For the types of business insurance most small business owners need, average insurance costs range from $885 to $1,785 per year in aggregate. However, this represents only an overall average for a three-person business with two employees for five of the most common coverage types, and costs will vary depending on your industry, business size, state and policy needs. So below we broke down the small company business insurance costs for policy types you'll likely come across in your comparison journey.

How Much Does Small Business Insurance Cost on Average?

The cost of small business insurance averages $110 per month or $1,322 per year according to our study of 5 common coverage types and 79 industries.

Get matched to the best cheap small business insurance provider for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

How Much Does Small Business Insurance Cost on Average?

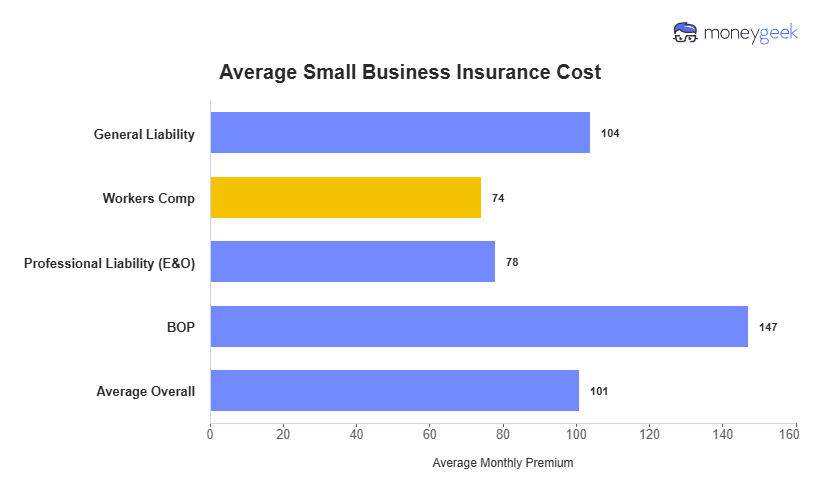

Small Business Coverage Type | Average Monthly Rate | Average Annual Rate |

|---|---|---|

$104 | $1,242 | |

$74 | $885 | |

$78 | $931 | |

$147 | $1,767 | |

$149 | $1,785 |

How We Determined Average Small Business Insurance Costs

*Business insurance rates vary based on your business operations, claims history and risk factors. These estimates are for informational purposes only and shouldn't be considered quotes and only represent a 2 employee company with $300,000 in annual revenue and $150,000 in payroll based on our methodology. Consult with licensed insurance professionals for coverage recommendations specific to your business needs.

Get Small Business Insurance Cost Quotes From Your Top Provider Match

Select your industry and state to get a customized best small business insurer match and get tailored quotes.

Check out these guides to help you get the best affordable fit for small business insurance coverage:

- Best Small Business Insurance

- Cheapest Small Business Insurance

- Best General Liability Insurance

- Cheapest General Liability Insurance

- Best Workers' Comp Insurance

- Cheapest Workers' Comp Insurance

- Best Professional Liability Insurance

- Cheapest Professional Liability Insurance

- Cheapest Commercial Auto Insurance

- Cheapest Commercial Truck Insurance

What Factors Affect Small Business Insurance Costs?

Below we've summarized the factors that affect small business insurance costs:

- Industry: Your industry greatly affects insurance costs. Businesses in sectors with higher claim risks, such as construction or health care, usually pay higher premiums than those in lower-risk industries.

- Business size: Larger businesses often face higher insurance costs due to the increased risk of managing more employees and operations. A business with multiple employees usually pays more for insurance than a sole proprietorship.

- Location: Your business location impacts insurance costs. Areas with higher claim rates, severe weather conditions or higher living costs lead to increased premiums.

- Claims history: Insurers charge higher premiums to businesses with claim histories, as they view such businesses as more likely to file future claims.

- Coverage amounts and deductibles: Your coverage choices also impact costs. Higher coverage limits and lower deductibles usually result in higher premiums, as the insurer takes on greater financial risk.

- Risk management practices: Insurers may reward businesses that implement strong risk management practices with lower premiums. These practices include following safety protocols, conducting employee training programs and following industry best practices.

- Insurance company: Your chosen insurer affects coverage costs. Different insurance companies have different risk appetites and pricing strategies. Businesses should compare offerings from multiple insurers to find the best fit for their needs and budget.

Average Small Business Insurance Cost By Provider and Coverage Type

At the provider level, average small business insurance rates vary anywhere from $69 to $178 per month considering coverage type selection.

| BOP Insurance | biBERK | $148 | $1,780 |

| General Liability | biBERK | $114 | $1,369 |

| Professional Liability | biBERK | $79 | $953 |

| Workers Comp | biBERK | $75 | $901 |

| BOP Insurance | Thimble | $121 | $1,450 |

| General Liability | Thimble | $107 | $1,286 |

| Professional Liability | Thimble | $76 | $914 |

| Workers Comp | Thimble | $71 | $847 |

| BOP Insurance | The Hartford | $115 | $1,382 |

| General Liability | The Hartford | $83 | $1,001 |

| Professional Liability | The Hartford | $72 | $858 |

| Workers Comp | The Hartford | $70 | $839 |

| BOP Insurance | Simply Business | $143 | $1,710 |

| General Liability | Simply Business | $95 | $1,139 |

| Professional Liability | Simply Business | $76 | $917 |

| Workers Comp | Simply Business | $71 | $856 |

| BOP Insurance | Progressive Commercial | $150 | $1,805 |

| General Liability | Progressive Commercial | $100 | $1,203 |

| Professional Liability | Progressive Commercial | $75 | $904 |

| Workers Comp | Progressive Commercial | $71 | $855 |

| BOP Insurance | Nationwide | $146 | $1,748 |

| General Liability | Nationwide | $97 | $1,165 |

| Professional Liability | Nationwide | $82 | $987 |

| Workers Comp | Nationwide | $81 | $974 |

| BOP Insurance | NEXT Insurance | $154 | $1,848 |

| General Liability | NEXT Insurance | $102 | $1,223 |

| Professional Liability | NEXT Insurance | $72 | $867 |

| Workers Comp | NEXT Insurance | $69 | $829 |

| BOP Insurance | Hiscox | $169 | $2,023 |

| General Liability | Hiscox | $114 | $1,371 |

| Professional Liability | Hiscox | $77 | $928 |

| Workers Comp | Hiscox | $72 | $861 |

| BOP Insurance | Coverdash | $150 | $1,801 |

| General Liability | Coverdash | $104 | $1,242 |

| Professional Liability | Coverdash | $78 | $933 |

| Workers Comp | Coverdash | $73 | $875 |

| BOP Insurance | Chubb | $178 | $2,136 |

| General Liability | Chubb | $119 | $1,423 |

| Professional Liability | Chubb | $89 | $1,062 |

| Workers Comp | Chubb | $85 | $1,018 |

Average Small Business Insurance Costs by Coverage Type and State

Depending on your state, average business insurance costs range from $64 to $171 per month. However, this also depends on your firm's coverage needs. Below are the costs of commonly needed commercial coverage policies.

| Alabama | $101 | $1,217 |

| Alaska | $95 | $1,143 |

| Arizona | $98 | $1,174 |

| Arkansas | $99 | $1,192 |

| California | $115 | $1,384 |

| Colorado | $103 | $1,232 |

| Connecticut | $112 | $1,350 |

| Delaware | $111 | $1,333 |

| Florida | $112 | $1,345 |

| Georgia | $105 | $1,262 |

| Hawaii | $112 | $1,343 |

| Idaho | $98 | $1,178 |

| Illinois | $114 | $1,364 |

| Indiana | $101 | $1,212 |

| Iowa | $99 | $1,183 |

| Kansas | $101 | $1,207 |

| Kentucky | $96 | $1,151 |

| Louisiana | $118 | $1,420 |

| Maine | $90 | $1,076 |

| Maryland | $99 | $1,185 |

| Massachusetts | $109 | $1,303 |

| Michigan | $98 | $1,176 |

| Minnesota | $97 | $1,165 |

| Mississippi | $104 | $1,248 |

| Missouri | $102 | $1,227 |

| Montana | $103 | $1,237 |

| Nebraska | $98 | $1,175 |

| Nevada | $117 | $1,405 |

| New Hampshire | $103 | $1,235 |

| New Jersey | $117 | $1,407 |

| New Mexico | $104 | $1,249 |

| New York | $120 | $1,444 |

| North Carolina | $90 | $1,076 |

| North Dakota | $90 | $1,080 |

| Ohio | $96 | $1,153 |

| Oklahoma | $98 | $1,178 |

| Oregon | $96 | $1,154 |

| Pennsylvania | $119 | $1,432 |

| Rhode Island | $114 | $1,365 |

| South Carolina | $107 | $1,279 |

| South Dakota | $97 | $1,161 |

| Tennessee | $101 | $1,212 |

| Texas | $104 | $1,253 |

| Utah | $98 | $1,179 |

| Vermont | $99 | $1,193 |

| Virginia | $94 | $1,131 |

| Washington | $118 | $1,413 |

| West Virginia | $109 | $1,303 |

| Wisconsin | $102 | $1,219 |

| Wyoming | $96 | $1,149 |

Average Small Business Insurance Cost by Coverage Type and Industry

Monthly small business insurance costs vary dramatically by industry across these coverage types with rates as low as $6 for DJ companies and $1,346 for pressure washing firms.. Below, you can review how much each coverage type costs for your industry.

| Accountants | $22 | $266 |

| Ad Agency | $36 | $429 |

| Auto Repair | $153 | $1,839 |

| Automotive | $54 | $643 |

| Bakery | $91 | $1,089 |

| Barber | $45 | $537 |

| Beauty Salon | $67 | $806 |

| Bounce House | $70 | $846 |

| Candle | $55 | $661 |

| Cannabis | $67 | $807 |

| Catering | $89 | $1,064 |

| Cleaning | $133 | $1,596 |

| Coffee Shop | $90 | $1,083 |

| Computer Programming | $29 | $353 |

| Computer Repair | $48 | $572 |

| Construction | $177 | $2,125 |

| Consulting | $22 | $265 |

| Contractor | $256 | $3,067 |

| Courier | $196 | $2,353 |

| DJ | $26 | $307 |

| Daycare | $33 | $396 |

| Dental | $22 | $259 |

| Dog Grooming | $64 | $763 |

| Drone | $17 | $201 |

| Ecommerce | $73 | $882 |

| Electrical | $113 | $1,353 |

| Engineering | $40 | $482 |

| Excavation | $468 | $5,617 |

| Florist | $43 | $517 |

| Food | $108 | $1,296 |

| Food Truck | $141 | $1,693 |

| Funeral Home | $61 | $728 |

| Gardening | $113 | $1,353 |

| HVAC | $246 | $2,956 |

| Handyman | $245 | $2,943 |

| Home-based | $24 | $287 |

| Hospitality | $66 | $790 |

| Janitorial | $138 | $1,653 |

| Jewelry | $41 | $490 |

| Junk Removal | $163 | $1,957 |

| Lawn/Landscaping | $121 | $1,453 |

| Lawyers | $23 | $275 |

| Manufacturing | $65 | $782 |

| Marine | $28 | $337 |

| Massage | $97 | $1,160 |

| Mortgage Broker | $23 | $276 |

| Moving | $125 | $1,499 |

| Nonprofit | $36 | $432 |

| Painting | $144 | $1,733 |

| Party Rental | $80 | $957 |

| Personal Training | $24 | $288 |

| Pest Control | $32 | $388 |

| Pet | $56 | $675 |

| Pharmacy | $62 | $746 |

| Photography | $24 | $292 |

| Physical Therapy | $113 | $1,352 |

| Plumbing | $363 | $4,361 |

| Pressure Washing | $918 | $11,022 |

| Real Estate | $53 | $635 |

| Restaurant | $146 | $1,753 |

| Retail | $66 | $790 |

| Roofing | $389 | $4,672 |

| Security | $140 | $1,675 |

| Snack Bars | $118 | $1,414 |

| Software | $27 | $319 |

| Spa/Wellness | $107 | $1,281 |

| Speech Therapist | $31 | $377 |

| Startup | $29 | $346 |

| Tech/IT | $27 | $320 |

| Transportation | $38 | $453 |

| Travel | $21 | $252 |

| Tree Service | $131 | $1,567 |

| Trucking | $103 | $1,234 |

| Tutoring | $31 | $367 |

| Veterinary | $45 | $539 |

| Wedding Planning | $28 | $336 |

| Welding | $166 | $1,987 |

| Wholesale | $45 | $538 |

| Window Cleaning | $160 | $1,919 |

How to Lower Small Business Insurance Costs

Small business insurance costs eat into your business budget, but you can reduce them with the right approach. Here are proven strategies to reduce your commercial insurance expenses while not excluding the protection you need.

- 1

Decide on business insurance coverage needs

Determining your business's particular needs for insurance will allow you to buy more confidently and avoid unnecessary coverage, saving money on small business insurance premiums in the long run. Assess your actual risk exposure and purchase only the policies that protect against real threats to your operations, rather than paying for blanket coverage you may never use.

- 2

Consider bundling policies, paying annually and higher deductibles

Many insurers offer significant discounts when you bundle multiple business policies together, such as general liability, property, and commercial auto insurance (with average savings of up to 15% per bundle). Paying your premiums annually instead of monthly can also reduce your total costs (average of 8%) by eliminating installment fees and often qualifies you for additional savings. Raising your deductible will also save you more if you can afford it as well.

- 3

Compare small business insurance rates

Small business insurance premiums vary widely among providers, so obtaining quotes from at least three to five insurers is essential to finding competitive rates. Use independent insurance brokers who can compare policies across multiple carriers to ensure you're getting the best coverage at the lowest price.

- 4

Lower small business insurance prices with claims risk management

Implementing comprehensive risk management practices, such as safety protocols, employee training programs, and workplace hazard assessments, demonstrates to insurers that you're actively working to prevent claims and lowers small business insurance rates. Businesses with strong safety records and fewer claims typically qualify for lower premiums and may receive additional discounts for documented risk reduction efforts.

- 5

Review your business insurance policy needs annually

As your company evolves, your needs and available coverage options change as well, making annual policy reviews essential for small business insurance cost optimization. During each review, look for opportunities to adjust your deductibles, remove coverage for discontinued operations, or take advantage of new discounts you've become eligible for as your business grows and matures to maximize savings.

Cost of Business Insurance: Bottom Line

Average monthly small business insurance costs vary widely, ranging from $10 to $1,991. Regardless of your business details, the way to get the best commercial insurance for you is to compare plenty of options through multiple means, decide on coverage before buying and research before comparing.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.