Find answers about general liability insurance in Massachusetts and discover best business insurance that works for you. Our FAQ gives you quick insights from MoneyGeek's research:

Best General Liability Insurance in Massachusetts

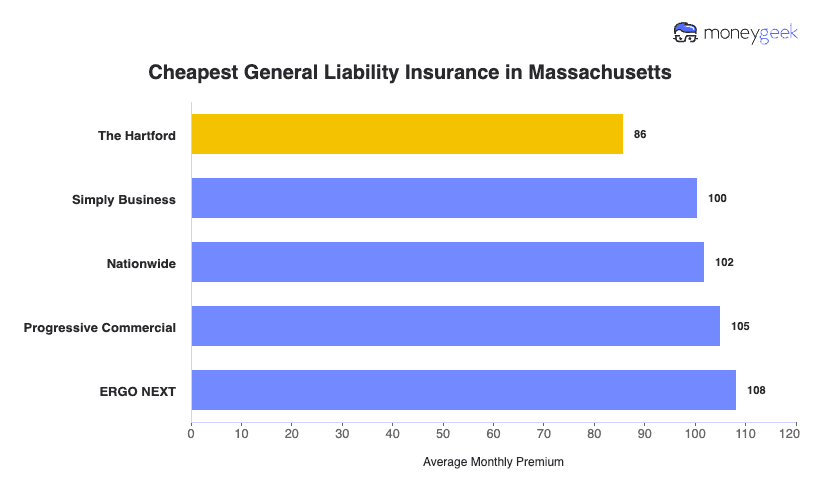

ERGO NEXT leads Massachusetts general liability insurance, while The Hartford offers the lowest rates starting at $86 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Massachusetts: Fast Answers

Which company offers the best general liability insurance in Massachusetts?

ERGO NEXT and The Hartford tie as the best general liability insurance company in Massachusetts, both earning 4.57 out of 5 overall scores. The Hartford offers the most affordable rates at $86 per month along with strong claims handling. ERGO NEXT provides an excellent digital experience for $108 per month, making business management simple and efficient.

Who offers the cheapest general liability insurance in Massachusetts?

The cheapest general liability insurance companies in Massachusetts are:

- The Hartford: $86 per month

- Simply Business: $100 per month

- Nationwide: $102 per month

- Progressive: $105 per month

- ERGO NEXT: $108 per month

Do Massachusetts businesses legally need general liability insurance?

Massachusetts doesn't legally require general liability insurance for most businesses statewide. However, certain licensed professionals like contractors and electricians must carry minimum coverage to maintain their licenses.

Local municipalities may impose additional requirements. Even when not legally mandated, most landlords and clients require proof of coverage before signing contracts or leases.

How much does general liability insurance cost in Massachusetts?

General liability insurance costs between $18 and $965 per month for small Massachusetts businesses with two employees. The drone industry tends to see the lowest rates, while pressure washing businesses pay some of the highest premiums. Your actual cost depends on your specific industry, business location, coverage limits and company size.

Best General Liability Insurance Companies in Massachusetts

ERGO NEXT and The Hartford are our joint top picks for general liability insurance in Massachusetts. ERGO NEXT has excellent customer service, while The Hartford offers good rates for small businesses. Nationwide also ranks as a reliable option with solid stability and customer support ratings.

| ERGO NEXT | 4.57 | $108 |

| The Hartford | 4.57 | $86 |

| Nationwide | 4.53 | $102 |

| Simply Business | 4.49 | $100 |

| Coverdash | 4.38 | $108 |

| Thimble | 4.35 | $112 |

| biBERK | 4.30 | $120 |

| Progressive Commercial | 4.28 | $105 |

| Chubb | 4.27 | $125 |

| Hiscox | 4.19 | $120 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Massachusetts General Liability Insurer

Select your industry and state to get a customized Massachusetts general liability insurance quote.

General liability insurance covers customer injuries and property damage for Massachusetts businesses, but it won't protect against every risk your business encounters. Explore these additional coverage options to build comprehensive financial protection:

Best Massachusetts General Liability Insurance Reviews

Finding the best general liability insurance in Massachusetts means looking beyond just affordable rates. Our research shows coverage quality and customer service matter just as much for protecting your business.

Best Massachusetts General Liability Insurer

Average Monthly General Liability Premium

$108These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Top-ranked digital platform with simple online tools

Among the lowest-priced general liability options

A- AM Best financial strength rating

High likelihood of customer recommendations and renewals

consShorter operating history than long-established insurers

Online-only model with no local agent access

Claims handling trails some competitors

Massachusetts businesses looking for streamlined service and digital policy control may find ERGO NEXT a good fit. The platform supports fast quoting, easy policy updates, and simple renewals across many industries. An A- AM Best rating supports confidence in the company’s financial position.

This provider works best for companies comfortable managing insurance online, especially those in technology, professional services, and contracting fields that benefit from industry-specific coverage options.

Overall Score 4.57 1 Affordability Score 4.31 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT places among the more affordable general liability providers in Massachusetts, with pricing that stays competitive across many business types. It performs especially well for specialized industries such as dental offices, home-based businesses, mortgage brokers, photographers and technology firms, where tailored coverage helps keep costs manageable.

Data filtered by:AccountantsAccountants $18 3 Business owners rate ERGO NEXT highly for its digital tools and ease of policy management. The platform lets users complete most tasks online without delays, appealing to owners who prefer self-service over agent-led support.

Claims handling ranks lower than some competitors, but feedback highlights smooth onboarding and simple account management that keeps the overall experience efficient for digitally focused businesses.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT offers general liability limits up to $2 million per claim and $4 million in total coverage, supporting businesses with higher exposure. Policies include contractor errors and omissions coverage and completed operations protection through the CG2010 endorsement, which suits construction and contract-driven work.

Additional endorsements support ongoing operations, allowing businesses to shape coverage around industry-specific risks. With options available across dozens of industries, ERGO NEXT delivers adaptable protection for Massachusetts companies with diverse needs.

Best Massachusetts Commercial General Liability

Average Monthly General Liability Premium

$86These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

A+ AM Best rating reflects strong financial backing

Top-ranked customer service with responsive support teams

Fast, well-organized claims handling

Leads overall customer satisfaction rankings

consOnline tools lag behind other providers

Most policies require working with an agent rather than buying fully online

The Hartford ranks as the best general liability insurance provider in Massachusetts for its excellent financial stability, competitive pricing and solid customer service.

With an A+ AM Best rating and top rankings in affordability and customer service, it offers reliable protection for small businesses across diverse industries. The Hartford works well for Massachusetts business owners who value financial security and responsive support when managing their liability risks.

Overall Score 4.57 1 Affordability Score 4.45 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 In Massachusetts, The Hartford offers general liability pricing that remains competitive across a wide range of industries. It performs well for businesses such as contractors, dental practices, engineering firms and HVAC services, where pricing stays balanced with coverage depth. This makes it a practical option for both professional services and trade-based businesses.

Data filtered by:AccountantsAccountants $18 2 The Hartford earns high marks for customer service and claims support nationwide, including in Massachusetts. Business owners often point to responsive representatives and efficient claim resolution as key strengths. Clear communication and reliable follow-through help maintain strong relationships with policyholders who value consistency.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford offers general liability policies with per-occurrence limits from $300,000 to $2 million and aggregate limits equal to twice that amount. Businesses can add product liability coverage for manufacturing or food-related operations, along with contractual liability protection.

Additional options include data breach coverage through business owner's policies, allowing Massachusetts companies to expand liability protection based on their operations.

Best Massachusetts Commercial General Liability: Runner-Up

Average Monthly General Liability Premium

$102These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.3/5

- pros

Strong customer service ranking with responsive support

Well-developed policy management tools

Top-ranked financial stability among surveyed providers

Long operating history with broad business insurance experience

consOnline tools lag behind many competitors

Pricing trends higher than several other providers

Nationwide ranks highly in Massachusetts for its excellent stability and solid customer service performance. Its competitive pricing and reliable claims handling make it appealing for service-based businesses like auto repair shops and professional services.

Massachusetts business owners who value personalized support will appreciate Nationwide's hands-on approach to insurance management.

Overall Score 4.53 2 Affordability Score 4.41 4 Customer Service Score 4.55 2 Coverage Score 4.61 4 Stability Score 4.98 1 In Massachusetts, Nationwide’s general liability pricing stays competitive across several industries, including auto repair, manufacturing, and professional services. While it does not lead on price alone, its rates align well with the depth of coverage and service support offered. Contractors, retailers and service providers often see solid value from this balance.

Data filtered by:AccountantsAccountants $21 4 Massachusetts policyholders rate Nationwide positively for policy management and customer service. Business owners often highlight clear communication and reliable claims handling as strengths. High renewal and recommendation rates point to durable relationships built on consistent service.

Overall Customer Score 4.16 6 Claims Process 3.90 5 Customer Service 4.30 3 Digital Experience 4.00 8 Overall Satisfaction 4.20 5 Policy Management 4.30 2 Recommend to Others 4.30 4 Renewal Likelihood 4.20 5 Nationwide offers general liability coverage with per-occurrence limits ranging from $300,000 to $2 million and aggregate limits set at twice the per-occurrence amount. Businesses can customize coverage with add-ons such as product liability protection and data breach coverage through business owner’s policies.

Broad form contractual liability coverage supports contractors and service providers that take on varied agreements. These options allow Massachusetts businesses to structure liability protection around their operational needs.

Cheapest General Liability Insurance Companies in Massachusetts

The Hartford offers the cheapest general liability insurance in Massachusetts at $86 per month, saving businesses $22 or 20.5% compared to the state average. Simply Business and Nationwide also provide affordable coverage options for Massachusetts businesses.

| The Hartford | $86 | $1,031 |

| Simply Business | $100 | $1,205 |

| Nationwide | $102 | $1,222 |

| Progressive Commercial | $105 | $1,261 |

| ERGO NEXT | $108 | $1,298 |

| Coverdash | $108 | $1,302 |

| Thimble | $112 | $1,348 |

| Hiscox | $120 | $1,434 |

| biBERK | $120 | $1,435 |

| Chubb | $125 | $1,496 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Massachusetts by Industry

MoneyGeek's research identifies the five most affordable general liability insurance providers across Massachusetts industries.

- The Hartford: Offers the lowest general liability rates in 23 of 81 industries across Massachusetts. It prices especially well for construction, electrical work, trucking and security services.

- Thimble: Provides the cheapest coverage in 14 industries, with strong pricing for service-based businesses such as cleaning companies, HVAC contractors and software developers.

- biBerk: Leads affordability in 13 industries. Personal service businesses, including barber shops, beauty salons and veterinary practices, see the most benefit.

- Simply Business: Posts the lowest rates in 12 industries, performing well for professional services like accounting, legal practices, consulting firms, and startups.

- Nationwide: Prices lowest in eight Massachusetts industries, especially in manufacturing, restaurants and real estate.

| Accountants | Simply Business | $15 | $181 |

Average Cost of General Liability Insurance in Massachusetts

General liability insurance costs Massachusetts small businesses an average of $108 monthly. The average general liability insurance cost for your company depends on your industry, business size, location and coverage limits.

Manufacturing companies pay higher premiums due to increased risk exposure, while accounting firms pay less because of lower claim potential. Sole proprietors generally pay lower rates compared to businesses with employees.

Average Cost of General Liability Insurance in Massachusetts by Industry

Massachusetts businesses pay anywhere from $18 monthly for drone operations to $965 for pressure washing companies when purchasing general liability coverage. Your industry determines where you fall within this range. Review this table to find typical rates for your specific business type.

| Accountants | $23 | $279 |

| Ad Agency | $37 | $447 |

| Automotive | $56 | $674 |

| Auto Repair | $160 | $1,922 |

| Bakery | $95 | $1,143 |

| Barber | $47 | $560 |

| Beauty Salon | $70 | $845 |

| Bounce House | $74 | $889 |

| Candle | $58 | $695 |

| Cannabis | $71 | $848 |

| Catering | $92 | $1,108 |

| Cleaning | $140 | $1,675 |

| Coffee Shop | $95 | $1,135 |

| Computer Programming | $31 | $368 |

| Computer Repair | $50 | $602 |

| Construction | $185 | $2,218 |

| Consulting | $23 | $278 |

| Contractor | $269 | $3,224 |

| Courier | $206 | $2,472 |

| Daycare | $35 | $416 |

| Dental | $23 | $272 |

| DJ | $27 | $320 |

| Dog Grooming | $67 | $803 |

| Drone | $18 | $211 |

| Ecommerce | $77 | $926 |

| Electrical | $119 | $1,422 |

| Engineering | $42 | $504 |

| Excavation | $491 | $5,891 |

| Florist | $45 | $541 |

| Food | $114 | $1,362 |

| Food Truck | $149 | $1,793 |

| Funeral Home | $64 | $764 |

| Gardening | $118 | $1,421 |

| Handyman | $257 | $3,088 |

| Home-based | $25 | $301 |

| Home-based | $48 | $579 |

| Hospitality | $69 | $824 |

| HVAC | $259 | $3,103 |

| Janitorial | $145 | $1,735 |

| Jewelry | $42 | $510 |

| Junk Removal | $171 | $2,055 |

| Lawn/Landscaping | $127 | $1,521 |

| Lawyers | $24 | $288 |

| Manufacturing | $67 | $808 |

| Marine | $30 | $354 |

| Massage | $101 | $1,212 |

| Mortgage Broker | $24 | $290 |

| Moving | $131 | $1,569 |

| Nonprofit | $38 | $454 |

| Painting | $152 | $1,819 |

| Party Rental | $84 | $1,006 |

| Personal Training | $25 | $302 |

| Pest Control | $34 | $408 |

| Pet | $59 | $709 |

| Pharmacy | $65 | $782 |

| Photography | $25 | $305 |

| Physical Therapy | $116 | $1,393 |

| Plumbing | $381 | $4,574 |

| Pressure Washing | $965 | $11,582 |

| Real Estate | $56 | $673 |

| Restaurant | $153 | $1,834 |

| Retail | $69 | $827 |

| Roofing | $409 | $4,909 |

| Security | $147 | $1,760 |

| Snack Bars | $124 | $1,485 |

| Software | $28 | $333 |

| Spa/Wellness | $112 | $1,350 |

| Speech Therapist | $33 | $395 |

| Startup | $30 | $362 |

| Tech/IT | $28 | $334 |

| Transportation | $40 | $476 |

| Travel | $22 | $264 |

| Tree Service | $137 | $1,642 |

| Trucking | $108 | $1,298 |

| Tutoring | $32 | $383 |

| Veterinary | $47 | $567 |

| Wedding Planning | $29 | $351 |

| Welding | $174 | $2,086 |

| Wholesale | $47 | $565 |

| Window Cleaning | $168 | $2,015 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Massachusetts General Liability Insurance Costs?

A range of factors can change how much Massachusetts businesses pay for general liability insurance coverage.

Massachusetts Legal Settlement Environment

Massachusetts doesn't place limits on damages in most personal injury cases. In 2024, one law firm reported 39 settlements above $1 million, with individual awards reaching as high as $7.7 million. A slip-and-fall claim that might resolve for $100,000 in another state can result in a $2 million verdict here.

Insurers study long-term jury outcomes across Massachusetts and factor those results into their pricing. Without statutory limits on payouts, carriers build larger reserves into each policy, which pushes premiums higher and directly affects what businesses pay for coverage.

Massachusetts Healthcare Cost Trends

Health care spending per person in Massachusetts jumped 8.6% from 2022 to 2023, hitting $11,153 annually - well above the state's 3.6% benchmark. Costs keep climbing because of higher service prices, more people seeking care and expensive new medications.

When someone gets hurt at your business, medical bills become the foundation of your claim. That broken arm treated at a Massachusetts hospital in 2022 for $15,000 now runs $16,290. Insurers set premiums based on current medical expenses in your area and Massachusetts ranks among the nation's highest.

Massachusetts Geographic Risk Variations

Boston businesses pay more than rural Massachusetts operations because of heavier foot traffic and more frequent claims. Rates shift considerably between cities based on local risk factors. Your street address matters. Downtown Boston restaurants serve hundreds of customers daily, creating more chances for accidents than small-town locations.

Urban areas bring higher crime rates affecting vandalism claims, heavier traffic increasing delivery incidents and juries awarding larger settlements. Insurers use ZIP code data showing Boston businesses file claims two to three times more often than rural businesses.

Massachusetts Comparative Fault Laws

Massachusetts uses a 51% comparative fault rule that allows injured parties to collect damages even when they share responsibility for an accident. A customer who trips over their own shoelace while walking through your store can still recover compensation if you're found partially at fault.

This system produces more successful claims compared to stricter fault standards in other states. Insurers account for this increased payout frequency when setting your premiums, knowing fewer claims get dismissed outright in Massachusetts courts.

How Much General Liability Insurance Do I Need in Massachusetts?

Most Massachusetts businesses have no state requirement to carry general liability insurance. Cannabis businesses are the exception and must maintain $1 million per occurrence and $2 million aggregate coverage to operate legally. Contractors also frequently need general liability or surety bonds for specific projects and licensing requirements, with rules varying by municipality.

Clients and landlords demand proof of coverage before signing contracts or leases, making general liability practically necessary. We recommend $1 million per occurrence and $2 million aggregate limits for Massachusetts small business owners. These requirements for commercial general liability insurance meet most contractual obligations and cover legal defense, settlements and medical expenses when customer injuries or property damage claims happen.

Note: State insurance requirements change regularly. Always verify the current rules with the Massachusetts Division of Insurance or a licensed insurance agent before purchasing coverage.

How to Choose the Best General Liability Insurance in Massachusetts

Choosing general liability insurance in Massachusetts means finding coverage that fits your business risks and budget. Getting business insurance starts with understanding your exposure to customer injuries and property damage claims, then adding coverage types that protect your specific operations.

- 1Determine Coverage Needs

Massachusetts doesn’t require general liability insurance for most businesses, but cannabis operations must carry $1 million per occurrence and $2 million in aggregate business insurance coverage.

Standard limits usually range from $500,000 to $2 million per occurrence and many clients and landlords ask for proof of insurance before they sign contracts. Check your lease agreements and client contracts when choosing limits so your policy meets their specific requirements.

- 2Prepare Business Information

Gather information insurers need for accurate quotes, including annual revenue, employee count, physical location and business classification code. Massachusetts insurers assess premiums based on industry risk, your location within the state and business size. Prepare your EIN, business registration from the Massachusetts Secretary of State and any required licenses before requesting quotes to speed up the application process.

- 3Compare Multiple Quotes

Request quotes from at least three insurers licensed by the Massachusetts Division of Insurance, as rates can vary between carriers. Compare policy deductibles, coverage limits and whether legal defense costs count toward or stay outside your policy limits. Understanding these differences in business insurance costs helps you evaluate the true value of each policy beyond the annual premium.

- 4Look Beyond Premium

Don't select a policy based solely on the lowest price, as cheap business insurance often comes with coverage gaps. Read policy exclusions carefully and confirm whether legal defense costs are included or subtract from your policy limits. Common exclusions like professional errors, pollution liability or employee injuries require separate Massachusetts policies, so identifying gaps protects your business completely.

- 5Verify Insurer Credibility

Check insurer legitimacy through the Massachusetts Division of Insurance's online license verification tool and review AM Best financial strength ratings. Research complaint ratios and customer reviews to spot companies with poor claims-handling reputations in Massachusetts. Strong financial backing matters when large claims occur, so select insurers with solid track records and adequate reserves to pay claims.

- 6Ask About Discounts

Massachusetts insurers offer discounts for bundled policies, safety programs, claims-free histories and annual premium payments. Combining general liability with commercial auto or property coverage in a business owner's policy can reduce costs by 10% to 25%. Safety certifications, OSHA training programs and security systems can lower your premiums by 10% to 20%.

- 7Obtain Certificate Documentation

A certificate of insurance proves your coverage to Massachusetts clients, landlords and contractors who require proof before doing business. Many insurers provide digital certificates instantly through online portals, while others take up to 48 hours for processing. Keep your agent's contact information accessible for urgent certificate requests to prevent project delays.

- 8Review Coverage Annually

Reassess your Massachusetts general liability coverage each year, especially after hiring employees, expanding services or increasing revenue. Compare quotes 60 to 90 days before your policy renewal to find better rates or adjust limits based on business changes. Maintaining current coverage prevents compliance gaps and avoids unexpected audit adjustments that increase costs later.

Top General Liability Insurance in Massachusetts: Bottom Line

Finding the right general liability insurance in Massachusetts starts with understanding your specific business needs and thoroughly researching available options. ERGO NEXT, The Hartford and Nationwide emerge as leading providers in the state. Your ideal choice depends on your industry type, business size and available budget. Compare quotes from multiple insurers and verify their credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Center for Health Information and Analysis. "Annual Report on the Performance of the Massachusetts Health Care System (March 2025)." Accessed February 7, 2026.

- Massachusetts General Laws. "Chapter 231, Section 85: Comparative Negligence." Accessed February 7, 2026.

- Massachusetts Health Policy Commission. "Health Care Spending Grew Faster Than Inflation, Labor Costs, and Income, Exacerbating Affordability Challenges for Massachusetts Residents." Accessed February 7, 2026.

- Massachusetts Lawyers Weekly. "Leaders in the Law 2025." Accessed February 7, 2026.