We compiled answers to common questions about Minnesota general liability insurance and best business insurance options based on our detailed research and analysis:

Best General Liability Insurance in Minnesota

The Hartford tops Minnesota for best and most affordable general liability coverage, with rates starting at $77 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Minnesota: Fast Answers

Which company offers the best general liability insurance in Minnesota?

The Hartford is the best general liability insurance company in Minnesota with an overall score of 4.60 out of 5. It provides affordable coverage at $77 per month and excels in claims handling. ERGO NEXT takes second place with a 4.59 score, known for its user-friendly digital platform and strong customer service at $97 per month.

Who offers the cheapest general liability insurance in Minnesota?

The cheapest general liability insurance companies in Minnesota are:

- The Hartford: $77 per month

- Simply Business: $90 per month

- Nationwide: $91 per month

- Progressive: $94 per month

- ERGO NEXT: $97 per month

Do Minnesota businesses legally need general liability insurance?

Minnesota doesn't legally require most businesses to carry general liability insurance at the state level. However, certain licensed professionals like contractors and electricians must meet specific coverage requirements. Local municipalities may impose their own insurance rules and most landlords and clients require proof of coverage before signing contracts.

How much does general liability insurance cost in Minnesota?

General liability insurance costs between $16 and $863 per month for small Minnesota businesses with two employees. The drone industry sees some of the lowest rates at $16 per month, while pressure washing businesses pay around $863 due to higher risk. Your actual cost depends on your specific industry, business location, coverage limits and company size.

Best General Liability Insurance Companies in Minnesota

The Hartford leads our rankings for general liability insurance in Minnesota, offering small businesses an excellent balance of affordable rates and quality customer service. ERGO NEXT is known for top-rated customer service and strong coverage options. Nationwide also performs well, particularly for affordability and financial stability among Minnesota providers.

| The Hartford | 4.60 | $77 |

| ERGO NEXT | 4.59 | $97 |

| Nationwide | 4.53 | $91 |

| Simply Business | 4.49 | $90 |

| Coverdash | 4.38 | $97 |

| Thimble | 4.35 | $101 |

| biBERK | 4.31 | $107 |

| Progressive Commercial | 4.28 | $94 |

| Chubb | 4.28 | $111 |

| Hiscox | 4.20 | $107 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Minnesota General Liability Insurer

Select your industry and state to get a customized Minnesota general liability insurance quote.

General liability insurance covers customer injuries and property damage for your Minnesota business, but it won't protect against every risk. Explore these additional coverage options:

Best Minnesota General Liability Insurance Reviews

Finding the best general liability insurance in Minnesota requires looking beyond just affordable rates. Coverage quality and customer service matter too. Our research identifies the top business insurers based on comprehensive analysis of these factors.

The Hartford

Best Minnesota General Liability Insurer

Average Monthly General Liability Premium

$77These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Ranks first statewide for overall customer satisfaction

Consistently high scores for claims handling speed

Holds an A+ AM Best financial rating

Good reputation for responsive customer support

consPolicies require working with an agent rather than full online purchase

Digital tools trail behind more online-focused competitors

The Hartford ranks as Minnesota’s top general liability insurer due to strong customer satisfaction and dependable financial backing. Its A+ AM Best rating supports long-term reliability, while claims handling and customer support receive high marks from business owners.

Companies that value experienced guidance often prefer The Hartford over fully online providers. Construction firms, professional services, and retail businesses tend to find its coverage structure a good match for their needs.

Overall Score 4.60 1 Affordability Score 4.52 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 In Minnesota, The Hartford prices general liability policies at an average of $77 per month, keeping costs competitive statewide. Rates stay favorable across construction, professional services, and retail sectors. More than 70 business types, including contractors, cleaning services, and food businesses, benefit from these price levels.

Data filtered by:AccountantsAccountants $16 2 Minnesota customers rate The Hartford highly for claims processing and service quality. Business owners often highlight prompt claim resolution and knowledgeable representatives. While online tools receive lower scores, service reliability continues to drive strong satisfaction.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford provides general liability limits ranging from $300,000 to $2 million per occurrence, with aggregate limits available up to twice that amount. Coverage can be expanded through a business owner's policy with options such as product liability, broad form contractual liability and data breach protection. These options allow businesses to adjust coverage based on their risk profile.

ERGO NEXT

Best Minnesota Commercial General Liability Customer Experience

Average Monthly General Liability Premium

$97These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Leads affordability rankings with competitive pricing

Fully digital platform simplifies policy management

Holds an A- AM Best financial rating

High recommendation rates among business owners

consShorter operating history than long-established insurers

Online-only model without local agent support

ERGO NEXT performs well in Minnesota by combining competitive pricing with a modern, digital-first approach. Its A- AM Best rating reflects solid financial backing, while coverage options appeal to businesses that prefer managing policies online.

Tech companies, contractors, and professional services often find the platform easy to use and well aligned with their needs. For businesses comfortable without in-person agent support, ERGO NEXT offers a practical alternative to traditional insurers.

Overall Score 4.59 2 Affordability Score 4.35 5 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 Many Minnesota businesses pay about $97 per month for general liability coverage through ERGO NEXT, keeping premiums within a lower-cost range. Dental practices, tech firms and home-based businesses often see favorable pricing. Competitive rates also extend to automotive, cleaning, and construction industries.

Data filtered by:AccountantsAccountants $16 3 Minnesota customers rate ERGO NEXT highly for its online experience and ease of policy management. Business owners often point to smooth renewals and clear account access as standout features. Recommendation rates remain high, reflecting overall satisfaction with the platform and service model.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT offers general liability limits up to $2 million per occurrence and $4 million in aggregate coverage. Businesses can add contractor E&O insurance and endorsements such as CG2010 for completed operations. These options allow companies to tailor coverage for contract-based work, making ERGO NEXT a strong fit for many Minnesota operations.

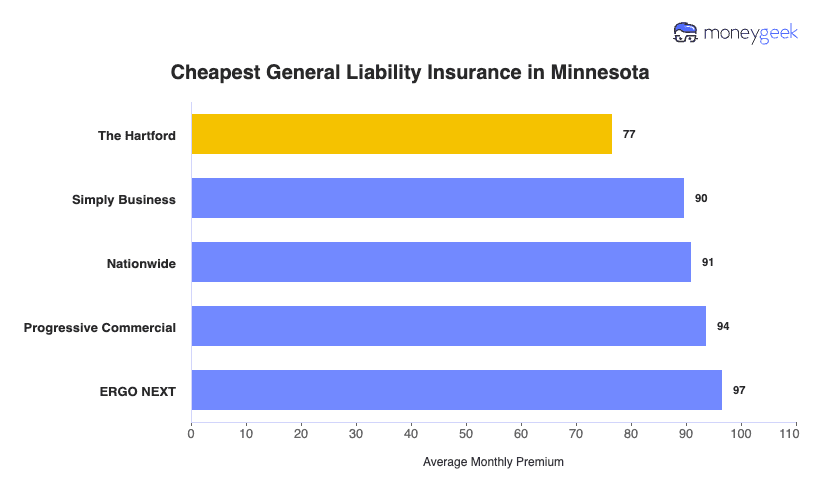

Cheapest General Liability Insurance Companies in Minnesota

The Hartford offers the cheapest general liability insurance in Minnesota at $77 per month, saving businesses $19 or 20% compared to the state average. Simply Business and Nationwide also provide affordable coverage options for small businesses.

| The Hartford | $77 | $919 |

| Simply Business | $90 | $1,077 |

| Nationwide | $91 | $1,091 |

| Progressive Commercial | $94 | $1,125 |

| ERGO NEXT | $97 | $1,159 |

| Coverdash | $97 | $1,164 |

| Thimble | $101 | $1,208 |

| Hiscox | $107 | $1,285 |

| biBERK | $107 | $1,286 |

| Chubb | $111 | $1,337 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Minnesota by Industry

MoneyGeek's research identifies the most affordable general liability insurance providers across Minnesota industries.

- The Hartford dominates with the cheapest rates in 23 industries, including construction, cleaning, food trucks, and transportation businesses.

- Simply Business and Thimble each lead affordability in 11 industries. Simply Business excels with professional services like accountants, consulting, and software companies, while Thimble serves bakeries, barbershops, HVAC contractors, and roofing businesses.

- biBerk offers the most affordable coverage in nine industries, particularly strong for contractors, engineering firms, catering, and veterinary practices.

- Coverdash and ERGO NEXT each provide cheap rates across seven industries. Coverdash leads in automotive, restaurant and trucking sectors, while ERGO NEXT dominates dental, photography, and tech businesses.

| Accountants | Simply Business | $14 | $162 |

Average Cost of General Liability Insurance in Minnesota

Small businesses in Minnesota often pay $96 monthly for general liability insurance. The average cost of general liability insurance coverage depends on your industry, business size, location and coverage limits.

Manufacturing companies often pay higher premiums due to increased liability risks, while accounting firms usually pay less because of lower exposure. Sole proprietors generally have cheaper rates compared to businesses with employees.

Average Cost of General Liability Insurance in Minnesota by Industry

Monthly costs for general liability coverage in Minnesota vary widely by industry. Drone businesses pay as little as $16 per month, while pressure washing companies can expect rates around $863 monthly. Review the table below to find typical rates for your specific business type.

| Accountants | $21 | $249 |

| Ad Agency | $33 | $400 |

| Automotive | $50 | $603 |

| Auto Repair | $143 | $1,719 |

| Bakery | $85 | $1,022 |

| Barber | $42 | $501 |

| Beauty Salon | $63 | $756 |

| Bounce House | $66 | $795 |

| Candle | $52 | $621 |

| Cannabis | $63 | $758 |

| Catering | $83 | $992 |

| Cleaning | $125 | $1,498 |

| Coffee Shop | $85 | $1,015 |

| Computer Programming | $27 | $329 |

| Computer Repair | $45 | $539 |

| Construction | $165 | $1,983 |

| Consulting | $21 | $248 |

| Contractor | $240 | $2,882 |

| Courier | $184 | $2,210 |

| Daycare | $31 | $372 |

| Dental | $20 | $243 |

| DJ | $24 | $287 |

| Dog Grooming | $60 | $718 |

| Drone | $16 | $188 |

| Ecommerce | $69 | $827 |

| Electrical | $106 | $1,272 |

| Engineering | $38 | $451 |

| Excavation | $439 | $5,266 |

| Florist | $40 | $484 |

| Food | $101 | $1,218 |

| Food Truck | $134 | $1,603 |

| Funeral Home | $57 | $683 |

| Gardening | $106 | $1,271 |

| Handyman | $230 | $2,761 |

| Home-based | $22 | $269 |

| Home-based | $43 | $517 |

| Hospitality | $61 | $737 |

| HVAC | $231 | $2,774 |

| Janitorial | $129 | $1,551 |

| Jewelry | $38 | $456 |

| Junk Removal | $153 | $1,837 |

| Lawn/Landscaping | $113 | $1,359 |

| Lawyers | $21 | $258 |

| Manufacturing | $60 | $723 |

| Marine | $26 | $317 |

| Massage | $90 | $1,084 |

| Mortgage Broker | $22 | $259 |

| Moving | $117 | $1,403 |

| Nonprofit | $34 | $406 |

| Painting | $136 | $1,626 |

| Party Rental | $75 | $899 |

| Personal Training | $22 | $270 |

| Pest Control | $30 | $365 |

| Pet | $53 | $634 |

| Pharmacy | $58 | $699 |

| Photography | $23 | $273 |

| Physical Therapy | $104 | $1,248 |

| Plumbing | $341 | $4,089 |

| Pressure Washing | $863 | $10,353 |

| Real Estate | $50 | $601 |

| Restaurant | $137 | $1,640 |

| Retail | $62 | $739 |

| Roofing | $366 | $4,389 |

| Security | $131 | $1,573 |

| Snack Bars | $111 | $1,328 |

| Software | $25 | $298 |

| Spa/Wellness | $101 | $1,207 |

| Speech Therapist | $29 | $353 |

| Startup | $27 | $323 |

| Tech/IT | $25 | $299 |

| Transportation | $35 | $425 |

| Travel | $20 | $236 |

| Tree Service | $122 | $1,468 |

| Trucking | $97 | $1,160 |

| Tutoring | $29 | $342 |

| Veterinary | $42 | $507 |

| Wedding Planning | $26 | $313 |

| Welding | $155 | $1,865 |

| Wholesale | $42 | $505 |

| Window Cleaning | $150 | $1,801 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Minnesota General Liability Insurance Costs?

General liability insurance costs for Minnesota businesses depend on several important factors.

Minnesota's Severe Weather and Climate Risk

Minnesota has weathered 62 billion-dollar disasters from 1980 to 2024. Annual events tripled from 1.4 to 4.6 in recent years. The state saw 87 hailstorms from 2012 to 2021 and gets hit by 28 tornadoes yearly. Severe weather triggers premises liability claims when hail damages sidewalks or storms injure visitors. Brutal winters spike premiums 10% to 40% through slip-and-fall claims and equipment failures. Weather-driven claims pushed reinsurance costs up 11.2% in 2025. Insurers pass these costs straight to business premiums.

Minnesota's Geographic Risk Variations

Northern Minnesota carries the highest insurance costs due to extreme conditions and short construction seasons. Where you operate affects what you pay, with rates swinging between cities. Duluth businesses battle six-month winters that cram construction into riskier periods. Minneapolis sees heavier foot traffic and more slip-and-fall claims.

Northern Minnesota's remoteness means longer emergency response times and worse injuries. Insurers bake these geographic differences into premiums. High-risk locations pay considerably more.

Minnesota's Legal and Regulatory Environment

Minnesota's 51% bar rule lets plaintiffs recover damages in 50/50 fault scenarios, broadening liability compared to stricter states. Claims succeed 67% of the time versus 53% nationally. That's a 26% higher payout likelihood for insurers. Dram shop laws hold bars and restaurants liable for injuries their drunk customers cause after leaving. Insurance is mandatory. Minnesota's plaintiff-friendly liability framework forces insurers to reserve more capital and charge higher premiums across all business types.

Minnesota's Rising Medical and Healthcare Costs

Healthcare spending rose 15%, with prescription drugs up 30% and inpatient care prices up 25%. Health insurers raised rates 9% to 15% for 2025. Every bodily injury claim includes medical bills for emergency visits, surgeries and therapy. A slip-and-fall settlement costing $50,000 five years ago now hits $65,000 to $75,000 for the same injuries. General liability insurers can't negotiate medical bills. Healthcare inflation flows straight into business premiums.

How Much General Liability Insurance Do I Need in Minnesota?

Minnesota law mandates general liability insurance for specific licensed trades working on residential properties. The requirements for commercial general liability coverage vary by profession, with contractors, electricians, plumbers and HVAC technicians facing distinct minimum limits set by the Minnesota Department of Labor and Industry. Residential roofers also need active policies to maintain their licenses, though Minnesota doesn't specify exact amounts.

Licensed trades must meet these specific insurance minimums:

Licensed contractors working in multiple skill areas need $100,000 per occurrence and $300,000 aggregate for bodily injury, plus $25,000 in property damage coverage. Contractors offering excavation, carpentry and masonry services under one license must meet these minimums to qualify for state licensing.

Coverage minimums include $100,000 per occurrence and $300,000 aggregate for bodily injury, with an additional $50,000 for property damage. Policies must come from insurers licensed to operate in Minnesota.

Minnesota requires plumbers to carry at least $50,000 per person and $100,000 per occurrence in liability coverage. The Department of Labor and Industry won't approve licenses without current proof of insurance on file.

Insurance requirements differ by city. For example, Minneapolis mandates $100,000 per occurrence and $300,000 aggregate, while St. Paul requires $500,000 combined for bodily injury and property damage.

Note: State insurance requirements change regularly. Check current requirements with the Minnesota Department of Commerce or contact a licensed insurance agent for the latest information.

How to Choose the Best General Liability Insurance in Minnesota

Choose general liability insurance in Minnesota by evaluating your industry risks, required coverage limits and budget constraints. Getting business insurance starts with understanding your exposure, from customer injuries to property damage claims. After that, compare policies that match your specific business needs.

- 1Determine Coverage Needs

The Hartford tops our Minnesota rankings for general liability insurance, giving small businesses affordable business insurance coverage without sacrificing quality service. ERGO NEXT excels at customer service and delivers robust coverage options. Nationwide ranks high for affordability and financial strength among Minnesota providers.

- 2Prepare Business Information

Request quotes from at least three carriers licensed in Minnesota. Business insurance costs swing by several hundred dollars annually between companies. Compare premiums, deductibles, coverage limits and whether legal defense expenses fall within or outside policy limits. This comparison shows which carrier delivers the best value for your money.

- 3Compare Multiple Quotes

Low-cost business insurance often includes exclusions that limit protection when claims occur. Review policy exclusions closely, since general liability coverage does not include professional errors, pollution claims, or employee injuries, which require separate policies. Confirm whether legal defense costs reduce your policy limit or apply outside it, as this detail affects how much coverage remains during a lawsuit.

- 4Look Beyond Price

Don't pick general liability insurance just because it has the most affordable business insurance premium. Policy exclusions and coverage gaps vary wildly between carriers. Knowing what's not covered saves you from expensive surprises at claim time. Professional errors, pollution liability and employee injuries always need their own policies. Understand the full scope of protection before you buy on price alone.

- 5Verify Insurer Credentials

Confirm insurer legitimacy through the Minnesota Department of Commerce. Check AM Best financial strength ratings to ensure they can actually pay claims. Look at complaint ratios and customer feedback to spot carriers with sketchy claims handling or payment delays. Financially solid carriers matter most when you're staring down a big liability claim.

- 6Ask About Discounts

Minnesota carriers offer discounts for bundling policies, staying claims-free and paying annually instead of monthly. Bundle general liability with commercial property or auto coverage to slash total costs 10% to 25% through a business owner's policy. Safety programs, employee training certifications and risk management systems prove you're lower risk and can drop your premiums.

- 7Obtain Certificate of Insurance

Certificates of insurance prove coverage to clients, landlords and contractors using the standard ACORD 25 form or Department of Commerce approved alternatives. Many carriers email digital certificates right after purchase. Others need one to two business days for custom versions. Keep your agent's contact info handy for rush certificate requests that could stall contract signings or project kickoffs.

- 8Review Coverage Annually

Review your general liability coverage every year, especially after you hire employees, expand services or boost revenue. Get renewal quotes 60 to 90 days before your policy expires so you can compare rates and tweak limits as your business grows. Annual checkups prevent coverage gaps and dodge premium audits that hit you with surprise bills for underreported revenue or payroll.

Top General Liability Insurance in Minnesota: Bottom Line

Finding the right general liability insurance in Minnesota starts with knowing your coverage needs and comparing providers carefully. The Hartford, ERGO NEXT and Nationwide lead the pack, but your best choice hinges on your industry, business size and budget. Get quotes from multiple insurers and check their credentials before you commit.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Minnesota Chamber of Commerce. "2025 State of Business Retention and Expansion in Minnesota." Accessed February 19, 2026.

- Minnesota Counties Intergovernmental Trust. "2025 Rates Influenced by Cost of Reinsurance, Claim Trends." Accessed February 19, 2026.

- Minnesota Department of Commerce. "Consumer Alert: MN Commerce Advises Minnesota Homeowners to Check Insurance Coverage for Wind, Hail Limits." Accessed February 19, 2026.

- Minnesota Department of Health. "Health Care Spending, Prices, and Utilization in Minnesota: 2018 to 2022." Accessed February 19, 2026.

- Minnesota Department of Health. "Section 1: Minnesota Health Care Spending and Cost Drivers - Chart Summaries." Accessed February 19, 2026.

- Minnesota Department of Natural Resources. "Minnesota Tornado History and Statistics." Accessed February 19, 2026.

- Minnesota Office of the Revisor of Statutes. "Minnesota Statutes Section 340A.801 - Civil Actions." Accessed February 19, 2026.

- Minnesota Office of the Revisor of Statutes. "Minnesota Statutes Section 604.01 - Comparative Fault; Effect." Accessed February 19, 2026.

- National Oceanic and Atmospheric Administration. "Billion-Dollar Weather and Climate Disasters." Accessed February 19, 2026.