We've compiled answers to common questions about general liability insurance in Washington and best business insurance options based on MoneyGeek's research and analysis:

Best General Liability Insurance in Washington

The Hartford leads Washington general liability insurance as both the top choice and the most affordable option at $93 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Washington: Fast Answers

Which company offers the best general liability insurance in Washington?

The Hartford ranks as the best general liability insurance company in Washington with an overall score of 4.64 out of 5. It provides affordable coverage at $93 per month and excellent claims handling. ERGO NEXT follows closely as the runner-up, offering strong digital tools and customer service for $117 per month.

Who offers the cheapest general liability insurance in Washington?

The cheapest general liability insurance companies in Washington offer affordable monthly rates:

- The Hartford: $93 per month

- Simply Business: $109 per month

- Nationwide: $110 per month

- Progressive: $114 per month

- ERGO NEXT: $117 per month

Do Washington businesses legally need general liability insurance?

Washington state doesn't legally mandate general liability insurance for most businesses. However, licensed contractors, electricians, and other trades often must carry minimum coverage to maintain their licenses. Local municipalities may impose additional requirements. Even without legal requirements, landlords and clients often ask for proof of coverage before signing contracts or leases.

How much does general liability insurance cost in Washington?

General liability insurance costs between $19 and $1,046 per month for small Washington businesses with two employees. Drone operators pay the lowest rates, while pressure washing companies see the highest premiums. Your actual cost depends on your industry, business location, coverage limits and company size.

Best General Liability Insurance Companies in Washington

The Hartford leads our rankings for general liability insurance in Washington, offering the most affordable rates with quality customer support. ERGO NEXT excels in customer service and provides strong coverage options for small businesses. Nationwide also delivers reliable service with excellent financial stability, making it another solid choice for Washington business owners.

| The Hartford | 4.64 | $93 |

| ERGO NEXT | 4.58 | $117 |

| Nationwide | 4.52 | $111 |

| Simply Business | 4.48 | $109 |

| Coverdash | 4.37 | $118 |

| Thimble | 4.35 | $122 |

| biBERK | 4.30 | $129 |

| Progressive Commercial | 4.27 | $114 |

| Chubb | 4.27 | $135 |

| Hiscox | 4.19 | $129 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Washington General Liability Insurer

Select your industry and state to get a customized Washington general liability insurance quote.

General liability insurance shields your Washington business from customer injury and property damage claims, but other risks require different coverage. Explore these additional financial protection options for your business:

Best Washington General Liability Insurance Reviews

Finding the right general liability insurance provider in Washington requires looking beyond affordable rates to consider coverage quality and customer service. Our research identifies the top business insurers based on comprehensive analysis.

The Hartford

Best Washington General Liability Insurer

Average Monthly General Liability Premium

$93These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Ranks first in the state for overall customer satisfaction

Handles claims quickly and efficiently with top-rated processing

Maintains A+ AM Best rating for exceptional financial stability

Provides outstanding customer service with highest satisfaction scores

consWeakest digital experience among major providers surveyed

Requires agent interaction for policy purchases versus online options

The Hartford leads Washington's general liability market through exceptional customer service, competitive pricing and strong financial stability backed by an A+ AM Best rating. The insurer excels in serving contractors, retail businesses and professional services with responsive claims handling and comprehensive coverage options.

Washington business owners who value personalized agent support and reliable claims resolution will find The Hartford's traditional service approach beneficial.

Overall Score 4.64 1 Affordability Score 4.62 1 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 The Hartford offers general liability coverage in Washington at $93 per month on average, ranking as the most affordable provider for many business types. The insurer shows competitive pricing for construction contractors, cleaning services and professional consultants, while also leading affordability rankings across retail and food service industries.

Data filtered by:AccountantsAccountants $19 2 The Hartford excels in customer satisfaction, earning top marks for claims processing efficiency and responsive service in Washington. Customer feedback consistently highlights the company's knowledgeable agents and fair claims settlements, though digital tools receive lower ratings compared to competitors.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford provides general liability coverage with limits from $300,000 to $2 million per occurrence and aggregate limits up to twice that amount. Businesses can enhance protection through product liability coverage, broad form contractual liability or data breach coverage bundled in a business owners policy.

This flexibility in coverage options makes The Hartford suitable for diverse Washington business needs.

ERGO NEXT

Best Washington Commercial General Liability: Runner-Up

Average Monthly General Liability Premium

$117These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Most competitive pricing among general liability insurance providers

Streamlined online platform makes policy management simple and efficient

Strong A- AM Best financial rating ensures reliable claim payments

Customers consistently recommend the insurer to other business owners

consNewer insurance company with less market experience than established competitors

No local agents available; all interactions happen through digital channels

Claims processing takes longer compared to top-performing insurers

ERGO NEXT excels in Washington’s general liability market with strong customer service and broad coverage options. Backed by an A- financial strength rating from AM Best, it’s a solid choice for tech companies, contractors and professional services that prefer a digital-first approach. The provider is a good fit for businesses that want simple online policy management and fast claims handling.

Overall Score 4.58 2 Affordability Score 4.32 5 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT offers general liability coverage in Washington at $117 per month on average, ranking highly affordable for many industries. The provider offers especially competitive rates for dental practices, food trucks, tech companies and home-based businesses, while maintaining strong pricing for contractors and professional services.

Data filtered by:AccountantsAccountants $20 3 Customer feedback shows ERGO NEXT excels in digital experience and policy management in Washington. The provider earns top marks for customer satisfaction, with businesses praising the easy online platform and renewal process. ERGO NEXT's streamlined digital tools make it ideal for tech-savvy business owners who prefer self-service options.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT provides general liability coverage with limits up to $2 million per occurrence and $4 million aggregate. The provider offers contractor E&O insurance and specialized endorsements like CG2010 for completed operations coverage. Businesses can customize protection through add-ons and bundled coverage options, though waiting periods may apply for certain industries.

Cheapest General Liability Insurance Companies in Washington

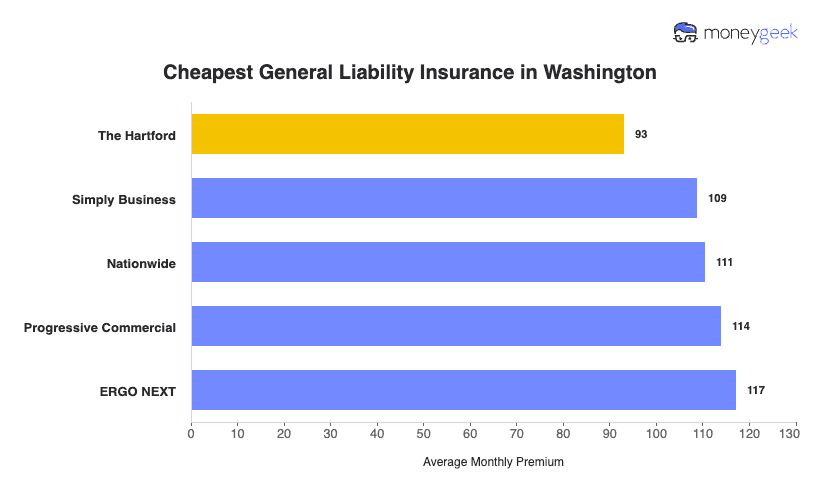

The Hartford provides the cheapest general liability insurance in Washington at $93 per month, saving businesses $24 or 20% compared to the state average. Simply Business and Nationwide also offer affordable coverage options.

| The Hartford | $93 | $1,119 |

| Simply Business | $109 | $1,307 |

| Nationwide | $111 | $1,326 |

| Progressive Commercial | $114 | $1,369 |

| ERGO NEXT | $117 | $1,407 |

| Coverdash | $118 | $1,411 |

| Thimble | $122 | $1,459 |

| Hiscox | $129 | $1,552 |

| biBERK | $129 | $1,553 |

| Chubb | $135 | $1,622 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Washington by Industry

MoneyGeek's research identifies the most affordable general liability insurance providers across Washington industries based on comprehensive rate analysis.

- The Hartford dominates with the cheapest rates in 17 industries. The company excels in service-based sectors like electrical work, trucking and pest control.

- Thimble offers the most affordable coverage in 13 industries and is especially strong for creative and technology businesses, including software companies and ad agencies.

- Nationwide ranks as the cheapest provider for 12 industries. The insurer performs best with traditional businesses like construction, manufacturing and restaurants.

- Simply Business leads affordability in 11 industries, focusing on professional service sectors such as accounting, legal practices and consulting firms.

- biBerk secures the lowest rates across 10 industries. The provider specializes in personal service trades including barber shops, beauty salons and contractor work.

| Accountants | Simply Business | $16 | $197 |

Average Cost of General Liability Insurance in Washington

General liability insurance costs Washington small businesses an average of $117 per month. The average cost of general liability coverage depends on your industry, business size, location and coverage limits.

Manufacturing companies often pay higher premiums due to greater liability risks, while accounting firms usually pay less because they have lower exposure to claims. Sole proprietors generally pay less than businesses with employees since they have fewer liability exposures.

Average Cost of General Liability Insurance in Washington by Industry

General liability insurance in Washington ranges from $19 monthly for drone businesses to $1,046 for pressure washing companies. This wide cost variation shows why general liability coverage rates depend heavily on your specific industry. Review this table to find typical costs for your business type.

| Accountants | $25 | $302 |

| Ad Agency | $40 | $485 |

| Automotive | $61 | $731 |

| Auto Repair | $174 | $2,083 |

| Bakery | $103 | $1,239 |

| Barber | $51 | $607 |

| Beauty Salon | $76 | $916 |

| Bounce House | $80 | $963 |

| Candle | $63 | $753 |

| Cannabis | $77 | $919 |

| Catering | $100 | $1,201 |

| Cleaning | $151 | $1,816 |

| Coffee Shop | $103 | $1,230 |

| Computer Programming | $33 | $398 |

| Computer Repair | $54 | $653 |

| Construction | $200 | $2,405 |

| Consulting | $25 | $301 |

| Contractor | $291 | $3,495 |

| Courier | $223 | $2,680 |

| Daycare | $38 | $451 |

| Dental | $25 | $295 |

| DJ | $29 | $347 |

| Dog Grooming | $73 | $870 |

| Drone | $19 | $228 |

| Ecommerce | $84 | $1,003 |

| Electrical | $128 | $1,541 |

| Engineering | $46 | $546 |

| Excavation | $532 | $6,385 |

| Florist | $49 | $587 |

| Food | $123 | $1,476 |

| Food Truck | $162 | $1,944 |

| Funeral Home | $69 | $828 |

| Gardening | $128 | $1,541 |

| Handyman | $279 | $3,348 |

| Home-based | $27 | $326 |

| Home-based | $52 | $628 |

| Hospitality | $74 | $894 |

| HVAC | $280 | $3,364 |

| Janitorial | $157 | $1,880 |

| Jewelry | $46 | $552 |

| Junk Removal | $186 | $2,228 |

| Lawn/Landscaping | $137 | $1,648 |

| Lawyers | $26 | $313 |

| Manufacturing | $73 | $875 |

| Marine | $32 | $384 |

| Massage | $109 | $1,314 |

| Mortgage Broker | $26 | $314 |

| Moving | $142 | $1,701 |

| Nonprofit | $41 | $492 |

| Painting | $164 | $1,972 |

| Party Rental | $91 | $1,090 |

| Personal Training | $27 | $327 |

| Pest Control | $37 | $442 |

| Pet | $64 | $769 |

| Pharmacy | $71 | $847 |

| Photography | $28 | $331 |

| Physical Therapy | $126 | $1,509 |

| Plumbing | $413 | $4,957 |

| Pressure Washing | $1,046 | $12,554 |

| Real Estate | $61 | $729 |

| Restaurant | $166 | $1,988 |

| Retail | $75 | $897 |

| Roofing | $443 | $5,320 |

| Security | $159 | $1,908 |

| Snack Bars | $134 | $1,610 |

| Software | $30 | $361 |

| Spa/Wellness | $122 | $1,463 |

| Speech Therapist | $36 | $428 |

| Startup | $33 | $392 |

| Tech/IT | $30 | $362 |

| Transportation | $43 | $516 |

| Travel | $24 | $286 |

| Tree Service | $148 | $1,780 |

| Trucking | $117 | $1,407 |

| Tutoring | $35 | $415 |

| Veterinary | $51 | $615 |

| Wedding Planning | $32 | $380 |

| Welding | $188 | $2,261 |

| Wholesale | $51 | $613 |

| Window Cleaning | $182 | $2,184 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Washington General Liability Insurance Costs?

Many factors determine what Washington businesses pay for general liability insurance.

Washington's Legal and Regulatory Environment

Washington’s pure comparative negligence system and the 1989 removal of damage caps allow unlimited jury awards. Juries in King County and Pierce County often issue six-figure verdicts, which pushes insurers to raise premiums to account for higher payout risks. The Insurance Fair Conduct Act adds extra penalties for bad-faith practices, so insurers are more likely to settle claims rather than challenge them, increasing overall claim costs.

Contractors must carry minimum limits of $200,000 and $50,000, but most clients require at least $1 million in coverage. Higher coverage limits lead to higher premiums because insurers charge more when they take on greater liability exposure.

Washington's Healthcare and Medical Costs

Washington’s healthcare costs rose 13% from 2016 to 2019, nearly double the inflation rate, and 2025 premiums climbed another 10.7%. Rising medical expenses push bodily injury payouts higher. When emergency room visits and surgeries cost more, insurers spend more on each slip and fall or accident, which leads to premium increases to cover those losses.

Medical malpractice settlements average $1.3 million, showing that Washington courts place a high value on injury cases. This approach carries over into general liability claims, prompting insurers to raise rates and maintain larger reserves for higher expected costs.

Washington's Geographic and Environmental Risks

Washington ranks second-highest for earthquake risk nationally. The Cascadia Subduction Zone and active fault lines near Puget Sound increase property damage liability and structural hazard claims. The 2001 Nisqually earthquake alone generated $315 million in insured losses. Frequent rainfall creates year-round slip-and-fall hazards, elevating premises liability frequency.

Washington Department of Ecology regulations require businesses near water or handling hazardous materials to purchase separate pollution liability endorsements, adding policy costs. Combined geographic and environmental factors force insurers to charge higher premiums, especially for Puget Sound businesses facing concentrated disaster exposure.

Washington's Urban vs. Rural Location Differences

King County (Seattle) and Pierce County (Tacoma) see the highest premiums in Washington because large jury pools often award higher verdicts, dense populations lead to more accidents per business, and urban medical costs drive up claim payouts. Lawsuits occur more often in major cities than in rural areas, raising legal expenses for insurers.

Heavy foot traffic also creates more chances for accidents. For example, Seattle restaurants report more slip and fall incidents than shops in rural communities. These urban conditions lead insurers to charge 30% to 50% more in King and Pierce counties compared with rural parts of the state because their loss histories are far different.

Washington's Economic and Industry Profile

Washington's technology sector dominates 22% of the state economy (the highest nationally) creating high-income workers whose injury claims include substantial lost wages, increasing average costs and pushing premiums higher. Strong construction activity gives clients leverage to demand $1 million coverage, five times state minimums, directly raising contractor premiums since higher limits cost more.

Elevated Seattle property values amplify damage claims when business operations harm expensive vehicles or commercial property. Fortune 500 concentration creates aggressive litigation, with attorneys targeting businesses expecting substantial insurance coverage. Higher settlement demands force insurers to increase rates, covering Washington's elevated claim environment.

How Much General Liability Insurance Do I Need in Washington?

Washington sets mandatory commercial general liability requirements based on your industry. Contractors need coverage to register with the state, while cannabis businesses have the highest minimums because of strict regulatory oversight.

These limits are only the legal baseline, and many businesses carry higher coverage to protect themselves from claims that can go beyond state minimums.

- $50,000 for property damage

- $100,000 per individual

- $200,000 for incidents involving multiple people This includes electricians, plumbers, roofers, painters, HVAC installers, and dozens of other licensed trades.

RCW 18.27.050 mandates $50,000 property damage coverage, $100,000 per person for injuries or death, and $200,000 when multiple people are injured. Registration suspends automatically if your policy lapses or gets canceled.

RCW 18.27.050 applies identical coverage requirements to specialty contractors:

WAC 314-55-082 sets cannabis licensee requirements at $1 million minimum, higher than contractor requirements. You must use an insurer rated A – Class VII or better and name the state as an additional insured with your business address on the policy.

Note: State insurance rules change often. Check with the Washington State Office of the Insurance Commissioner or talk to a licensed agent to confirm the latest requirements before buying coverage.

How to Choose the Best General Liability Insurance in Washington

Getting business insurance in Washington starts with understanding your industry's mandatory minimums, then adding coverage that matches your actual risk exposure. Small businesses often need $1 million in general liability coverage, though contractors and cannabis operations must meet higher state-mandated requirements.

- 1Determine Coverage Needs

Washington doesn’t require general liability insurance for most businesses, although municipalities can set their own rules and licensed contractors must meet specific coverage levels.

Small business coverage limits usually range from $500,000 to $2 million per occurrence. Your contracts, lease agreements and client expectations ultimately guide how much business insurance coverage you need.

- 2Prepare Business Information

Insurers calculate quotes using your annual revenue, employee count, location, and business classification code. Washington premiums vary based on industry risk, claims history, and coverage limits you select. Prepare your EIN, business registration, and state business license before requesting quotes.

- 3Compare Multiple Quotes

General liability insurance costs Washington small businesses an average of $117 per month, with rates ranging from $19 for drone businesses to $1,046 for pressure washing companies.

Request quotes from at least three Washington-licensed insurers, comparing premiums, deductibles, coverage limits and whether legal defense costs sit inside or outside policy limits. The cost of your coverage depends primarily on your industry risk level, with high-risk trades paying more than office-based businesses.

- 4Look Beyond Price

Cheap business insurance creates costly gaps when claims arise. Policy exclusions for professional errors, pollution and employee injuries require separate coverage. Washington courts award large judgments, so verify your limits cover both settlements and legal defense costs.

- 5Verify Insurer Credentials

The Washington Office of the Insurance Commissioner's lookup tool verifies insurer and agent licenses. Choose insurers rated A- or better by AM Best, which are strong ratings indicate financial stability to pay future claims. Review complaint ratios through the state commissioner to avoid companies with poor claims-handling records.

- 6Ask About Discounts

Bundling general liability with commercial property insurance saves Washington businesses 10% to 25% on premiums. Claims-free histories, annual payments, and safety certifications reduce costs further. OSHA compliance and employee training programs qualify for additional discounts at most insurers.

- 7Obtain Certificate of Insurance

Washington landlords, contractors, and clients require proof of insurance before doing business. Most insurers issue digital certificates instantly, though some take 24 to 48 hours. Keep your agent's contact information handy for urgent requests that could delay projects or contracts.

- 8Review Coverage Annually

Review coverage 60 to 90 days before renewal, especially after hiring employees, expanding services, or increasing revenue. Washington contractors risk automatic registration suspension if insurance lapses, so continuous coverage is mandatory. Annual quote shopping identifies better rates and ensures limits align with current operations.

Top General Liability Insurance in Washington: Bottom Line

Finding the right general liability insurance in Washington starts with understanding your specific business needs and budget. The Hartford, ERGO NEXT and Nationwide are leading providers in the state, but your best choice depends on your industry, company size and coverage requirements. Compare quotes from multiple insurers and verify their credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Justia US Law. "Sofie v. Fibreboard Corp., 771 P.2d 711 (Wash. 1989)." Accessed February 27, 2026.

- Office of the Insurance Commissioner Washington State. "Average 10.7% Rate Increase Approved for 2025 Individual Health Insurance Market." Accessed February 27, 2026.

- Office of the Insurance Commissioner Washington State. "Health Care Cost Affordability." Accessed February 27, 2026.

- Office of the Insurance Commissioner Washington State. "Medical Malpractice Annual Report 2024." Accessed February 27, 2026.

- Office of the Insurance Commissioner Washington State. "New Legislative Report on Affordability Reveals Current State of Washington's Health Care System." Accessed February 27, 2026.

- Office of Financial Management Washington State. "October 2024 Washington Monthly Economic Report." Accessed February 27, 2026.

- The Seattle Times. "Premiums for WA Health Insurance Will Go Up in 2025. Here's How Much." Accessed February 27, 2026.

- Washington State Legislature. "Chapter 4.22 RCW: Contributory Fault." Accessed February 27, 2026.