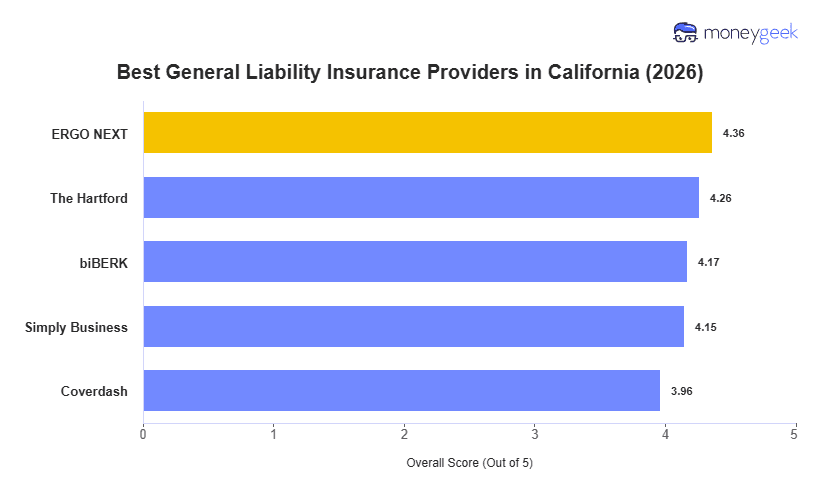

After evaluating business insurance providers based on affordability, coverage options and terms, and customer support, these five carriers deliver the most balanced California general liability insurance:

- ERGO NEXT: Best Overall, Best for Hands-on Work Industries

- The Hartford: Best for Office-Based Professional Services

- biBERK: Best for Recreation and Low-Risk Industries

- Simply Business: Best for Comparing Multiple Carriers

- Coverdash: Best Selection of Coverage Options

California's small business landscape spans everything from tech consultancies in Silicon Valley to restaurants in Los Angeles, healthcare practices across major metros, and construction firms statewide. This diversity also means needs and your best general liability insurance match vary significantly based on your industry, team size, and location even within your state.

To make clear who is likely best for you, we break down what sets each provider apart and who benefits most from their coverage in California: