To get you the information you need fast, we've answered common questions about BOP insurance costs:

BOP Insurance Cost

According to our extensive rate analysis of 79 industries and all 50 states, BOP insurance costs average $147/mo ($1,767/yr) for small businesses.

Get matched to the top BOP insurer for your business needs below.

Updated: January 6, 2026

Advertising & Editorial Disclosure

Business Owners Policy Cost: FAQ Fast Answers

How much does BOP insurance cost on average?

For most small businesses, BOP or business owners policies cost an average of $147 per month or $1,767 per year. However, depending on your business details, rates can range anywhere from $22 and $1,607 monthly.

What factors affect the cost of BOP insurance?

In general, the following factors affect your BOP insurance costs:

- Business size and number of employees

- Coverage limits and add-ons

- Claims history

- Business industry or area

- Property values

- Location

Which industries pay the most or least for BOP insurance?

Based on our research, drone related businesses pay the least for BOP insurance with an average rate of $25 per month or $297 per year. The most expensive industry for this type of coverage is pressure washing which has an astounding average cost of $1,346 monthly or $16,158 annually.

How can I lower my BOP insurance cost?

In general, lowering BOP insurance costs involves removing coverage items you don't need, raising your deductible, bundling with other policies and paying annually. On the business operations end you can also get cheaper business owners' policies by instituting safety programs and documentation, not making claims for small expenses and ensuring that you solve customer issues fast.

We researched hundreds of thousands of quotes from 79 industries and all 50 states specific to BOP policy costs for the top 10 business insurance providers to give you the most representative averages based on our methodology's base profile:

- 3 total people (owner plus two employees)

- $150,000 annual payroll

- $300,000 annual revenue

- $1 million per occurrence and $2 million total coverage limits

- $5,000 business property coverage

How Much Does BOP Insurance Cost?

BOP insurance costs an average of $1,767 yearly based on a two-person business with $300,000 in annual revenue and $150,000 in payroll with a $1 million per claim $2 million aggregate general liability policy with $5,000 of property coverage. While this is the case, your premium can range from $297 to $16,158 annually depending on your business's specific risk and location.

Get Matched With Cheap BOP Insurance Providers

Select your industry and state to get a cheap customized BOP insurance quote.

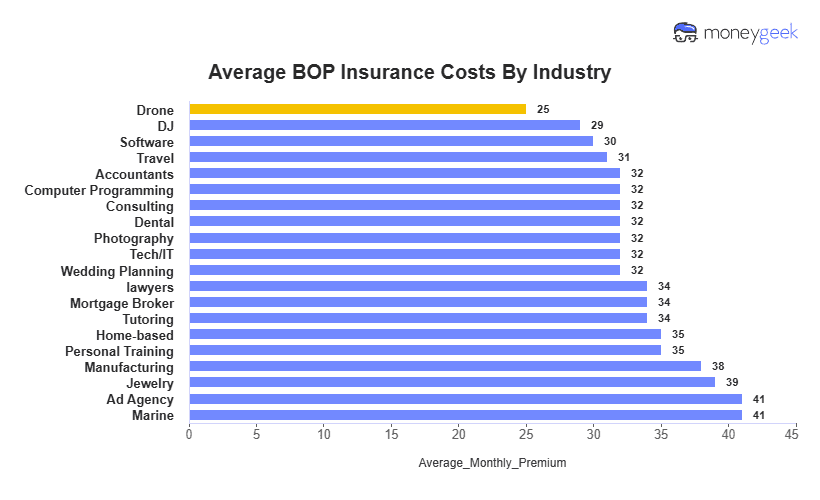

How Much Does BOP Insurance Cost by Industry?

The average cost of BOP insurance at the industry level ranges from $25/mo for drone businesses to $1,346/mo for pressure washing companies. Based on the average cost for business owners' policies, the industries we studied fall into the following rate categories:

- Below average BOP costs (Less than $120/mo): Tech related businesses (software, IT, computer repair), marketing/consulting, daycares, professional consumer services (barbers for example), retail.

- Average BOP costs ($120/mo to $170/mo): Catering, coffee shops, landscaping, massage, spa and electrician businesses.

- Higher than average BOP costs (Over $170/mo): Most contractors and those in construction, higher risk food businesses (food trucks, restaurants), cleaning firms and pressure washing.

| Accountants | $32 | $390 |

| Ad Agency | $41 | $496 |

| Auto Repair | $223 | $2,675 |

| Automotive | $79 | $944 |

| Bakery | $134 | $1,606 |

| Barber | $54 | $645 |

| Beauty Salon | $99 | $1,188 |

| Bounce House | $104 | $1,249 |

| Candle | $81 | $975 |

| Cannabis | $99 | $1,191 |

| Catering | $99 | $1,192 |

| Cleaning | $188 | $2,259 |

| Coffee Shop | $133 | $1,594 |

| Computer Programming | $32 | $386 |

| Computer Repair | $67 | $806 |

| Construction | $228 | $2,736 |

| Consulting | $32 | $388 |

| Contractor | $378 | $4,531 |

| Courier | $289 | $3,464 |

| DJ | $29 | $345 |

| Daycare | $49 | $583 |

| Dental | $32 | $381 |

| Dog Grooming | $93 | $1,120 |

| Drone | $25 | $297 |

| Ecommerce | $104 | $1,250 |

| Electrical | $166 | $1,989 |

| Engineering | $49 | $583 |

| Excavation | $692 | $8,299 |

| Florist | $59 | $713 |

| Food | $158 | $1,898 |

| Food Truck | $207 | $2,485 |

| Funeral Home | $89 | $1,067 |

| Gardening | $158 | $1,890 |

| HVAC | $361 | $4,337 |

| Handyman | $363 | $4,353 |

| Home-based | $35 | $420 |

| Hospitality | $95 | $1,143 |

| Janitorial | $202 | $2,426 |

| Jewelry | $39 | $467 |

| Junk Removal | $240 | $2,884 |

| Lawn/Landscaping | $177 | $2,124 |

| Manufacturing | $38 | $454 |

| Marine | $41 | $496 |

| Massage | $141 | $1,689 |

| Mortgage Broker | $34 | $405 |

| Moving | $183 | $2,194 |

| Nonprofit | $53 | $639 |

| Painting | $211 | $2,536 |

| Party Rental | $117 | $1,407 |

| Personal Training | $35 | $426 |

| Pest Control | $48 | $573 |

| Pet | $83 | $997 |

| Pharmacy | $91 | $1,090 |

| Photography | $32 | $385 |

| Physical Therapy | $41 | $494 |

| Plumbing | $535 | $6,415 |

| Pressure Washing | $1,346 | $16,158 |

| Real Estate | $79 | $943 |

| Restaurant | $214 | $2,566 |

| Retail | $98 | $1,174 |

| Roofing | $567 | $6,806 |

| Security | $206 | $2,475 |

| Snack Bars | $175 | $2,095 |

| Software | $30 | $363 |

| Spa/Wellness | $156 | $1,874 |

| Speech Therapist | $46 | $555 |

| Startup | $43 | $510 |

| Tech/IT | $32 | $386 |

| Transportation | $56 | $669 |

| Travel | $31 | $370 |

| Tree Service | $192 | $2,306 |

| Trucking | $152 | $1,822 |

| Tutoring | $34 | $407 |

| Veterinary | $67 | $799 |

| Wedding Planning | $32 | $382 |

| Welding | $244 | $2,928 |

| Wholesale | $66 | $794 |

| Window Cleaning | $234 | $2,813 |

| lawyers | $34 | $403 |

Note: We used quotes from 10 major insurers for businesses with three employees, $150,000 payroll and $300,000 revenue. Expect different pricing for your unique situation and state.

How Much Does BOP Insurance Cost by State?

Average BOP insurance costs vary by state ranging from $128 to $171. If you operate in low-litigation states (those with fewer lawsuits against businesses) like Maine, North Dakota or Kentucky, you'll pay the lower end of this range under $140 monthly. Coverage costs more in high-lawsuit states like New York, Pennsylvania and New Jersey between $168 and $171 because insurers face frequent claims and larger payouts.

| Alabama | $144 | $1,734 |

| Alaska | $132 | $1,586 |

| Arizona | $139 | $1,668 |

| Arkansas | $141 | $1,696 |

| California | $164 | $1,966 |

| Colorado | $146 | $1,754 |

| Connecticut | $160 | $1,919 |

| Delaware | $158 | $1,894 |

| Florida | $160 | $1,916 |

| Georgia | $149 | $1,793 |

| Hawaii | $155 | $1,858 |

| Idaho | $140 | $1,679 |

| Illinois | $162 | $1,939 |

| Indiana | $144 | $1,725 |

| Iowa | $141 | $1,688 |

| Kansas | $144 | $1,722 |

| Kentucky | $137 | $1,639 |

| Louisiana | $167 | $2,000 |

| Maine | $128 | $1,536 |

| Maryland | $140 | $1,686 |

| Massachusetts | $155 | $1,858 |

| Michigan | $140 | $1,677 |

| Minnesota | $138 | $1,655 |

| Mississippi | $148 | $1,780 |

| Missouri | $145 | $1,745 |

| Montana | $146 | $1,758 |

| Nebraska | $140 | $1,677 |

| Nevada | $167 | $2,000 |

| New Hampshire | $146 | $1,757 |

| New Jersey | $168 | $2,012 |

| New Mexico | $149 | $1,783 |

| New York | $171 | $2,055 |

| North Carolina | $128 | $1,532 |

| North Dakota | $128 | $1,535 |

| Ohio | $137 | $1,644 |

| Oklahoma | $138 | $1,656 |

| Oregon | $137 | $1,647 |

| Pennsylvania | $171 | $2,046 |

| Rhode Island | $162 | $1,947 |

| South Carolina | $152 | $1,827 |

| South Dakota | $138 | $1,655 |

| Tennessee | $144 | $1,724 |

| Texas | $148 | $1,781 |

| Utah | $139 | $1,673 |

| Vermont | $141 | $1,693 |

| Virginia | $134 | $1,611 |

| Washington | $167 | $2,007 |

| West Virginia | $155 | $1,855 |

| Wisconsin | $144 | $1,731 |

| Wyoming | $137 | $1,642 |

Note: We gathered quotes for businesses with three employees, $150,000 payroll and $300,000 revenue from 10 major insurers in each state. Your BOP costs will vary based on your industry, business size and claims history.

What Affects the Business Owners Policy (BOP) Insurance Costs?

Several factors affect your BOP insurance rates including:

- Industry Type: What your business does sets your baseline premium more than anything else. Software companies pay far less than roofing contractors or pressure washing services because the risk is lower.

- Geographic Location: Your state's legal climate and claims patterns matter. States with tort reform and less litigation have lower premiums. High-lawsuit areas cost more.

- Business Size: More employees, customer interactions and revenue mean more chances for claims. A solo consultant has minimal claim risk compared to a larger firm with multiple employees and high customer volume.

- Property Values: BOP bundles property coverage with general liability, so your physical assets affect your premium. Businesses with expensive specialized equipment pay much more than home-based operations with minimal property.

- Past Claims History: Your claims history affects BOP rates. Clean records get the best pricing. One liability claim can trigger rate increases that last for years. Multiple claims push premiums even higher.

- Coverage Limits: Higher liability and property limits cost more. The protection you buy directly affects what you pay.

How To Lower BOP Insurance Cost

Try these strategies to lower BOP insurance costs:

- 1Choose the Right BOP Insurance Coverage Limits

Don't over-insure or under-insure. BOP bundles general liability with commercial property coverage, so review both carefully. Work with an agent to set appropriate liability limits based on your actual risk and property coverage that matches your assets' replacement value. Excessive coverage or inflated equipment values waste money. Too little coverage leaves you exposed.

- 2Get Multiple BOP Insurance Quotes

Get at least three quotes to find affordable business insurance that fits your budget. Industries with substantial property values or heavy customer interaction see wide rate differences, so compare options.

- 3Raise Your BOP Deductible Strategically

A higher deductible lowers monthly premiums by reducing the insurer's exposure on liability and property claims. BOP deductibles usually apply to the property portion. Higher deductibles mean you'll handle smaller property losses yourself. Make sure you can afford potential claims for equipment damage, theft or business interruption.

- 4Bundle with Business Owners Policies With Other Plans

Most insurers give 5% to 15% discounts when you combine BOP with other coverage types like workers' comp, commercial auto or professional liability. On a $147 monthly BOP policy, bundling saves $7 to $22 monthly. Add more policies to save more.

- 5Reduce BOP Insurance Claims

Your claims history affects long-term costs more than anything else. If you've never filed a claim, you'll pay standard rates. File one claim and your BOP premiums jump 25% to 100% for several years. A single liability incident can push your $147 monthly premium to $185 to $295.

- 6Move To Locations With Lower BOP Insurance Risk

Location affects costs if you operate in multiple states. Moving from high-lawsuit states like New York to business-friendly states like North Carolina saves $43 monthly per location based on our research. Businesses with more than three locations save over $1,500 annually.

Average Cost of BOP Insurance: Bottom Line

Although BOP insurance costs an average of $147 per month, our research shows it can range from $22 to $1,607 monthly based on your industry, location, claims history and business size. When shopping for quotes, you don't have to accept the first one you get. Adjust coverage limits, raise deductibles and bundle policies to find cheaper premiums.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.