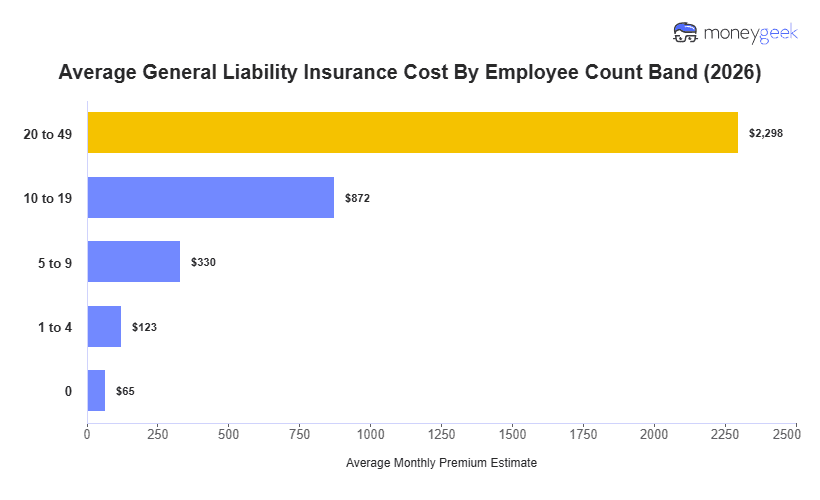

Small businesses with one to four employees pay $123 per month ($1,474 annually) on average for general liability insurance with $1 million per occurrence/$2 million aggregate limits. This average reflects analysis across 408 industries and all 50 states, plus Washington, D.C.

This national benchmark doesn't guarantee your price. General liability premiums vary based on industry risk level, location and business size, even for identical coverage limits.