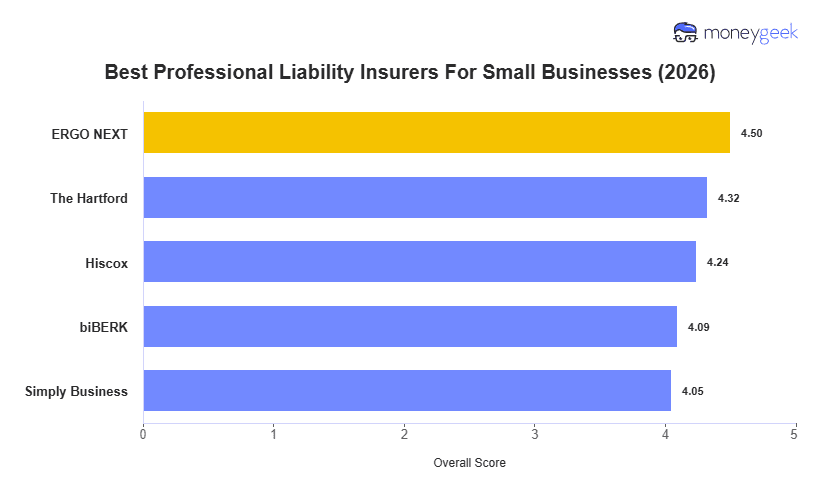

We analyzed major commercial insurers across the United States and found these providers had the best professional liability offerings:

- ERGO NEXT: NEXT wins our first-place spot as the Best Overall and the Best For B2C Industries. The company won primarily due to its great balance of affordability across most business profiles, a great service experience from buying to claims and flexible coverage.

- The Hartford: As the oldest and most trusted insurer on our list The Hartford won our title for the Best Cheap Professional Liability Insurance. They seldom rank below the top three for affordability and have the top-rated claims experience in our study, particularly performing well for consultants and financial professionals.

- Hiscox: Rounding out the middle of our top 5 list, Hiscox provides great value for beauty services and nonprofits and specialized coverage packages for select industries.

- biBERK: While not the absolute best for any industry area, biBERK offers a great buying process online (2nd overall) and the top ratings for underwriting transparency and sales support quality.

- Simply Business: As an aggregator Simply Business is ideal for comparing multiple providers all at once and they have the best coverage selection and flexibility for professional liability policies. They also have an ideal experience and pricing that benefits cleaning companies the most.

The table below highlights each of our top 5 insurers so you can compare at a high-level.