Find answers to your general liability insurance questions in Montana. Our research covers the best business insurance options and breaks down what you need to know about coverage:

Best General Liability Insurance in Montana

The Hartford leads Montana general liability insurance as both the top choice and the most affordable at $81 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Montana: Fast Answers

Which company offers the best general liability insurance in Montana?

The Hartford ranks as the best general liability insurance company in Montana with a 4.58 overall score out of 5. It provides affordable coverage at $81 per month with reliable claims handling. ERGO NEXT takes second place with a 4.56 score, known for its user-friendly digital platform and excellent customer support at $103 per month.

Who offers the cheapest general liability insurance in Montana?

The cheapest general liability insurance companies in Montana offer affordable monthly rates:

- The Hartford: $81 per month

- Simply Business: $95 per month

- Nationwide: $97 per month

- Progressive: $100 per month

- ERGO NEXT: $103 per month

Do Montana businesses legally need general liability insurance?

Montana doesn't legally require general liability insurance for most businesses statewide. However, certain licensed professionals like contractors and electricians must carry minimum coverage amounts. Local municipalities may have their own requirements, and most landlords and clients demand proof of insurance before signing contracts.

How much does general liability insurance cost in Montana?

General liability insurance costs between $17 and $916 per month for small Montana businesses with two employees. The drone industry sees the lowest rates at $17 per month, while pressure washing businesses pay the highest at $916 per month. Your actual premium depends on your industry, location, coverage limits and business size.

Best General Liability Insurance Companies in Montana

The Hartford ranks as our top choice for general liability insurance in Montana, offering an excellent balance of affordability and quality service. ERGO NEXT and Nationwide are strong alternatives, with ERGO NEXT excelling in customer service and coverage options, while Nationwide provides competitive rates and financial stability for small businesses.

| The Hartford | 4.58 | $81 |

| ERGO NEXT | 4.56 | $103 |

| Nationwide | 4.54 | $97 |

| Simply Business | 4.50 | $95 |

| Thimble | 4.40 | $107 |

| Coverdash | 4.39 | $103 |

| biBERK | 4.30 | $114 |

| Progressive Commercial | 4.29 | $100 |

| Chubb | 4.27 | $118 |

| Hiscox | 4.19 | $114 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Montana General Liability Insurer

Select your industry and state to get a customized Montana general liability insurance quote.

General liability insurance covers your Montana business against customer injuries and property damage claims, but it won't protect you from every risk. Explore these additional coverage options:

Best Montana General Liability Insurance Reviews

Finding the best general liability insurance in Montana requires looking beyond affordable rates to consider coverage quality and service. Our analysis reveals which business insurers deliver the most value.

Best Montana General Liability Insurer

Average Monthly General Liability Premium

$81These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Top overall general liability provider in Montana

Fast, dependable claims handling

Good financial backing with A+ AM Best rating

consRequires working with an agent to buy a policy

Online tools lag behind competitors

The Hartford sets the standard for general liability coverage in Montana, combining strong financial backing with dependable customer support. Businesses benefit from fast claims handling and knowledgeable service teams, which helps reduce disruptions after an incident.

Companies that value hands-on guidance and consistent claims outcomes often lean toward The Hartford. This is especially true for construction firms, contractors and professional service providers that want coverage backed by experience rather than a self-service model.

Overall Score 4.58 1 Affordability Score 4.47 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 In Montana, The Hartford charges an average of $81 per month for general liability coverage. Rates trend lower for many trades, including construction, electrical work, and professional services. The company ranks as the most affordable option for 22 industry categories, including contractors and home-based businesses.

Data filtered by:AccountantsAccountants $17 2 Montana policyholders rate The Hartford highly for claims handling and customer support. Business owners report smooth claims resolutions and clear communication throughout the process. While digital tools leave room for improvement, strong service teams continue to drive positive feedback.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford offers per-occurrence limits ranging from $300,000 to $2 million, with aggregate limits that can reach twice that amount. Businesses can add product liability coverage and expanded contractual liability options based on operational needs.

Policyholders also have the option to bundle coverage through a business owner's policy, which allows for added protections like data breach coverage and tailored policy enhancements.

Best Montana Commercial General Liability Customer Experience

Average Monthly General Liability Premium

$103These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first for affordability among general liability providers

Excellent digital platform makes policy management simple and efficient

Strong A- AM Best rating demonstrates solid financial stability

Highly recommended by existing customers for overall experience

consNewer company with less industry experience than established competitors

Online-only service model lacks local agent support options

ERGO NEXT tops Montana insurers for customer service and places second for coverage options. Munich Re backs this 2016 startup, which now serves over 600,000 customers online.

ERGO NEXT uses AI technology to provide instant quotes and coverage in 10 minutes, with 24/7 access to certificates and policy management. It's best for Montana business owners who prioritize speed, convenience and digital experiences over traditional agent relationships and low costs.

Overall Score 4.56 2 Affordability Score 4.27 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT provides general liability insurance in Montana for an average of $104 monthly ($1,247 annually). Among the providers in our study, ERGO NEXT ranks sixth for affordability but offers the most affordable option in nine industries.

Dental and tech/IT services pay the lowest rates with ERGO NEXT. Automotive shops and personal trainers also save money, with ERGO NEXT ranking second cheapest for those businesses.

Data filtered by:AccountantsAccountants $17 3 ERGO NEXT excels in Montana customer experience, ranking first in digital experience and policy management. Customers most often recommend ERGO NEXT to others. Its digital-first approach lets you instantly generate certificates of insurance and manage your policy 24/7 without waiting for agent callbacks.

Claims processing ranks fourth, meaning longer waits when filing claims. On Trustpilot, customers rave about "extremely fair" pricing and "seamless" setup, while others are frustrated by "horrible customer service" and claim denials.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT offers flexible Montana general liability coverage with limits up to $2 million per claim and $4 million aggregate. Its policies also include contractor E&O insurance, making it attractive for construction and other contract-based businesses.

ERGO NEXT offers endorsements protecting you from damage claims on completed work through its CG2010 or ongoing operations endorsement.

Cheapest General Liability Insurance Companies in Montana

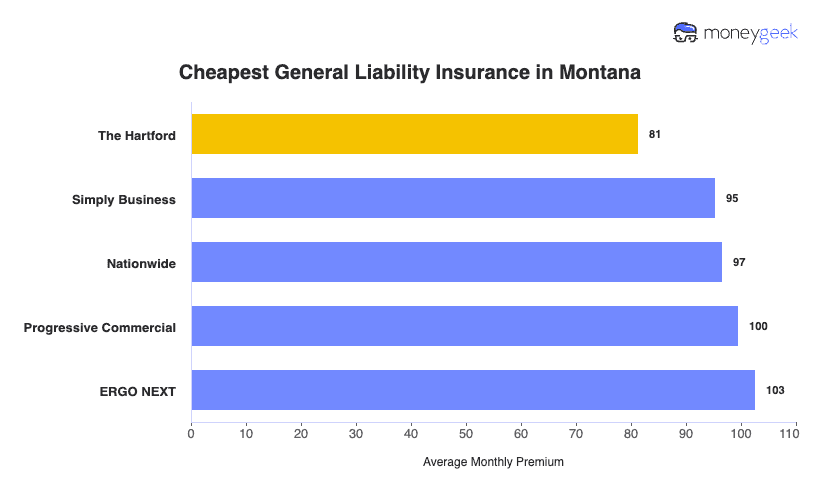

The Hartford offers the cheapest general liability insurance in Montana at $81 per month, saving businesses $21 or 20% compared to the state average. Simply Business and Nationwide also provide affordable coverage options for Montana businesses.

| The Hartford | $81 | $977 |

| Simply Business | $95 | $1,144 |

| Nationwide | $97 | $1,159 |

| Progressive Commercial | $100 | $1,196 |

| ERGO NEXT | $103 | $1,231 |

| Coverdash | $103 | $1,235 |

| Thimble | $107 | $1,281 |

| Hiscox | $114 | $1,363 |

| biBERK | $114 | $1,363 |

| Chubb | $118 | $1,420 |

How Did We Determine These Rates?

These rates come from small businesses with two employees across 79 major industries and cover general liability policies only. Your premium depends on your business location, industry, coverage limits and other factors insurers review. Options vary by state.

Cheapest General Liability Insurance in Montana by Industry

Based on MoneyGeek’s research, these five insurers offer the lowest general liability rates across a wide range of Montana industries:

- The Hartford: Offers the lowest pricing in 22 industries, with strong results for construction, electrical work, food trucks and home-based businesses.

- Thimble: Posts the lowest rates in 14 industries, with competitive pricing for cleaning services, HVAC businesses, software developers, and tutors.

- biBerk: Ranks lowest in 11 industries and prices well for contractors, engineering firms, hospitality businesses, and trucking companies.

- Simply Business: Provides low-cost coverage across 10 industries, with a focus on professional services like accounting, consulting, legal firms and startups.

- ERGO NEXT: Ranks lowest in seven industries, performing best for dental offices, tech companies, photographers and spa or wellness businesses.

| Accountants | Simply Business | $14 | $172 |

Average Cost of General Liability Insurance in Montana

Most small businesses in Montana pay around $102 monthly for general liability insurance. The average cost of general liability insurance coverage changes based on your industry, business size, location and coverage limits.

Manufacturing companies pay higher premiums due to increased risk exposure, while accounting firms pay less because of lower liability concerns. Sole proprietors usually secure cheaper rates compared to businesses with several employees.

Average Cost of General Liability Insurance in Montana by Industry

Montana businesses pay between $17 and $916 monthly for general liability coverage, depending on industry type. Drone businesses often get the lowest rates at about $17 per month, while pressure washing companies see the highest costs at roughly $916 monthly. Review this table for rates specific to your business type.

| Accountants | $22 | $265 |

| Ad Agency | $35 | $425 |

| Automotive | $53 | $640 |

| Auto Repair | $152 | $1,824 |

| Bakery | $90 | $1,085 |

| Barber | $44 | $532 |

| Beauty Salon | $67 | $802 |

| Bounce House | $70 | $843 |

| Candle | $55 | $659 |

| Cannabis | $67 | $805 |

| Catering | $88 | $1,052 |

| Cleaning | $133 | $1,590 |

| Coffee Shop | $90 | $1,077 |

| Computer Programming | $29 | $349 |

| Computer Repair | $48 | $572 |

| Construction | $175 | $2,105 |

| Consulting | $22 | $263 |

| Contractor | $255 | $3,060 |

| Courier | $196 | $2,346 |

| Daycare | $33 | $395 |

| Dental | $22 | $258 |

| DJ | $25 | $304 |

| Dog Grooming | $63 | $762 |

| Drone | $17 | $200 |

| Ecommerce | $73 | $878 |

| Electrical | $112 | $1,350 |

| Engineering | $40 | $478 |

| Excavation | $466 | $5,590 |

| Florist | $43 | $514 |

| Food | $108 | $1,292 |

| Food Truck | $142 | $1,701 |

| Funeral Home | $60 | $725 |

| Gardening | $112 | $1,349 |

| Handyman | $244 | $2,931 |

| Home-based | $24 | $285 |

| Home-based | $46 | $549 |

| Hospitality | $65 | $783 |

| HVAC | $245 | $2,945 |

| Janitorial | $137 | $1,646 |

| Jewelry | $40 | $484 |

| Junk Removal | $163 | $1,950 |

| Lawn/Landscaping | $120 | $1,443 |

| Lawyers | $23 | $274 |

| Manufacturing | $64 | $767 |

| Marine | $28 | $336 |

| Massage | $96 | $1,150 |

| Mortgage Broker | $23 | $275 |

| Moving | $124 | $1,489 |

| Nonprofit | $36 | $431 |

| Painting | $144 | $1,726 |

| Party Rental | $80 | $954 |

| Personal Training | $24 | $287 |

| Pest Control | $32 | $387 |

| Pet | $56 | $673 |

| Pharmacy | $62 | $742 |

| Photography | $24 | $290 |

| Physical Therapy | $110 | $1,323 |

| Plumbing | $362 | $4,340 |

| Pressure Washing | $916 | $10,989 |

| Real Estate | $53 | $638 |

| Restaurant | $145 | $1,741 |

| Retail | $65 | $785 |

| Roofing | $388 | $4,658 |

| Security | $139 | $1,670 |

| Snack Bars | $117 | $1,409 |

| Software | $26 | $316 |

| Spa/Wellness | $107 | $1,281 |

| Speech Therapist | $31 | $375 |

| Startup | $29 | $344 |

| Tech/IT | $26 | $317 |

| Transportation | $38 | $452 |

| Travel | $21 | $251 |

| Tree Service | $130 | $1,558 |

| Trucking | $103 | $1,231 |

| Tutoring | $30 | $363 |

| Veterinary | $45 | $538 |

| Wedding Planning | $28 | $333 |

| Welding | $165 | $1,979 |

| Wholesale | $45 | $536 |

| Window Cleaning | $159 | $1,912 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Montana General Liability Insurance Costs?

Many important factors influence what Montana businesses pay for general liability insurance.

Montana's Environmental and Natural Disaster Risks

Montana ranks second in the nation for wildfire risk, with over half of homes facing direct threat. Insurance rates jumped 44.3% from 2019 to 2024, driven mainly by worsening wildfire conditions. Summer hailstorms and thunderstorms add to property damage and create injury risks for customers.

The state also ranks second for animal-vehicle collisions, raising liability exposure for businesses with commercial vehicles or outdoor customer areas. These environmental hazards increase both claim frequency and severity, driving up general liability costs for many businesses.

Montana's Geographic and Infrastructure Challenges

Montana's rural geography and remote business locations increase liability claim severity. Longer ambulance response times in rural areas (30 to 60 minutes or more) worsen injury outcomes, expanding medical costs that liability policies cover. Businesses outside major cities deal with elevated accident exposure on unpaved roads, mountain passes and agricultural routes.

Vast distances mean minor customer injuries can escalate into major claims due to delayed emergency care. Insurers price these geography-driven severity increases into premiums for mobile businesses and isolated locations.

Montana's Economic and Industry Composition

Montana's economy centers on higher-risk primary industries including agriculture (28,000 farms), construction, forestry, mining and tourism rather than lower-risk office work. Industries carry vastly different liability exposures: pressure washing businesses pay $916 monthly while drone companies pay $17.

Montana's strong economic growth (2% GDP increase in 2024) and low unemployment (1.5 points below national average) increase commercial activity and claim frequency. Higher GDP per capita ($51,458) correlates with larger jury awards, as juries base damages on regional economic capacity and income levels.

Montana's Legal and Healthcare Cost Environment

Social inflation has increased liability claims by 57% over the past decade, with personal injury filings surging 78% in 2024. Rising attorney representation and aggressive litigation tactics are pushing settlement costs higher for Montana businesses, even for straightforward claims.

About 70% of claimants receive compensation, and 95% of cases settle before trial, so most claims end in payouts. Montana's healthcare spending has grown faster than the state economy since the mid-1960s, increasing bodily injury claim costs. These dual inflationary pressures force insurers to raise premiums.

Montana's Legal and Regulatory Environment

Montana doesn't require most businesses to carry general liability insurance at the state level, but cities and counties set their own rules. Licensed contractors must maintain minimum limits of $100,000 per occurrence and $300,000 annual aggregate. Businesses operating across multiple counties often need pricier policies that meet the highest local requirements.

The Montana Legislature adopted House Joint Resolution 61 in 2025 to study rising insurance rates, creating regulatory uncertainty. Insurers factor potential future regulation into current pricing while managing different local requirements.

How Much General Liability Insurance Do I Need in Montana?

Montana doesn't mandate general liability insurance for most businesses at the state level. The Montana Board of Plumbers is the primary exception, requiring licensed plumbers to carry minimum coverage of $300,000 per occurrence for property damage.

State law imposes few requirements for commercial general liability insurance, but businesses still encounter coverage demands from other sources. Cities and counties can establish local insurance mandates. Landlords routinely require proof of coverage before signing leases, and clients often make insurance a contractual condition with limits from $100,000 to $1 million per occurrence.

Note: State insurance requirements in Montana change regularly. Always verify current requirements with the Montana Commissioner of Securities and Insurance or a licensed agent before purchasing coverage.

How to Choose the Best General Liability Insurance in Montana

Getting general liability insurance in Montana means weighing coverage needs against your budget while considering your industry's specific risks. Getting business insurance that protects your operations means evaluating policy limits, understanding coverage exclusions and comparing quotes from multiple Montana-licensed insurers.

- 1Assess Coverage Needs

Montana doesn’t require general liability insurance for most businesses, but cities like Billings, Missoula, and Great Falls may set their own rules. Montana State University asks contractors to carry $1 million per occurrence and $2 million aggregate limits, which aligns with common business insurance coverage standards in the state.

Licensed trades such as contractors must meet minimums of $100,000 per occurrence and $300,000 annual aggregate and many landlords or clients still ask for $1 million in coverage before signing agreements.

- 2Prepare Business Information

Montana insurers calculate premiums using your business classification code, annual revenue, employee count, and physical location within the state. Montana's industry composition, with agriculture, construction, forestry and tourism dominating the economy, means insurers price general liability based on industry-specific risks.

Have your Federal Employer Identification Number, Montana business registration from the Secretary of State and recent tax returns ready when requesting quotes to expedite the underwriting process.

- 3Compare Multiple Quotes

Request quotes from at least three insurers licensed by the Montana Commissioner of Securities and Insurance since business insurance costs vary widely between carriers. We found that Montana businesses pay between $17 and $916 monthly for general liability coverage depending on industry: drone businesses average $17 monthly while pressure washing companies pay $916. Compare whether defense costs count toward your policy limit or sit outside it, as this affects the cost of your coverage during claims.

- 4Evaluate Policy Details

Don't choose a policy based solely on price, as the cheapest coverage options often come with restrictive exclusions that leave Montana businesses exposed during claims. Read your policy's exclusions section carefully to understand what's not covered since standard general liability policies exclude professional errors, pollution liability and employee injuries.

Montana businesses deal with unique risks like wildfire liability and severe weather damage, which may require additional endorsements or separate policies to fill coverage gaps.

- 5Verify Insurer Credibility

Check insurer legitimacy through the Montana Commissioner of Securities and Insurance website, which maintains complaint records and licensing information. Review AM Best ratings to confirm financial stability of A- or better, ensuring carriers can pay large claims. File complaints through the Commissioner's office at 800-332-6148 if you experience claim delays, coverage disputes, or premium problems with any Montana insurer.

- 6Explore Available Discounts

Montana insurers offer discounts for bundling general liability with commercial property or auto insurance, saving 10% to 25% on combined premiums. Many carriers reduce rates for businesses with documented safety training programs, claims-free histories of three years or more, and annual payment plans rather than monthly installments.

Installing security systems, implementing workplace safety protocols or joining industry associations can also lower your general liability costs.

- 7Obtain Coverage Certificate

Request a certificate of insurance immediately after purchasing coverage since Montana landlords, contractors and clients often require these documents before work begins. Most insurers licensed in Montana provide digital certificates within 24 hours through online portals, though some may take 48 hours for first-time requests.

Keep your insurance agent's contact information accessible for urgent certificate needs when bidding new projects or signing lease agreements.

- 8Schedule Annual Reviews

Reassess your coverage each year before your policy renews, especially after hiring employees, expanding into new Montana counties, or increasing annual revenue beyond $500,000. Montana experienced a 44.3% insurance rate increase from 2019 to 2024, so compare quotes 60 to 90 days before renewal to find competitive rates.

Updating your policy limits prevents coverage gaps and avoids surprise audit adjustments that insurers charge when your actual business operations exceed what you originally reported.

Top General Liability Insurance in Montana: Bottom Line

Finding the right general liability insurance in Montana starts with understanding your specific coverage needs and comparing providers thoroughly. The Hartford, ERGO NEXT and Nationwide represent strong options in the market, but your ideal choice depends on your industry, business size and available budget. Compare quotes from multiple insurers and verify their credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.