MoneyGeek's research shows New Jersey business owners need reliable best business insurance guidance. Our FAQ section answers common general liability insurance questions with data-driven insights:

Best General Liability Insurance in New Jersey

The Hartford offers the best and cheapest general liability coverage in New Jersey, starting at $93 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in New Jersey: Fast Answers

Which company offers the best general liability insurance in New Jersey?

The Hartford ranks as the best general liability insurance company in New Jersey with a 4.56 overall score out of 5. It provides affordable coverage at $93 per month with strong claims handling. ERGO NEXT comes in second place with a 4.55 score, featuring excellent digital tools and customer service for $117 per month.

Who offers the cheapest general liability insurance in New Jersey?

The cheapest general liability insurance companies in New Jersey are:

- The Hartford: $93 per month

- Simply Business: $108 per month

- Nationwide: $110 per month

- Progressive: $114 per month

- ERGO NEXT: $117 per month

Do New Jersey businesses legally need general liability insurance?

New Jersey doesn't legally require most businesses to carry general liability insurance at the state level. However, certain licensed professionals like contractors and electricians may need coverage to maintain their licenses. Local municipalities can also set their own insurance requirements. Even without legal mandates, most landlords and clients require proof of coverage before signing contracts or leases.

How much does general liability insurance cost in New Jersey?

General liability insurance costs between $19 and $1,042 per month for small New Jersey businesses with two employees. Drone companies often get the lowest rates, while pressure washing businesses see the highest premiums. Your actual cost depends on your industry risk level, business location, coverage amounts and company size.

Best General Liability Insurance Companies in New Jersey

The Hartford is our top choice for general liability insurance in New Jersey, offering small businesses an excellent mix of affordable rates and quality customer service. ERGO NEXT also performs well with the strongest customer service ratings and solid coverage options.

Nationwide rounds out our recommendations with reliable stability and dependable customer support for New Jersey businesses.

| The Hartford | 4.56 | $93 |

| ERGO NEXT | 4.55 | $117 |

| Nationwide | 4.51 | $110 |

| Simply Business | 4.46 | $108 |

| Coverdash | 4.36 | $117 |

| Thimble | 4.35 | $121 |

| biBERK | 4.29 | $129 |

| Chubb | 4.27 | $135 |

| Progressive Commercial | 4.26 | $114 |

| Hiscox | 4.18 | $129 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap New Jersey General Liability Insurer

Select your industry and state to get a customized New Jersey general liability insurance quote.

General liability insurance shields New Jersey businesses from customer injury and property damage claims, but most companies need broader financial protection. Explore these additional coverage options:

Best New Jersey General Liability Insurance Reviews

Finding the right general liability insurance in New Jersey requires looking beyond price alone. Our analysis of top business insurers considers coverage quality and customer service to help you choose wisely.

Best New Jersey General Liability Insurer

Average Monthly General Liability Premium

$93These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Processes claims quickly with top-rated handling

Maintains A+ AM Best rating for strong financial stability

Ranks first among general liability providers

Provides excellent customer service with high satisfaction scores

consRequires agent consultation with no online-only purchase option

Digital experience lags behind major competitors

The Hartford leads New Jersey's general liability market through excellent customer service and solid financial stability, earning an A+ rating from AM Best. Its thorough coverage and fast claims processing work well for service businesses, contractors and professional services firms.

The Hartford stands out by offering personalized support through dedicated agents, which appeals to business owners who prefer relationship-based insurance partnerships.

Overall Score 4.56 1 Affordability Score 4.42 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 The Hartford charges $93 per month on average for general liability coverage in New Jersey, making it one of the more affordable providers statewide. It offers competitive rates for professional services, construction and cleaning businesses, with strong affordability across 27 industry categories.

Data filtered by:AccountantsAccountants $19 2 Customer feedback shows The Hartford performs well in claims processing, customer service and overall satisfaction, earning top national rankings in these areas. The company's personalized customer support and efficient claims handling receive consistent praise from policyholders, though its digital platform has room for improvement.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford provides general liability coverage with limits from $300,000 to $2 million per occurrence and aggregate limits up to double the occurrence amount. Business owners can add product liability coverage and broad form contractual liability options.

The company also includes data breach protection when you bundle through a business owner's policy, giving New Jersey businesses comprehensive coverage solutions.

Best New Jersey Commercial General Liability Customer Experience

Average Monthly General Liability Premium

$117These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Best digital experience with easy-to-use online platform

Most affordable rates in New Jersey

A- AM Best rating shows solid financial strength

Simple online tools make managing your policy easy

consClaims take longer to resolve than top competitors

Relatively new company without long industry history

No local agents if you prefer in-person help

ERGO NEXT performs well in New Jersey's general liability market through strong customer service and broad coverage options. With an A- rating from AM Best, ERGO NEXT serves tech companies, contractors and professional services firms looking for digital-first insurance solutions. The company offers a user-friendly online platform and flexible coverage terms that fit modern business needs.

Overall Score 4.55 2 Affordability Score 4.24 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT charges $117 per month for general liability coverage in New Jersey, ranking among the state's more affordable providers. The company offers competitive pricing in tech, food service and professional services sectors, plus reasonable rates for contractors and retail businesses.

Data filtered by:AccountantsAccountants $20 3 New Jersey business owners rate ERGO NEXT highly for its easy-to-use digital platform and smooth policy management. Reviews often mention the simple online tools and a claims process that moves quickly without extra hassle.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 With per-claim limits reaching $2 million and a $4 million aggregate cap, ERGO NEXT provides solid general liability coverage. Policyholders can also add contractor E&O and completed operations coverage using the CG2010 endorsement. These options suit contractors and professional service providers operating in New Jersey.

Cheapest General Liability Insurance Companies in New Jersey

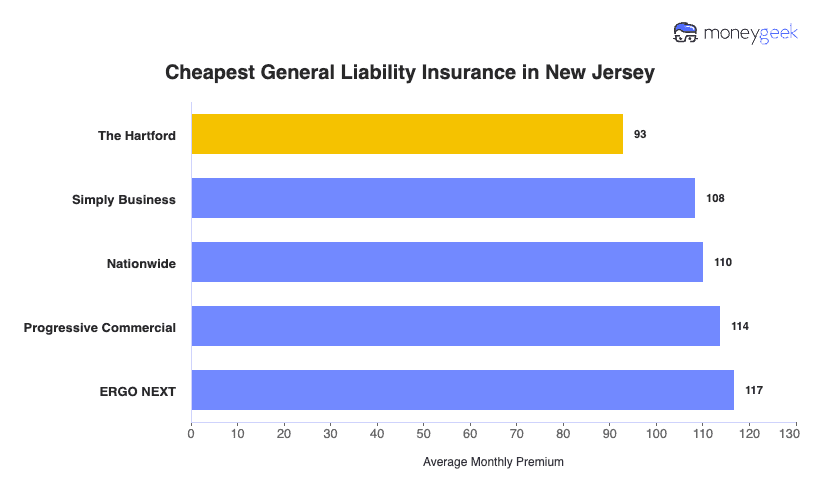

The Hartford offers the cheapest general liability insurance in New Jersey at $93 per month, saving businesses $23 or 20% compared to the state average. Simply Business and Nationwide also provide affordable coverage options.

| The Hartford | $93 | $1,115 |

| Simply Business | $108 | $1,302 |

| Nationwide | $110 | $1,321 |

| Progressive Commercial | $114 | $1,364 |

| ERGO NEXT | $117 | $1,402 |

| Coverdash | $117 | $1,406 |

| Thimble | $121 | $1,454 |

| Hiscox | $129 | $1,547 |

| biBERK | $129 | $1,548 |

| Chubb | $135 | $1,616 |

How Did We Determine These Rates?

These rates apply to small businesses with two employees across 79 major industries and cover general liability policies only. Your premium varies based on your business location, industry, coverage limits and other factors insurers evaluate. Available options differ by state.

Cheapest General Liability Insurance in New Jersey by Industry

MoneyGeek’s analysis highlights the lowest-cost general liability insurance options across New Jersey industries.

- The Hartford ranks first on affordability, posting the lowest rates in 17 industries. It shows strong pricing across service-driven fields such as electrical work, trucking, pest control and home-based businesses.

- Nationwide and Thimble each provide the best pricing in 12 industries. Nationwide posts its lowest costs in construction, manufacturing and restaurant businesses, while Thimble focuses on professional services like software development and tutoring.

- Simply Business offers the lowest rates in 11 industries, with competitive pricing for professional service firms including accounting, legal and consulting businesses.

- biBerk rounds out the list with the cheapest coverage in 10 industries across New Jersey. Its pricing works well for service-oriented businesses such as bakeries, beauty salons and general contractors.

| Accountants | Simply Business | $16 | $196 |

Average Cost of General Liability Insurance in New Jersey

General liability insurance costs small businesses in New Jersey an average of $116 per month. The average general liability insurance cost for you depends on your industry, business size, location and coverage limits.

Manufacturing companies tend to pay higher premiums than accounting firms because their risk levels are very different. Sole proprietors generally pay less than businesses with employees since they have lower exposure.

Average Cost of General Liability Insurance in New Jersey by Industry

General liability insurance in New Jersey ranges from $19 monthly for drone businesses to $1,042 for pressure washing companies. This wide cost variation reflects different industry risk levels. Review this table to find typical general liability coverage rates for your specific business type.

| Accountants | $25 | $301 |

| Ad Agency | $40 | $483 |

| Automotive | $61 | $728 |

| Auto Repair | $173 | $2,075 |

| Bakery | $103 | $1,234 |

| Barber | $50 | $605 |

| Beauty Salon | $76 | $913 |

| Bounce House | $80 | $960 |

| Candle | $63 | $750 |

| Cannabis | $76 | $916 |

| Catering | $100 | $1,197 |

| Cleaning | $151 | $1,810 |

| Coffee Shop | $102 | $1,226 |

| Computer Programming | $33 | $397 |

| Computer Repair | $54 | $651 |

| Construction | $200 | $2,396 |

| Consulting | $25 | $300 |

| Contractor | $290 | $3,483 |

| Courier | $223 | $2,670 |

| Daycare | $37 | $449 |

| Dental | $24 | $294 |

| DJ | $29 | $346 |

| Dog Grooming | $72 | $867 |

| Drone | $19 | $228 |

| Ecommerce | $83 | $1,000 |

| Electrical | $128 | $1,536 |

| Engineering | $45 | $544 |

| Excavation | $530 | $6,363 |

| Florist | $49 | $585 |

| Food | $123 | $1,471 |

| Food Truck | $161 | $1,937 |

| Funeral Home | $69 | $825 |

| Gardening | $128 | $1,535 |

| Handyman | $278 | $3,336 |

| Home-based | $27 | $325 |

| Home-based | $52 | $625 |

| Hospitality | $74 | $890 |

| HVAC | $279 | $3,352 |

| Janitorial | $156 | $1,873 |

| Jewelry | $46 | $550 |

| Junk Removal | $185 | $2,220 |

| Lawn/Landscaping | $137 | $1,642 |

| Lawyers | $26 | $312 |

| Manufacturing | $73 | $872 |

| Marine | $32 | $383 |

| Massage | $109 | $1,309 |

| Mortgage Broker | $26 | $312 |

| Moving | $141 | $1,695 |

| Nonprofit | $41 | $490 |

| Painting | $164 | $1,965 |

| Party Rental | $90 | $1,086 |

| Personal Training | $27 | $326 |

| Pest Control | $37 | $440 |

| Pet | $64 | $766 |

| Pharmacy | $70 | $844 |

| Photography | $27 | $330 |

| Physical Therapy | $125 | $1,503 |

| Plumbing | $412 | $4,940 |

| Pressure Washing | $1,042 | $12,509 |

| Real Estate | $61 | $727 |

| Restaurant | $165 | $1,981 |

| Retail | $74 | $894 |

| Roofing | $442 | $5,301 |

| Security | $158 | $1,901 |

| Snack Bars | $134 | $1,604 |

| Software | $30 | $359 |

| Spa/Wellness | $122 | $1,458 |

| Speech Therapist | $36 | $426 |

| Startup | $33 | $391 |

| Tech/IT | $30 | $360 |

| Transportation | $43 | $514 |

| Travel | $24 | $285 |

| Tree Service | $148 | $1,774 |

| Trucking | $117 | $1,402 |

| Tutoring | $34 | $413 |

| Veterinary | $51 | $612 |

| Wedding Planning | $32 | $378 |

| Welding | $188 | $2,253 |

| Wholesale | $51 | $610 |

| Window Cleaning | $181 | $2,176 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect New Jersey General Liability Insurance Costs?

Many important factors influence what New Jersey businesses pay for general liability insurance.

New Jersey's Legal and Regulatory Environment

New Jersey has tough employment laws against discrimination, harassment and retaliation. Legal defense alone can cost over $150,000, and settlements often hit $250,000 or higher. Last year, the state spent $177.9 million settling lawsuits, with 35 cases costing at least $1 million each. State law requires businesses to carry at least $500,000 in liability coverage. Insurers need bigger reserves to handle these expensive claims, so they charge more for coverage.

New Jersey's Environmental Liability Exposure

Enforcement agencies have filed 80 civil environmental cases since 2018, collecting over $31 million in damages and penalties. New Jersey may be small, but it has more Superfund toxic waste sites than any other state. The state passed the nation's first enforceable PFAS water standards and collected $393 million from Solvay Specialty Polymers and $285 million from 3M. Tough enforcement and expensive cleanup costs mean insurers charge manufacturing and property development businesses more for general liability coverage.

New Jersey's Population Density and Urban Risk

New Jersey packs 1,185 residents into every square mile, making it the most densely populated state. Every county counts as urban. This density means more liability claims. Lots of foot traffic means more slip-and-fall accidents and injury claims. Insurers know from their data that urban areas produce more claims. Without any rural areas to balance things out, every New Jersey business pays more.

New Jersey's Commercial Property and Lease Requirements

Most commercial leases in New Jersey require at least $1 million in general liability coverage per incident. Every county is urban, so businesses operate where there's heavy foot traffic and high exposure. Landlords want coverage to avoid getting sued over tenant incidents. Businesses can't skip insurance. Old buildings, bad weather and constant foot traffic create plenty of opportunities for claims. Insurers know this and price accordingly.

How Much General Liability Insurance Do I Need in New Jersey?

New Jersey law requires general liability insurance for home improvement and home elevation contractors. Most other businesses aren't legally required to have it, though clients and landlords often make it mandatory through contracts and lease agreements.

Knowing the requirements for commercial general liability insurance helps you get the right coverage for your business. Here's who must carry general liability insurance in New Jersey:

These contractors must maintain commercial general liability insurance with minimum coverage of $500,000 per occurrence. Registered contractors must file proof of coverage with the Director of the Division of Consumer Affairs.

These contractors are required to carry higher limits of $1,000,000 per occurrence for commercial general liability insurance. Home elevation contractors also have additional cargo insurance requirements to cover damages during elevation work.

Note: State insurance requirements change often. Check the latest requirements with the New Jersey Department of Banking and Insurance or talk to a licensed insurance agent.

How to Choose the Best General Liability Insurance in New Jersey

Choosing general liability insurance in New Jersey requires balancing your coverage needs with your budget. Getting business insurance starts with evaluating your risk exposure, comparing quotes from multiple insurers and selecting policy limits that protect your assets without overpaying for unnecessary coverage.

- 1Determine Coverage Needs

New Jersey requires home improvement contractors to carry at least $500,000 in general liability business insurance to operate legally. Some cities, like Atlantic City, set higher limits and require a $1 million per-occurrence policy with the city listed as an additional insured.

Since August 2022, state law also requires business owners to maintain $500,000 in liability coverage and submit updated certificates to their local municipalities every year.

- 2Prepare Business Information

Gather your business details including revenue, employee count, physical location and NAICS classification code before you request quotes. New Jersey insurers look at industry risk and location when they price policies. Have your EIN, business registration and any required contractor licenses ready to speed up the application process and get accurate pricing.

- 3Compare Multiple Quotes

Get quotes from at least three insurers licensed in New Jersey, since business insurance costs can differ by hundreds of dollars annually between carriers. Compare policy limits, deductibles and whether legal defense costs count toward or sit outside your coverage limit. We found general liability insurance in New Jersey costs small businesses an average of $116 per month.

- 4Look Beyond Price

Don't pick a policy just because it has the lowest business insurance rates without checking what's excluded from coverage. Read policy exclusions carefully and confirm whether legal defense costs are separate from or included in your policy limits. Common exclusions like professional errors, pollution or employee injuries need separate policies, so understanding gaps helps you avoid expensive surprises when filing claims.

- 5Verify Insurer Credentials

Make sure the insurer is legitimate by checking with the New Jersey Department of Banking and Insurance. Look up their AM Best rating to see if they're financially stable. Check state regulators for complaint ratios to find out which companies handle claims poorly. You want an insurer with strong finances when a big claim comes in, so stick with companies that have clean records and at least an A- rating.

- 6Ask About Discounts

New Jersey insurers give discounts when you bundle policies. A business owner's policy (BOP) costs less than buying general liability and property coverage separately. Pay for the full year upfront instead of monthly and you'll save up to 15%. Been in business for three years or more? You might get extra discounts. Safety programs, employee training and no claims on your record can all cut your premiums too.

- 7Obtain Certificate of Insurance

A certificate of insurance proves you have coverage. New Jersey municipalities, clients and landlords require it, and business owners need to file certificates annually with local governments. Most insurers provide certificates of insurance at no cost, with many offering digital COIs right away when you buy your policy.

Keep your agent's contact information handy for urgent certificate requests to meet contract deadlines and avoid project delays.

- 8Review Coverage Annually

Check your general liability coverage each year, especially after hiring employees, expanding services or increasing revenue that changes your risk profile. New Jersey law requires annual registration of liability insurance certificates with municipalities, making yearly policy reviews necessary for compliance.

Get quotes 60 to 90 days before renewal to find better rates or adjust limits, keeping coverage that prevents gaps and expensive audit adjustments.

Top General Liability Insurance in New Jersey: Bottom Line

Getting good general liability insurance in New Jersey means knowing what your business needs and doing your homework on providers. The Hartford, ERGO NEXT and Nationwide rank highest in the state, but the best choice for you depends on your industry, how big your business is and what you can afford. Get quotes from several insurers and check their credentials before you decide.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- New Jersey Legislature. "Chapter 92 - An Act Requiring Liability Insurance for Business Owners and Rental Unit Owners." Accessed February 7, 2026.

- New Jersey Monitor. "Lawsuits Cost New Jersey $178 Million in 2024, as Abuse Claims Rise." Accessed February 7, 2026.

- New Jersey Monitor. "New Laws Hike Liability Insurance Required for Car Owners and Landlords." Accessed February 7, 2026.

- New Jersey Office of Attorney General. "AG Platkin and DEP Commissioner LaTourette Announce Two Settlements and Five Environmental Enforcement Lawsuits." Accessed February 7, 2026.

- New Jersey Office of Attorney General. "Discrimination in Employment." Accessed February 7, 2026.

- New Jersey Office of Attorney General. "Environmental Justice." Accessed February 7, 2026.

- New Jersey Office of Attorney General. "Securing Environmental Justice 2024." Accessed February 7, 2026.

- New Jersey Revised Statutes. "Section 10:5-12 - Unlawful Employment Practices, Discrimination." Accessed February 7, 2026.

- New Jersey Senate. "Senate Resolution 63 - Urging EPA to Expend Funds from NJ Superfund Settlements." Accessed February 7, 2026.

- U.S. Census Bureau. "QuickFacts: New Jersey." Accessed February 7, 2026.

- U.S. Environmental Protection Agency. "Current NPL Updates: New Proposed NPL Sites and New NPL Sites." Accessed February 7, 2026.

- U.S. Environmental Protection Agency. "EPA Announces Bipartisan Infrastructure Law Funds for Cleanups at Three Superfund Sites in New Jersey." Accessed February 7, 2026.

- U.S. Environmental Protection Agency. "Superfund Sites in Reuse in New Jersey." Accessed February 7, 2026.