We researched best business insurance options to bring you clear answers about general liability coverage in South Dakota. Our analysis covers the most common questions business owners ask:

Best General Liability Insurance in South Dakota

ERGO NEXT is the best general liability provider in South Dakota, while The Hartford offers the lowest rates starting at $76 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in South Dakota: Fast Answers

Which company offers the best general liability insurance in South Dakota?

ERGO NEXT and The Hartford tie as the best general liability insurance companies in South Dakota, both earning 4.56 out of 5. The Hartford offers the most affordable coverage at $76 per month with excellent claims handling. ERGO NEXT provides strong digital tools and customer service for $96 per month.

Who offers the cheapest general liability insurance in South Dakota?

The cheapest general liability insurance companies in South Dakota are:

- The Hartford: $76 per month

- Simply Business: $89 per month

- Nationwide: $91 per month

- Progressive: $93 per month

- ERGO NEXT: $96 per month

Do South Dakota businesses legally need general liability insurance?

South Dakota doesn't legally require most businesses to carry general liability insurance. Certain licensed professionals like contractors and electricians need coverage to maintain their licenses. Local municipalities set their own requirements, and most landlords and clients demand proof of insurance before signing contracts.

How much does general liability insurance cost in South Dakota?

General liability insurance costs between $16 and $860 per month for small South Dakota businesses with two employees. Drone services often pay the lowest rates, while pressure washing companies tend to have the highest premiums. Your actual cost depends on your industry risk level, business location, coverage limits, and employee count.

Best General Liability Insurance Companies in South Dakota

ERGO NEXT and The Hartford are our joint top picks for general liability insurance in South Dakota. ERGO NEXT delivers excellent customer service and reliable coverage options, while The Hartford offers competitive pricing and strong financial strength.

Nationwide is also a dependable choice, with good customer service scores and solid stability for small businesses that want consistent financial protection.

| ERGO NEXT | 4.56 | $96 |

| The Hartford | 4.56 | $76 |

| Nationwide | 4.52 | $91 |

| Simply Business | 4.48 | $89 |

| Coverdash | 4.37 | $97 |

| Thimble | 4.35 | $100 |

| biBERK | 4.29 | $107 |

| Chubb | 4.27 | $111 |

| Progressive Commercial | 4.27 | $93 |

| Hiscox | 4.18 | $107 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap South Dakota General Liability Insurer

Select your industry and state to get a customized South Dakota general liability insurance quote.

General liability insurance covers customer injuries and property damage for your South Dakota business, but most companies need additional financial protection. Explore these related coverage options:

Best South Dakota General Liability Insurance Reviews

Finding the best general liability insurance in South Dakota requires looking beyond affordable rates to consider coverage quality and customer service. Our research analyzed top business insurers to help you make the right choice.

ERGO NEXT

Best South Dakota General Liability Insurer

Average Monthly General Liability Premium

$96These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first in customer service

Ranks second for coverage options

Instant certificates and 24/7 online policy management

Munich Re financial backing since acquisition

consPremiums rank sixth, higher costs than most competitors

Newer company with shorter operating history

Not included in major third-party satisfaction studies

ERGO NEXT leads South Dakota in customer service and offers strong digital capabilities with broad coverage options. Founded in 2016 and backed by Munich Re, it generates instant quotes and completes coverage setup in minutes.

Overall Score 4.56 1 Affordability Score 4.27 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT charges $96 monthly ($1,156 annually) for general liability coverage in South Dakota. The company offers competitive rates for seven industries, including dental practices, tech companies and home-based businesses.

Data filtered by:AccountantsAccountants $16 3 ERGO NEXT's digital capabilities create a strong customer experience in South Dakota. The online platform enables 24/7 policy management and instant certificate generation.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT offers general liability coverage with customizable limits for over 1,300 business types. Coverage includes automatic protection for completed operations and personal injuries.

ERGO NEXT excludes coverage for independent contractors and business interruption. Businesses can bundle policies for broader financial protection and cost savings.

Nationwide

Best South Dakota Commercial General Liability: Runner-Up

Average Monthly General Liability Premium

$91These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.3/5

- pros

Ranks first in financial stability; reliable claim payments

Excellent customer service with knowledgeable representatives

Strong A+ AM Best rating shows financial strength

Competitive coverage options for most business needs

consLower digital experience ranking limits online self-service

Higher rates than some budget-focused competitors

Nationwide leads South Dakota general liability insurance with strong customer service and excellent financial stability. The company holds an A+ AM Best rating and high scores for stability and customer support, delivering reliable financial protection backed by responsive service.

South Dakota businesses that value personalized support and established expertise, especially in electrical, manufacturing and professional services, benefit from Nationwide's approach.

Overall Score 4.52 2 Affordability Score 4.38 4 Customer Service Score 4.55 2 Coverage Score 4.61 4 Stability Score 4.98 1 Nationwide charges $91 monthly on average for general liability coverage in South Dakota. The company ranks among the most affordable options for electrical contractors, manufacturing firms and professional services.

Data filtered by:AccountantsAccountants $19 4 Customer feedback highlights Nationwide's excellence in policy management and customer service, with strong claims handling ratings. The company earns high marks for renewal experiences and overall satisfaction across key service areas.

Overall Customer Score 4.16 6 Claims Process 3.90 5 Customer Service 4.30 3 Digital Experience 4.00 8 Overall Satisfaction 4.20 5 Policy Management 4.30 2 Recommend to Others 4.30 4 Renewal Likelihood 4.20 5 Nationwide offers general liability policies with coverage limits from $500,000 to $2 million per occurrence and aggregate limits up to $4 million. Businesses can add product liability and professional liability or bundle with a business owner's policy for broader coverage.

The company offers flexible payment terms and industry-specific endorsements for South Dakota businesses.

Cheapest General Liability Insurance Companies in South Dakota

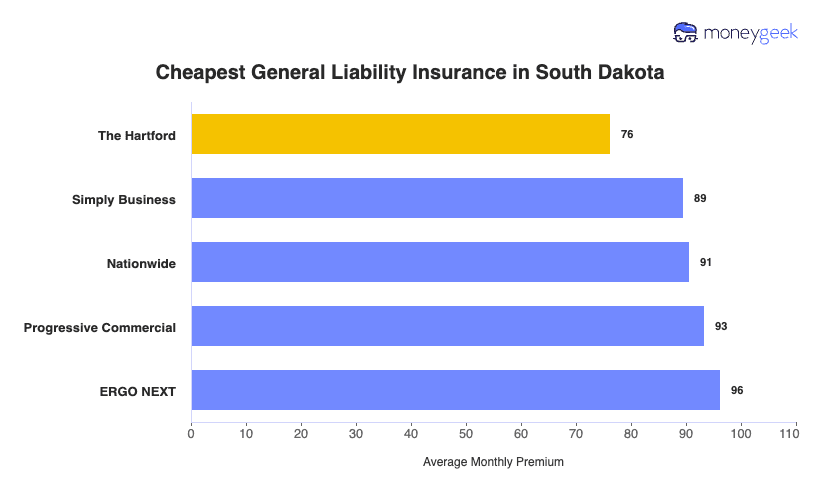

The Hartford offers the most affordable general liability insurance in South Dakota at $76 monthly — saving businesses $20 or 21% compared to the state average. Simply Business and Nationwide also offer competitive rates for small businesses.

| The Hartford | $76 | $916 |

| Simply Business | $89 | $1,074 |

| Nationwide | $91 | $1,088 |

| Progressive Commercial | $93 | $1,121 |

| ERGO NEXT | $96 | $1,156 |

| Coverdash | $97 | $1,160 |

| Thimble | $100 | $1,204 |

| Hiscox | $107 | $1,281 |

| biBERK | $107 | $1,282 |

| Chubb | $111 | $1,333 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in South Dakota by Industry

MoneyGeek's research identifies the cheapest general liability insurance providers across industries in South Dakota.

- The Hartford: Offers the most affordable coverage in 23 industries, leading in construction, cleaning, food trucks, transportation and home-based businesses.

- Simply Business: Provides cheap rates for 11 industries, excelling in professional services like accounting, consulting, legal practices and software companies.

- Thimble: Matches Simply Business with affordability wins in 11 industries, specializing in service businesses including bakeries, barbershops, HVAC and roofing.

- biBerk: Ranks as the cheapest provider for nine industries, performing well in catering, contracting, engineering and veterinary services.

- Coverdash and ERGO NEXT: Each lead in seven industries. Coverdash dominates automotive and trucking sectors, while ERGO NEXT excels in professional services like dental practices, photography and tech companies.

| Accountants | Simply Business | $14 | $162 |

Average Cost of General Liability Insurance in South Dakota

General liability insurance costs South Dakota small businesses an average of $96 per month. The average cost of general liability coverage depends on your industry, business size, location and coverage limits.

Manufacturing companies have higher premiums because of increased risk exposure, while accounting firms pay less because of lower liability concerns. Sole proprietors pay lower rates compared to businesses with multiple employees.

Average Cost of General Liability Insurance in South Dakota by Industry

Monthly costs for general liability coverage in South Dakota vary widely by industry. Drone businesses pay as little as $16 per month, while pressure washing companies pay up to $860. Review this table to find typical rates for your specific business type.

| Accountants | $21 | $248 |

| Ad Agency | $33 | $399 |

| Automotive | $50 | $601 |

| Auto Repair | $143 | $1,713 |

| Bakery | $85 | $1,018 |

| Barber | $42 | $500 |

| Beauty Salon | $63 | $753 |

| Bounce House | $66 | $792 |

| Candle | $52 | $619 |

| Cannabis | $63 | $755 |

| Catering | $82 | $989 |

| Cleaning | $124 | $1,493 |

| Coffee Shop | $84 | $1,011 |

| Computer Programming | $27 | $328 |

| Computer Repair | $45 | $537 |

| Construction | $165 | $1,977 |

| Consulting | $21 | $247 |

| Contractor | $239 | $2,873 |

| Courier | $184 | $2,203 |

| Daycare | $31 | $371 |

| Dental | $20 | $242 |

| DJ | $24 | $285 |

| Dog Grooming | $60 | $715 |

| Drone | $16 | $188 |

| Ecommerce | $69 | $825 |

| Electrical | $106 | $1,268 |

| Engineering | $37 | $449 |

| Excavation | $437 | $5,249 |

| Florist | $40 | $483 |

| Food | $101 | $1,214 |

| Food Truck | $133 | $1,598 |

| Funeral Home | $57 | $681 |

| Gardening | $106 | $1,267 |

| Handyman | $229 | $2,752 |

| Home-based | $22 | $268 |

| Home-based | $43 | $516 |

| Hospitality | $61 | $735 |

| HVAC | $230 | $2,765 |

| Janitorial | $129 | $1,546 |

| Jewelry | $38 | $454 |

| Junk Removal | $153 | $1,832 |

| Lawn/Landscaping | $113 | $1,355 |

| Lawyers | $21 | $257 |

| Manufacturing | $60 | $721 |

| Marine | $26 | $316 |

| Massage | $90 | $1,080 |

| Mortgage Broker | $22 | $258 |

| Moving | $117 | $1,399 |

| Nonprofit | $34 | $404 |

| Painting | $135 | $1,621 |

| Party Rental | $75 | $896 |

| Personal Training | $22 | $269 |

| Pest Control | $30 | $364 |

| Pet | $53 | $632 |

| Pharmacy | $58 | $697 |

| Photography | $23 | $272 |

| Physical Therapy | $104 | $1,244 |

| Plumbing | $340 | $4,075 |

| Pressure Washing | $860 | $10,319 |

| Real Estate | $50 | $599 |

| Restaurant | $136 | $1,635 |

| Retail | $61 | $737 |

| Roofing | $365 | $4,374 |

| Security | $131 | $1,568 |

| Snack Bars | $110 | $1,323 |

| Software | $25 | $297 |

| Spa/Wellness | $100 | $1,203 |

| Speech Therapist | $29 | $352 |

| Startup | $27 | $323 |

| Tech/IT | $25 | $298 |

| Transportation | $35 | $424 |

| Travel | $20 | $235 |

| Tree Service | $122 | $1,463 |

| Trucking | $96 | $1,156 |

| Tutoring | $28 | $341 |

| Veterinary | $42 | $505 |

| Wedding Planning | $26 | $313 |

| Welding | $155 | $1,859 |

| Wholesale | $42 | $504 |

| Window Cleaning | $150 | $1,795 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect South Dakota General Liability Insurance Costs?

Many factors determine general liability insurance costs for South Dakota businesses.

South Dakota Weather and Climate Conditions

South Dakota's extreme weather increases general liability rates through higher premises liability claims. The state experiences 134 hail events annually that cause $12.7 million in losses, along with harsh winters with temperatures near 0°F and about 38 inches of snow.

Hailstorms damage buildings and outdoor areas, creating customer hazards, while ice accumulation on walkways drives slip-and-fall claims higher. Insurers raise premiums for South Dakota businesses to account for more frequent weather-related premises liability incidents.

South Dakota Economic and Industry Landscape

South Dakota's agriculture-dominated economy and tourism industry increase rates for businesses in these sectors. Agricultural operations have higher premiums because of product liability from crops and livestock, plus visitor injury risks on working farms that offer agritourism.

Tourism businesses pay higher rates because heavy customer foot traffic during peak seasons, like the Sturgis Rally and Mount Rushmore visits, increases premises liability claims. Insurers charge more when businesses operate in agriculture (product and animal liability exposures) or tourism (concentrated seasonal customer volume raising injury risk).

South Dakota Population and Geographic Distribution

South Dakota's low population density lowers general liability rates for rural businesses compared to urban operations. Sparse customer foot traffic in rural areas reduces slip-and-fall frequency and customer injury claims, letting insurers offer lower premiums. Businesses in Sioux Falls or Rapid City pay higher rates that reflect claim frequencies similar to other mid-sized cities.

Urban locations mean more customer interactions and higher injury risk, driving premiums up. Insurers adjust rates based on business location and customer exposure levels.

South Dakota Legal and Regulatory Environment

South Dakota uses a "slight/gross negligence" standard that affects claim costs compared to other states. Plaintiffs can only recover damages if their negligence was "slight" compared to the defendant's "gross" negligence, without specific percentage thresholds.

This standard makes liability outcomes harder to predict than traditional comparative negligence states because courts lack clear guidance on what constitutes "slight" versus substantial fault. Uncertainty around claim viability and settlement values complicates insurer risk assessment, leading to higher premiums that account for variable legal outcomes and litigation costs.

How Much General Liability Insurance Do I Need in South Dakota?

South Dakota has minimal statewide general liability insurance requirements, with most mandates determined at the city level for contractors. General liability insurance requirements vary by location, ranging from $300,000 in Sioux Falls to $1 million in Rapid City.

Cities like Brookings and Watertown also require coverage for residential contractors but don't specify minimum amounts publicly, so verify requirements with local building departments before starting work. These requirements outline the coverage amounts mandated by South Dakota law:

- Residential Building Contractors: Sioux Falls requires residential building contractors to maintain $300,000 in general liability coverage. This applies to anyone performing work on single-family homes, duplexes, or townhouses that requires a building permit.

- Plumbers: Licensed plumbers must carry $300,000 in general liability insurance along with a $20,000 compliance bond. The coverage protects clients from property damage or accidents during plumbing installations and repairs.

- Electricians: Electricians operating in Sioux Falls need $300,000 in general liability coverage plus a $20,000 bond. This requirement applies whether you're installing new systems or performing maintenance work.

Rapid City requires all licensed contractors, regardless of license class, to maintain $1 million in general aggregate liability with $300,000 fire damage and $1 million per occurrence. Class A covers all structure types, Class B handles residential buildings (single-family and two-family dwellings), and Class C includes specialized trades like plumbing, mechanical and electrical work.

*State insurance requirements may change without notice. Always verify current requirements with the South Dakota Department of Labor and Regulation Division of Insurance or a licensed insurance agent before purchasing coverage.

How to Choose the Best General Liability Insurance in South Dakota

Choosing the right general liability insurance requires understanding business risks and budget constraints. Getting business insurance that covers liability claims and industry-specific exposures protects South Dakota businesses from lawsuits, property damage, and unexpected financial losses.

- 1Determine Your Coverage Needs

South Dakota doesn't mandate general liability insurance statewide, but cities like Sioux Falls and Rapid City require contractors to carry $300,000 to $1 million in business insurance coverage. Your industry's risk level, business size and contract obligations determine the right limits for your policy.

Most South Dakota businesses choose $1 million per occurrence and $2 million aggregate. Review client contracts and lease agreements closely — many specify exact coverage amounts before work begins.

- 2Prepare Business Information

Gather your federal EIN, South Dakota contractor's excise tax license (if applicable), annual revenue figures and employee count before requesting quotes. South Dakota insurers assess premiums based on business classification code, operational location and claims history. Business registration documents and tax permits speed up the application process and help insurers generate accurate quotes.

- 3Compare Multiple Quotes

Request quotes from at least three insurers licensed with the South Dakota Division of Insurance. Premium differences can reach several hundred dollars annually for identical coverage limits because of varying underwriting criteria and risk assessments. Compare deductibles, coverage limits and whether defense costs apply within or outside policy limits.

- 4Look Beyond Price

Cheap business insurance often includes restrictive exclusions or lower coverage limits that leave gaps in protection when claims arise. South Dakota's "slight/gross negligence" tort standard affects litigation outcomes, making your policy's legal defense provisions critical to understand. Read exclusions for professional services, pollution, cyber liability and employee injuries. These require separate policies and aren't covered under standard general liability.

- 5Verify Insurer Credentials

Check insurer licensing status through the South Dakota Division of Insurance website before purchasing any policy. Review AM Best financial strength ratings of A- or higher and examine complaint ratios through the National Association of Insurance Commissioners database. Verify insurance company complaints and enforcement actions through South Dakota's system to identify carriers with poor claims-handling records.

- 6Ask About Discounts

South Dakota insurers commonly offer discounts for bundling general liability with commercial auto or workers' compensation coverage, reducing premiums by 15% to 25%. Maintaining a claims-free history, implementing documented safety programs or paying annually instead of monthly can lower costs.

Contact multiple agents to compare available discounts. Some carriers offer credits for industry-specific certifications or membership in South Dakota business associations.

- 7Get Certificate of Insurance

Most South Dakota commercial leases, client contracts and municipal permits require a certificate of insurance (COI) as proof of coverage before work begins. Cities like Sioux Falls and Rapid City require contractors to list the municipality as the certificate holder when applying for licenses.

Request digital COIs from your insurer or agent. Many carriers offer instant access through online portals, while others need 24 to 48 hours to process the request.

- 8Review Coverage Annually

Reassess general liability coverage each year, especially after hiring employees, expanding into new South Dakota cities with different requirements or increasing revenue. Review renewal quotes 60 to 90 days before policy expiration to identify better pricing or coverage options.

South Dakota's contractor excise tax requirements and local licensing rules change periodically. Annual reviews help businesses maintain compliance and avoid coverage gaps.

Top General Liability Insurance in South Dakota: Bottom Line

Finding the right general liability insurance in South Dakota starts with knowing your business needs and comparing providers thoroughly. ERGO NEXT, The Hartford and Nationwide are leading options, but your ideal choice depends on your industry type, company size and budget. Get quotes from multiple insurers and verify their credentials before deciding.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Justia. "Comparative & Contributory Negligence Laws: 50-State Survey." Accessed February 20, 2026.

- NOAA National Centers for Environmental Information. "Billion-Dollar Weather and Climate Disasters | South Dakota." Accessed February 20, 2026.

- NOAA National Severe Storms Laboratory. "Severe Weather 101: Hail Basics." Accessed February 20, 2026.

- National Weather Service. "Record Setting Hail Event in Vivian, South Dakota on July 23, 2010." Accessed February 20, 2026.

- U.S. Bureau of Economic Analysis. "Gross Domestic Product by State, 4th Quarter 2024 and Annual 2024." Accessed February 20, 2026.