Business owners seeking the best business insurance can find clear answers about Louisiana general liability coverage below. Our research team analyzed key factors to provide reliable insights for your insurance decisions:

Best General Liability Insurance in Louisiana

The Hartford leads Louisiana as the top and most affordable general liability insurer, with coverage starting at $96 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Louisiana: Fast Answers

Which company offers the best general liability insurance in Louisiana?

The Hartford ranks as the best general liability insurance company in Louisiana with a 4.56 overall score. It combines affordable coverage at $96 per month with strong claims handling. ERGO NEXT follows closely with a 4.55 rating, offering an excellent digital platform and responsive customer service for $120 per month.

Who offers the cheapest general liability insurance in Louisiana?

The cheapest general liability insurance companies in Louisiana are:

- The Hartford: $96 per month

- Simply Business: $111 per month

- Nationwide: $113 per month

- Progressive: $117 per month

- ERGO NEXT: $120 per month

Do Louisiana businesses legally need general liability insurance?

Louisiana doesn't legally mandate general liability insurance for most businesses statewide. However, certain licensed professionals like contractors and electricians must carry minimum coverage to maintain their licenses. Local municipalities may impose their own requirements. Even without legal mandates, most landlords and clients demand proof of coverage before signing contracts or leases.

How much does general liability insurance cost in Louisiana?

General liability insurance costs between $19 and $1,030 per month for small Louisiana businesses with two employees. Drone businesses often pay the lowest rates, while pressure washing companies pay the highest premiums. Your actual cost depends on your industry, business location, coverage limits and employee count.

Best General Liability Insurance Companies in Louisiana

The Hartford is our top choice for general liability insurance in Louisiana, offering an excellent balance of affordability and customer service for small businesses. ERGO NEXT also performs strongly with outstanding customer support, while Simply Business excels in coverage options. All three providers deliver reliable financial protection tailored to Louisiana business needs.

| The Hartford | 4.56 | $96 |

| ERGO NEXT | 4.55 | $120 |

| Simply Business | 4.48 | $111 |

| Coverdash | 4.37 | $120 |

| Thimble | 4.35 | $122 |

| biBERK | 4.32 | $130 |

| Progressive Commercial | 4.27 | $117 |

| Hiscox | 4.21 | $130 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Louisiana General Liability Insurer

Select your industry and state to get a customized Louisiana general liability insurance quote.

General liability insurance covers customer injuries and property damage for Louisiana businesses, but it won't protect against every risk your business may encounter. Smart business owners explore additional coverage options to fill these gaps:

Best Louisiana General Liability Insurance Reviews

Finding the right general liability insurance provider in Louisiana involves more than comparing prices. Coverage quality and customer service matter too. Our research reveals the top business insurers in the state.

Best Louisiana General Liability Insurer

Average Monthly General Liability Premium

$96These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Ranks first for claims process, handling claims quickly and efficiently

Ranks first for customer service with responsive, helpful support staff

Maintains A+ AM Best rating for superior financial stability

Over 200 years of industry experience and expertise

consRanks last in digital experience among surveyed providers

Requires agent interaction for most policy purchases versus online options

The Hartford ranks as Louisiana's top general liability provider, combining excellent customer service with strong financial stability backed by an A+ AM Best rating. Its customer-focused approach and efficient claims processing make it ideal for businesses prioritizing personalized support and reliable coverage.

The Hartford serves construction, professional services and retail businesses seeking comprehensive financial protection with responsive agent assistance.

Overall Score 4.56 1 Affordability Score 4.43 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 The Hartford offers general liability coverage in Louisiana at competitive rates averaging $96 monthly. The company provides especially favorable pricing for construction, electrical work and professional services, ranking as most affordable for 23 different industry categories including manufacturing, retail and hospitality businesses.

Data filtered by:AccountantsAccountants $19 2 Louisiana customers rate The Hartford highest for claims processing and customer service quality, with strong recommendations for policy management and renewal experiences. The company excels in providing personalized support through its agent network, though digital tools receive more modest feedback compared to competitors.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford provides general liability coverage with limits from $300,000 to $2 million per occurrence, offering aggregate limits up to twice that amount. Businesses can enhance financial protection through product liability coverage, broad form contractual liability or data breach coverage via a business owner's policy. These flexible options allow Louisiana companies to customize coverage based on specific industry needs.

Best Louisiana Commercial General Liability Customer Experience

Average Monthly General Liability Premium

$120These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first for digital experience with streamlined online tools

Most affordable rates among top general liability providers

Excellent policy management capabilities for easy account access

Strong A- AM Best financial stability rating

consNewer insurer with limited operating history compared to competitors

No local agents available; all interactions handled online

Customer service responsiveness lags behind top competitors

ERGO NEXT performs strongly in Louisiana for its exceptional customer service ranking and robust coverage options, backed by an A- AM Best rating. Its digital-first approach and comprehensive coverage make it suitable for tech-savvy business owners in professional services, retail and construction industries.

ERGO NEXT excels in policy management and digital experience, offering efficient solutions for Louisiana businesses that value streamlined insurance processes.

Overall Score 4.55 2 Affordability Score 4.26 5 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT offers general liability coverage at $120 per month in Louisiana, with competitive rates for dental practices, food trucks and tech companies. The provider shows strong affordability rankings across diverse industries, including automotive, computer programming and cleaning services, making it an economical choice for various business types.

Data filtered by:AccountantsAccountants $20 3 Louisiana customers consistently praise ERGO NEXT's digital experience and policy management capabilities. The provider earns top marks for customer satisfaction, with strong feedback on renewal processes and likelihood to recommend to others. While claims processing shows room for improvement, customers appreciate the overall service quality.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT provides flexible coverage limits up to $2 million per claim and $4 million aggregate for Louisiana businesses. The provider includes contractor E&O insurance and offers specialized endorsements like CG2010 for completed operations coverage. Businesses can customize their financial protection with various endorsements, making ERGO NEXT appealing for contract-based operations and construction companies.

Cheapest General Liability Insurance Companies in Louisiana

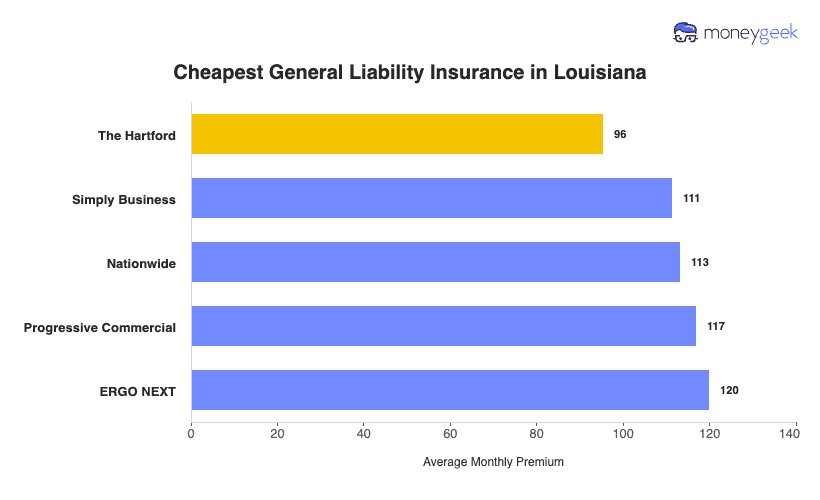

The Hartford offers the cheapest general liability insurance in Louisiana at $96 per month, saving businesses $22 or 18% compared to the state average. Simply Business and Nationwide also provide affordable coverage options.

| The Hartford | $96 | $1,146 |

| Simply Business | $111 | $1,338 |

| Nationwide | $113 | $1,358 |

| Progressive Commercial | $117 | $1,403 |

| ERGO NEXT | $120 | $1,441 |

| Coverdash | $120 | $1,445 |

| Thimble | $122 | $1,468 |

| biBERK | $130 | $1,557 |

| Hiscox | $130 | $1,559 |

| Chubb | $138 | $1,661 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Louisiana by Industry

MoneyGeek's research identifies the cheapest general liability insurance providers by industry across Louisiana.

- The Hartford ranks as the most affordable provider in 23 industries, dominating construction, manufacturing, trucking and electrical sectors.

- Simply Business offers the cheapest coverage in 14 industries, excelling with professional services like accountants, lawyers and consulting firms.

- biBerk leads affordability in 13 industries, performing strongest with contractors, engineering companies and hospitality businesses.

- Thimble tops 12 industries for cheap rates, specializing in tech companies, software developers and HVAC contractors.

- Coverdash rounds out the top five with wins in nine industries, including retail, restaurants and automotive businesses.

| Accountants | Simply Business | $17 | $201 |

Average Cost of General Liability Insurance in Louisiana

General liability insurance costs Louisiana small businesses an average of $117 per month. The average cost of general liability coverage changes based on your industry, business size, location and coverage limits.

Manufacturing companies pay higher premiums due to increased risk exposure, while accounting firms often pay less because of lower liability concerns. Sole proprietors usually pay lower rates compared to businesses with employees since they have fewer liability exposures.

Average Cost of General Liability Insurance in Louisiana by Industry

Louisiana businesses pay between $19 and $1,030 monthly for general liability coverage, depending on industry type. Drone operators often see the most affordable rates at $19 per month, while pressure washing companies pay the highest costs at $1,030 monthly. Review the table below for rates specific to your business type.

| Accountants | $25 | $302 |

| Ad Agency | $43 | $521 |

| Automotive | $60 | $724 |

| Auto Repair | $184 | $2,207 |

| Bakery | $104 | $1,247 |

| Barber | $54 | $648 |

| Beauty Salon | $78 | $939 |

| Bounce House | $79 | $947 |

| Candle | $62 | $740 |

| Cannabis | $75 | $903 |

| Catering | $108 | $1,301 |

| Cleaning | $151 | $1,814 |

| Coffee Shop | $105 | $1,256 |

| Computer Programming | $35 | $425 |

| Computer Repair | $51 | $606 |

| Construction | $217 | $2,602 |

| Consulting | $25 | $303 |

| Contractor | $285 | $3,421 |

| Courier | $218 | $2,620 |

| Daycare | $37 | $442 |

| Dental | $25 | $295 |

| DJ | $30 | $364 |

| Dog Grooming | $70 | $843 |

| Drone | $19 | $223 |

| Ecommerce | $84 | $1,002 |

| Electrical | $129 | $1,543 |

| Engineering | $48 | $577 |

| Excavation | $541 | $6,489 |

| Florist | $50 | $600 |

| Food | $120 | $1,442 |

| Food Truck | $137 | $1,640 |

| Funeral Home | $69 | $831 |

| Gardening | $127 | $1,519 |

| Handyman | $281 | $3,367 |

| Home-based | $27 | $320 |

| Home-based | $54 | $642 |

| Hospitality | $80 | $957 |

| HVAC | $282 | $3,381 |

| Janitorial | $160 | $1,917 |

| Jewelry | $51 | $607 |

| Junk Removal | $183 | $2,202 |

| Lawn/Landscaping | $146 | $1,752 |

| Lawyers | $26 | $314 |

| Manufacturing | $85 | $1,018 |

| Marine | $31 | $376 |

| Massage | $115 | $1,381 |

| Mortgage Broker | $26 | $315 |

| Moving | $145 | $1,744 |

| Nonprofit | $40 | $484 |

| Painting | $165 | $1,981 |

| Party Rental | $89 | $1,071 |

| Personal Training | $28 | $333 |

| Pest Control | $36 | $434 |

| Pet | $63 | $760 |

| Pharmacy | $72 | $867 |

| Photography | $28 | $340 |

| Physical Therapy | $151 | $1,809 |

| Plumbing | $416 | $4,990 |

| Pressure Washing | $1,030 | $12,359 |

| Real Estate | $51 | $609 |

| Restaurant | $172 | $2,069 |

| Retail | $79 | $951 |

| Roofing | $434 | $5,212 |

| Security | $154 | $1,844 |

| Snack Bars | $133 | $1,596 |

| Software | $32 | $380 |

| Spa/Wellness | $112 | $1,342 |

| Speech Therapist | $37 | $440 |

| Startup | $34 | $403 |

| Tech/IT | $32 | $380 |

| Transportation | $42 | $502 |

| Travel | $24 | $285 |

| Tree Service | $153 | $1,833 |

| Trucking | $113 | $1,360 |

| Tutoring | $36 | $434 |

| Veterinary | $49 | $590 |

| Wedding Planning | $33 | $402 |

| Welding | $187 | $2,241 |

| Wholesale | $51 | $608 |

| Window Cleaning | $184 | $2,214 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Louisiana General Liability Insurance Costs?

Several factors influence what Louisiana businesses pay for general liability insurance coverage.

Louisiana's Legal and Litigation Environment

Louisiana has one of the most challenging legal climates in the country for businesses. The state sees claim litigation rates nearly four times higher than the national average. About half of all accidents here lead to bodily injury claims, compared to only a quarter nationwide.

Insurers pay more in legal defense costs, settle claims more often, and receive larger jury awards in Louisiana courts. Until recently, the state's pure comparative negligence system allowed people to sue even when they were mostly at fault for their own injuries, which contributed to more lawsuits and higher premiums for small business owners.

Louisiana's Recent Tort Reform Legislation

Louisiana passed sweeping tort reforms in May 2025 that should eventually help your insurance costs. The state switched from pure comparative fault to modified comparative fault, meaning people who are mostly to blame for their injuries can't recover damages anymore. Lawmakers also eliminated the Housley Presumption, so injured parties now must prove your business actually caused their injuries rather than just assuming you did.

These changes cut down on weak lawsuits and give insurers stronger defenses against questionable claims. The catch? You won't see immediate rate drops. Insurers need one to three years of claims data under these new rules before adjusting premiums downward.

Louisiana's Hurricane and Severe Weather Risk

Your business sits in hurricane alley, where major storms hit every three years on average. These hurricanes do more than damage property. They create serious liability hazards for your customers, including shattered windows, scattered debris, wet floors, cracked walkways and weakened structures. When you reopen after a storm, your premises can remain hazardous for weeks or even months during repairs.

Louisiana shares the Gulf Coast with Florida and Texas, and together these three states account for two-thirds of all hurricane and flood losses nationwide. Insurers understand that businesses here encounter elevated slip-and-fall risks again and again and they price your general liability coverage with those conditions in mind.

Louisiana's Medical and Healthcare Costs

The state's already high number of bodily injury claims gets worse when you factor in medical costs. Every customer injury at your business triggers medical expenses: emergency room visits, ambulance rides, follow-up appointments, physical therapy and specialist care. These healthcare costs run higher in Louisiana than in many other states.

When someone slips and falls at your store or gets hurt on your job site, the medical bills your general liability insurance covers are steeper. Courts often use these medical expenses as the starting point for calculating pain and suffering damages, multiplying your total claim costs beyond just the initial hospital bills.

Louisiana's Geographic and Regional Factors

Your specific location within Louisiana plays a major role in what you pay. Businesses in New Orleans, Baton Rouge and other cities deal with constant foot traffic, higher crime rates and court systems that often favor plaintiffs. More customers walking through your door creates more chances for someone to trip, slip or get injured.

Different parishes have their own jury pools and litigation trends that insurers monitor closely. Coastal businesses encounter hurricane risks more often than inland ones. A small retail shop in rural Louisiana might pay hundreds less per year than an identical store in the French Quarter, even with the same coverage limits and safety practices.

Louisiana's Industry-Specific Risk Profiles

What your business does matters as much as where you operate. General liability costs in Louisiana swing wildly by industry, from $29 monthly for low-risk businesses to over $10,000 for high-risk operations. Construction companies work with heavy equipment, elevated platforms, and power tools that can injure bystanders or clients. Restaurants and retail stores interact with customers all day, creating constant opportunities for food-related illnesses or slip-and-falls on wet floors.

Contractors carry liability beyond the initial work, staying responsible if something they built or installed later causes injuries. Insurers pull Louisiana claims history for your specific industry classification code and price your policy based on how often businesses like yours file claims here.

How Much General Liability Insurance Do I Need in Louisiana?

Louisiana doesn't mandate general liability insurance for most businesses. However, certain licensed contractors must carry minimum coverage to operate legally. Commercial contractors have no statewide general liability requirement, although many clients still ask for proof of insurance before signing contracts. The amount of coverage you need depends on your industry, client agreements and business size.

Residential contractors working on single-family homes and small residential projects need at least $100,000 in general liability coverage to qualify for licensing. The Louisiana State Licensing Board for Contractors verifies you maintain continuous coverage during both initial application and annual renewal.

You'll need to prove $100,000 in coverage when applying for your home improvement contractor license. This requirement stays in effect throughout your license period, and you must submit updated certificates of insurance at renewal.

Mold remediation work carries lower minimum coverage requirements at $50,000. Submit your certificate of insurance to the licensing board when you apply and again each time you renew your contractor license.

Fire safety companies in Louisiana must carry at least $100,000 per incident and $300,000 aggregate commercial general liability coverage. This coverage is required as part of the state licensing process for fire protection system contractors.

Note: Louisiana insurance requirements update regularly. Check with the Louisiana Department of Insurance or a licensed agent to confirm current regulations before purchasing coverage.

How to Choose the Best General Liability Insurance in Louisiana

The ideal coverage means matching your policy limits to your actual business risks and budget. Getting business insurance in Louisiana starts with understanding your industry's exposure to customer injuries, property damage claims and contract requirements.

- 1Determine Coverage Needs

General liability insurance costs Louisiana small businesses an average of $117 per month, though rates range from $19 to $1,030 depending on your industry. The Louisiana State Licensing Board for Contractors sets specific minimums if you're a licensed contractor.

Review your client contracts and commercial lease to confirm what business insurance coverage your partners require, then consider your industry's actual risks when choosing limits.

- 2Prepare Business Information

Get quotes from at least three insurers licensed by the Louisiana Department of Insurance so you can compare business insurance costs accurately. You'll see rate differences of thousands of dollars per year between carriers offering the same coverage. Look at deductibles, how defense costs work and whether the policy covers products-completed operations, not just the monthly premium.

- 3Compare Multiple Quotes

Get quotes from at least three insurers licensed by the Louisiana Department of Insurance so you can compare business insurance costs accurately. You'll see rate differences of thousands of dollars per year between carriers offering the same coverage. Look at deductibles, how defense costs work and whether the policy covers products-completed operations, not just the monthly premium.

- 4Look Beyond Price

Finding affordable business insurance means reading the fine print on exclusions and coverage definitions. Standard Louisiana policies exclude flood damage, hurricane-related losses and pollution liability. Read the definitions section carefully to understand what counts as an "occurrence" and what "personal injury" actually means in your policy.

- 5Verify Insurer Credentials

Confirm your insurer is licensed through the Louisiana Department of Insurance at ldi.la.gov and check their AM Best financial strength rating. Look up complaint ratios to spot carriers with reputations for denying valid claims or slow payment. You want an A-rated insurer with solid financials backing your policy when a major claim hits.

- 6Ask About Discounts

Louisiana carriers offer discounts when you bundle policies, maintain a claims-free record, complete safety training or pay annually instead of monthly. Packaging general liability with commercial property in a business owner's policy cuts costs by 15% to 25%. Security systems, documented safety programs and proper employee training can also trim your premium.

- 7Obtain Certificate of Insurance

Your Louisiana clients, landlords and general contractors will ask for certificates of insurance before you start work. Many insurers email digital certificates within minutes through their online portals, though some take up to 48 hours. Save your agent's contact information where you can find it quickly when a client needs proof of coverage immediately.

- 8Review Coverage Annually

Check your general liability coverage each year, especially after you hire staff, expand to new parishes or see your revenue grow. Start comparing quotes 60 to 90 days before renewal to lock in better rates or adjust your limits based on how your business changed. Current coverage keeps you compliant with the Louisiana State Licensing Board and prevents surprise audit charges.

Top General Liability Insurance in Louisiana: Bottom Line

Finding the right general liability insurance in Louisiana starts with understanding your specific business needs and comparing providers thoroughly. The Hartford, ERGO NEXT and Simply Business represent strong options in the market, but your ideal choice depends on your industry, company size and budget. Compare multiple quotes and verify each insurer's credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Louisiana State Legislature. "House Bill 431: Modified Comparative Fault." Accessed February 7, 2026.

- National Oceanic and Atmospheric Administration. "Billion-Dollar Weather and Climate Disasters: Louisiana." Accessed February 7, 2026.

- National Weather Service Lake Charles. "Research Studies: Hurricane Frequency for Southwest Louisiana and Southeast Texas." Accessed February 7, 2026.