Nationwide has a MoneyGeek score of 4.5 and ranks fourth among national providers in our analysis of 10 carriers across 79 industries. The company has strong financial stability and high-quality customer service, while offering competitive coverage options and standard pricing.

Nationwide Business Insurance Review

Nationwide ranks fourth in MoneyGeek's study with a score of 4.5 out of 5. It's excellent for affordability and service but offers limited coverage.

Discover if Nationwide is the best business insurance option for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Small businesses pay $102 monthly ($1,224 annually) for Nationwide business insurance. The company ranks sixth for affordability in our analysis.

Nationwide has good customer service quality, securing third place nationally. Their high ranking shows strong performance in claims handling and support.

In terms of coverage options, Nationwide ranks sixth nationally. This indicates fewer policy customization choices compared to top-performing competitors.

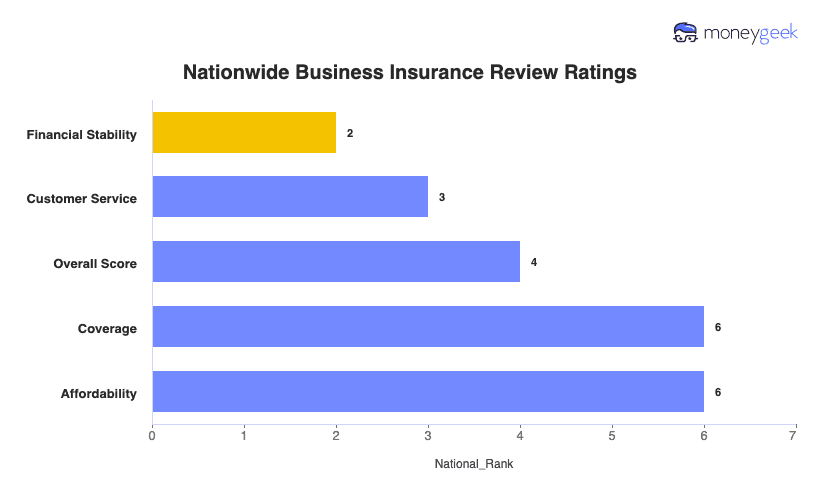

Nationwide Business Insurance Ratings

| Overall Score | 4.5 | 4 |

| Financial Stability | 5 | 2 |

| Customer Service | 4.55 | 3 |

| Coverage | 4.59 | 6 |

| Affordability | 4.34 | 6 |

How Did We Determine These Scores?

These scores are for small businesses with two employees across 79 major industries or business types and focus on four coverage types: general liability, professional liability or errors and omissions (E&O), workers' comp and business owner's policy.

Get Matched To The Best Business Insurer For You

Select your industry and state to get a customized match.

To ensure you're making the right choice for your business, we've linked our reviews to Nationwide's competitors so you can compare:

Nationwide Business Insurance Ratings by Industry

Nationwide ranks first overall in 7 of 79 industries, including auto repair, construction and hospitality. The company offers the most affordable rates for bakeries and auto repair businesses. Nationwide consistently ranks first for customer service, coverage and financial stability across all business types.

| Accountants | 4.40 | 6 | 2 | 4 | 1 |

| Ad Agency | 4.40 | 6 | 2 | 4 | 1 |

| Automotive | 4.50 | 5 | 2 | 4 | 1 |

| Auto Repair | 4.80 | 2 | 2 | 4 | 1 |

| Bakery | 4.60 | 3 | 2 | 4 | 1 |

| Barber | 4.70 | 3 | 2 | 4 | 1 |

| Beauty Salon | 4.70 | 3 | 2 | 4 | 1 |

| Bounce House | 4.30 | 6 | 2 | 4 | 1 |

| Candle | 4.50 | 6 | 2 | 4 | 1 |

| Cannabis | 4.30 | 6 | 2 | 4 | 1 |

| Catering | 4.60 | 3 | 2 | 4 | 1 |

| Cleaning | 4.50 | 4 | 2 | 4 | 1 |

| Coffee Shop | 4.70 | 3 | 2 | 4 | 1 |

| Computer Programming | 4.40 | 6 | 2 | 4 | 1 |

| Computer Repair | 4.30 | 6 | 2 | 4 | 1 |

| Construction | 4.60 | 3 | 2 | 4 | 1 |

| Consulting | 4.50 | 4 | 2 | 4 | 1 |

| Contractor | 4.30 | 6 | 2 | 4 | 1 |

| Courier | 4.40 | 6 | 2 | 4 | 1 |

| Daycare | 4.30 | 6 | 2 | 4 | 1 |

| Dental | 4.50 | 4 | 2 | 4 | 1 |

| DJ | 4.50 | 5 | 2 | 4 | 1 |

| Dog Grooming | 4.30 | 6 | 2 | 4 | 1 |

| Drone | 4.40 | 5 | 2 | 4 | 1 |

| Ecommerce | 4.40 | 5 | 2 | 4 | 1 |

| Electrical | 4.60 | 3 | 2 | 4 | 1 |

| Engineering | 4.50 | 5 | 2 | 4 | 1 |

| Excavation | 4.70 | 3 | 2 | 4 | 1 |

| Florist | 4.50 | 4 | 2 | 4 | 1 |

| Food | 4.40 | 7 | 2 | 4 | 1 |

| Food Truck | 4.30 | 7 | 2 | 4 | 1 |

| Funeral Home | 4.40 | 6 | 2 | 4 | 1 |

| Gardening | 4.50 | 4 | 2 | 4 | 1 |

| Handyman | 4.60 | 4 | 2 | 4 | 1 |

| Home-based | 4.40 | 6 | 2 | 4 | 1 |

| Home-based business | 4.40 | 6 | 2 | 4 | 1 |

| Hospitality | 4.80 | 2 | 2 | 4 | 1 |

| HVAC | 4.50 | 2 | 2 | 4 | 1 |

| Janitorial | 4.60 | 2 | 2 | 4 | 1 |

| Jewelry | 4.50 | 3 | 2 | 4 | 1 |

| Junk Removal | 4.30 | 6 | 2 | 4 | 1 |

| Lawn/Landscaping | 4.70 | 2 | 2 | 4 | 1 |

| Lawyers | 4.40 | 6 | 2 | 4 | 1 |

| Manufacturing | 4.60 | 3 | 2 | 4 | 1 |

| Marine | 4.40 | 5 | 2 | 4 | 1 |

| Massage | 4.80 | 2 | 2 | 4 | 1 |

| Mortgage Broker | 4.40 | 6 | 2 | 4 | 1 |

| Moving | 4.70 | 2 | 2 | 4 | 1 |

| Nonprofit | 4.40 | 6 | 2 | 4 | 1 |

| Painting | 4.50 | 2 | 2 | 4 | 1 |

| Party Rental | 4.40 | 6 | 2 | 4 | 1 |

| Personal Training | 4.60 | 3 | 2 | 4 | 1 |

| Pest Control | 4.30 | 6 | 2 | 4 | 1 |

| Pet | 4.40 | 6 | 2 | 4 | 1 |

| Pharmacy | 4.70 | 3 | 2 | 4 | 1 |

| Photography | 4.50 | 4 | 2 | 4 | 1 |

| Physical Therapy | 4.60 | 2 | 2 | 4 | 1 |

| Plumbing | 4.50 | 5 | 2 | 4 | 1 |

| Pressure Washing | 4.40 | 5 | 2 | 4 | 1 |

| Real Estate | 4.30 | 7 | 2 | 4 | 1 |

| Restaurant | 4.80 | 2 | 2 | 4 | 1 |

| Retail | 4.80 | 2 | 2 | 4 | 1 |

| Roofing | 4.40 | 5 | 2 | 4 | 1 |

| Security | 4.40 | 5 | 2 | 4 | 1 |

| Snack Bars | 4.40 | 5 | 2 | 4 | 1 |

| Software | 4.50 | 5 | 2 | 4 | 1 |

| Spa/Wellness | 4.30 | 7 | 2 | 4 | 1 |

| Speech Therapist | 4.40 | 6 | 2 | 4 | 1 |

| Startup | 4.60 | 3 | 2 | 4 | 1 |

| Tech/IT | 4.50 | 5 | 2 | 4 | 1 |

| Transportation | 4.40 | 5 | 2 | 4 | 1 |

| Travel | 4.50 | 5 | 2 | 4 | 1 |

| Tree Service | 4.60 | 3 | 2 | 4 | 1 |

| Trucking | 4.40 | 6 | 2 | 4 | 1 |

| Tutoring | 4.40 | 6 | 2 | 4 | 1 |

| Veterinary | 4.30 | 6 | 2 | 4 | 1 |

| Wedding Planning | 4.50 | 4 | 2 | 4 | 1 |

| Welding | 4.40 | 5 | 2 | 4 | 1 |

| Wholesale | 4.40 | 7 | 2 | 4 | 1 |

| Window Cleaning | 4.50 | 3 | 2 | 4 | 1 |

How Did We Determine These Scores?

These scores are for small businesses with two employees across 79 major industries or business types and focus on four coverage types: general liability, professional liability (E&O), workers' comp and business owner's policy.

Nationwide Business Insurance Ratings by State

Nationwide is competitive, taking third place in eight markets and fourth position in 38 others. This consistent performance puts it among the top insurers. Pricing for Nationwide is less competitive, ranking fifth or lower in most states.

| Alabama | 4.46 | 4 | 2 | 4 | 1 |

| Arizona | 4.47 | 4 | 2 | 4 | 1 |

| Arkansas | 4.48 | 4 | 2 | 4 | 1 |

| California | 4.47 | 4 | 2 | 4 | 1 |

| Colorado | 4.48 | 4 | 2 | 4 | 1 |

| Connecticut | 4.48 | 4 | 2 | 4 | 1 |

| Delaware | 4.48 | 4 | 2 | 4 | 1 |

| Florida | 4.47 | 4 | 2 | 4 | 1 |

| Georgia | 4.47 | 4 | 2 | 4 | 1 |

| Idaho | 4.47 | 4 | 2 | 4 | 1 |

| Illinois | 4.48 | 3 | 2 | 4 | 1 |

| Indiana | 4.48 | 3 | 2 | 4 | 1 |

| Iowa | 4.49 | 4 | 2 | 4 | 1 |

| Kansas | 4.47 | 4 | 2 | 4 | 1 |

| Kentucky | 4.47 | 3 | 2 | 4 | 1 |

| Maine | 4.46 | 4 | 2 | 4 | 1 |

| Maryland | 4.48 | 3 | 2 | 4 | 1 |

| Massachusetts | 4.47 | 4 | 2 | 4 | 1 |

| Michigan | 4.46 | 4 | 2 | 4 | 1 |

| Minnesota | 4.47 | 4 | 2 | 4 | 1 |

| Mississippi | 4.48 | 4 | 2 | 4 | 1 |

| Missouri | 4.47 | 4 | 2 | 4 | 1 |

| Montana | 4.48 | 3 | 2 | 4 | 1 |

| Nebraska | 4.48 | 3 | 2 | 4 | 1 |

| Nevada | 4.48 | 3 | 2 | 4 | 1 |

| New Hampshire | 4.48 | 4 | 2 | 4 | 1 |

| New Jersey | 4.46 | 4 | 2 | 4 | 1 |

| New Mexico | 4.47 | 4 | 2 | 4 | 1 |

| New York | 4.47 | 4 | 2 | 4 | 1 |

| North Carolina | 4.47 | 4 | 2 | 4 | 1 |

| North Dakota | 4.47 | 4 | 2 | 4 | 1 |

| Ohio | 4.48 | 4 | 2 | 4 | 1 |

| Oregon | 4.47 | 4 | 2 | 4 | 1 |

| Pennsylvania | 4.47 | 4 | 2 | 4 | 1 |

| Rhode Island | 4.48 | 4 | 2 | 4 | 1 |

| South Carolina | 4.48 | 4 | 2 | 4 | 1 |

| South Dakota | 4.47 | 4 | 2 | 4 | 1 |

| Tennessee | 4.47 | 4 | 2 | 4 | 1 |

| Texas | 4.48 | 4 | 2 | 4 | 1 |

| Utah | 4.47 | 4 | 2 | 4 | 1 |

| Vermont | 4.48 | 4 | 2 | 4 | 1 |

| Virginia | 4.46 | 4 | 2 | 4 | 1 |

| Washington | 4.47 | 4 | 2 | 4 | 1 |

| West Virginia | 4.47 | 4 | 2 | 4 | 1 |

| Wisconsin | 4.47 | 3 | 2 | 4 | 1 |

| Wyoming | 4.48 | 4 | 2 | 4 | 1 |

How Did We Determine These Scores?

These scores are for small businesses with two employees across 79 major industries or business types and focus on four coverage types: general liability, professional liability (E&O), workers' comp and business owner's policy.

How Much Does Nationwide Business Insurance Cost?

Nationwide business insurance costs $102 per month ($1,224 yearly) on average. When you get business insurance, prices vary by coverage types. Monthly rates start at $81 for workers' compensation and go up to $146 for business owner's policies.

| Business Owners Policies | $146 | $1,748 |

| General Liability | $97 | $1,165 |

| Professional Liability (E&O) | $82 | $987 |

| Workers Compensation | $81 | $974 |

How Did We Determine These Rates?

These rates are based on MoneyGeek's 2025 analysis of quotes for small businesses with two employees, $300,000 annual revenue and $150,000 payroll across four core coverage types.

How Much Does Nationwide Business Insurance Cost by Industry?

The average cost of business insurance through Nationwide varies from $29 monthly for ad agencies to $660 for pressure washing businesses. Service-based companies with minimal physical risks pay lower premiums than businesses involving equipment and an increased chance of property damage.

| Accountants | $58 | $698 |

| Ad Agency | $29 | $346 |

| Auto Repair | $113 | $1,357 |

| Automotive | $87 | $1,044 |

| Bakery | $79 | $947 |

| Barber | $33 | $396 |

| Beauty Salon | $48 | $571 |

| Bounce House | $78 | $931 |

| Candle | $60 | $718 |

| Cannabis | $104 | $1,249 |

| Catering | $72 | $869 |

| Cleaning | $106 | $1,274 |

| Coffee Shop | $73 | $874 |

| Computer Programming | $49 | $583 |

| Computer Repair | $74 | $889 |

| Construction | $119 | $1,425 |

| Consulting | $50 | $599 |

| Contractor | $248 | $2,970 |

| Courier | $207 | $2,485 |

| DJ | $29 | $347 |

| Daycare | $57 | $684 |

| Dental | $34 | $413 |

| Dog Grooming | $79 | $951 |

| Drone | $48 | $574 |

| Ecommerce | $73 | $873 |

| Electrical | $92 | $1,109 |

| Engineering | $58 | $698 |

| Excavation | $284 | $3,409 |

| Florist | $49 | $587 |

| Food | $122 | $1,463 |

| Food Truck | $220 | $2,634 |

| Funeral Home | $63 | $756 |

| Gardening | $99 | $1,186 |

| HVAC | $178 | $2,139 |

| Handyman | $184 | $2,214 |

| Home-based | $29 | $348 |

| Hospitality | $51 | $610 |

| Janitorial | $89 | $1,066 |

| Jewelry | $39 | $467 |

| Junk Removal | $171 | $2,048 |

| Lawn/Landscaping | $71 | $852 |

| Lawyers | $66 | $795 |

| Manufacturing | $44 | $532 |

| Marine | $82 | $988 |

| Massage | $63 | $758 |

| Mortgage Broker | $62 | $747 |

| Moving | $145 | $1,739 |

| Nonprofit | $47 | $561 |

| Painting | $133 | $1,600 |

| Party Rental | $80 | $957 |

| Personal Training | $38 | $462 |

| Pest Control | $68 | $812 |

| Pet | $59 | $705 |

| Pharmacy | $43 | $514 |

| Photography | $35 | $416 |

| Physical Therapy | $40 | $483 |

| Plumbing | $276 | $3,317 |

| Pressure Washing | $660 | $7,920 |

| Real Estate | $119 | $1,430 |

| Restaurant | $91 | $1,098 |

| Retail | $43 | $517 |

| Roofing | $513 | $6,161 |

| Security | $143 | $1,714 |

| Snack Bars | $98 | $1,180 |

| Software | $46 | $549 |

| Spa/Wellness | $140 | $1,676 |

| Speech Therapist | $42 | $500 |

| Startup | $36 | $431 |

| Tech/IT | $47 | $558 |

| Transportation | $112 | $1,346 |

| Travel | $41 | $496 |

| Tree Service | $133 | $1,592 |

| Trucking | $175 | $2,101 |

| Tutoring | $35 | $422 |

| Veterinary | $74 | $889 |

| Wedding Planning | $41 | $492 |

| Welding | $163 | $1,951 |

| Wholesale | $57 | $686 |

| Window Cleaning | $161 | $1,938 |

How Did We Determine These Rates?

These rates are based on MoneyGeek's 2025 analysis of quotes for small businesses with two employees, $300,000 annual revenue and $150,000 payroll across four core coverage types.

How Much Does Nationwide Business Insurance Cost by State?

State regulations, natural disaster risks and legal environments create different insurance costs across regions. Nationwide offers the cheapest business insurance in North Carolina at $88 per month, while Washington business owners pay $123 monthly.

| Alabama | $100 | $1,205 |

| Arizona | $96 | $1,156 |

| Arkansas | $97 | $1,163 |

| California | $113 | $1,357 |

| Colorado | $100 | $1,205 |

| Connecticut | $110 | $1,319 |

| Delaware | $109 | $1,308 |

| Florida | $110 | $1,318 |

| Georgia | $103 | $1,236 |

| Idaho | $96 | $1,152 |

| Illinois | $111 | $1,334 |

| Indiana | $99 | $1,186 |

| Iowa | $96 | $1,157 |

| Kansas | $99 | $1,184 |

| Kentucky | $95 | $1,135 |

| Maine | $89 | $1,064 |

| Maryland | $96 | $1,155 |

| Massachusetts | $107 | $1,285 |

| Michigan | $96 | $1,155 |

| Minnesota | $95 | $1,137 |

| Mississippi | $102 | $1,219 |

| Missouri | $101 | $1,207 |

| Montana | $101 | $1,214 |

| Nebraska | $96 | $1,148 |

| Nevada | $116 | $1,389 |

| New Hampshire | $101 | $1,212 |

| New Jersey | $115 | $1,380 |

| New Mexico | $103 | $1,231 |

| New York | $119 | $1,430 |

| North Carolina | $88 | $1,061 |

| North Dakota | $95 | $1,135 |

| Ohio | $101 | $1,209 |

| Oregon | $95 | $1,135 |

| Pennsylvania | $118 | $1,416 |

| Rhode Island | $111 | $1,336 |

| South Carolina | $105 | $1,259 |

| South Dakota | $95 | $1,140 |

| Tennessee | $99 | $1,182 |

| Texas | $102 | $1,227 |

| Utah | $97 | $1,162 |

| Vermont | $97 | $1,167 |

| Virginia | $93 | $1,112 |

| Washington | $123 | $1,471 |

| West Virginia | $107 | $1,280 |

| Wisconsin | $99 | $1,192 |

| Wyoming | $100 | $1,204 |

How Did We Determine These Rates?

These rates are based on MoneyGeek's 2025 analysis of quotes for small businesses with two employees, $300,000 annual revenue and $150,000 payroll across four core coverage types.

Nationwide Business Insurance Customer Experience Ratings

We analyzed over 1,100 customer reviews to evaluate how Nationwide serves small business insurance customers. The company ranks sixth overall with a customer score of 4.16 out of 5. Nationwide has good policy management and customer service but receives lower scores for affordability and digital tools.

| Affordability | 4.10 | 9 |

| Claims Process | 3.90 | 5 |

| Customer Service | 4.30 | 3 |

| Digital Experience | 4.00 | 8 |

| Policy Management | 4.30 | 2 |

| Recommend to Others | 4.30 | 4 |

Nationwide Business Insurance Customer Reviews and Sentiment

Nationwide receives generally positive feedback for its commercial insurance, with some customers highlighting strong agent relationships, while others report frustrations with claims communication.

Official Website Reviews | Nationwide’s business insurance pages don't display a dedicated customer review section. |

Better Business Bureau (U.S.) | Nationwide Mutual Insurance Company is BBB-accredited with an A+ rating. |

Trustpilot | Holds a 1.5/5 TrustScore from recent reviews. |

Reddit | Nationwide is reliable for BOPs and commercial auto, especially through independent agents. It has a slower claims process than some insurers. |

Nationwide earns praise for agent-led service and personalized attention, but its claims process can feel slower and less streamlined for customers used to digital-first carriers.

Nationwide Business Insurance Industry Ratings

Independent industry ratings show how well Nationwide performs when customers need to file a claim.

In J.D. Power’s 2024 U.S. Small Commercial Insurance Study, Nationwide scored 701 out of 1,000, ranking 7th overall, just above the industry average of 697. This performance places it in the upper tier among national insurers like Chubb (703), Erie (706), and Allstate (716), signaling strong satisfaction among small-business customers.

NAIC data shows Nationwide’s commercial property and liability lines have complaint indices below the national average, indicating fewer regulator-filed complaints than expected for its size.

Nationwide’s A+ BBB accreditation signals adherence to high ethical standards, though mixed individual review sentiment suggests variability in service experiences.

These industry ratings show Nationwide generally satisfies small business policyholders. Most businesses are satisfied, and there are a low number of complaints.

Nationwide Business Insurance Financial Strength Ratings

Nationwide carries an A+ (Superior) financial strength rating from AM Best, showing excellent ability to pay claims. S&P rates Nationwide Mutual Insurance Company A+, and Moody’s assigns an A1 rating—both considered strong.

Nationwide Business Insurance Coverage Options and Add-ons

Nationwide offers a wide array of small business and specialized commercial coverages.

Core | Combines general liability, commercial property and business income coverage | |

Core | Covers third-party injury, property damage and advertising injury | |

Core | Pays for employee medical care and lost wages after a work injury | |

Core | Liability and physical damage for company-owned vehicles | |

Core | Covers buildings, equipment and inventory | |

Core | Protects against professional errors and negligence claims | |

Umbrella Liability | Specialized | Extends liability limits beyond base policies |

Specialized | Covers data breaches, cyberattacks and related costs | |

Employment Practices Liability | Specialized | Protects against wrongful termination, discrimination and harassment claims |

Inland Marine | Specialized | Covers mobile tools, equipment and property in transit |

Disclaimer

Deductibles, coverage limits and specific terms vary by policy and business type. Contact Nationwide for detailed coverage information, including deductibles.

Availability and eligibility vary by state, industry, and business size. Nationwide’s agent-driven model offers strong personal service, but may not match the speed of digital-first competitors for quoting and claims.

Nationwide Business Insurance: Bottom Line

Nationwide's small business coverage averages $102 monthly, which is above many competitors. It has straightforward policy management and responsive customer service teams. Nationwide's digital tools and self-service options remain less developed than other insurers.

Nationwide Business Insurance: FAQ

Based on our comprehensive analysis of Nationwide's business insurance offerings, we provide answers to common questions about policy coverage, pricing and what to expect as a customer.

How much can I expect to pay for Nationwide business insurance?

Nationwide business insurance costs average $102 per month ($1,224 annually) for small businesses. Coverage prices range from $81 per month for workers' compensation to $146 per month for business owners policies.

How much does Nationwide business insurance cost by industry?

Nationwide business insurance costs range from $29 per month for advertising agencies to $660 per month for pressure washing companies. Service-based businesses like ad agencies face lower premiums than companies with physical property risks. Insurance rates directly correspond to each industry's unique risk factors.

What industries does Nationwide rank best for?

Nationwide ranks first in 7 of 79 industries, leading in auto repair, construction, hospitality, retail, restaurants, massage and landscaping services. The insurer offers competitive rates across industries, ranking second for accountants, automotive businesses and bakeries.

Which states offer the cheapest Nationwide business insurance rates?

North Carolina offers the lowest Nationwide business insurance rates at $88 per month, while Washington has higher rates at $123 per month. Nationwide tends to have mid-range pricing, with rates varying by state.

What are Nationwide's biggest weaknesses compared to competitors?

Nationwide ranks sixth for coverage options and eighth for digital experience, limiting customization choices and online self-service features.

How We Rated Nationwide Business Insurance

Small business owners need reliable information to choose the right insurance carrier. Our analysis shows how Nationwide compares to other providers on the factors that impact your business protection:

- Affordability (50% of score): We compared Nationwide's rates for small business coverage against nine other national carriers to find the best value for your money.

- Customer experience (30% of score): We analyzed J.D. Power scores, complaint records and customer feedback to see how well Nationwide handles claims and supports businesses.

- Coverage options (15% of score): We checked Nationwide's available policies, coverage limits and optional add-ons to determine if they match common business needs.

- Financial strength (5% of score): We reviewed financial ratings and stability metrics to confirm Nationwide can reliably pay claims.

We gathered quotes from 79 industries for four types of coverage, using a standard business profile: two employees, $300,000 in yearly revenue and $150,000 in payroll. Our research reveals both the strengths and limitations of Nationwide's business insurance offerings.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Affirms Credit Ratings of Nationwide Mutual Insurance Company." Accessed September 1, 2025.

- Better Business Bureau. "Nationwide | BBB Business Profile | Better Business Bureau." Accessed September 1, 2025.

- Better Business Bureau. "Nationwide | BBB Reviews | Better Business Bureau." Accessed September 1, 2025.

- J.D. Power. "2025 U.S. Auto Insurance Study | J.D. Power." Accessed September 1, 2025.

- Nationwide. "Nationwide Commercial Insurance." Accessed September 1, 2025.

- Trustpilot. "Nationwide Reviews ." Accessed September 1, 2025.