered by:AccountantsAccountants $16 2 Alaska business owners frequently point to ERGO NEXT's online platform and easy policy controls as highlights. Customers mention quick account access and hassle-free renewals most. Claims handling ranks lower than other service areas, but high renewal and referral rates show overall satisfaction stays strong.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT covers third-party bodily injury, property damage and advertising injury claims under its general liability policies. Businesses can adjust limits and bundle policies directly through the online platform. Standard liability coverage is solid, but specialized risks or independent contractor work often require separate policies.

Simply Business

Best Alaska Commercial General Liability Customer Experience

Average Monthly General Liability Premium

$88These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.7/5Our Survey: Likely to Be Recommended to Others

4.2/5

- pros

Widest range of coverage options among Alaska providers

Ranks second statewide for affordability

Clean, easy-to-use online platform for policy management

Strong customer satisfaction scores

consClaims handling ranks lowest, which can mean longer processing times

No local agents for in-person support

Simply Business offers broad coverage options and competitive pricing for Alaska businesses. It ranks first for coverage variety and second for affordability, letting small businesses get solid coverage without overpaying.

Simply Business is a natural fit for contractors, professional service firms and retail businesses that want flexible coverage without a high price tag. It's one of the better picks for Alaska business owners who prioritize value and choice.

Overall Score 4.49 2 Affordability Score 4.45 2 Customer Service Score 4.15 3 Coverage Score 4.90 1 Stability Score 4.83 3 Simply Business charges $88 per month ($1,053 per year) for general liability coverage in Alaska. It's the cheapest option for 14 business types in the state, including accountants, lawyers, home-based businesses and consultants.

Data filtered by:AccountantsAccountants $13 1 Customer reviews highlight Simply Business's digital tools and competitive pricing. Many Alaska business owners like being able to compare policies and manage coverage online. Claims processing ranks lower than other service areas, but customers who care most about digital access and cost tend to rate the experience highly.

Overall Customer Score 4.14 7 Claims Process 3.70 8 Customer Service 4.00 6 Digital Experience 4.50 3 Overall Satisfaction 4.10 7 Policy Management 4.10 7 Recommend to Others 4.20 8 Renewal Likelihood 4.10 7 Simply Business connects Alaska businesses with general liability coverage from top-rated carriers. Business owners can compare multiple quotes through its online marketplace and choose policies that fit their industry.

Cheapest General Liability Insurance Companies in Alaska

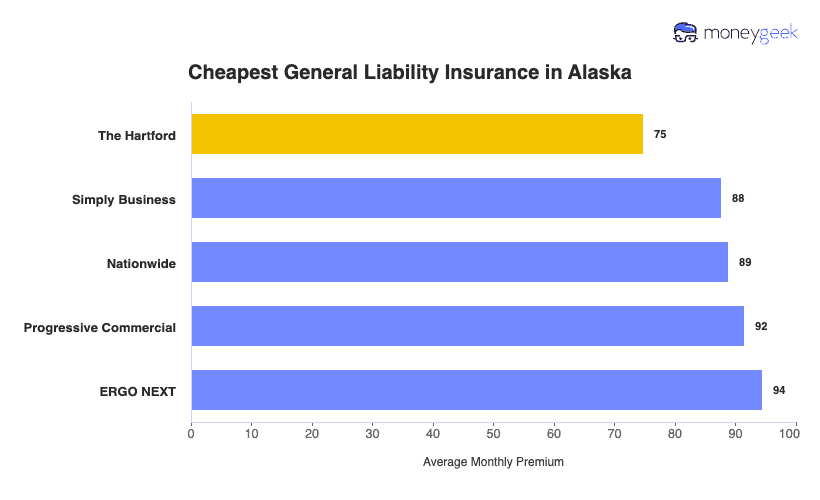

The Hartford offers the cheapest general liability insurance in Alaska at $75 per month, saving businesses $20 (about 21%) compared with the state average. Simply Business and Nationwide also provide affordable coverage options for Alaska businesses.

| The Hartford | $75 | $898 |

| Simply Business | $88 | $1,053 |

| Nationwide | $89 | $1,066 |

| Progressive Commercial | $92 | $1,099 |

| ERGO NEXT | $94 | $1,133 |

| Coverdash | $95 | $1,137 |

| Thimble | $98 | $1,181 |

| Hiscox | $105 | $1,257 |

| biBERK | $105 | $1,258 |

| Chubb | $109 | $1,307 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Alaska by Industry

Based on MoneyGeek's research, these five providers offer the most affordable general liability insurance across different industries in Alaska:

- ERGO NEXT leads affordability in 28 of 66 industries statewide, covering a wide range including manufacturing, tech/IT, real estate and construction-related businesses.

- Simply Business anks as the cheapest option in 14 industries, primarily in professional services, such as accountants, lawyers, consulting firms and software businesses.

- Thimble offers the lowest rates in 12 industries, leading in construction, HVAC, roofing and tutoring businesses.

- biBerk is also the most affordable option in 12 industries, leading in engineering, excavation, hospitality and veterinary practices.

- Coverdash and Progressive each lead in seven industries. Coverdash covers automotive and transportation sectors, while Progressive leads in food service, retail and wellness businesses.

| Accountants | Simply Business | $13 | $158 |

Average Cost of General Liability Insurance in Alaska

General liability insurance costs Alaska small businesses an average of $95 per month. The average cost of general liability coverage changes based on your industry, business size, location and coverage limits.

Manufacturing companies pay higher premiums because the work carries more risk, while accounting firms typically pay less because their liability exposure is lower. Sole proprietors often pay lower rates than businesses with several employees.

Average Cost of General Liability Insurance in Alaska by Industry

General liability insurance costs in Alaska vary widely by industry, from $15 per month for drone businesses to $809 for pressure washing companies. Higher-risk work drives higher premiums, and the gap across trades can be substantial.

| Accountants | $20 | $246 |

| Ad Agency | $38 | $455 |

| Automotive | $49 | $592 |

| Auto Repair | $151 | $1,809 |

| Bakery | $85 | $1,015 |

| Barber | $47 | $562 |

| Beauty Salon | $62 | $749 |

| Bounce House | $63 | $756 |

| Candle | $50 | $599 |

| Cannabis | $60 | $720 |

| Catering | $96 | $1,147 |

| Cleaning | $114 | $1,368 |

| Coffee Shop | $85 | $1,017 |

| Computer Programming | $32 | $379 |

| Computer Repair | $41 | $492 |

| Construction | $184 | $2,209 |

| Consulting | $21 | $252 |

| Contractor | $225 | $2,699 |

| Courier | $173 | $2,079 |

| Daycare | $30 | $354 |

| Dental | $20 | $241 |

| DJ | $27 | $322 |

| Dog Grooming | $57 | $679 |

| Drone | $15 | $179 |

| Ecommerce | $65 | $779 |

| Electrical | $83 | $994 |

| Engineering | $41 | $486 |

| Excavation | $428 | $5,134 |

| Florist | $39 | $464 |

| Food | $97 | $1,165 |

| Food Truck | $104 | $1,244 |

| Funeral Home | $56 | $677 |

| Gardening | $89 | $1,070 |

| Handyman | $230 | $2,762 |

| Home-based | $23 | $272 |

| Home-based | $42 | $505 |

| Hospitality | $66 | $790 |

| HVAC | $219 | $2,634 |

| Janitorial | $111 | $1,326 |

| Jewelry | $46 | $554 |

| Junk Removal | $147 | $1,767 |

| Lawn/Landscaping | $108 | $1,291 |

| Lawyers | $21 | $254 |

| Manufacturing | $83 | $996 |

| Marine | $25 | $298 |

| Massage | $97 | $1,162 |

| Mortgage Broker | $21 | $257 |

| Moving | $119 | $1,422 |

| Nonprofit | $32 | $389 |

| Painting | $128 | $1,536 |

| Party Rental | $71 | $857 |

| Personal Training | $23 | $281 |

| Pest Control | $29 | $347 |

| Pet | $52 | $622 |

| Pharmacy | $59 | $705 |

| Photography | $24 | $288 |

| Physical Therapy | $153 | $1,839 |

| Plumbing | $344 | $4,131 |

| Pressure Washing | $809 | $9,710 |

| Real Estate | $41 | $490 |

| Restaurant | $141 | $1,695 |

| Retail | $61 | $733 |

| Roofing | $341 | $4,087 |

| Security | $141 | $1,691 |

| Snack Bars | $107 | $1,289 |

| Software | $28 | $338 |

| Spa/Wellness | $88 | $1,059 |

| Speech Therapist | $30 | $355 |

| Startup | $29 | $344 |

| Tech/IT | $28 | $330 |

| Transportation | $33 | $397 |

| Travel | $20 | $234 |

| Tree Service | $124 | $1,483 |

| Trucking | $90 | $1,079 |

| Tutoring | $32 | $385 |

| Veterinary | $39 | $468 |

| Wedding Planning | $30 | $356 |

| Welding | $151 | $1,812 |

| Wholesale | $41 | $488 |

| Window Cleaning | $147 | $1,758 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Alaska General Liability Insurance Costs?

General liability insurance pricing for Alaska businesses changes depending on industry type, location and coverage choices.

Alaska's Remote Geography and Limited Service Access

Investigating claims in Alaska costs four times what it does elsewhere. That $500 slip-and-fall investigation in Seattle? It's $2,000 in rural Alaska once you factor in travel. Shipping materials and finding qualified contractors drive settlement costs higher. Your premiums reflect these realities.

Alaska's Seismic Activity and Earthquake Risk

More than 12,000 earthquakes shake Alaska every year. Tremors knock shelves through shared walls or drop signs onto parked cars below. After quakes, cracked sidewalks and unstable building elements create new liability risks. Insurers price coverage for a place where this is routine, not rare.

Alaska's Extreme Weather and Climate Conditions

Six to eight months of brutal winter means most of your year involves slip-and-fall risk. Snow piles up daily. Ice builds on roofs and crashes down on people or vehicles. General liability covers the injuries and damage, but insurers pay out claims all winter long. Extended exposure drives up what you pay.

Alaska's Elevated Medical and Health Care Costs

Emergency room visits after falls run $3,000 in Alaska compared with $1,200 in most states. Health care premiums jumped 16% from 2023 to 2025. Remote patients get airlifted to Anchorage or sent to the Lower 48, adding thousands to the bill. Higher medical costs push up every claim, and premiums follow.

Alaska's Legal and Regulatory Environment

Data breaches require mandatory reporting to affected residents, and resolution costs add up fast. Contractors must carry commercial general liability plus a $25,000 surety bond. Remote regulatory oversight stretches dispute timelines and raises legal costs that insurers ultimately absorb. Claims take longer and cost more to close.

How Much General Liability Insurance Do I Need in Alaska?

Alaska law doesn't mandate general liability insurance for most businesses, but operating without it is harder than it sounds. Landlords write coverage requirements into lease agreements. Clients demand proof before signing contracts.

Licensed electricians, HVAC contractors and safety companies must carry coverage under state law. Most Alaska businesses buy $1 million per occurrence and $2 million aggregate limits to meet contract requirements.

Alaska requires the same general liability insurance minimums for electricians, electrical sign contractors, HVAC contractors and safety companies.

All licensed contractors must carry at least $20,000 property damage coverage, $50,000 bodily injury per person and $100,000 bodily injury per accident. These minimums apply regardless of specialty trade, though commercial projects and larger contracts often require higher coverage limits.

*Alaska insurance requirements change regularly. Verify the current rules with the Alaska Division of Insurance or a licensed agent before purchasing.

How to Choose the Best General Liability Insurance in Alaska

Getting business insurance in Alaska means finding coverage that protects your operations while fitting your budget and meeting client contract requirements.

- 1Determine Coverage Needs

Alaska doesn't legally require general liability insurance, but most commercial leases in Anchorage, Fairbanks and other cities require proof of coverage before signing. Lease agreements often set minimum limits between $1 million and $2 million per occurrence, with aggregate limits that match or exceed that amount. Check your lease terms, client contracts and industry standards to confirm the coverage limits your business needs.

- 2Prepare Business Information

Insurers need detailed information to generate accurate Alaska quotes — your business classification, annual revenue, employee count and operating location. General liability premiums in Alaska average $48 per month, though rates shift based on industry risk and whether you operate in urban centers like Anchorage or remote areas. Gather your EIN, Alaska business license and tax records ahead of time to speed up applications and avoid pricing errors.

- 3Compare Multiple Quotes

Request quotes from at least three Alaska-licensed insurers, since pricing and policy terms differ by carrier. Check how each policy treats defense costs, whether they're included in your coverage limit or paid separately, and compare deductibles and limits. Getting business insurance quotes from multiple insurers is the most reliable way to find the right balance of price and coverage.

- 4Look Beyond Price

Don't choose coverage based on price alone. Many Alaska policies exclude professional errors, pollution exposure and employee injuries, all of which need separate coverage. Read exclusions carefully and confirm whether legal defense costs are inside or outside your policy limits — that distinction changes your actual coverage when a claim hits.

- 5Verify Insurer Credentials

Confirm insurer licensing through the Alaska Division of Insurance and check AM Best financial strength ratings before buying. You can check complaint ratios at the Alaska Division of Insurance — (800) 467-8725 — to spot patterns in claims handling before you buy. Work with insurers that have a track record of financial stability and consistent claims performance.

Read more: Best Insurance for Your Business

- 6Ask About Discounts

Many Alaska insurers offer discounts for bundling policies, keeping a claims-free record, running safety programs or paying premiums annually. Adding commercial property coverage through a business owner's policy often lowers premiums by 10% to 25%. Security systems, employee safety training and Alaska industry memberships can also qualify your business for reduced rates.

- 7Get Certificate of Insurance

Commercial landlords and clients across Alaska require certificates of insurance before contracts begin, especially in Anchorage and Juneau. Some insurers issue digital certificates instantly; others take up to 48 hours. Keep your insurer or agent's contact details handy, since delays in providing proof of coverage can hold up projects or lease approvals.

- 8Review Coverage Annually

Revisit your general liability policy each year, especially after hiring staff, expanding services or bringing in more revenue. Start comparing quotes 60 to 90 days before renewal, so you have time to adjust limits or find better pricing. Annual reviews help catch compliance gaps tied to lease requirements and lower the risk of audit-related premium increases.

Top General Liability Insurance in Alaska: Bottom Line

Get quotes from at least three Alaska-licensed insurers before buying. ERGO NEXT, Simply Business and Thimble are strong picks depending on your industry, business size and budget. But verify credentials and check complaint ratios before committing.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Alaska Department of Labor and Workforce Development. "Construction Contractor Licensing." Accessed February 27, 2026.

- Alaska Division of Geological & Geophysical Surveys. "Earthquakes & Tsunamis." Accessed February 27, 2026.

- Alaska Division of Insurance. "2024 Annual Report." Accessed February 27, 2026.

- Alaska Public Media. "Monthly Premiums for Health Insurance on the Federal Marketplace Will Rise 16% in Alaska Next Year." Accessed February 27, 2026.

- U.S. Bureau of Labor Statistics. "Census of Fatal Occupational Injuries." Accessed February 27, 2026.

- U.S. Geological Survey. "Alaska Earthquake and Tsunami Hazards." Accessed February 27, 2026.

- U.S. Geological Survey. "Earthquakes." Accessed February 27, 2026.

- U.S. Climate Resilience Toolkit. "Arctic Weather and Extreme Events." Accessed February 27, 2026.

- VolcanoDiscovery. "Latest Earthquakes in Alaska and the Aleutian Islands." Accessed February 27, 2026.