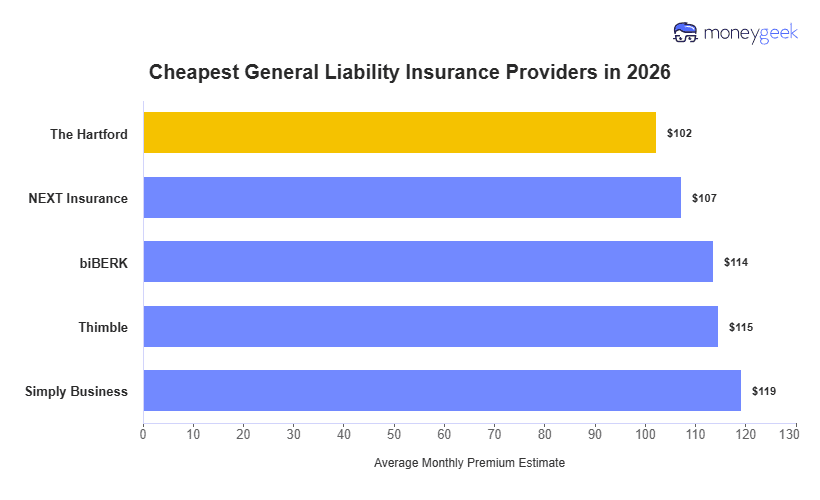

We found these providers to have the cheapest general liability insurance on average:

- The Hartford : Often cheapest for most professional service and office-based businesses (finance, tech, marketing)

- ERGO NEXT: Often cheapest for hands-on, operational service businesses (Contractors, Food & Beverage, Transportation)

- biBERK: Often cheapest for sole proprietor service businesses (cleaning, fitness, recreation).

>>(Click Each Provider To Learn More)

Your most affordable commercial general liability insurance provider and monthly rate can vary widely based on your specific business details. So, use these companies as a starting point, not a final answer.