We researched the best business insurance options to answer your top questions about general liability insurance in Colorado based on our detailed analysis and research:

Best General Liability Insurance in Colorado

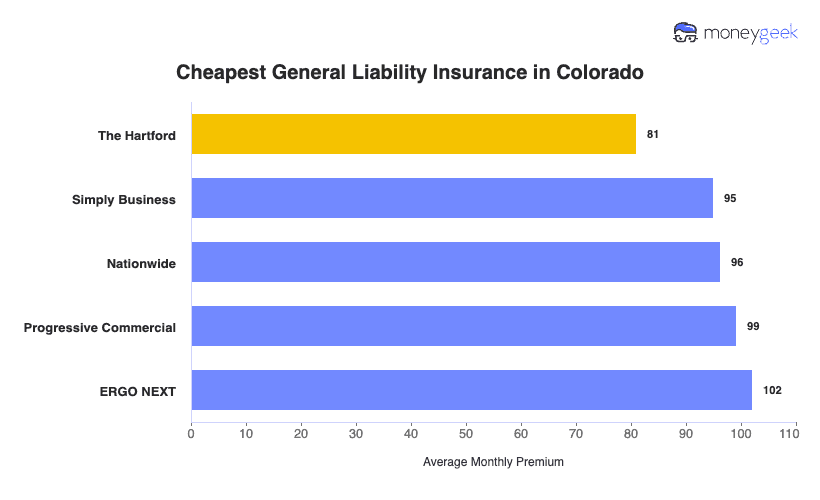

ERGO NEXT leads Colorado general liability insurance, while The Hartford offers the lowest rates starting at $81 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: January 29, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Colorado: Fast Answers

Which company offers the best general liability insurance in Colorado?

ERGO NEXT and The Hartford tie as the best general liability insurance company in Colorado, both earning 4.57 out of 5 overall scores. The Hartford offers the most affordable coverage at $81 per month with excellent claims handling. ERGO NEXT provides strong digital tools and customer service for $102 per month.

Who offers the cheapest general liability insurance in Colorado?

The cheapest general liability insurance companies in Colorado are:

- The Hartford: $81 per month

- Simply Business: $95 per month

- Nationwide: $96 per month

- Progressive: $99 per month

- ERGO NEXT: $102 per month

Do Colorado businesses legally need general liability insurance?

Colorado doesn't legally require most businesses to carry general liability insurance at the state level. However, specific licensed trades like contractors and electricians often must maintain minimum coverage amounts. Local municipalities may have their own requirements, and most landlords and clients demand proof of insurance before signing contracts.

How much does general liability insurance cost in Colorado?

General liability insurance costs between $17 and $912 per month for small Colorado businesses with two employees. Drone businesses usually see the lowest rates at $17 per month, while pressure washing companies land at the higher end at $912 per month. Your actual premium depends on your industry, business location, coverage limits and company size.

Best General Liability Insurance Companies in Colorado

ERGO NEXT and The Hartford lead our list of general liability providers in Colorado. ERGO NEXT delivers excellent customer service, while The Hartford offers strong affordability and financial stability. Nationwide is another solid choice with dependable customer service and competitive pricing for small businesses in the state.

| ERGO NEXT | 4.57 | $102 |

| The Hartford | 4.57 | $81 |

| Nationwide | 4.53 | $96 |

| Simply Business | 4.48 | $95 |

| Coverdash | 4.38 | $103 |

| Thimble | 4.35 | $106 |

| biBERK | 4.30 | $113 |

| Progressive Commercial | 4.27 | $99 |

| Chubb | 4.27 | $118 |

| Hiscox | 4.19 | $113 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Colorado General Liability Insurer

Select your industry and state to get a customized Colorado general liability insurance quote.

General liability insurance covers customer injuries and property damage for Colorado businesses, but it won’t protect against every risk your business may encounter. Explore these related guides for complete coverage:

Best Colorado General Liability Insurance Reviews

Finding the right general liability insurance provider in Colorado involves more than comparing prices. Our research reveals which business insurers offer the best combination of coverage and service.

Best Colorado General Liability Insurer

Average Monthly General Liability Premium

$102These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first in customer service among providers

Ranks second for coverage options and breadth

Instant certificates and digital policy management tools

Strong financial backing from Munich Re acquisition

consPremium costs higher than many competing providers

Newer company with limited long-term operating history

ERGO NEXT excels in Colorado with outstanding customer service and comprehensive coverage options. Backed by an A- AM Best rating, ERGO NEXT offers reliable protection particularly suited for contractors and tech companies seeking digital-first insurance solutions. Its combination of flexible coverage terms and strong policy management makes it ideal for businesses valuing streamlined operations.

Overall Score 4.57 1 Affordability Score 4.29 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT provides general liability coverage in Colorado for an average of $102 monthly ($1,226 annually), ranking sixth in affordability among studied providers. The insurer offers the most competitive rates for seven industries in the state, including dental practices, tech companies and photography businesses.

Data filtered by:AccountantsAccountants $17 3 Colorado customers consistently praise ERGO NEXT's digital experience, policy management capabilities and likelihood of renewal. Customer feedback highlights the company's efficient online platform and straightforward policy administration, though some businesses note room for improvement in claims processing.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT offers comprehensive general liability coverage for over 1,300 business types. It provides industry-specific coverage enhancements, such as product liability protection for retailers and liquor liability for restaurants.

While ERGO NEXT excludes coverage for independent contractors and business interruption, their policies can be bundled with other business insurance products for complete protection.

Best Colorado Commercial General Liability: Runner-Up

Average Monthly General Liability Premium

$96These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.3/5

- pros

Ranks first in financial stability ensuring reliable claim payments

Excellent customer service with responsive support representatives

Strong policy management systems for easy account handling

Decades of insurance experience and proven track record

consDigital experience ranks lower with limited online tools

Higher costs compared to more affordable competitors

Nationwide is a strong contender in Colorado’s general liability market thanks to its exceptional stability and customer service quality. With solid financial ratings and a second-place ranking for customer support, it delivers reliable coverage backed by responsive claims handling.

This provider works well for Colorado businesses that want personalized service and established financial strength, especially in industries like manufacturing, real estate and professional services.

Overall Score 4.53 2 Affordability Score 4.40 4 Customer Service Score 4.55 2 Coverage Score 4.61 4 Stability Score 4.98 1 Nationwide offers general liability coverage in Colorado at an average rate of $96 monthly. The provider shows competitive pricing across diverse sectors, with particularly strong affordability rankings in janitorial, manufacturing and real estate services. Professional service businesses like accounting and consulting firms also benefit from Nationwide's cost-effective coverage options.

Data filtered by:AccountantsAccountants $20 4 Colorado customers rate Nationwide highly for policy management, customer service and likelihood to recommend to others. The provider excels in claims handling and renewal processes, with customers consistently praising the straightforward policy management experience. Business owners particularly value the personalized support from agents during claims processing.

Overall Customer Score 4.16 6 Claims Process 3.90 5 Customer Service 4.30 3 Digital Experience 4.00 8 Overall Satisfaction 4.20 5 Policy Management 4.30 2 Recommend to Others 4.30 4 Renewal Likelihood 4.20 5 Nationwide provides general liability policies with customizable coverage limits ranging from $500,000 to $2 million per occurrence, with aggregate limits available up to $4 million. Businesses can enhance protection through optional endorsements like product liability coverage and professional liability add-ons. The provider offers flexibility in bundling coverage through business owner policies, making it adaptable for various Colorado industry needs.

Cheapest General Liability Insurance Companies in Colorado

The Hartford offers the cheapest general liability insurance in Colorado at $81 per month, saving businesses $21 or 20% compared to the state average. Simply Business and Nationwide also provide affordable coverage options.

| The Hartford | $81 | $973 |

| Simply Business | $95 | $1,139 |

| Nationwide | $96 | $1,154 |

| Progressive Commercial | $99 | $1,190 |

| ERGO NEXT | $102 | $1,226 |

| Coverdash | $103 | $1,230 |

| Thimble | $106 | $1,275 |

| Hiscox | $113 | $1,357 |

| biBERK | $113 | $1,358 |

| Chubb | $118 | $1,414 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Colorado by Industry

MoneyGeek's research identifies the five most affordable general liability insurance providers by industry in Colorado.

- The Hartford dominates affordability across 23 industries, leading in diverse sectors from construction and cleaning to food trucks and security services.

- Simply Business ranks as the cheapest option in 12 industries, excelling with professional service businesses like accountants, lawyers, consulting firms and software companies.

- Thimble wins 11 industries with strong performance in service-based sectors including barber shops, dog grooming, tutoring and wedding planning.

- biBerk also captures 11 industries, focusing primarily on contractor and trade businesses like catering, handyman services, trucking and veterinary practices.

- ERGO NEXT offers the most affordable coverage in seven industries, strong for dental practices, photography studios and tech companies.

>>Back to top

| Accountants | Simply Business | $14 | $171 |

Average Cost of General Liability Insurance in Colorado

Most small businesses in Colorado pay around $102 monthly for general liability insurance. The average cost of general liability insurance for you depends on your industry, business size, location and coverage limits.

Manufacturing companies often pay higher premiums due to increased risk exposure, while accounting firms usually pay less because they have lower liability concerns. Sole proprietors generally pay lower rates compared to businesses with multiple employees since they have fewer risk factors.

Average Cost of General Liability Insurance in Colorado by Industry

General liability insurance costs in Colorado vary widely by industry, ranging from $17 monthly for drone businesses to $912 for pressure washing companies. These rates show how your business type affects your general liability coverage costs. Review this table to find rates specific to your industry.

| Accountants | $22 | $264 |

| Ad Agency | $35 | $423 |

| Automotive | $53 | $637 |

| Auto Repair | $151 | $1,817 |

| Bakery | $90 | $1,080 |

| Barber | $44 | $530 |

| Beauty Salon | $67 | $799 |

| Bounce House | $70 | $840 |

| Candle | $55 | $656 |

| Cannabis | $67 | $801 |

| Catering | $87 | $1,048 |

| Cleaning | $132 | $1,584 |

| Coffee Shop | $89 | $1,073 |

| Computer Programming | $29 | $347 |

| Computer Repair | $47 | $570 |

| Construction | $175 | $2,097 |

| Consulting | $22 | $262 |

| Contractor | $254 | $3,047 |

| Courier | $195 | $2,337 |

| Daycare | $33 | $393 |

| Dental | $21 | $257 |

| DJ | $25 | $303 |

| Dog Grooming | $63 | $759 |

| Drone | $17 | $199 |

| Ecommerce | $73 | $875 |

| Electrical | $112 | $1,344 |

| Engineering | $40 | $477 |

| Excavation | $464 | $5,567 |

| Florist | $43 | $512 |

| Food | $107 | $1,287 |

| Food Truck | $141 | $1,695 |

| Funeral Home | $60 | $722 |

| Gardening | $112 | $1,343 |

| Handyman | $243 | $2,919 |

| Home-based | $24 | $284 |

| Home-based | $46 | $547 |

| Hospitality | $65 | $780 |

| HVAC | $244 | $2,933 |

| Janitorial | $137 | $1,640 |

| Jewelry | $40 | $482 |

| Junk Removal | $162 | $1,942 |

| Lawn/Landscaping | $120 | $1,437 |

| Lawyers | $23 | $273 |

| Manufacturing | $64 | $764 |

| Marine | $28 | $335 |

| Massage | $95 | $1,146 |

| Mortgage Broker | $23 | $274 |

| Moving | $124 | $1,483 |

| Nonprofit | $36 | $429 |

| Painting | $143 | $1,719 |

| Party Rental | $79 | $950 |

| Personal Training | $24 | $286 |

| Pest Control | $32 | $385 |

| Pet | $56 | $670 |

| Pharmacy | $62 | $739 |

| Photography | $24 | $289 |

| Physical Therapy | $110 | $1,318 |

| Plumbing | $360 | $4,322 |

| Pressure Washing | $912 | $10,945 |

| Real Estate | $53 | $636 |

| Restaurant | $144 | $1,734 |

| Retail | $65 | $782 |

| Roofing | $387 | $4,639 |

| Security | $139 | $1,663 |

| Snack Bars | $117 | $1,404 |

| Software | $26 | $315 |

| Spa/Wellness | $106 | $1,276 |

| Speech Therapist | $31 | $373 |

| Startup | $29 | $342 |

| Tech/IT | $26 | $316 |

| Transportation | $37 | $450 |

| Travel | $21 | $249 |

| Tree Service | $129 | $1,552 |

| Trucking | $102 | $1,227 |

| Tutoring | $30 | $362 |

| Veterinary | $45 | $536 |

| Wedding Planning | $28 | $331 |

| Welding | $164 | $1,972 |

| Wholesale | $45 | $534 |

| Window Cleaning | $159 | $1,904 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Colorado General Liability Insurance Costs?

A few important factors affect how much Colorado businesses pay for general liability insurance coverage.

Colorado's Legal and Regulatory Environment

Colorado small businesses have operated under a different liability environment since January 1, 2025. House Bill 24-1472 increased non-economic damage caps from $250,000 to $1.5 million and wrongful death caps to $2.125 million, with biennial inflation adjustments starting in 2028. The American Tort Reform Association now labels Colorado a "Lawsuit Inferno" due to expanded liability protections for plaintiffs.

Attorney advertising and third-party litigation funding have intensified, pushing your business's potential claim costs higher. Claimants increasingly wait for larger settlements rather than accepting early offers, which drives up what insurers pay and what you'll spend on general liability coverage.

Colorado's Rising Medical and Healthcare Costs

Medical expenses directly affect what you pay for general liability insurance in Colorado because your policy covers treatment costs when customers get injured at your business. Hospital operating expenses climbed 7.4% in 2024, and labor costs jumped 16% as facilities compete for workers.

Colorado is projected to have a shortage of 54,000 healthcare workers by 2026, which adds pressure on wages and service costs. Medical inflation keeps accelerating even though general price increases have slowed. When a slip-and-fall or customer injury happens, your insurer pays these inflated medical bills, which translates to higher premiums for Colorado business owners.

Geographic Cost Variations Within Colorado

Your business location impacts your general liability rates across Colorado. Front Range metro areas like Denver, Aurora and Colorado Springs see higher premiums than Western Slope communities. You'll pay more in urban areas because of increased foot traffic, more frequent customer injury claims and higher local medical costs.

Metropolitan juries also tend to award larger settlements than rural communities for similar incidents. Population density matters because a retail shop in downtown Denver simply encounters more potential liability situations daily than a comparable business in Grand Junction, and insurers price your coverage accordingly.

How Much General Liability Insurance Do I Need in Colorado?

Colorado doesn't require most businesses to carry general liability insurance at the state level. However, local cities and counties throughout Colorado set their own commercial general liability requirements for licensed contractors. Licensed electricians must register as electrical contractors with the Colorado Division of Professions and Occupations and comply with workers' compensation laws, but general liability insurance amounts are determined locally.

Insurance requirements vary across Colorado jurisdictions:

Contractors with Class A licenses need $500,000 per occurrence and $1 million aggregate coverage. Class B and C license holders need $300,000 combined single limit coverage.

Class A, B and C general contractors must carry $1 million combined single limit coverage. Contractors with single trade, roofing or mechanical licenses need $300,000 combined single limit coverage.

General contractors need $1 million per occurrence, $2 million general aggregate and $2 million products completed aggregate coverage.

Contractors must maintain $1 million per occurrence and $2 million aggregate coverage.

Beyond licensing requirements, most commercial clients and property owners require proof of general liability insurance before signing contracts or leases. We recommend Colorado businesses maintain at least $1 million per occurrence and $2 million aggregate coverage. This amount satisfies most local licensing requirements and contractual obligations across the state.

Note: State requirements change often. Check current rules with the Colorado Division of Insurance or talk to a licensed agent before buying coverage.

How to Choose the Best General Liability Insurance in Colorado

Getting business insurance in Colorado starts with matching coverage to your specific risks and budget. General liability covers customer injuries and property damage claims, but comprehensive financial protection requires combining multiple policies. Smart business owners evaluate their industry exposures, local requirements and contractual obligations before choosing coverage amounts.

- 1Assess Coverage Needs

Most Colorado businesses have no state-level mandate for general liability insurance, but your city or county may set specific minimums for contractors. Pikes Peak requires $500,000 per occurrence for Class A licenses, while Larimer County demands $1 million combined single limit coverage. Review your local jurisdiction’s rules and any contract obligations before choosing your business insurance coverage limits.

- 2Prepare Business Information

Pull together your EIN from the IRS, your entity ID number from the Colorado Secretary of State and your sales tax license from the Department of Revenue before requesting quotes. Insurers calculate your premium based on annual revenue, employee count, physical location and your specific business classification code. Having your business registration and local permits organized saves time and ensures accurate pricing.

- 3Compare Multiple Quotes

Get quotes from at least three insurers licensed through Colorado's Division of Insurance to find competitive rates for your business. Colorado business insurance costs can swing by several hundred dollars annually between carriers offering identical coverage, so examine deductibles, limits and how defense costs apply. Online comparison tools help you review multiple Colorado insurers quickly without multiple phone calls.

- 4Review Policy Details

Don't pick a policy solely based on affordable business insurance rates when evaluating your options. Read exclusions carefully and understand whether legal defense costs count toward or are separate from policy limits. Common exclusions like professional errors, pollution or employee injuries require separate policies, so understanding these gaps prevents coverage surprises later.

- 5Verify Insurer Credentials

Confirm your chosen insurer holds an active Colorado license through the Division of Insurance's online verification system and check their complaint ratio in annual Division reports. The best insurance for your business comes from financially stable carriers with AM Best ratings of A- or higher and complaint index scores under 1.0. Solid financial backing matters when you file large claims since shaky insurers tend to delay or dispute legitimate payouts.

- 6Explore Available Discounts

Bundle your general liability with commercial auto or property coverage to unlock discounts of 10% to 25% on your total Colorado premium. Carriers also cut rates for businesses maintaining clean claims histories over three years, completing safety training programs or paying annually instead of monthly. Adding security cameras or fire suppression systems demonstrates lower risk and often qualifies you for additional premium reductions.

- 7Obtain Certificate Documentation

Your Colorado clients, landlords and general contractors require proof of insurance before you start work on their property or sign any contracts. Most insurers now provide digital certificates instantly through online portals, though some Colorado carriers still need 24 to 48 hours for processing. Save your agent's contact details for urgent certificate requests that could otherwise stall project kickoffs.

- 8Schedule Annual Reviews

Review your coverage each year before renewal, especially if you’ve opened new Colorado locations, added employees or increased your revenue. Request fresh quotes 60 to 90 days before your policy expires since Colorado insurers regularly adjust rates based on your claims record and local market conditions.

This annual checkup helps catch compliance gaps with updated local requirements and avoids surprise audit charges.

Top General Liability Insurance in Colorado: Bottom Line

Finding the right general liability insurance in Colorado comes down to understanding your specific business needs and comparing providers thoroughly. ERGO NEXT, The Hartford and Nationwide represent strong options in the market, but your ideal choice depends on your industry, company size and budget constraints. Get quotes from multiple insurers and verify their credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- American Tort Reform Association. "Colorado Dubbed 'Lawsuit Inferno' as Litigation Risks Soar After 2025 Legislative Session." Accessed February 7, 2026.

- Colorado Department of Health Care Policy & Financing. "Colorado Department of Health Care Policy & Financing Releases Hospital Transparency Reports." Accessed February 7, 2026.

- Colorado Division of Insurance. "Congressional Inaction Leads to An Average Doubling of Health Insurance Costs for 225,000 Hardworking Coloradans." Accessed February 7, 2026.

- Colorado General Assembly. "HB24-1472 - Raise Damage Limit Tort Actions." Accessed February 7, 2026.

- The Denver Post. "Hospital systems in Colorado reported improved finances in 2024." Accessed February 7, 2026.