Our research on the best business insurance gives Oregon business owners a clearer look at general liability coverage options. The questions below explain general liability insurance requirements and costs in Oregon:

Best General Liability Insurance in Oregon

The Hartford tops Oregon for best and cheapest general liability insurance, with rates starting at $76 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 18, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Oregon: Fast Answers

Which company offers the best general liability insurance in Oregon?

The Hartford ranks as the best general liability insurance company in Oregon with a 4.62 overall score out of 5. It provides affordable coverage at $76 per month and excels in claims processing. ERGO NEXT comes in second with a 4.55 score, offering strong digital tools and customer support for $96 per month.

Who offers the cheapest general liability insurance in Oregon?

The cheapest general liability insurance companies in Oregon are:

- The Hartford: $76 per month

- Simply Business: $89 per month

- Nationwide: $90 per month

- Progressive: $93 per month

- ERGO NEXT: $96 per month

Do Oregon businesses legally need general liability insurance?

Oregon doesn't legally require most businesses to carry general liability insurance at the state level. However, certain licensed professionals like contractors and electricians must maintain specific coverage limits. Local cities and counties may impose their own requirements. Even without legal mandates, landlords and clients often require proof of coverage before signing contracts.

How much does general liability insurance cost in Oregon?

General liability insurance costs between $16 and $854 per month for small Oregon businesses with two employees. The drone industry has some of the lowest rates, while pressure washing businesses tend to pay the highest premiums. Your actual cost depends on your specific industry, business location, coverage limits and company size.

Best General Liability Insurance Companies in Oregon

The Hartford ranks first for general liability insurance in Oregon, with affordable rates and strong customer service. NEXT delivers solid customer support and a wide range of coverage options. Nationwide brings reliable stability and competitive pricing for small businesses across the state.

| The Hartford | 4.62 | $76 |

| ERGO NEXT | 4.55 | $96 |

| Nationwide | 4.52 | $90 |

| Simply Business | 4.48 | $89 |

| Coverdash | 4.37 | $96 |

| Thimble | 4.35 | $100 |

| biBERK | 4.29 | $106 |

| Progressive Commercial | 4.27 | $93 |

| Chubb | 4.26 | $110 |

| Hiscox | 4.18 | $106 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Oregon General Liability Insurer

Select your industry and state to get a customized Oregon general liability insurance quote.

General liability insurance covers customer injuries and property damage for Oregon businesses, but it won't protect against every risk you may encounter. Explore these additional coverage options:

Best Oregon General Liability Insurance Reviews

Finding the right general liability insurance provider in Oregon requires looking beyond cost alone. Coverage quality and service matter too. Our research reveals which business insurers deliver the best value in the state.

The Hartford

Best Oregon General Liability Insurer

Average Monthly General Liability Premium

$76These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Fast, efficient claims handling with top processing rankings

Highest customer satisfaction scores among surveyed providers

A+ AM Best rating for financial strength

Ranks first overall for general liability insurance

consDigital platform ranks last among surveyed insurers

Requires agent consultation instead of direct online purchase

The Hartford ranks first in Oregon’s general liability market, supported by strong customer service and an A+ AM Best rating. The company offers broad coverage options and dependable claims handling. It works well for service-based businesses such as construction firms, professional services and retail operations. The Hartford focuses on agent-led support, making it a good fit for owners who prefer personal guidance over a fully digital experience.

Overall Score 4.62 1 Affordability Score 4.57 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 At about $76 per month, The Hartford provides general liability coverage in Oregon. It ranks among the more affordable options across several industries. Pricing remains competitive in construction, cleaning services and professional fields. Contractors, consultants and retail businesses may find its rates appealing compared to other providers.

Data filtered by:AccountantsAccountants $15 2 Customer feedback highlights The Hartford’s strength in claims handling and service quality, with top national rankings in both areas. Many business owners appreciate the company’s hands-on support. While its digital tools do not rank as highly as some competitors, satisfaction with claim outcomes and renewals remains strong.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford offers general liability limits ranging from $300,000 to $2 million per occurrence, with aggregate limits up to twice that amount. Businesses can expand coverage with options such as product liability, broad form contractual liability or data breach protection through a business owner’s policy. Its flexible structure supports a range of Oregon industries, including retail and construction.

ERGO NEXT

Best Oregon Commercial General Liability Customer Experience

Average Monthly General Liability Premium

$96These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first for customer service with responsive support teams

Maintains A- AM Best financial stability rating

Offers most affordable rates among major providers

Provides superior digital experience for online policy management

consNewer company with limited operating history compared to competitors

Online-only platform without local agent support available

Claims processing takes longer than top-performing competitors

ERGO NEXT is known in Oregon for exceptional customer service and comprehensive coverage options. With an A- rating from AM Best, it delivers reliable protection and ranks first in digital experience and policy management. The provider suits tech-savvy Oregon businesses that want streamlined online service and broad coverage for industries such as tech, professional services and construction.

Overall Score 4.55 2 Affordability Score 4.25 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 At $96 per month, ERGO NEXT offers competitive general liability coverage in Oregon. The provider shows strong affordability rankings for dental practices, tech companies and home-based businesses, while also delivering cost-effective solutions for automotive, cleaning and professional service industries.

Data filtered by:AccountantsAccountants $16 3 Oregon customers consistently praise ERGO NEXT's digital experience, policy management capabilities and likelihood of recommending the provider to others. Customer feedback highlights the provider's user-friendly online platform and efficient policy administration tools, making it ideal for businesses preferring digital-first insurance management.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT provides general liability coverage with limits up to $2 million per claim and $4 million aggregate. The provider includes contractor E&O insurance and offers specialized endorsements like CG2010 for completed work protection. These flexible coverage options benefit construction and contract-based businesses seeking comprehensive protection.

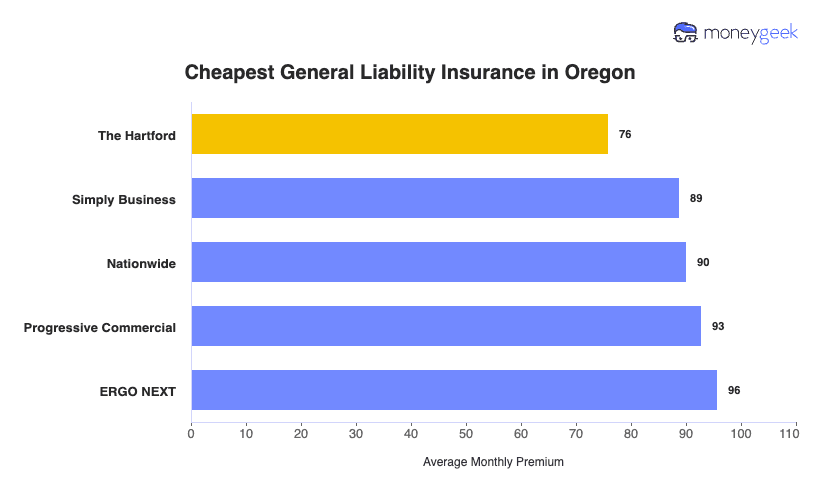

Cheapest General Liability Insurance Companies in Oregon

The Hartford offers the cheapest general liability insurance in Oregon at $76 per month, saving businesses $19 or 20.2% compared to the state average. Simply Business and Nationwide also provide affordable coverage options for Oregon companies.

| The Hartford | $76 | $910 |

| Simply Business | $89 | $1,067 |

| Nationwide | $90 | $1,080 |

| Progressive Commercial | $93 | $1,114 |

| ERGO NEXT | $96 | $1,148 |

| Coverdash | $96 | $1,152 |

| Thimble | $100 | $1,196 |

| Hiscox | $106 | $1,273 |

| biBERK | $106 | $1,274 |

| Chubb | $110 | $1,324 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Oregon by Industry

MoneyGeek's research identifies the most affordable general liability insurance providers by industry in Oregon.

- The Hartford wins affordability across 22 industries, leading in construction, cleaning, food trucks, security and welding sectors.

- Simply Business and Thimble each offer cheap coverage for 11 industries. Simply Business excels with professional services like accountants, lawyers and software companies.

- Thimble ranks as the most affordable option for 11 service-based industries, including bakeries, barber shops, HVAC and roofing businesses.

- biBerk provides the cheapest rates across 10 industries, performing well for contractors, engineering firms and handyman services.

- Coverdash and ERGO NEXT each lead affordability in seven industries. Coverdash dominates automotive and restaurant sectors, while ERGO NEXT offers low rates for dental practices and tech companies.

| Accountants | Simply Business | $13 | $160 |

Average Cost of General Liability Insurance in Oregon

Most small businesses in Oregon pay around $95 monthly for general liability insurance. The average cost of general liability coverage changes based on your industry type, business size, location and policy limits.

Manufacturing companies tend to pay higher premiums due to increased risk exposure, while accounting firms often pay less because of lower liability concerns. Sole proprietors generally pay lower rates compared to businesses with several employees since they have fewer liability exposures.

Average Cost of General Liability Insurance in Oregon by Industry

Oregon businesses pay between $16 and $854 monthly for general liability coverage. Drone operations have some of the lowest rates at $16 per month, while pressure washing companies pay the highest costs at $854 monthly. Review this table for rates specific to your industry.

| Accountants | $21 | $247 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Oregon General Liability Insurance Costs?

Several key factors determine how much Oregon businesses pay for general liability insurance coverage.

Oregon Legal and Regulatory Environment

Oregon's comparative negligence system lets injured parties recover damages even when they're partly at fault, which pushes up successful claim rates. The state ranks 25th nationally for lawsuit activity, with tort costs of $3,105 per household. That creates a predictable litigation exposure insurers build into premiums.

Extensive commercial auto requirements and licensed trade minimums set a high bar for coverage standards statewide. Workers' compensation costs run low at $50 monthly, which frees up budget room, but municipal variations and strong consumer protection laws push baseline general liability requirements higher across most business sectors.

Oregon Natural Disaster and Weather Conditions

Rain, snow and ice are year-round realities in Oregon, and that means year-round slip-and-fall exposure. Premises liability claims here run higher than in drier states. The January 2024 ice storm alone caused a spike in customer injuries and property damage claims.

Oregon also contends with a 37% chance of a 7.1 or greater Cascadia earthquake in the next 50 years, wildfires affecting about a third of the population and flooding across 55 rivers. Add coastal landslides into the mix and insurers charge more in disaster-prone zones to account for the higher probability and cost of claims.

Oregon Economic and Industry Factors

Oregon's tourism industry brings in $14.3 billion annually and concentrates liability exposure wherever visitors gather. Portland alone sees 12.3 million visitor trips per year, generating more slip-and-fall and property damage claims than lower-traffic parts of the state. That gap drives real differences in what businesses pay by location.

The state's 400,000 small businesses create enough market competition to keep pricing in check to a degree, but the shift toward high-liability sectors like hospitality, retail and recreation keeps pushing statewide exposure and premiums higher for customer-facing businesses.

Oregon Health Care and Medical Costs

Oregon's 8.3% to 12.2% health insurance rate increases for 2025 directly inflate general liability claim payouts for bodily injuries. Expensive diagnostic tests and emergency room care mean even minor injuries generate substantial claims. A simple head bump that requires precautionary CT scans can cost more than $3,500.

Rising medical costs extend claim duration and increase lifetime medical calculations for permanent injuries. Healthcare affordability stress (83% of Oregon adults worried about costs) motivates injured parties to pursue liability claims to recover unaffordable medical expenses, increasing both claim frequency and severity for Oregon businesses.

How Much General Liability Insurance Do I Need in Oregon?

The amount of general liability insurance you need in Oregon depends on your profession and whether state law mandates coverage. Requirements for commercial general liability vary by industry, with construction contractors facing the strictest rules. Oregon sets specific minimum coverage amounts for licensed contractors and trade professionals, including landscape contractors. Most other businesses choose limits based on risk exposure and client contracts.

- Residential: Oregon requires at least $500,000 per occurrence for these contractors. The Construction Contractors Board won't issue or renew licenses without proof of coverage.

- Commercial (Level 1): Your license requires $2 million in aggregate coverage. This higher requirement reflects the increased risks of large-scale commercial projects.

- Commercial (Level 2): The state mandates $1 million aggregate coverage for this classification. Level 2 contractors handle smaller commercial projects but still carry substantial liability exposure.

- Level 1: Coverage starts at $1 million aggregate for commercial specialty work. Oregon bases this amount on the complexity and scale of commercial trade projects.

- Level 2: These contractors need $500,000 per occurrence minimum. The lower tier reflects smaller project scopes while protecting consumers.

- Residential: You need $100,000 per occurrence and $300,000 aggregate to work on homes. These minimums apply when installing or servicing residential heating and cooling systems.

- Commercial: Oregon requires $300,000 per occurrence and $600,000 aggregate for commercial HVAC work. The higher limits account for larger systems and greater property damage potential.

Oregon requires $300,000 per occurrence and $600,000 aggregate coverage for both classifications. Your policy must include completed operations coverage to protect against post-project claims.

Licensed plumbers must carry $300,000 for property damage and $100,000 for general liability. Oregon's Building Codes Division verifies coverage during the licensing process.

These contractors need only $100,000 per occurrence for smaller projects. Total annual sales must stay under $40,000 with no single contract exceeding $5,000.

Developers must maintain $500,000 per occurrence coverage. This protects homebuyers and investors in residential development projects throughout Oregon.

Oregon mandates $100,000 minimum coverage for licensed home inspectors. This relatively modest requirement reflects the advisory nature of inspection services.

Licensed locksmiths need $100,000 in general liability coverage. The requirement protects clients from property damage during lock installation or repair work.

State insurance rules change often. Check current requirements with the Oregon Division of Financial Regulation or talk with a licensed agent for the latest information.

How to Choose the Best General Liability Insurance in Oregon

Choosing general liability insurance in Oregon starts with understanding your business risks and state requirements. Getting business insurance that covers accidents, property damage and professional mistakes protects your finances when clients file claims against your company.

- 1Determine Coverage Needs

Oregon doesn't require general liability insurance for most businesses, except licensed contractors who must meet the Construction Contractors Board minimums. Licensed contractors need coverage ranging from $100,000 to $2 million depending on their classification, while many other businesses choose $1 million per occurrence and $2 million aggregate as part of their business insurance coverage.

Check whether your clients, landlords or contracts require specific limits before selecting your policy.

- 2Prepare Business Information

Gather your business details including annual revenue, employee count, Oregon business registration and Employer Identification Number before requesting quotes. Oregon insurers calculate premiums based on industry classification, location and claims history. Having documentation ready speeds up the application process and helps agents provide accurate quotes for your business type.

- 3Compare Multiple Quotes

Request quotes from at least three insurers licensed in Oregon since the cost of your coverage varies by carrier and industry. Small businesses in Oregon pay around $95 monthly for general liability insurance, with rates from $16 for drone operations to $854 for pressure washing companies. Compare premiums, deductibles, whether defense costs are included within or outside policy limits, and the insurer's claims-handling reputation.

- 4Look Beyond Price

Affordable business insurance doesn't mean choosing the lowest premium without reviewing coverage details. Read policy exclusions carefully since common risks like professional errors, pollution liability and employee injuries require separate coverage in Oregon. Understand whether legal defense costs count toward your policy limit or if the insurer covers them separately.

- 5Verify Insurer Credentials

Verify insurer licensing through Oregon's Division of Financial Regulation and check AM Best ratings to confirm financial stability. The Division of Financial Regulation maintains a license lookup tool where you can verify an insurance company's authorization to operate in Oregon. Review complaint ratios to identify insurers with poor claims-handling reputations before purchasing coverage.

- 6Ask About Discounts

Oregon insurers offer discounts for bundling general liability with commercial property or workers' compensation coverage. Implementing safety training programs, maintaining a claims-free history and paying premiums annually instead of monthly can reduce costs. Business Owner's Policies combining multiple coverages save Oregon businesses 10% to 25% compared to purchasing policies separately.

- 7Obtain Certificate Documentation

Oregon landlords, clients and general contractors require certificates of insurance before allowing you to work on their properties or projects. Most insurers provide digital certificates instantly through online portals, though some take up to 48 hours. Keep your agent's contact information accessible since you'll need certificates for each new contract or lease agreement.

- 8Review Coverage Annually

Reassess your coverage limits 60 to 90 days before renewal, especially after hiring employees, expanding services or moving to a new Oregon location. Oregon's weather risks including winter ice and rain may require adjustments to liability limits as your business grows. Comparing quotes annually helps you find better rates and ensures coverage keeps pace with business changes.

Top General Liability Insurance in Oregon: Bottom Line

Finding the right general liability insurance in Oregon starts with understanding your specific business needs and comparing providers thoroughly. The Hartford, ERGO NEXT and Nationwide consistently rank among top choices, but your ideal provider depends on your industry, company size and budget. Smart business owners compare multiple quotes and verify insurer credentials before making their final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Altarum. "Consumer Healthcare Experience State Survey (CHESS): Oregon Survey Respondents Worry about High Hospital Costs." Accessed February 27, 2026.

- Dean Runyan Associates. "The Economic Impact of Travel in Oregon: Calendar Year 2024 Preliminary." (Prepared for Travel Oregon)." Accessed February 27, 2026.

- Federal Emergency Management Agency. "Oregon; Major Disaster and Related Determinations." Accessed February 27, 2026.

- Oregon Division of Financial Regulation. "Consumer Guide to 2025 Health Insurance Rate Filings." Accessed February 27, 2026.

- Oregon Division of Financial Regulation. "Oregon Division of Financial Regulation Issues Final Health Rates for 2025." Accessed February 27, 2026.

- Oregon Health Authority. "2024 Impact of Health Care Costs on Oregonians." Accessed February 27, 2026.

- Travel Oregon. "Travel Oregon Marks National Travel & Tourism Week by Showcasing Community Investments and $14.3 Billion in Visitor Spending." Accessed February 27, 2026.

- U.S. Chamber Institute for Legal Reform. "2019 Lawsuit Climate Survey: Ranking the States." Accessed February 27, 2026.