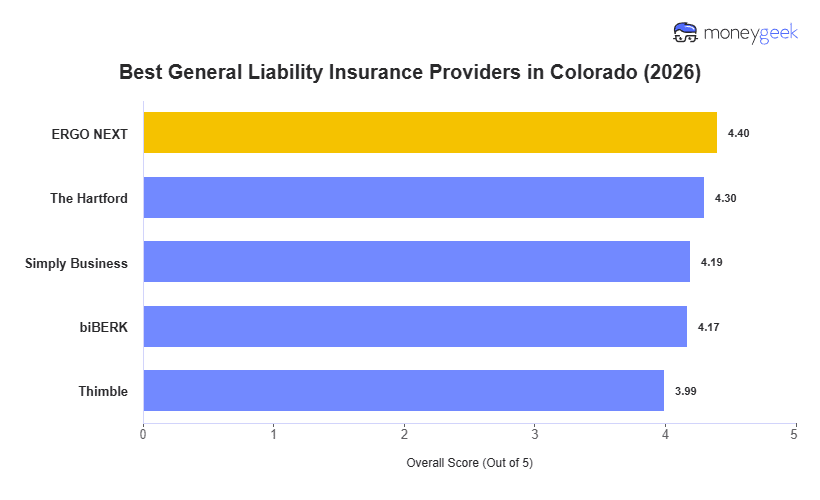

Small businesses in Colorado face liability risks shaped by the state's mix of seasonal tourism, construction growth, and service-based industries. The best general liability insurance depends on what you do, how many people you employ and where in the state you operate. These five providers earned top marks for balancing affordable rates with strong service and flexible coverage:

- ERGO NEXT: Best Overall, Best for High-Risk Industries

- The Hartford: Best for Professional Services

- Simply Business: Best for Comparing Multiple Carriers

- biBERK: Best for Solopreneurs

- Thimble: Best for Gig Workers and Seasonal Businesses

Top insureres address practical needs of Colorado's small business owners, whether you're running a landscaping crew in Boulder, managing a café in Colorado Springs, or operating a contracting business in the Front Range. The comparison below shows what sets each one apart: