We researched Nevada general liability insurance extensively to help you find the best business insurance for your needs. These are answers to common questions business owners ask, backed by MoneyGeek’s analysis:

Best General Liability Insurance in Nevada

The Hartford leads Nevada general liability insurance, while ERGO NEXT offers the most affordable rates starting at $100 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Nevada: Fast Answers

Which company offers the best general liability insurance in Nevada?

The Hartford stands as the best general liability insurance company in Nevada with a 4.64 overall score out of 5. It provides reliable coverage and excellent service for $103 per month. ERGO NEXT ranks second with a strong digital platform and competitive rates at $100 per month, making it an affordable alternative.

Who offers the cheapest general liability insurance in Nevada?

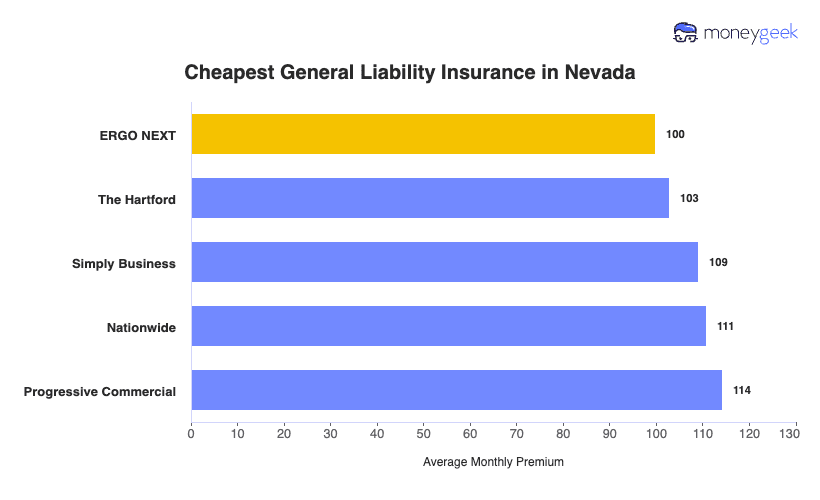

The cheapest general liability insurance companies in Nevada are:

- ERGO NEXT: $100 per month

- The Hartford: $103 per month

- Simply Business: $109 per month

- Nationwide: $111 per month

- Progressive: $114 per month

Do Nevada businesses legally need general liability insurance?

Nevada doesn't legally require most businesses to carry general liability insurance at the state level. However, certain licensed professionals like contractors and electricians may need specific coverage amounts to maintain their licenses. Local municipalities can also set their own insurance requirements. Even without legal mandates, most landlords and clients require proof of coverage before signing contracts or leases.

How much does general liability insurance cost in Nevada?

General liability insurance in Nevada costs between $19 and $1,038 per month for small businesses with two employees. The drone industry sees the lowest rates at $19 per month, while pressure washing businesses pay the highest at $1,038 per month. Your actual premium depends on your industry risk level, business location, coverage limits and company size.

What general liability coverage limits should Nevada businesses choose?

Most Nevada businesses choose $1 million per occurrence and $2 million aggregate limits for general liability coverage. These amounts protect against common risks like customer injuries or property damage. Per-occurrence policies provide better protection than claims-made policies because they cover incidents that happen during your policy period, regardless of when someone files the claim.

Best General Liability Insurance Companies in Nevada

The Hartford ranks first for general liability insurance in Nevada with competitive rates and strong financial stability. ERGO NEXT offers superior customer service and comprehensive coverage options, providing a solid alternative for small businesses. Nationwide maintains reliable stability and reasonable pricing compared to other Nevada providers.

| The Hartford | 4.64 | $103 |

| ERGO NEXT | 4.56 | $100 |

| Nationwide | 4.53 | $111 |

| Simply Business | 4.49 | $109 |

| Thimble | 4.40 | $122 |

| Coverdash | 4.38 | $118 |

| biBERK | 4.29 | $130 |

| Progressive Commercial | 4.28 | $114 |

| Chubb | 4.26 | $135 |

| Hiscox | 4.19 | $130 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Nevada General Liability Insurer

Select your industry and state to get a customized Nevada general liability insurance quote.

General liability insurance protects Nevada businesses from customer injuries and property damage claims, but it doesn’t cover every risk. Explore these additional financial protection options for complete coverage:

Best Nevada General Liability Insurance Reviews

Finding the best general liability insurance in Nevada requires looking beyond affordable rates to consider coverage quality and customer service. Our research reveals which business insurers deliver the most value for Nevada companies.

Best Nevada General Liability Insurer

Average Monthly General Liability Premium

$103These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Ranks first statewide with top overall customer satisfaction

Handles claims quickly and efficiently with excellent processing

Maintains A+ AM Best rating for financial strength

Provides exceptional customer service with responsive support

consWeakest digital experience among surveyed providers statewide

Requires agent interaction rather than convenient online-only purchasing

The Hartford leads Nevada's general liability market with exceptional customer service and strong financial stability, backed by an A+ AM Best rating. The company excels in claims processing and customer support, making it ideal for businesses prioritizing personalized service over digital platforms.

Construction contractors, professional services and retail businesses benefit from The Hartford's comprehensive coverage options and industry expertise.

Overall Score 4.64 1 Affordability Score 4.62 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 The Hartford offers general liability coverage in Nevada at $103 per month, ranking among the state's most cost-effective providers. The company shows competitive pricing for contractors, professional services and retail businesses, with strong affordability ratings across construction, consulting and food service industries.

Data filtered by:AccountantsAccountants $21 3 Customer feedback places The Hartford at the top for claims processing and customer service in Nevada. The provider excels in overall satisfaction and policyholder retention, though digital experience ratings suggest room for improvement. Business owners consistently praise the company's efficient claims resolution and knowledgeable support staff.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford provides general liability coverage with limits from $300,000 to $2 million per occurrence, offering aggregate limits up to twice that amount. Businesses can enhance financial protection with product liability coverage and broad form contractual liability options.

The company allows bundling with data breach protection through a business owner's policy, providing comprehensive coverage solutions for Nevada businesses.

Best Nevada Commercial General Liability Customer Experience

Average Monthly General Liability Premium

$100These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first in affordability with competitive commercial liability rates

Superior digital platform makes policy management simple and efficient

Strong A- AM Best rating demonstrates solid financial stability

Customers highly likely to recommend based on positive experiences

consNewer insurer with less established history than traditional competitors

No local agents available; all interactions handled online

Claims processing ranks lower among surveyed providers

ERGO NEXT leads Nevada's general liability market with superior customer service and comprehensive coverage options. With an A- rating from AM Best, ERGO NEXT offers reliable financial protection for consulting, tech and professional service businesses.

The company provides an exceptional digital experience and efficient policy management, making it ideal for Nevada business owners who value streamlined online operations.

Overall Score 4.56 2 Affordability Score 4.27 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT offers general liability coverage in Nevada for about $100 monthly, ranking among the most cost-effective providers statewide. The company shows particular strength in pricing for consulting, tech services and professional industries, with competitive rates also available for contractors and retail businesses.

Data filtered by:AccountantsAccountants $17 2 Nevada customers consistently praise ERGO NEXT's digital experience, policy management capabilities and overall satisfaction levels. Customer feedback highlights the company's efficient online platform and straightforward policy administration. While claims processing receives positive marks, some users note room for improvement in traditional customer service channels.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT provides general liability coverage with limits up to $2 million per claim and $4 million aggregate in Nevada. The company offers specialized features including contractor E&O insurance and endorsements for completed work protection through CG2010 coverage. These flexible policy options particularly benefit construction and contract-based businesses seeking comprehensive protection.

Cheapest General Liability Insurance Companies in Nevada

ERGO NEXT offers the most affordable general liability insurance in Nevada at $100 per month, saving businesses $16 or 14% compared to the state average. The Hartford and Simply Business also provide budget-friendly coverage options for Nevada companies.

| ERGO NEXT | $100 | $1,198 |

| The Hartford | $103 | $1,233 |

| Simply Business | $109 | $1,309 |

| Nationwide | $111 | $1,328 |

| Progressive Commercial | $114 | $1,372 |

| Coverdash | $118 | $1,414 |

| Thimble | $122 | $1,462 |

| Hiscox | $130 | $1,555 |

| biBERK | $130 | $1,556 |

| Chubb | $135 | $1,625 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Nevada by Industry

MoneyGeek's research identifies the cheapest general liability insurance providers across Nevada industries based on our comprehensive analysis.

- ERGO NEXT dominates affordability in 23 industries, covering diverse sectors from construction and manufacturing to tech and professional consulting services.

- Simply Business and Thimble each lead in 13 industries. Simply Business excels with professional services like accountants and lawyers, plus food-related businesses. Thimble specializes in creative and tech sectors including software companies and ad agencies.

- Nationwide and biBerk tie at eight industries each. Nationwide offers competitive rates for traditional businesses like auto repair and restaurants, while biBerk focuses on service trades including contractors and trucking companies.

- Coverdash rounds out the top five with seven industries, strong in retail and automotive sectors.

| Accountants | Simply Business | $16 | $197 |

Average Cost of General Liability Insurance in Nevada

Most small businesses in Nevada pay around $116 monthly for general liability insurance. The average cost of general liability coverage depends on your industry, business size, location and coverage limits.

Manufacturing companies pay higher premiums due to increased risk exposure, while accounting firms pay less because of lower claim potential. Sole proprietors usually see cheaper rates compared to businesses with multiple employees since they have fewer liability exposures.

Average Cost of General Liability Insurance in Nevada by Industry

Nevada businesses pay between $19 and $1,038 monthly for general liability coverage, with drone companies seeing the lowest rates and pressure washing businesses paying the highest costs. Review this table to find typical rates for your specific industry.

| Accountants | $25 | $301 |

| Ad Agency | $40 | $480 |

| Automotive | $61 | $732 |

| Auto Repair | $173 | $2,078 |

| Bakery | $102 | $1,225 |

| Barber | $51 | $608 |

| Beauty Salon | $76 | $914 |

| Bounce House | $80 | $959 |

| Candle | $63 | $753 |

| Cannabis | $76 | $917 |

| Catering | $100 | $1,200 |

| Cleaning | $151 | $1,812 |

| Coffee Shop | $101 | $1,216 |

| Computer Programming | $33 | $398 |

| Computer Repair | $54 | $652 |

| Construction | $197 | $2,369 |

| Consulting | $25 | $300 |

| Contractor | $290 | $3,474 |

| Courier | $223 | $2,672 |

| Daycare | $37 | $450 |

| Dental | $25 | $295 |

| DJ | $29 | $347 |

| Dog Grooming | $72 | $867 |

| Drone | $19 | $228 |

| Ecommerce | $83 | $1,002 |

| Electrical | $128 | $1,534 |

| Engineering | $45 | $541 |

| Excavation | $532 | $6,380 |

| Florist | $49 | $586 |

| Food | $121 | $1,456 |

| Food Truck | $162 | $1,947 |

| Funeral Home | $69 | $826 |

| Gardening | $128 | $1,541 |

| Handyman | $274 | $3,292 |

| Home-based | $27 | $329 |

| Home-based | $45 | $535 |

| Hospitality | $74 | $891 |

| HVAC | $279 | $3,343 |

| Janitorial | $156 | $1,875 |

| Jewelry | $46 | $551 |

| Junk Removal | $185 | $2,222 |

| Lawn/Landscaping | $135 | $1,624 |

| Lawyers | $26 | $312 |

| Manufacturing | $73 | $875 |

| Marine | $32 | $383 |

| Massage | $109 | $1,310 |

| Mortgage Broker | $26 | $313 |

| Moving | $141 | $1,697 |

| Nonprofit | $41 | $491 |

| Painting | $163 | $1,961 |

| Party Rental | $91 | $1,087 |

| Personal Training | $27 | $326 |

| Pest Control | $37 | $441 |

| Pet | $64 | $765 |

| Pharmacy | $70 | $845 |

| Photography | $28 | $331 |

| Physical Therapy | $126 | $1,510 |

| Plumbing | $409 | $4,903 |

| Pressure Washing | $1,038 | $12,454 |

| Real Estate | $61 | $732 |

| Restaurant | $164 | $1,972 |

| Retail | $75 | $895 |

| Roofing | $443 | $5,318 |

| Security | $159 | $1,903 |

| Snack Bars | $133 | $1,591 |

| Software | $30 | $360 |

| Spa/Wellness | $122 | $1,459 |

| Speech Therapist | $35 | $422 |

| Startup | $32 | $386 |

| Tech/IT | $30 | $361 |

| Transportation | $43 | $514 |

| Travel | $24 | $285 |

| Tree Service | $148 | $1,775 |

| Trucking | $117 | $1,403 |

| Tutoring | $35 | $415 |

| Veterinary | $51 | $611 |

| Wedding Planning | $32 | $380 |

| Welding | $188 | $2,255 |

| Wholesale | $51 | $608 |

| Window Cleaning | $179 | $2,147 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Nevada General Liability Insurance Costs?

Many important factors influence how much Nevada businesses pay for general liability insurance coverage.

Nevada's Urban Density and Tourism-Driven Economy

Nevada's 94% urban population concentration and 40.8 million annual visitors create massive premises liability exposure for businesses. Dense Las Vegas and Reno metros mean more customers on business premises daily, multiplying slip-and-fall and accident probability.

Tourism-dependent businesses deal with higher risk from customers who may not recognize potential hazards, and Nevada’s nightlife economy creates added liquor liability exposure. Crowd-dense casinos, hotels and entertainment venues experience higher accident rates, and urban construction projects risk damaging adjacent properties.

Nevada's Legal and Regulatory Environment

Las Vegas operates as one of the nation's most litigious markets, with insurance experts noting higher lawsuit frequency compared to other Nevada cities. Aggressive personal injury attorney marketing encourages litigation over direct settlements, increasing both claim frequency and legal defense costs.

Out-of-state visitors often hire attorneys viewing Nevada businesses as deep-pocketed targets, elevating settlement demands. The Nevada Division of Insurance approved rate increases of 5% to 25% across insurance lines in 2024, allowing insurers to pass rising litigation costs directly to businesses through higher premiums.

Nevada's Construction Industry Requirements and Licensing Mandates

Nevada law requires licensed contractors to carry general liability coverage ranging from $100,000 to $1,000,000 based on license classification, with electricians mandating $100,000 per occurrence and $300,000 aggregate minimums. The Nevada State Contractors Board ties insurance compliance directly to licensing, creating inelastic demand where contractors must purchase coverage at prevailing rates or lose their legal operating authority.

Construction's inherently high-risk classification, combined with required completed operations coverage, subcontractor liability exposure and industry growth, drives contractor premiums substantially higher than low-risk service businesses.

Nevada's Low Natural Disaster Exposure

Nevada experienced only three billion-dollar weather disasters from 1980 to 2024, fewer than coastal and tornado-prone states. This low catastrophic event frequency reduces disaster-triggered premises liability claims from damaged properties, unstable structures, and hazardous post-storm conditions.

Stable climate conditions allow businesses to operate in consistent, controlled environments where third-party risks are more manageable. Insurers can forecast claim costs more accurately without adding large disaster-contingency buffers to premiums. This favorable disaster profile prevents rates from escalating to levels seen in hurricane-prone and tornado-alley states.

How Much General Liability Insurance Do I Need in Nevada?

Nevada law does not mandate general liability insurance for most businesses. Licensed contractors must maintain workers' compensation coverage and surety bonds under Nevada Revised Statutes Chapter 624, but the state establishes no requirements for commercial general liability insurance for contractors or other professions.

Despite the lack of state mandates, general liability insurance remains essential for Nevada businesses. Clients, commercial property owners and lease agreements often require proof of coverage before awarding contracts or permitting business operations. We recommend securing at least $1 million per occurrence and $2 million aggregate coverage to meet standard contractual requirements in Nevada's business environment.

Note: State insurance rules change regularly. Check with the Nevada Division of Insurance or a licensed agent to confirm current requirements before purchasing coverage.

How to Choose the Best General Liability Insurance in Nevada

Choose general liability insurance in Nevada by evaluating your business's third-party liability exposure and budget constraints. Getting business insurance requires comparing coverage limits, premiums and policy exclusions across multiple insurers to find adequate protection for your specific operations.

- 1Determine Coverage Needs

Nevada doesn’t require general liability insurance at the state level, but many commercial leases and client contracts still expect businesses to have business insurance coverage in place before any work starts.

Most contractors choose $1 million to $2 million per occurrence to meet contract requirements and safeguard against third-party claims. Review your lease terms, client agreements and industry standards to decide the limits that fit your operations.

- 2Prepare Business Information

Nevada insurers calculate premiums based on annual revenue, payroll costs, square footage and industry classification code. Contractors working on construction projects pay different rates than office-based businesses because their risk profiles vary. Gather your EIN, Nevada state business license and workers' compensation documentation before requesting quotes.

- 3Compare Multiple Quotes

Request quotes from at least three Nevada-licensed carriers, as annual premiums vary by several hundred dollars between insurers. Compare whether defense costs count toward your policy limit or provide additional protection beyond the limit, and examine how business insurance costs fluctuate based on coverage limits and deductibles.

- 4Look Beyond Price

Reading policy exclusions matters more than finding affordable business insurance because coverage gaps can devastate your business financially. Most general liability policies exclude professional errors, pollution liability and employee injuries, requiring separate coverage through errors and omissions or workers' compensation. Nevada follows modified comparative negligence rules, affecting claim settlements.

- 5Verify Insurer Credibility

Confirm your insurer holds proper licensing through the Nevada Division of Insurance and maintains an AM Best rating of A- or higher. Check complaint ratios filed with state regulators and read customer reviews about claims handling. Nevada's insurance market includes national carriers and regional providers with local expertise.

- 6Ask About Discounts

Bundling general liability with commercial property insurance through a business owner's policy reduces costs by 15% to 25% in Nevada. Insurers reward businesses that maintain claims-free records, implement safety training programs and pay premiums annually rather than monthly. Membership in industry associations may qualify for additional group discounts.

- 7Obtain Insurance Certificate

Nevada landlords and contractors require certificates of insurance before executing lease agreements or allowing work to begin on job sites. Most insurers provide digital certificates immediately through online portals, while others deliver certificates within 24 to 48 hours. Keep your agent's contact information accessible for urgent certificate requests during contract negotiations.

- 8Review Coverage Annually

Reassess your general liability limits before each renewal period, especially after hiring employees, expanding into new service areas, or increasing annual revenue. Request competitive quotes 60 to 90 days before your policy expires to leverage better rates or enhanced coverage. Nevada's evolving business landscape requires current protection against emerging liability risks.

Top General Liability Insurance in Nevada: Bottom Line

Finding the right general liability insurance in Nevada starts with understanding your specific business needs and researching providers thoroughly. The Hartford, ERGO NEXT and Nationwide emerge as top options, but your ideal choice depends on your industry, business size and budget. Compare multiple quotes and verify each insurer's credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Las Vegas Convention and Visitors Authority. "Las Vegas Historical Visitation Statistics." Accessed February 7, 2026.

- NOAA National Centers for Environmental Information. "U.S. Billion-Dollar Weather and Climate Disasters, 1980-2024." Accessed February 7, 2026.

- The Nevada Independent. "Nevada Officials Rush Emergency Rule Change Amid 'Grave Concerns' With New Insurance Law." Accessed February 7, 2026.

- U.S. Census Bureau. "Nation's Urban and Rural Populations Shift Following 2020 Census." Accessed February 7, 2026.