We researched the best business insurance options to answer your most common questions about general liability coverage in New Hampshire based on our analysis:

Best General Liability Insurance in New Hampshire

The Hartford leads New Hampshire general liability insurance as both the best and cheapest option, with coverage starting at $81 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 18, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in New Hampshire: Fast Answers

Which company offers the best general liability insurance in New Hampshire?

The Hartford is the top general liability insurance company in New Hampshire, earning a 4.61 overall score out of 5. The company offers affordable coverage at $81 per month and delivers strong claims handling. ERGO NEXT follows closely with a 4.56 score, offering excellent digital tools and customer service for $102 per month.

Who offers the cheapest general liability insurance in New Hampshire?

The cheapest general liability insurance companies in New Hampshire are:

- The Hartford: $81 per month

- Simply Business: $95 per month

- Nationwide: $96 per month

- Progressive: $100 per month

- ERGO NEXT: $102 per month

Do New Hampshire businesses legally need general liability insurance?

New Hampshire doesn't legally require most businesses to carry general liability insurance at the state level. However, certain licensed professionals like contractors and electricians may need coverage to maintain their licenses. Local municipalities can set their own requirements, and most landlords and clients demand proof of insurance before signing contracts.

How much does general liability insurance cost in New Hampshire?

General liability insurance costs between $17 and $915 per month for small New Hampshire businesses with two employees. The drone industry sees the lowest rates at $17 per month, while pressure washing businesses have the highest at $915 per month. Your actual premium depends on your specific industry, business location, coverage limits and employee count.

Best General Liability Insurance Companies in New Hampshire

The Hartford is our top choice for general liability insurance in New Hampshire, offering a mix of affordable rates and strong financial stability. ERGO NEXT and Nationwide also perform well, with ERGO NEXT known for excellent customer service and Nationwide providing solid coverage options for small businesses across the state.

| The Hartford | 4.61 | $81 |

| ERGO NEXT | 4.56 | $102 |

| Nationwide | 4.53 | $96 |

| Simply Business | 4.49 | $95 |

| Coverdash | 4.38 | $103 |

| Thimble | 4.35 | $107 |

| biBERK | 4.31 | $114 |

| Chubb | 4.29 | $118 |

| Progressive Commercial | 4.28 | $100 |

| Hiscox | 4.20 | $113 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap New Hampshire General Liability Insurer

Select your industry and state to get a customized New Hampshire general liability insurance quote.

General liability insurance shields New Hampshire businesses from customer injury and property damage claims, but it won't cover every risk. Explore these additional coverage options for comprehensive financial protection:

Best New Hampshire General Liability Insurance Reviews

Finding the best general liability insurance in New Hampshire means looking beyond affordable rates. Coverage quality and customer service matter too. Our research reveals which business insurers deliver the strongest combination of value and protection.

The Hartford

Best New Hampshire General Liability Insurer

Average Monthly General Liability Premium

$81These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Top national ranking for overall customer satisfaction

Fast and efficient claims handling

A+ financial strength rating from AM Best

Highest national marks for customer service

consBelow-average digital platform compared to competitors

Most policies require agent assistance instead of full online purchasing

The Hartford ranks first in New Hampshire’s general liability market, earning high scores for both affordability and financial stability. Its A+ financial strength rating from AM Best reflects strong long-term reliability. Businesses that value responsive support and smooth claim resolution will benefit from its service model. The company works well for construction firms, professional service providers and retail businesses that want broad coverage backed by personalized guidance.

Overall Score 4.61 1 Affordability Score 4.55 1 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 Businesses in New Hampshire can get general liability coverage from The Hartford for $81 per month, making it the most affordable option across several industries. The company prices policies competitively for construction firms, electrical contractors and professional service providers. Retail and service-based businesses also receive solid value at that rate.

Data filtered by:AccountantsAccountants $17 2 The Hartford earns strong marks for customer satisfaction in New Hampshire, ranking near the top for both claims handling and service quality. Policyholders often mention clear communication, knowledgeable representatives and timely claim payments. While its digital tools trail some competitors, its agent-focused approach delivers consistent personal support throughout the policy period.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford offers general liability coverage with limits from $300,000 to $2 million per occurrence and aggregate limits up to double those amounts. Businesses can add product liability coverage and broad form contractual liability options. The insurer's business owner's policy bundles with data breach protection, giving New Hampshire businesses a wider range of coverage in one package.

ERGO NEXT

Best New Hampshire Commercial General Liability: Runner-Up

Average Monthly General Liability Premium

$102These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first in customer service and second for coverage among New Hampshire providers

Provides instant quotes and coverage in 10 minutes

Has an A- AM Best rating with backing from Munich Re

Covers 1,300+ business types with AI-driven customization

consCosts more than five other New Hampshire providers

Newer insurer with less history than competitors

No local agents; everything's online

ERGO NEXT is known in New Hampshire for excellent customer service, comprehensive coverage options and strong financial stability with an A- rating from AM Best. It excels in digital experience and policy management, making it ideal for tech-savvy business owners who prefer online tools.

The provider works especially well for service-based businesses like dental offices, tech companies and professional services firms seeking streamlined coverage management.

Overall Score 4.56 2 Affordability Score 4.28 5 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 At $102 per month on average, ERGO NEXT offers competitive rates for New Hampshire businesses. The provider shows particularly strong pricing for dental practices, funeral homes and tech companies, while also maintaining affordable options for automotive, cleaning and professional service industries.

Data filtered by:AccountantsAccountants $17 3 ERGO NEXT earns top marks from New Hampshire customers for its digital experience, policy management and likelihood to recommend to others. Customer feedback consistently highlights the provider's user-friendly online platform and efficient policy administration tools. The company's strong renewal rates indicate high satisfaction among existing clients.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT provides general liability coverage with limits up to $2 million per claim and $4 million aggregate. The provider includes contractor E&O insurance and offers endorsements for completed work protection through CG2010 or ongoing operations coverage. These flexible options particularly benefit construction and contract-based businesses in New Hampshire.

Cheapest General Liability Insurance Companies in New Hampshire

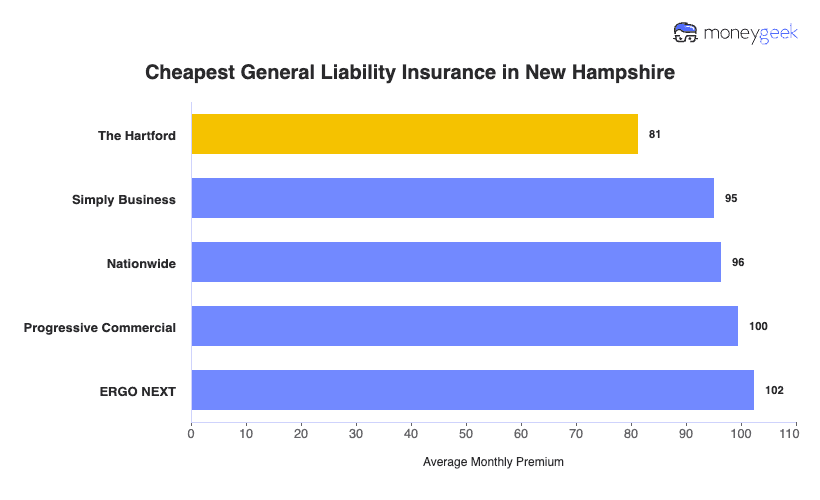

The Hartford offers the cheapest general liability insurance in New Hampshire at $81 per month, saving businesses $21 or 20% compared to the state average. Simply Business and Nationwide also provide affordable coverage options for small businesses.

| The Hartford | $81 | $976 |

| Simply Business | $95 | $1,142 |

| Nationwide | $96 | $1,158 |

| Progressive Commercial | $100 | $1,194 |

| ERGO NEXT | $102 | $1,230 |

| Coverdash | $103 | $1,234 |

| Thimble | $107 | $1,279 |

| Hiscox | $113 | $1,361 |

| biBERK | $114 | $1,362 |

| Chubb | $118 | $1,418 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and cover general liability policies only. Your premium depends on your location, industry, coverage amount and other factors insurers weigh. Available options differ by state.

Cheapest General Liability Insurance in New Hampshire by Industry

MoneyGeek’s analysis shows five insurers stand out for affordable general liability coverage across New Hampshire industries:

- The Hartford: Holds the lowest rates in 22 industries, including construction, electrical work, welding and security services.

- Thimble: Provides the best pricing in 14 industries, with competitive rates for cleaning companies, HVAC contractors, roofers and software developers.

- biBerk: Tops affordability in 11 industries, performing well for catering businesses, contractors, engineering firms and trucking companies.

- Simply Business: Offers low-cost coverage in 10 industries and remains competitive for accountants, consultants, law firms and plumbing businesses.

- ERGO NEXT: Leads pricing in seven industries and works well for dental practices, photographers, spa and wellness businesses and tech companies.

| Accountants | Simply Business | $14 | $172 |

Average Cost of General Liability Insurance in New Hampshire

Most small businesses in New Hampshire pay around $102 monthly for general liability insurance. The average general liability insurance cost for you depends on your industry, business size, location and coverage limits.

Manufacturing companies have higher premiums due to increased risk exposure, while accounting firms often pay less because of lower liability risks. Sole proprietors generally pay lower rates compared to businesses with employees since they have fewer liability exposures.

Average Cost of General Liability Insurance in New Hampshire by Industry

Monthly costs for general liability coverage in New Hampshire range from $17 for drone businesses to $915 for pressure washing companies. This wide cost variation reflects the different risk levels across industries. Review this table to find typical rates for your specific business type.

| Accountants | $22 | $264 |

| Ad Agency | $35 | $424 |

| Automotive | $53 | $639 |

| Auto Repair | $152 | $1,822 |

| Bakery | $90 | $1,084 |

| Barber | $44 | $531 |

| Beauty Salon | $67 | $801 |

| Bounce House | $70 | $842 |

| Candle | $55 | $659 |

| Cannabis | $67 | $804 |

| Catering | $88 | $1,051 |

| Cleaning | $132 | $1,589 |

| Coffee Shop | $90 | $1,076 |

| Computer Programming | $29 | $348 |

| Computer Repair | $48 | $571 |

| Construction | $175 | $2,103 |

| Consulting | $22 | $263 |

| Contractor | $255 | $3,056 |

| Courier | $195 | $2,344 |

| Daycare | $33 | $394 |

| Dental | $21 | $258 |

| DJ | $25 | $304 |

| Dog Grooming | $63 | $761 |

| Drone | $17 | $200 |

| Ecommerce | $73 | $877 |

| Electrical | $112 | $1,348 |

| Engineering | $40 | $478 |

| Excavation | $465 | $5,584 |

| Florist | $43 | $513 |

| Food | $108 | $1,291 |

| Food Truck | $142 | $1,700 |

| Funeral Home | $60 | $724 |

| Gardening | $112 | $1,348 |

| Handyman | $244 | $2,928 |

| Home-based | $24 | $285 |

| Home-based | $46 | $548 |

| Hospitality | $65 | $782 |

| HVAC | $245 | $2,942 |

| Janitorial | $137 | $1,644 |

| Jewelry | $40 | $483 |

| Junk Removal | $162 | $1,948 |

| Lawn/Landscaping | $120 | $1,442 |

| Lawyers | $23 | $274 |

| Manufacturing | $64 | $767 |

| Marine | $28 | $336 |

| Massage | $96 | $1,149 |

| Mortgage Broker | $23 | $275 |

| Moving | $124 | $1,488 |

| Nonprofit | $36 | $430 |

| Painting | $144 | $1,725 |

| Party Rental | $79 | $953 |

| Personal Training | $24 | $286 |

| Pest Control | $32 | $387 |

| Pet | $56 | $672 |

| Pharmacy | $62 | $741 |

| Photography | $24 | $289 |

| Physical Therapy | $110 | $1,322 |

| Plumbing | $361 | $4,335 |

| Pressure Washing | $915 | $10,978 |

| Real Estate | $53 | $638 |

| Restaurant | $145 | $1,739 |

| Retail | $65 | $784 |

| Roofing | $388 | $4,653 |

| Security | $139 | $1,668 |

| Snack Bars | $117 | $1,408 |

| Software | $26 | $316 |

| Spa/Wellness | $107 | $1,280 |

| Speech Therapist | $31 | $374 |

| Startup | $29 | $343 |

| Tech/IT | $26 | $317 |

| Transportation | $38 | $451 |

| Travel | $21 | $250 |

| Tree Service | $130 | $1,556 |

| Trucking | $103 | $1,230 |

| Tutoring | $30 | $363 |

| Veterinary | $45 | $537 |

| Wedding Planning | $28 | $332 |

| Welding | $165 | $1,977 |

| Wholesale | $45 | $536 |

| Window Cleaning | $159 | $1,910 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect New Hampshire General Liability Insurance Costs?

Many factors determine general liability insurance costs for New Hampshire businesses.

New Hampshire Legal and Regulatory Environment

New Hampshire courts recognize independent tort actions for third-party liability claims, requiring insurers to exercise reasonable care in settlements. More lawsuits, larger jury awards, plaintiff-friendly rulings, third-party litigation funding and aggressive plaintiff bar advertising all push litigation costs higher. Those costs get passed along to policyholders.

When courts award larger settlements, insurers pay more per claim. Higher legal defense costs and jury awards feed directly into general liability premiums for New Hampshire businesses.

New Hampshire Economic and Cost Inflation Pressures

Average hourly earnings in New Hampshire's construction industry are up 4.4% over the past 12 months, with average wages reaching $74,268. New England inflation ran at 3.5% in 2024, ahead of the 2.9% national rate, with medical costs seeing the sharpest increases.

General liability insurance covers bodily injury and property damage claims. Rising construction costs push property damage repair expenses higher, while regional medical inflation raises bodily injury payouts. Insurers adjust premiums to keep up with both.

New Hampshire Industry Composition and Seasonal Characteristics

New Hampshire draws 4.5 million summer visitors spending $2.3 billion, 3.6 million fall visitors spending $1.7 billion and 3 million winter visitors spending $1.5 billion. Construction employment hit 31,600 in August 2024, up 10% from February 2020.

Seasonal tourism creates sharp customer volume spikes that increase slip-and-fall and premises liability exposure. Construction's growth adds more businesses operating in a high-risk sector. Both trends push claim frequency and severity higher across the state.

New Hampshire Operational Risk Factors

Insurance companies saw heavy losses as both the number and severity of claims went up, leading some New Hampshire policyholders to experience premium increases of 30% or more in 2024. The state also deals with an aging workforce and very few new workers entering the trades. Long winters add more pressure, with ice and snow causing steady slip-and-fall risks for businesses.

On top of that, labor shortages push companies to hire less experienced workers or speed through projects, raising the chances of errors that result in property damage or injury claims. Together, these factors drive higher claim frequency across the state.

How Much General Liability Insurance Do I Need in New Hampshire?

New Hampshire doesn't require businesses to carry general liability insurance by state law, but most small businesses purchase $1 million per occurrence and $2 million aggregate coverage. This standard protects against typical claims while meeting client expectations and commercial lease requirements that specify minimum coverage amounts.

Your actual needs depend on your industry risk level and contract obligations. High-risk businesses like construction or food service should consider higher limits. Contractors often need coverage ranging from $300,000 to $1 million based on local municipal requirements and project contracts. Check your agreements for requirements for commercial general liability before starting work.

Note: State insurance rules change regularly. Check current requirements with the New Hampshire Insurance Department or talk with a licensed insurance agent for the latest information.

How to Choose the Best General Liability Insurance in New Hampshire

Choosing general liability insurance in New Hampshire requires balancing coverage needs with your budget. Getting business insurance starts with understanding your industry risks, then comparing quotes from multiple insurers to find adequate protection at competitive rates for your specific business operations.

- 1Assess Your Coverage Needs

New Hampshire doesn't legally require general liability insurance for most businesses, although commercial leases and client contracts often set specific coverage requirements.

Standard business insurance coverage often includes limits of $1 million per occurrence and $2 million aggregate. Contractors may need between $300,000 and $1 million, depending on local municipal rules. Review your lease agreements and client contracts carefully to confirm the minimum coverage amounts you must carry.

- 2Prepare Business Information

Insurers rely on specific business details to calculate accurate quotes. Gather your annual revenue, number of employees, business address and classification code before you begin. Industry risk level and company size directly influence your premium. Keep your EIN, registration documents and recent financial records ready to help move the application forward without delays.

- 3Compare Multiple Quotes

Request quotes from at least three insurers licensed by the New Hampshire Insurance Department to operate in the state. The cost of your coverage varies from one insurer to another based on underwriting standards and risk evaluation methods. Compare more than just the premium. Review deductibles, coverage limits and whether the policy includes legal defense costs within the limit or pays them separately.

- 4Look Beyond Premium Price

Cheap business insurance doesn't always deliver strong value if it creates coverage gaps that leave your company exposed. Review policy exclusions carefully so you understand what the plan leaves out. Standard general liability policies often exclude professional errors, pollution liability and employee injuries.

Confirm whether the policy includes legal defense costs within your coverage limits or pays them separately. That distinction affects how much protection remains available if your business must defend against a lawsuit.

- 5Verify Insurer Credentials

Confirm that each insurer holds a valid license through the New Hampshire Insurance Department. Review AM Best financial strength ratings to evaluate the company’s ability to pay claims.

You can also check complaint ratios through the department’s consumer services division to identify insurers with repeated claims issues. Focus on companies with ratings of A- or higher when comparing long-term reliability.

- 6Ask About Discounts

Many New Hampshire insurers offer discounts for bundling policies, running workplace safety programs, maintaining a clean claims history or paying premiums annually.

Combining general liability with commercial property or auto coverage through a business owner’s policy can lower total costs by 10% to 25%. Installing security systems, offering employee safety training or earning industry certifications may also reduce your premium.

- 7Obtain Certificate of Insurance

A certificate of insurance provides proof of coverage to clients, landlords and contractors before you sign agreements or begin work. Most insurers issue digital certificates immediately or within 24 hours of purchase.

Keep your agent’s contact details accessible for urgent certificate requests. Many commercial contracts require updated certificates that list the requesting party as an additional insured.

- 8Review Coverage Annually

Reevaluate your general liability policy each year before renewal. Hiring staff, expanding services, increasing revenue or relocating can all change your risk profile. Request updated quotes 60 to 90 days before renewal to compare pricing and coverage limits.

Annual reviews help you avoid compliance gaps with lease agreements and reduce the chance of premium adjustments during audits if your business operations exceed earlier estimates.

Top General Liability Insurance in New Hampshire: Bottom Line

Finding the right general liability insurance in New Hampshire comes down to understanding your specific business needs and doing thorough research. The Hartford, ERGO NEXT and Nationwide emerge as leading options, but your ideal provider depends on your industry, company size, and budget. Smart business owners compare quotes from multiple insurers and check each company's credentials before making their final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Associated Builders and Contractors. "Construction Industry Outlook and Economic Impact." Accessed March 4, 2026.

- Federal Reserve Bank of Boston. "New England Economic Conditions through September 3, 2024." Accessed March 4, 2026.

- New Hampshire Business Review. "What Is Influencing Insurance Rates in New Hampshire?." Accessed March 4, 2026.

- New Hampshire Department of Labor, Economic & Labor Market Information Bureau. "Employment and Wage Data." Accessed March 4, 2026.

- New Hampshire Department of Transportation. "New Hampshire Construction Cost Index." Accessed March 4, 2026.

- New Hampshire Fiscal Policy Institute. "Construction and Homebuilding in New Hampshire." Accessed March 4, 2026.

- New Hampshire Fiscal Policy Institute. "New Hampshire Policy Points 2025: Economy and Jobs." Accessed March 4, 2026.

- New Hampshire Insurance Department. "Property & Casualty Markets Symposium." Accessed March 4, 2026.

- U.S. Bureau of Economic Analysis. "Outdoor Recreation Satellite Account, U.S. and States, 2023." Accessed March 4, 2026.