ERGO NEXT tops MoneyGeek's Florida professional liability insurance rankings with strong customer service ratings, comprehensive coverage options and an intuitive digital experience. The insurer ties with The Hartford as the cheapest professional indemnity option at $78 monthly, $6 below the state average. The Hartford ranks second overall despite matching ERGO NEXT's rates. Simply Business and Coverdash follow as top errors and omissions insurance providers in Florida for business owners seeking additional quote options.

Best Professional Liability Insurance in Florida

Get FL professional liability insurance quotes starting at $30 monthly from MoneyGeek's top companies like ERGO NEXT, The Hartford and Simply Business.

Get matched to the best professional liability insurance in FL for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

ERGO NEXT provides the best professional liability insurance in Florida, while The Hartford delivers the most affordable coverage starting at $78 monthly (Read More).

Professional liability insurance costs in Florida average $84 per month ($1,009 per year), placing the state below the national average (Read More).

Professional liability insurance protects Florida businesses from financial losses due to professional mistakes, negligence claims and missed contractual deadlines (Read More).

Florida doesn't mandate professional liability insurance for most businesses, though health care providers and certain licensed professionals are subject to specific coverage requirements (Read More).

Getting multiple small business insurance quotes from different Florida providers ensures you secure appropriate coverage limits at competitive rates (Read More).

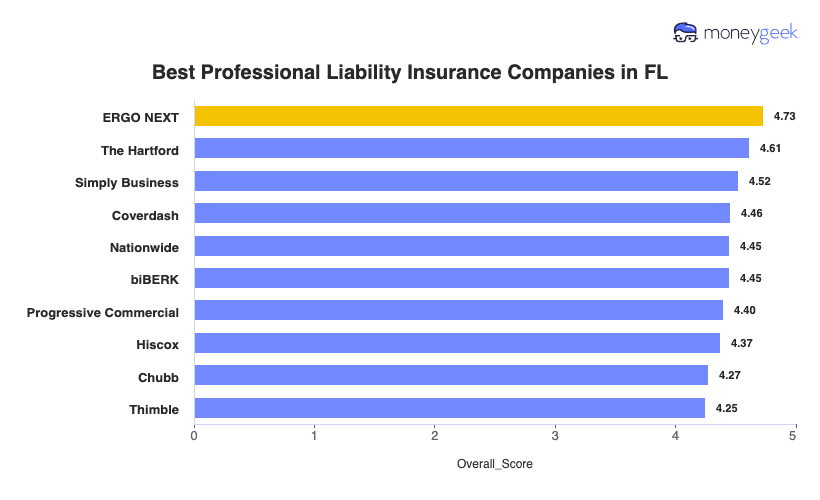

Best Professional Liability Insurance Companies in Florida

| ERGO NEXT | 4.73 | $78 |

| The Hartford | 4.61 | $78 |

| Simply Business | 4.52 | $83 |

| Coverdash | 4.46 | $84 |

| Nationwide | 4.45 | $89 |

| biBERK | 4.45 | $85 |

| Progressive Commercial | 4.40 | $81 |

| Hiscox | 4.37 | $83 |

| Chubb | 4.27 | $96 |

| Thimble | 4.25 | $83 |

How Did We Determine the Best Professional Liability Insurance in Florida?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

Beyond professional liability insurance in Florida, we've provided the following state-specific resources to get the best coverage for your business:

1. ERGO NEXT: Best Professional Liability Insurance in FL

Tops MoneyGeek's Florida professional liability rankings overall

Ranks first nationally for customer service and digital experience

Get coverage in 10 minutes with instant certificates of insurance

Backed by A+ Superior AM Best rating through Munich Re

Founded in 2016 with shorter track record than traditional insurers

Claims process ranks fourth nationally, indicating longer wait times

ERGO NEXT tops MoneyGeek's Florida professional liability insurance rankings with the highest customer service scores and a mobile app rated 4.9 out of 5 stars in Apple Store. Business owners in Miami, Tampa and Orlando can get E&O coverage in about 10 minutes with instant certificates of insurance. The insurer charges $78 monthly, $6 below the state average and tied for the cheapest rate among top Florida providers. An A+ Superior AM Best rating through Munich Re backs all policies.

2. The Hartford: Cheapest Professional Liability Insurance in FL

Lowest professional liability rates in Florida at $78 monthly

Ranks first nationally for claims process satisfaction

A+ Superior AM Best rating with over 200 years of experience

Specialized E&O coverage for tech, legal and medical professionals

Not available in Alaska or Hawaii

Digital experience ranks tenth nationally among competitors

The Hartford offers the cheapest professional liability insurance in Florida at $78 monthly, $6 below the state average. The insurer ranks first nationally for claims handling and overall customer satisfaction, making it a strong choice for Jacksonville consultants or Orlando tech firms that value fast reimbursements over app-based tools. Over 200 years of industry experience and an A+ Superior AM Best rating back every policy. Florida business owners who prefer working with agents will find The Hartford well-suited for their errors and omissions coverage needs.

3. Simply Business: Best Professional Liability Insurance Coverage Option in FL

Ranks first nationally for coverage options across 16+ carriers

Backed by Travelers' A++ Superior AM Best rating

Compare multiple E&O quotes in 10 minutes online

Broker model finds coverage for hard-to-insure Florida businesses

Claims process ranks eighth nationally, indicating slower resolution

Customer service ranks seventh with longer response times

Professional liability rates are higher than other providers

Simply Business leads MoneyGeek's rankings for professional liability coverage options by connecting Florida business owners with 16+ carrier partners through one application. This broker model helps Miami tech consultants, Orlando event planners and Jacksonville architects compare specialized E&O policies side-by-side rather than calling insurers individually. The approach works especially well for Florida's service-heavy economy, where niche professionals often struggle to find tailored coverage. Travelers' A++ Superior AM Best rating backs all policies at $83 monthly, just below the state average.

Average Cost of Professional Liability Insurance in Florida

Professional liability insurance costs in Florida vary by industry. Home-based businesses pay the most affordable rates at around $40 per month, while mortgage brokers pay the highest costs at approximately $178 per month. You can find specific rates for your industry using the filtering tool below.

| Accountants | $160 | $1,923 |

| Ad Agency | $106 | $1,266 |

| Auto Repair | $89 | $1,069 |

| Automotive | $83 | $990 |

| Bakery | $57 | $682 |

| Barber | $47 | $564 |

| Beauty Salon | $53 | $639 |

| Bounce House | $63 | $756 |

| Candle | $45 | $546 |

| Cannabis | $133 | $1,594 |

| Catering | $86 | $1,038 |

| Cleaning | $58 | $700 |

| Coffee Shop | $67 | $799 |

| Computer Programming | $115 | $1,375 |

| Computer Repair | $67 | $806 |

| Construction | $83 | $1,000 |

| Consulting | $114 | $1,368 |

| Contractor | $69 | $828 |

| Courier | $54 | $654 |

| DJ | $48 | $581 |

| Daycare | $117 | $1,404 |

| Dental | $91 | $1,086 |

| Dog Grooming | $60 | $723 |

| Drone | $115 | $1,375 |

| Ecommerce | $66 | $797 |

| Electrical | $70 | $837 |

| Engineering | $114 | $1,371 |

| Excavation | $75 | $904 |

| Florist | $41 | $492 |

| Food | $119 | $1,428 |

| Food Truck | $64 | $764 |

| Funeral Home | $88 | $1,057 |

| Gardening | $44 | $528 |

| HVAC | $87 | $1,048 |

| Handyman | $59 | $704 |

| Home-based business | $40 | $483 |

| Hospitality | $79 | $950 |

| Janitorial | $54 | $654 |

| Jewelry | $66 | $797 |

| Junk Removal | $73 | $876 |

| Lawn/Landscaping | $56 | $673 |

| Lawyers | $158 | $1,891 |

| Manufacturing | $65 | $776 |

| Marine | $94 | $1,124 |

| Massage | $116 | $1,396 |

| Mortgage Broker | $178 | $2,138 |

| Moving | $88 | $1,057 |

| Nonprofit | $55 | $658 |

| Painting | $70 | $841 |

| Party Rental | $60 | $719 |

| Personal Training | $76 | $916 |

| Pest Control | $104 | $1,253 |

| Pet | $50 | $594 |

| Pharmacy | $63 | $760 |

| Photography | $69 | $832 |

| Physical Therapy | $101 | $1,213 |

| Plumbing | $98 | $1,176 |

| Pressure Washing | $62 | $750 |

| Real Estate | $135 | $1,621 |

| Restaurant | $86 | $1,037 |

| Retail | $60 | $715 |

| Roofing | $105 | $1,260 |

| Security | $110 | $1,322 |

| Snack Bars | $52 | $624 |

| Software | $104 | $1,252 |

| Spa/Wellness | $118 | $1,417 |

| Speech Therapist | $106 | $1,272 |

| Startup | $78 | $936 |

| Tech/IT | $105 | $1,261 |

| Transportation | $103 | $1,240 |

| Travel | $103 | $1,241 |

| Tree Service | $82 | $989 |

| Trucking | $119 | $1,433 |

| Tutoring | $66 | $787 |

| Veterinary | $126 | $1,512 |

| Wedding Planning | $83 | $999 |

| Welding | $84 | $1,010 |

| Wholesale | $66 | $793 |

| Window Cleaning | $67 | $808 |

How Did We Determine These Florida Professional Liability Insurance Rates?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

What Does Florida Professional Liability Insurance Cover?

Florida professional liability insurance protects your business when clients claim you made mistakes or failed to deliver promised services. The coverage handles liability damages from these situations and pays for legal costs when you face lawsuits. This insurance goes by several different names:

- Errors and omissions insurance (E&O)

- Malpractice insurance (specialized type, typically in legal and medical fields)

- Professional indemnity insurance

How Much Professional Liability Insurance Do I Need in Florida?

Florida doesn't require professional liability insurance for most businesses, but contracts and clients often demand coverage. Standard limits of $1 million per occurrence and $2 million aggregate satisfy most contract requirements in the state. Health care providers are the exception: Florida Statute 458.320 mandates physicians carry minimum coverage of $100,000 per claim and $300,000 aggregate without hospital privileges, or $250,000 per claim and $750,000 aggregate with hospital staff privileges.

Who Needs Professional Liability Insurance in Florida?

Any Florida business providing professional services or advice to clients should consider professional liability insurance. The following industries carry negligence exposure and contract-based risks in the state.

Florida's technology sector ranks fifth nationally for job growth in professional and scientific services, driving demand for tech E&O insurance. Miami and Tampa tech consultants handling sensitive client data or software development risk costly claims if projects fail to meet specifications or cause financial losses.

Florida Statute 458.320 requires physicians to maintain malpractice coverage as a condition of licensure, with minimum limits of $100,000 per claim for non-hospital practitioners. The state's health care sector added 38,000 jobs in 2024 alone, making proper coverage essential for any medical professional treating Florida patients.

Florida ranked first nationally in real estate job growth, and agents handling property transactions risk claims for disclosure failures, contract errors or misrepresentation. While not mandated by state law, brokerages and clients often require errors and omissions insurance for real estate professionals before closing deals.

Florida's construction industry employs over 622,600 workers and contributes 6.5% of the state's GDP, creating liability exposure for builders. Contractors and engineers working on commercial or residential projects risk lawsuits for design errors, missed deadlines or work that fails to meet building code specifications.

Financial advisors and consultants in Florida's $208 billion professional services sector provide guidance that directly impacts client investments and business decisions. A single recommendation leading to financial losses can trigger expensive litigation, making E&O coverage critical for Miami wealth managers or Orlando business consultants.

Florida welcomed nearly 143 million tourists in 2024, creating unique liability exposure for event planners, tour operators and hospitality consultants across the state. A cancelled event, missed vendor contract or planning error in Orlando or Miami Beach can result in costly claims from disappointed clients.

How to Get the Best Professional Liability Insurance in Florida

Our step-by-step guide walks you through how to get business insurance in Florida that matches your professional liability needs and budget. These steps help you compare carriers, coverage options and costs specific to your industry.

- 1Assess your professional liability insurance coverage needs

Start by evaluating your business risks and any client or contract requirements you must meet. A Miami software developer working with enterprise clients needs different coverage limits than a Jacksonville freelance bookkeeper serving local small businesses.

- 2Work with a local agent

Find an agent who understands Florida's business landscape and knows how business insurance costs vary across industries and regions. Local agents can explain whether your Tampa consulting firm requires different coverage than similar businesses operating in South Florida's competitive market.

- 3Get quotes and compare coverage details

Request quotes from at least three insurers, comparing both affordable business insurance rates and policy terms like exclusions and deductibles. An Orlando IT consultant should examine coverage differences, not just premium costs, when evaluating $1 million liability policies from different carriers.

- 4Research the best providers

Look beyond price when researching professional liability insurers for your Florida business. Check AM Best ratings for financial stability, read customer reviews and verify the insurer has experience covering your specific industry.

- 5Consider bundling discounts

Many Florida insurers offer lower premiums when you combine professional liability with other types of business insurance coverage like general liability or a business owner's policy. A Fort Lauderdale marketing agency, for example, could save 10% to 15% by bundling E&O and general liability coverage with the same carrier.

- 6Don't let your coverage lapse

Professional liability policies cover claims filed only while your policy is active, even if the work occurred years earlier. A Tampa consultant switching carriers should ensure the new policy covers prior acts or purchase tail coverage (extended reporting coverage that protects against claims filed after a policy ends) from the previous insurer.

Get Florida Professional Liability Insurance Quotes

MoneyGeek matches Florida business owners with professional liability insurance providers who specialize in your industry. Use our tool below to find top-rated carriers and get quotes tailored to your coverage needs.

Get Matched to the Best FL Professional Liability Insurer for You

Select your industry and state to get a customized FL professional liability insurer match and get tailored quotes.

Florida Professional Liability: Bottom Line

Finding the right professional liability insurance in Florida means understanding your business risks and choosing a provider that fits your budget. ERGO NEXT earns our top rating, but your industry, client contracts and coverage needs should guide your final decision. Assess your requirements, then work with a local agent to compare options and secure coverage that financially protects your Florida business.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.