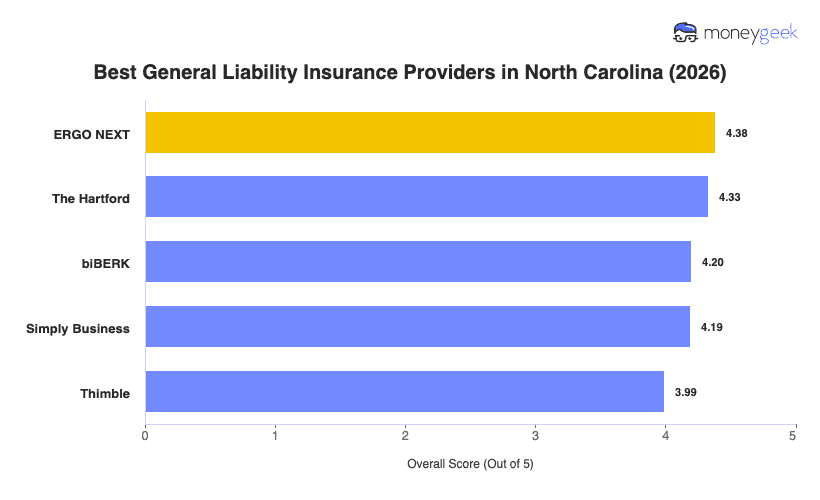

Whether you operate a Raleigh tech startup, an Asheville brewery or a Fayetteville landscaping service, these providers offer the best general liability insurance for North Carolina small businesses:

- ERGO NEXT: Best Overall, Best for Service-Based and Hands-On Businesses

- The Hartford: Best Cheap General Liability Insurance

- biBERK: Best for Service-Based Businesses

- Simply Business: Best for Carrier Choice

- Thimble: Best for On-Demand Coverage

Each of these carriers stands out for delivering value without sacrificing service quality or coverage customization. Our detailed analysis below explains what makes each provider competitive and helps you identify the right match for your business.