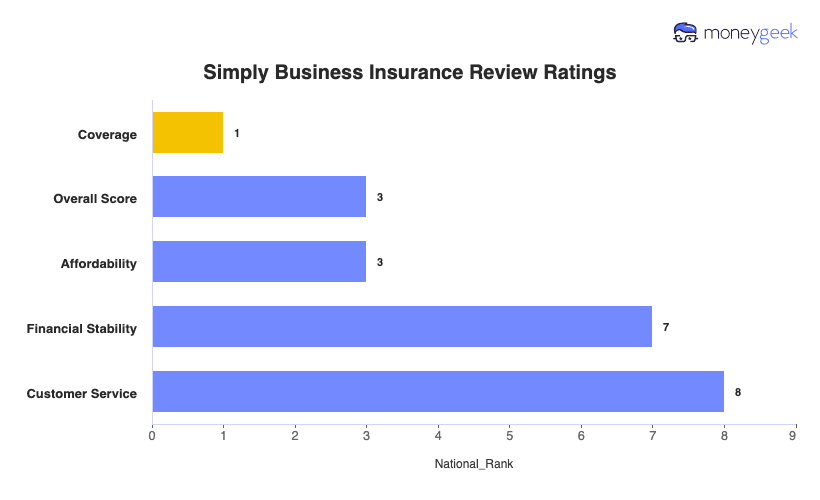

Simply Business achieves a MoneyGeek score of 4.50, securing third place among national providers in our analysis of 10 carriers across 79 industries. The company has exceptional coverage options and competitive pricing. However, customer service experiences and financial stability metrics suggest room for improvement compared to other providers in our review.

Simply Business Business Insurance Review

Simply Business ranks third in MoneyGeek's study with a score of 4.5 out of 5. It's excellent for affordability and service but offers limited coverage.

Discover if Simply Business is the best business insurer for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Small businesses pay $97 monthly ($1,162 annually) for Simply Business insurance, making it the third most affordable provider in our analysis.

Simply Business ranks eighth for customer experience, showing room for improvement in service quality and response times.

Simply Business leads the industry in coverage options, ranking first nationally with comprehensive policy choices for small businesses.

Simply Business Business Insurance Ratings

| Overall Score | 4.5 | 3 |

| Financial Stability | 4.84 | 7 |

| Customer Service | 4.15 | 8 |

| Coverage | 4.9 | 1 |

| Affordability | 4.45 | 3 |

How Did We Determine These Scores?

These scores are for small businesses with two employees across 79 major industries or business types and focus on four coverage types: general liability, professional liability or errors and omissions (E&O), workers' comp and business owner's policy. Read more on our methodology page.

Get Matched To The Best Business Insurer For You

Select your industry and state to get a customized company match.

To ensure you're making the right choice for your business, we've linked our reviews to Simply Business's competitors so you can compare:

Simply Business Business Insurance Ratings by Industry

Simply Business ranks first overall in 3 of 79 industries, including electrical contractors, spa and wellness, and startups. The company offers the most affordable coverage for several businesses, such as ad agencies, auto repair shops and wedding planners. Simply Business is among the top providers for customer service while leading in coverage and financial stability across industries.

| Accountants | 4.50 | 4 | 5 | 2 | 4 |

| Ad Agency | 4.50 | 4 | 5 | 2 | 3 |

| Automotive | 4.60 | 3 | 5 | 2 | 3 |

| Auto Repair | 4.50 | 4 | 5 | 2 | 3 |

| Bakery | 4.50 | 3 | 5 | 2 | 3 |

| Barber | 4.70 | 2 | 5 | 2 | 3 |

| Beauty Salon | 4.70 | 3 | 5 | 2 | 3 |

| Bounce House | 4.40 | 3 | 5 | 2 | 3 |

| Candle | 4.30 | 8 | 5 | 2 | 3 |

| Cannabis | 4.50 | 3 | 5 | 2 | 3 |

| Catering | 4.60 | 4 | 5 | 2 | 3 |

| Cleaning | 4.50 | 3 | 5 | 2 | 3 |

| Coffee Shop | 4.50 | 4 | 5 | 2 | 3 |

| Computer Programming | 4.50 | 4 | 5 | 2 | 3 |

| Computer Repair | 4.50 | 4 | 5 | 2 | 3 |

| Construction | 4.40 | 5 | 5 | 2 | 3 |

| Consulting | 4.70 | 2 | 5 | 2 | 3 |

| Contractor | 4.50 | 3 | 5 | 2 | 3 |

| Courier | 4.60 | 3 | 5 | 2 | 3 |

| Daycare | 4.50 | 4 | 5 | 2 | 3 |

| Dental | 4.40 | 4 | 5 | 2 | 3 |

| DJ | 4.70 | 2 | 5 | 2 | 3 |

| Dog Grooming | 4.30 | 6 | 5 | 2 | 3 |

| Drone | 4.50 | 4 | 5 | 2 | 3 |

| Ecommerce | 4.30 | 6 | 5 | 2 | 3 |

| Electrical | 4.70 | 2 | 5 | 2 | 3 |

| Engineering | 4.30 | 7 | 5 | 2 | 3 |

| Excavation | 4.30 | 8 | 5 | 2 | 3 |

| Florist | 4.60 | 3 | 5 | 2 | 3 |

| Food | 4.50 | 3 | 5 | 2 | 3 |

| Food Truck | 4.70 | 2 | 5 | 2 | 3 |

| Funeral Home | 4.50 | 3 | 5 | 2 | 3 |

| Gardening | 4.50 | 2 | 5 | 2 | 3 |

| Handyman | 4.60 | 3 | 5 | 2 | 3 |

| Home-based | 4.60 | 2 | 5 | 2 | 3 |

| Home-based business | 4.50 | 4 | 5 | 2 | 3 |

| Hospitality | 4.50 | 4 | 5 | 2 | 3 |

| HVAC | 4.40 | 3 | 5 | 2 | 3 |

| Janitorial | 4.50 | 2 | 5 | 2 | 3 |

| Jewelry | 4.70 | 2 | 5 | 2 | 3 |

| Junk Removal | 4.40 | 4 | 5 | 2 | 3 |

| Lawn/Landscaping | 4.60 | 2 | 5 | 2 | 3 |

| Lawyers | 4.50 | 4 | 5 | 2 | 3 |

| Manufacturing | 4.50 | 4 | 5 | 2 | 3 |

| Marine | 4.60 | 3 | 5 | 2 | 3 |

| Massage | 4.60 | 3 | 5 | 2 | 3 |

| Mortgage Broker | 4.50 | 3 | 5 | 2 | 3 |

| Moving | 4.50 | 3 | 5 | 2 | 3 |

| Nonprofit | 4.40 | 3 | 5 | 2 | 3 |

| Painting | 4.30 | 4 | 5 | 2 | 3 |

| Party Rental | 4.30 | 7 | 5 | 2 | 3 |

| Personal Training | 4.60 | 2 | 5 | 2 | 3 |

| Pest Control | 4.50 | 3 | 5 | 2 | 3 |

| Pet | 4.30 | 7 | 5 | 2 | 3 |

| Pharmacy | 4.50 | 4 | 5 | 2 | 3 |

| Photography | 4.60 | 2 | 5 | 2 | 3 |

| Physical Therapy | 4.50 | 4 | 5 | 2 | 3 |

| Plumbing | 4.70 | 2 | 5 | 2 | 3 |

| Pressure Washing | 4.50 | 3 | 5 | 2 | 3 |

| Real Estate | 4.60 | 4 | 5 | 2 | 3 |

| Restaurant | 4.40 | 4 | 5 | 2 | 3 |

| Retail | 4.40 | 5 | 5 | 2 | 3 |

| Roofing | 4.50 | 3 | 5 | 2 | 3 |

| Security | 4.30 | 7 | 5 | 2 | 3 |

| Snack Bars | 4.50 | 3 | 5 | 2 | 3 |

| Software | 4.60 | 2 | 5 | 2 | 3 |

| Spa/Wellness | 4.70 | 2 | 5 | 2 | 3 |

| Speech Therapist | 4.50 | 4 | 5 | 2 | 3 |

| Startup | 4.70 | 2 | 5 | 2 | 3 |

| Tech/IT | 4.50 | 4 | 5 | 2 | 3 |

| Transportation | 4.50 | 3 | 5 | 2 | 3 |

| Travel | 4.50 | 4 | 5 | 2 | 3 |

| Tree Service | 4.30 | 8 | 5 | 2 | 3 |

| Trucking | 4.50 | 3 | 5 | 2 | 3 |

| Tutoring | 4.50 | 3 | 5 | 2 | 3 |

| Veterinary | 4.40 | 5 | 5 | 2 | 3 |

| Wedding Planning | 4.60 | 2 | 5 | 2 | 3 |

| Welding | 4.40 | 5 | 5 | 2 | 3 |

| Wholesale | 4.40 | 6 | 5 | 2 | 3 |

| Window Cleaning | 4.50 | 3 | 5 | 2 | 3 |

How Did We Determine These Scores?

These scores are for small businesses with two employees across 79 major industries or business types and focus on four coverage types: general liability, professional liability (E&O), workers' comp and business owner's policy.

Simply Business Business Insurance Ratings by State

Simply Business operates nationwide, ranking second in 10 markets and third across remaining states. Rates stay competitive throughout its coverage areas.

| Alabama | 4.49 | 3 | 5 | 1 | 5 |

| Alaska | 4.49 | 2 | 3 | 1 | 3 |

| Arizona | 4.49 | 3 | 5 | 1 | 5 |

| Arkansas | 4.50 | 3 | 5 | 1 | 5 |

| California | 4.49 | 3 | 5 | 1 | 5 |

| Colorado | 4.49 | 3 | 5 | 1 | 5 |

| Connecticut | 4.50 | 3 | 5 | 1 | 5 |

| Delaware | 4.50 | 3 | 5 | 1 | 5 |

| Florida | 4.49 | 3 | 5 | 1 | 5 |

| Georgia | 4.48 | 3 | 5 | 1 | 5 |

| Hawaii | 4.48 | 2 | 4 | 1 | 3 |

| Idaho | 4.49 | 3 | 5 | 1 | 5 |

| Illinois | 4.50 | 2 | 5 | 1 | 5 |

| Indiana | 4.50 | 2 | 5 | 1 | 5 |

| Iowa | 4.51 | 3 | 5 | 1 | 5 |

| Kansas | 4.49 | 3 | 5 | 1 | 5 |

| Kentucky | 4.48 | 2 | 5 | 1 | 5 |

| Louisiana | 4.49 | 3 | 4 | 1 | 5 |

| Maine | 4.50 | 3 | 5 | 1 | 5 |

| Maryland | 4.50 | 2 | 5 | 1 | 5 |

| Massachusetts | 4.49 | 3 | 5 | 1 | 5 |

| Michigan | 4.48 | 3 | 5 | 1 | 5 |

| Minnesota | 4.49 | 3 | 5 | 1 | 5 |

| Mississippi | 4.50 | 3 | 5 | 1 | 5 |

| Missouri | 4.48 | 3 | 5 | 1 | 5 |

| Montana | 4.49 | 2 | 5 | 1 | 5 |

| Nebraska | 4.50 | 2 | 5 | 1 | 5 |

| Nevada | 4.50 | 2 | 5 | 1 | 5 |

| New Hampshire | 4.50 | 3 | 5 | 1 | 5 |

| New Jersey | 4.48 | 3 | 5 | 1 | 5 |

| New Mexico | 4.49 | 3 | 5 | 1 | 5 |

| New York | 4.50 | 3 | 5 | 1 | 5 |

| North Carolina | 4.50 | 3 | 5 | 1 | 5 |

| North Dakota | 4.50 | 3 | 5 | 1 | 5 |

| Ohio | 4.50 | 3 | 5 | 1 | 5 |

| Oklahoma | 4.49 | 3 | 5 | 1 | 5 |

| Oregon | 4.49 | 3 | 5 | 1 | 5 |

| Pennsylvania | 4.48 | 3 | 5 | 1 | 5 |

| Rhode Island | 4.49 | 3 | 5 | 1 | 5 |

| South Carolina | 4.50 | 3 | 5 | 1 | 5 |

| South Dakota | 4.49 | 3 | 5 | 1 | 5 |

| Tennessee | 4.48 | 3 | 5 | 1 | 5 |

| Texas | 4.50 | 3 | 5 | 1 | 5 |

| Utah | 4.49 | 3 | 5 | 1 | 5 |

| Vermont | 4.49 | 3 | 5 | 1 | 5 |

| Virginia | 4.48 | 3 | 5 | 1 | 5 |

| Washington | 4.49 | 3 | 5 | 1 | 5 |

| West Virginia | 4.48 | 3 | 5 | 1 | 5 |

| Wisconsin | 4.48 | 2 | 5 | 1 | 5 |

| Wyoming | 4.49 | 3 | 5 | 1 | 5 |

How Did We Determine These Scores?

These scores are for small businesses with two employees across 79 major industries or business types and focus on four coverage types: general liability, professional liability (E&O), workers' comp and business owner's policy.

How Much Does Simply Business Business Insurance Cost?

Simply Business offers business insurance at an average cost of $97 per month ($1,162 yearly). Your cost depends on your chosen coverage types. Monthly rates start at $71 for workers' compensation and go up to $143 for a business owner's policy.

| Business Owners Policies | $143 | $1,710 |

| General Liability | $95 | $1,139 |

| Professional Liability (E&O) | $76 | $917 |

| Workers Compensation | $71 | $856 |

How Did We Determine These Rates?

These rates are based on MoneyGeek's 2025 analysis of quotes for small businesses with two employees, $300,000 annual revenue and $150,000 payroll across four core coverage types.

How Much Does Simply Business Business Insurance Cost by Industry?

The average cost of business insurance through Simply Business varies from $22 monthly for DJs to $489 for pressure washing services. Businesses with more physical risks and potential property damage typically pay higher premiums than service-based operations with minimal equipment needs.

| Accountants | $51 | $610 |

| Ad Agency | $40 | $483 |

| Auto Repair | $150 | $1,804 |

| Automotive | $76 | $916 |

| Bakery | $80 | $954 |

| Barber | $31 | $376 |

| Beauty Salon | $46 | $551 |

| Bounce House | $68 | $816 |

| Candle | $81 | $967 |

| Cannabis | $92 | $1,103 |

| Catering | $73 | $870 |

| Cleaning | $93 | $1,114 |

| Coffee Shop | $80 | $955 |

| Computer Programming | $46 | $550 |

| Computer Repair | $51 | $609 |

| Construction | $168 | $2,010 |

| Consulting | $43 | $513 |

| Contractor | $201 | $2,408 |

| Courier | $178 | $2,134 |

| DJ | $22 | $263 |

| Daycare | $51 | $611 |

| Dental | $36 | $434 |

| Dog Grooming | $77 | $924 |

| Drone | $44 | $529 |

| Ecommerce | $82 | $978 |

| Electrical | $55 | $656 |

| Engineering | $65 | $783 |

| Excavation | $464 | $5,571 |

| Florist | $43 | $513 |

| Food | $91 | $1,094 |

| Food Truck | $74 | $888 |

| Funeral Home | $63 | $753 |

| Gardening | $72 | $868 |

| HVAC | $182 | $2,181 |

| Handyman | $169 | $2,026 |

| Home-based | $23 | $273 |

| Hospitality | $74 | $894 |

| Janitorial | $99 | $1,190 |

| Jewelry | $33 | $398 |

| Junk Removal | $154 | $1,844 |

| Lawn/Landscaping | $73 | $876 |

| Lawyers | $58 | $692 |

| Manufacturing | $45 | $536 |

| Marine | $74 | $884 |

| Massage | $81 | $967 |

| Mortgage Broker | $57 | $690 |

| Moving | $156 | $1,872 |

| Nonprofit | $43 | $516 |

| Painting | $152 | $1,829 |

| Party Rental | $83 | $993 |

| Personal Training | $36 | $433 |

| Pest Control | $60 | $723 |

| Pet | $67 | $802 |

| Pharmacy | $55 | $661 |

| Photography | $31 | $373 |

| Physical Therapy | $43 | $519 |

| Plumbing | $209 | $2,504 |

| Pressure Washing | $489 | $5,873 |

| Real Estate | $70 | $841 |

| Restaurant | $126 | $1,510 |

| Retail | $69 | $833 |

| Roofing | $447 | $5,370 |

| Security | $199 | $2,391 |

| Snack Bars | $93 | $1,118 |

| Software | $39 | $469 |

| Spa/Wellness | $44 | $532 |

| Speech Therapist | $39 | $466 |

| Startup | $30 | $362 |

| Tech/IT | $44 | $524 |

| Transportation | $101 | $1,214 |

| Travel | $39 | $465 |

| Tree Service | $232 | $2,780 |

| Trucking | $153 | $1,840 |

| Tutoring | $30 | $363 |

| Veterinary | $65 | $774 |

| Wedding Planning | $35 | $419 |

| Welding | $158 | $1,901 |

| Wholesale | $55 | $664 |

| Window Cleaning | $149 | $1,782 |

How Did We Determine These Rates?

These rates are based on MoneyGeek's 2025 analysis of quotes for small businesses with two employees, $300,000 annual revenue and $150,000 payroll across four core coverage types.

How Much Does Simply Business Business Insurance Cost by State?

State insurance regulations, natural disaster risks and legal environments create different insurance costs across the country. Simply Business offers cheapest business insurance rates in North Carolina at $83 per month, while business owners in Washington state pay $120 monthly.

| Alabama | $88 | $1,058 |

| Alaska | $89 | $1,063 |

| Arizona | $92 | $1,102 |

| Arkansas | $93 | $1,111 |

| California | $108 | $1,294 |

| Colorado | $96 | $1,154 |

| Connecticut | $105 | $1,262 |

| Delaware | $96 | $1,156 |

| Florida | $105 | $1,254 |

| Georgia | $98 | $1,178 |

| Hawaii | $102 | $1,218 |

| Idaho | $92 | $1,103 |

| Illinois | $106 | $1,272 |

| Indiana | $95 | $1,139 |

| Iowa | $92 | $1,100 |

| Kansas | $94 | $1,128 |

| Kentucky | $90 | $1,082 |

| Louisiana | $113 | $1,356 |

| Maine | $83 | $1,001 |

| Maryland | $92 | $1,108 |

| Massachusetts | $101 | $1,216 |

| Michigan | $92 | $1,099 |

| Minnesota | $91 | $1,088 |

| Mississippi | $97 | $1,170 |

| Missouri | $89 | $1,064 |

| Montana | $97 | $1,163 |

| Nebraska | $91 | $1,094 |

| Nevada | $110 | $1,322 |

| New Hampshire | $96 | $1,155 |

| New Jersey | $110 | $1,320 |

| New Mexico | $97 | $1,166 |

| New York | $112 | $1,349 |

| North Carolina | $83 | $994 |

| North Dakota | $90 | $1,083 |

| Ohio | $97 | $1,170 |

| Oklahoma | $84 | $1,011 |

| Oregon | $90 | $1,080 |

| Pennsylvania | $112 | $1,348 |

| Rhode Island | $107 | $1,279 |

| South Carolina | $99 | $1,190 |

| South Dakota | $90 | $1,084 |

| Tennessee | $94 | $1,133 |

| Texas | $98 | $1,176 |

| Utah | $93 | $1,110 |

| Vermont | $93 | $1,113 |

| Virginia | $88 | $1,054 |

| Washington | $120 | $1,435 |

| West Virginia | $101 | $1,215 |

| Wisconsin | $95 | $1,144 |

| Wyoming | $98 | $1,171 |

How Did We Determine These Rates?

These rates are based on MoneyGeek's 2025 analysis of quotes for small businesses with two employees, $300,000 annual revenue and $150,000 payroll across four core coverage types.

Simply Business Business Insurance Customer Experience Ratings

We analyzed over 1,100 customer reviews to evaluate Simply Business against other small business insurance providers. The company ranks seventh with a customer score of 4.14. Simply Business has a user-friendly digital platform and competitive pricing. Its claims processing and overall satisfaction could be better.

| Affordability | 4.40 | 3 |

| Claims Process | 3.70 | 8 |

| Customer Service | 4.00 | 6 |

| Digital Experience | 4.50 | 3 |

| Policy Management | 4.10 | 7 |

| Recommend to Others | 4.20 | 8 |

Simply Business Business Insurance Customer Reviews and Sentiment

Simply Business operates as an online insurance brokerage connecting small business owners to policies from multiple carriers. Customer feedback shows satisfaction with its quick quoting process but challenges during claims and policy servicing.

Official Website Reviews | Simply Business features customer ratings from partner review platforms on its site, averaging 4.7/5. Customers like the quick application process and help from agents. |

Better Business Bureau (U.S.) | BBB-accredited with an A+ rating. Positive reviews point to efficient setup and knowledgeable representatives but there are site miscommunications about coverage terms. |

Trustpilot | Holds a 4.8/5 TrustScore from over 1,500 reviews. It has a fast, straightforward quote process and ability to compare multiple providers. Customers mention confusion over being billed by different insurers and inconsistent follow-up after purchase. |

Reddit | Recent threads show customers appreciate Simply Business’s role in finding affordable coverage quickly. But, as a broker, it offers little direct involvement in claims. |

Simply Business is a strong choice for owners who want to compare multiple insurance quotes quickly and easily online. It is limited in claims handling and post-sale servicing, which are dependent on third-party carriers.

Simply Business Business Insurance Industry Ratings

Because Simply Business is a brokerage and not a carrier, it doesn't appear in J.D. Power’s insurance rankings or have its own NAIC complaint index. Instead, its performance is measured through the reputations of the insurers it partners with.

Simply Business doesn't directly handle claims. Policyholders’ experiences with claims depend on the insurers it represents, such as CNA, Travelers, Markel and Hiscox, many of which hold J.D. Power scores.

NAIC complaint indices apply to insurers, not brokers. Still, customers can expect regulatory oversight and complaint monitoring through each underwriter.

Simply Business is BBB-accredited with an A+ rating. There are still some individual customer complaints about miscommunication.

Simply Business Business Insurance Financial Strength Ratings

Simply Business doesn't carry its own financial strength rating, as it doesn't underwrite policies. Its partner carriers include top-rated insurers with strong AM Best ratings such as CNA, Travelers, Markel and Hiscox.

Simply Business Business Insurance Coverage Options and Add-ons

Partner carriers provide policies through Simply Business, customized for small business requirements. Your location and industry determine which coverage options you can access.

Core | Covers third-party bodily injury, property damage and advertising injury | |

Core | Protects service providers from negligence or error claims | |

Core | Bundles general liability and commercial property coverage | |

Core | Covers medical expenses and lost wages for injured employees | |

Core | Liability and physical damage coverage for business vehicles | |

Inland Marine | Specialized | Protects mobile property, tools and equipment |

Specialized | Covers data breaches, cyberattacks and related expenses | |

Employment Practices Liability | Specialized | Protects against wrongful termination, harassment or discrimination claims |

Disclaimer

Policy terms, coverage limits and deductibles change based on your business type. Call Simply Business directly for detailed information on deductibles and coverage specifics.

Coverage options, terms, and pricing are determined by the underwriting carrier. Claims must be filed directly with the insurer issuing the policy.

Simply Business Business Insurance: Bottom Line

Simply Business provides small business coverage at $97 monthly, offering competitive rates for most operations. Customers frequently praise its comprehensive coverage options and user-friendly digital tools. Business owners might experience longer wait times during the claims process compared to other insurers.

Simply Business Business Insurance: FAQ

Based on our analysis of Simply Business insurance offerings, we provide answers to common questions about business coverage options, insurance costs and what to expect as a customer.

How much can I expect to pay for Simply Business business insurance?

Simply Business insurance costs an average of $97 per month ($1,162 annually) for small businesses. Coverage costs range from $71 per month for workers' compensation to $143 per month for business owners policies.

How much does Simply Business business insurance cost by industry?

Business insurance costs range from $22 per month for DJs to $489 per month for pressure washing businesses. Service-based businesses with minimal physical contact pay lower premiums than those with property damage risks.

What industries does Simply Business rank best for?

Simply Business ranks first in 3 of 79 industries: electrical contractors, spa and wellness businesses, and startups. It offers competitive pricing in most sectors.

Which states offer the cheapest Simply Business business insurance rates?

North Carolina offers the lowest Simply Business rates at $83 per month, while Washington has higher rates at $120 per month. Simply Business is the second most affordable option in one state. Insurance costs vary by state due to regulations, disaster risks and local legal environments.

What are Simply Business's biggest weaknesses compared to competitors?

Simply Business ranks eighth for claims processing and policy management efficiency. Customer service scores are also in the lower tier.

How does Simply Business's customer service compare to other insurers?

Simply Business ranks sixth nationally for customer service (4.0) and eighth for claims processing (3.7).

What coverage types does Simply Business offer for small businesses?

Simply Business provides business owner's policies combining general liability, commercial property and business income coverage. Core offerings include professional liability, workers' compensation and commercial auto insurance. They also offer cyber liability, employment practices liability and commercial flood coverage.

Is Simply Business available in my state?

Simply Business provides insurance coverage in 48 states and Washington D.C., excluding Alaska and Hawaii. Some products like business owner's policies have state-specific restrictions. Coverage availability and options depend on your business type, location and risk profile.

How We Rated Simply Business Business Insurance

Our Research Approach

Small business owners juggle multiple responsibilities while searching for insurance that protects their operations without breaking their budgets. Comparing providers gets complicated when each insurer structures policies differently and targets specific industries.

MoneyGeek evaluated Simply Business against nine national carriers to show where it excels and where competitors deliver better value. Quote data from 79 industries covered four major policy types, using a standard profile: two employees, $300,000 annual revenue, $150,000 payroll.

Affordability (50%): Premium costs determine whether small businesses can maintain continuous coverage. Monthly expenses add up quickly when you're covering general liability, professional liability, workers' compensation and commercial property. Rate comparisons across all coverage types revealed Simply Business's pricing position against national competitors.

Customer experience (30%): Claims processing and customer support separate reliable insurers from problematic ones. J.D. Power ratings, state complaint indexes and customer reviews showed how Simply Business handles claims and resolves problems.

Coverage options (15%): Small businesses need flexibility to match policies with their specific risks. Product variety, customization features and specialty coverage availability determined which insurers accommodate diverse business needs.

Financial strength (5%): Strong financial backing ensures your claims get paid when losses occur. Financial ratings and stability reports confirmed Simply Business maintains the resources to handle claims reliably.

Why pricing weighs heaviest: Small business insurance premiums strain tight budgets. A $50 monthly difference costs $600 annually and $3,000 over five years. Affordable coverage lets you protect your business without sacrificing other critical expenses like marketing, inventory or employee wages.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.