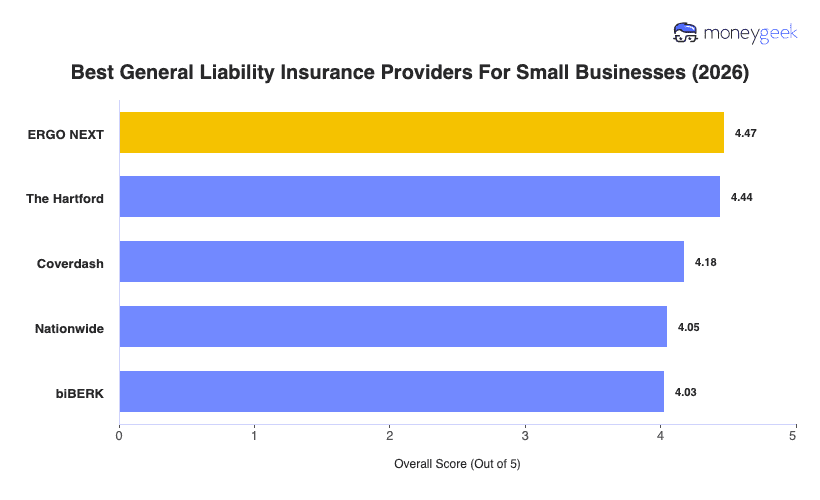

No single workers' comp insurer fits every small business, but the following five companies offer the strongest combination of pricing, service quality, and policy features across industries and business profiles.

- ERGO NEXT: Best overall, Best for hands-on industries

- The Hartford: Best for Professional Services

- Coverdash: Best for Personal Service and Fitness Businesses

- Nationwide: Best for Agricultural Businesses

- biBERK: Best for Recreation and Sports Businesses

These providers balance affordability, customer experience, and coverage options, making them reliable starting points for small businesses. The sections below explain why each insurer made the top five and where its strengths align with specific business needs.