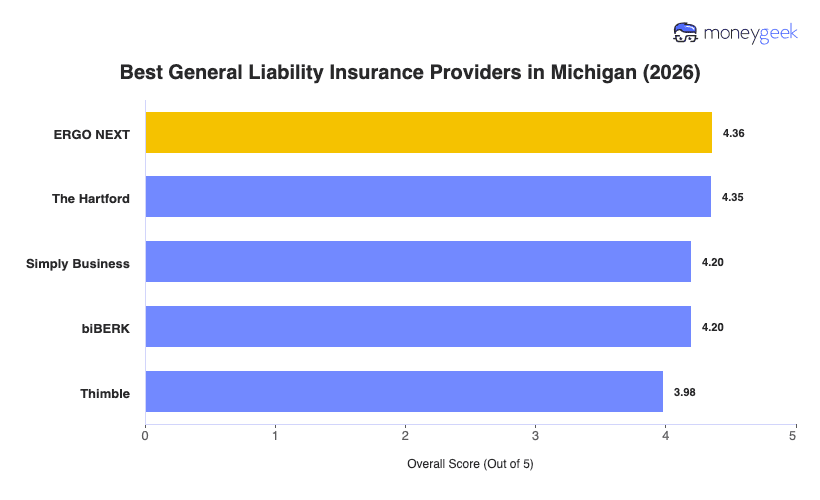

Michigan small businesses face different liability risks depending on what they do and where they operate, so a Kalamazoo manufacturer needs different protection than a Marquette retail shop. The following best general liability insurance companies rank highest statewide for balancing cost, service quality, and policy strength across different types of businesses.

- ERGO NEXT: Best Overall, Best for Solo Operators, Service and Hands-On Industries

- The Hartford: Best Cheap General Liability Insurance

- Simply Business: Best for Comparing Multiple Carriers

- biBERK: Best for Service Businesses

- Thimble: Best for On-Demand Coverage

These providers cover the liability risks Michigan businesses deal with, from customer injuries at a Dearborn retail shop to property damage during a winter ice storm. The profiles below explain what each insurer does well and which businesses get the most value from their coverage.