Get answers to common questions about general liability insurance in South Carolina through our best business insurance research. MoneyGeek's analysis provides reliable insights to help South Carolina business owners make informed coverage decisions:

Best General Liability Insurance in South Carolina

The Hartford leads South Carolina as the top-rated and most affordable general liability insurer, with coverage starting at $84 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in South Carolina: Fast Answers

Which company offers the best general liability insurance in South Carolina?

The Hartford is the top general liability insurance company in South Carolina, earning a 4.59 out of 5 with competitive rates at $84 per month. It delivers strong claims handling and affordable coverage for local businesses. ERGO NEXT follows closely with a 4.56 score, offering reliable digital tools and solid customer support for $106 per month.

Who offers the cheapest general liability insurance in South Carolina?

The cheapest general liability insurance companies in South Carolina are:

- The Hartford: $84 per month

- Simply Business: $99 per month

- Nationwide: $100 per month

- Progressive: $103 per month

- ERGO NEXT: $106 per month

Do South Carolina businesses legally need general liability insurance?

South Carolina doesn't legally require most businesses to carry general liability insurance. However, certain licensed professionals like contractors and electricians may need specific coverage amounts. Local municipalities can impose their own requirements, and most landlords and clients demand proof of insurance before signing contracts.

How much does general liability insurance cost in South Carolina?

General liability insurance costs between $17 and $947 per month for small South Carolina businesses with two employees. Drone companies pay the lowest rates, while pressure washing businesses see the highest premiums. Your actual cost depends on your industry risk level, business location, coverage limits and employee count.

Best General Liability Insurance Companies in South Carolina

The Hartford leads our South Carolina rankings for general liability insurance with low rates and quality customer service. ERGO NEXT earns high marks for helping small business owners navigate claims and coverage questions. Nationwide offers reliable financial strength and broad coverage choices.

| The Hartford | 4.59 | $84 |

| ERGO NEXT | 4.56 | $106 |

| Nationwide | 4.53 | $100 |

| Simply Business | 4.48 | $99 |

| Coverdash | 4.38 | $106 |

| Thimble | 4.35 | $110 |

| biBERK | 4.31 | $117 |

| Chubb | 4.28 | $122 |

| Progressive Commercial | 4.28 | $103 |

| Hiscox | 4.20 | $117 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap South Carolina General Liability Insurer

Select your industry and state to get a customized South Carolina general liability insurance quote.

General liability insurance covers your South Carolina business against customer injuries and property damage, but it won't protect you from every risk. Complete your business insurance strategy with these additional guides:

Best South Carolina General Liability Insurance Reviews

Finding the best general liability insurance provider in South Carolina requires looking beyond affordable rates to consider coverage quality and customer service. Our research analyzed top business insurers to help you make the right choice.

The Hartford

Best South Carolina General Liability Insurer

Average Monthly General Liability Premium

$84These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Processes claims quickly with high service ratings

Delivers responsive support through experienced service teams

Holds an A+ AM Best rating for financial strength

Ranks first statewide for general liability coverage

consPolicy purchases require working with an agent

Online tools trail those of other large insurers

The Hartford ranks first in South Carolina for general liability insurance with an A+ AM Best rating. The insurer handles claims quickly and provides direct support through local agents, which works well for businesses that want personal attention.

South Carolina contractors, retail operations and professional service firms get access to The Hartford's broad coverage options and industry knowledge.

Overall Score 4.59 1 Affordability Score 4.49 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 At $84 per month on average, The Hartford offers some of the lowest general liability rates in South Carolina. Construction, electrical and professional service businesses see strong pricing, with affordability extending across 26 business categories.

Accountants $17 2 Ad Agency $24 4 Bakery $70 8 Automotive $40 3 Auto Repair $123 2 Barber $29 6 Beauty Salon $53 8 Candle $42 3 Bounce House $57 1 Cannabis $54 1 Cleaning $103 2 Catering $55 5 Coffee Shop $77 10 Computer Programming $17 3 Consulting $17 2 Computer Repair $38 1 Construction $134 1 Contractor $212 2 Courier $172 1 Dental $17 2 Daycare $26 1 Dog Grooming $49 3 DJ $15 4 Excavation $453 4 Drone $13 1 Ecommerce $56 6 Electrical $87 1 Engineering $26 2 Florist $37 4 Food Truck $114 2 Food $84 1 Funeral Home $47 2 Home-based $18 1 Gardening $84 2 Handyman $184 2 Hospitality $52 5 Janitorial $111 2 HVAC $218 2 Jewelry $21 3 Lawyers $18 2 Junk Removal $130 1 Lawn/Landscaping $100 4 Manufacturing $21 2 Massage $75 8 Marine $24 1 Mortgage Broker $18 2 Painting $114 1 Moving $98 2 Nonprofit $30 2 Party Rental $68 6 Pet $42 2 Personal Training $19 1 Pest Control $26 1 Physical Therapy $23 3 Pharmacy $49 4 Photography $17 2 Plumbing $286 2 Pressure Washing $880 1 Retail $50 5 Real Estate $41 4 Restaurant $115 3 Roofing $375 3 Snack Bars $92 1 Security $113 1 Software $16 3 Transportation $32 1 Spa/Wellness $85 1 Speech Therapist $26 2 Startup $24 4 Tech/IT $17 2 Travel $16 1 Tree Service $105 2 Trucking $83 10 Welding $138 1 Tutoring $18 3 Veterinary $40 2 Wedding Planning $16 4 Wholesale $40 2 Window Cleaning $132 1 Customer feedback places The Hartford among the leading insurers for claims handling and service support in South Carolina. Policyholders report high satisfaction and renewal rates tied to clear communication and efficient claim resolution. Digital account features receive lower marks, though many business owners continue to value the company’s knowledgeable support teams.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford offers general liability coverage with limits from $300,000 to $2 million per occurrence and aggregate limits up to twice that amount. Businesses can add product liability coverage and broad form contractual liability options.

You can bundle data breach protection through a business owner's policy, which gives South Carolina businesses multiple coverage types in one package.

ERGO NEXT

Best South Carolina Commercial General Liability Customer Experience

Average Monthly General Liability Premium

$106These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first for customer service with responsive support

Has an A- AM Best financial strength rating

Leads in digital experience with user-friendly online platform

Most affordable rates among general liability providers surveyed

consNewer insurer with limited operating history compared to competitors

All interactions handled online without local agent support

Lower financial stability ranking among surveyed providers

ERGO NEXT is a strong option in South Carolina for its exceptional customer service and comprehensive coverage options. With an A- rating from AM Best, ERGO NEXT delivers reliable financial protection well-suited for tech companies, professional services and contractors.

South Carolina businesses prioritizing digital convenience and streamlined policy management will find ERGO NEXT's online platform especially valuable.

Overall Score 4.56 2 Affordability Score 4.28 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT offers general liability coverage in South Carolina at competitive rates averaging $106 monthly. The provider shows strength in affordability for dental practices, tech companies and professional services, while also maintaining competitive pricing for contractors and retail businesses.

Data filtered by:AccountantsAccountants $18 3 Customer feedback highlights ERGO NEXT's excellence in digital experience and policy management. South Carolina businesses consistently praise the provider's user-friendly platform and straightforward renewal process. The high likelihood of customers to recommend ERGO NEXT reflects strong overall satisfaction with their service delivery.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT provides general liability coverage with limits up to $2 million per claim and $4 million aggregate. The provider offers valuable add-ons including contractor E&O insurance and endorsements for completed work protection through CG2010. These flexible coverage options benefit construction and contract-based businesses in South Carolina.

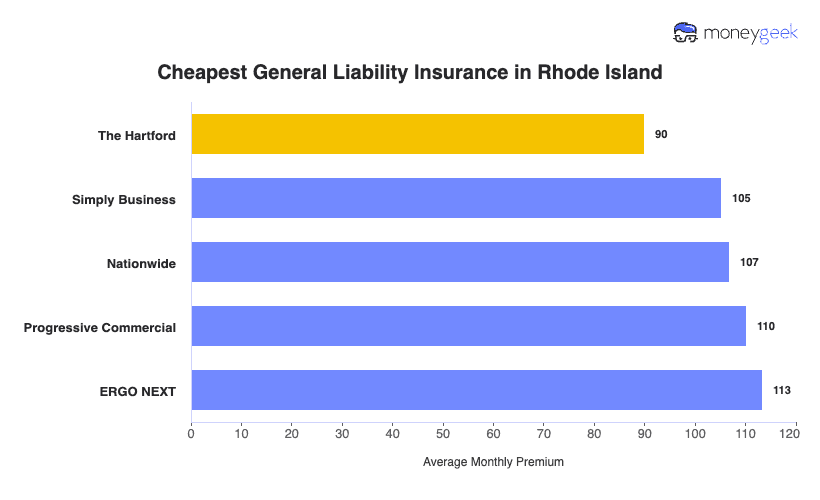

Cheapest General Liability Insurance Companies in South Carolina

The Hartford offers the cheapest general liability insurance in South Carolina at $84 per month, saving businesses $22 or 20.5% compared to the state average. Simply Business and Nationwide also provide affordable coverage options.

| The Hartford | $84 | $1,011 |

| Simply Business | $99 | $1,183 |

| Nationwide | $100 | $1,200 |

| Progressive Commercial | $103 | $1,238 |

| ERGO NEXT | $106 | $1,274 |

| Coverdash | $107 | $1,278 |

| Thimble | $110 | $1,324 |

| Hiscox | $117 | $1,409 |

| biBERK | $117 | $1,410 |

| Chubb | $122 | $1,469 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in South Carolina by Industry

MoneyGeek's research identifies the most affordable general liability insurance providers by industry across South Carolina.

- The Hartford provides the lowest rates across 23 industries statewide. Its strongest pricing appears in construction, electrical work, pest control and transportation businesses.

- Thimble claims the top affordability spot in 14 industries. The provider prices especially well for service-based businesses such as cleaning companies, HVAC contractors and software developers.

- biBerk leads pricing in 12 industries across South Carolina. The insurer performs best among personal service businesses, including barber shops, beauty salons and veterinary practices.

- Simply Business posts the lowest rates in 11 industries. Its pricing works particularly well for professional service firms like accounting offices, consulting businesses and law practices.

- ERGO NEXT and Nationwide each rank first in seven industries. ERGO NEXT shows its best pricing for tech companies and photographers, while Nationwide leads in manufacturing and real estate sectors.

| Accountants | Simply Business | $15 | $178 |

Average Cost of General Liability Insurance in South Carolina

General liability insurance costs South Carolina small businesses an average of $106 per month. The average cost of general liability coverage depends on your industry, business size, location and coverage limits.

Manufacturing companies often pay higher premiums due to increased risk exposure, while accounting firms tend to pay less because of lower liability concerns. Sole proprietors generally pay less than businesses with employees since they have fewer liability risks.

Average Cost of General Liability Insurance in South Carolina by Industry

General liability insurance costs in South Carolina vary widely by industry, ranging from $17 monthly for drone businesses to $947 for pressure washing companies. This difference shows how your business type directly impacts your general liability coverage rates. Review this table to find typical costs for your specific industry.

| Accountants | $23 | $274 |

| Ad Agency | $37 | $439 |

| Automotive | $55 | $662 |

| Auto Repair | $157 | $1,887 |

| Bakery | $93 | $1,122 |

| Barber | $46 | $550 |

| Beauty Salon | $69 | $830 |

| Bounce House | $73 | $873 |

| Candle | $57 | $682 |

| Cannabis | $69 | $832 |

| Catering | $91 | $1,088 |

| Cleaning | $137 | $1,645 |

| Coffee Shop | $93 | $1,114 |

| Computer Programming | $30 | $361 |

| Computer Repair | $49 | $592 |

| Construction | $182 | $2,178 |

| Consulting | $23 | $273 |

| Contractor | $264 | $3,165 |

| Courier | $202 | $2,427 |

| Daycare | $34 | $408 |

| Dental | $22 | $267 |

| DJ | $26 | $314 |

| Dog Grooming | $66 | $788 |

| Drone | $17 | $207 |

| Ecommerce | $76 | $909 |

| Electrical | $116 | $1,396 |

| Engineering | $41 | $495 |

| Excavation | $482 | $5,783 |

| Florist | $44 | $532 |

| Food | $111 | $1,337 |

| Food Truck | $147 | $1,761 |

| Funeral Home | $62 | $750 |

| Gardening | $116 | $1,396 |

| Handyman | $253 | $3,032 |

| Home-based | $25 | $295 |

| Home-based | $47 | $568 |

| Hospitality | $67 | $809 |

| HVAC | $254 | $3,046 |

| Janitorial | $142 | $1,703 |

| Jewelry | $42 | $500 |

| Junk Removal | $168 | $2,018 |

| Lawn/Landscaping | $124 | $1,493 |

| Lawyers | $24 | $283 |

| Manufacturing | $66 | $794 |

| Marine | $29 | $348 |

| Massage | $99 | $1,190 |

| Mortgage Broker | $24 | $284 |

| Moving | $128 | $1,541 |

| Nonprofit | $37 | $446 |

| Painting | $149 | $1,786 |

| Party Rental | $82 | $987 |

| Personal Training | $25 | $296 |

| Pest Control | $33 | $401 |

| Pet | $58 | $696 |

| Pharmacy | $64 | $767 |

| Photography | $25 | $300 |

| Physical Therapy | $114 | $1,368 |

| Plumbing | $374 | $4,490 |

| Pressure Washing | $947 | $11,369 |

| Real Estate | $55 | $661 |

| Restaurant | $150 | $1,801 |

| Retail | $68 | $812 |

| Roofing | $402 | $4,819 |

| Security | $144 | $1,728 |

| Snack Bars | $122 | $1,458 |

| Software | $27 | $327 |

| Spa/Wellness | $110 | $1,325 |

| Speech Therapist | $32 | $388 |

| Startup | $30 | $355 |

| Tech/IT | $27 | $328 |

| Transportation | $39 | $467 |

| Travel | $22 | $259 |

| Tree Service | $134 | $1,612 |

| Trucking | $106 | $1,274 |

| Tutoring | $31 | $376 |

| Veterinary | $46 | $557 |

| Wedding Planning | $29 | $344 |

| Welding | $171 | $2,048 |

| Wholesale | $46 | $555 |

| Window Cleaning | $165 | $1,978 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect South Carolina General Liability Insurance Costs?

Many factors influence how much South Carolina businesses pay for general liability insurance coverage.

South Carolina Legal and Regulatory Environment

South Carolina's 2025 tort reform lowers general liability insurance costs by capping how much businesses pay when accidents occur. South Carolina’s “empty chair” defense lets juries assign blame to parties not included in the lawsuit. Joint liability rules also limit businesses to paying only their share of fault instead of covering the full damages, and bars now carry a maximum of 50% liability in DUI cases.

Insurers reduce premiums by 20% to 40% in response to these lower payout caps. Charleston, Columbia and Greenville businesses still pay 15% to 25% more than rural areas because juries in these cities award larger settlements.

South Carolina Geographic and Environmental Risks

Coastal businesses pay 25% to 40% higher general liability premiums because hurricanes and tourism increase injury claims. Insurers raise rates in hurricane-prone areas since storms create hazardous conditions, like wet floors, debris, and damaged walkways, that generate 3-4x more slip-and-fall claims.

Myrtle Beach, Charleston and Hilton Head see additional 20% to 35% rate increases due to tourist-related liability. Unfamiliar visitors slip, trip and fall more often than locals, file injury claims more readily, and sometimes sue in their home states where verdicts are unpredictable and potentially larger.

South Carolina Economic and Industry Landscape

South Carolina's manufacturing-heavy economy pushes general liability rates higher for all businesses. Insurers charge manufacturers 15% to 25% more because defective products, completed work failures, and supply chain issues create claims that last years after a sale.

The state's 6.9% GDP growth adds rate pressure as rapid expansion brings construction hazards near businesses, undertrained workers in tight labor markets, and higher wage-loss claims from injured parties earning more. Even service businesses pay 5% to 10% extra because insurers set statewide baseline rates reflecting the high-risk manufacturing sector.

South Carolina Healthcare and Medical Costs

Medical expenses drive 60% to 70% of general liability claim costs, so rising healthcare prices directly increase insurance premiums. South Carolina's projected 20% to 27% health insurance rate hikes for 2026 force GL insurers to raise premiums proportionally since every injured customer's emergency room visit, surgery and prescription costs more to cover.

The state's 37th-ranked healthcare system further inflates claim costs because uninsured injured parties skip initial treatment, develop complications requiring expensive emergency care, and use medical lien arrangements that charge 40-60% more than standard insured rates.

How Much General Liability Insurance Do I Need in South Carolina?

Your coverage needs depend on your industry and location in South Carolina. The state doesn't require general liability insurance for most businesses, but certain licensed trades must carry minimum coverage to keep their credentials active. Charleston and other cities add their own requirements beyond state rules, and these apply to specific professions.

Electricians must carry $300,000 per occurrence and $600,000 annual aggregate coverage that includes completed operations protection. South Carolina ties this insurance requirement directly to maintaining an active electrical contractor license.

Coverage requirements mirror those for standard electricians at $300,000 per occurrence and $600,000 aggregate. Policies must include protection for work completed after leaving the job site.

The South Carolina Contractor's Licensing Board requires at least $100,000 in general liability coverage. This protects against third-party claims related to installation, testing and maintenance of fire suppression systems.

Contractors working on City of Charleston projects must carry $1 million per occurrence and $2 million aggregate minimum coverage. Charleston also mandates professional liability insurance with matching limits and a $20,000 deductible.

Note: State insurance requirements can change frequently. Always verify current requirements with the South Carolina Department of Insurance or consult a licensed insurance agent.

How to Choose the Best General Liability Insurance in South Carolina

Balance coverage requirements with your budget when getting business insurance in South Carolina. General liability protects against customer accidents and property damage claims, but comprehensive protection requires evaluating multiple factors beyond basic coverage limits.

- 1Determine Coverage Needs

Licensed electricians in South Carolina must carry $300,000 per occurrence and $600,000 in annual aggregate coverage, while fire safety companies need $1 million per occurrence and $2 million aggregate.

Many commercial landlords and larger companies still require $1 million in coverage even when state minimums fall lower. Review industry licensing rules and client contracts before comparing business insurance coverage so you know the minimum limits your business must meet.

- 2Prepare Business Information

Insurers base South Carolina premiums on factors such as annual revenue, employee count, business classification and physical location. Coastal businesses often see higher pricing due to hurricane exposure, and construction companies pay more than lower-risk retail operations. Gather your EIN, business registration and tax permits before requesting quotes to keep applications accurate and efficient.

- 3Compare Multiple Quotes

Request quotes from at least three insurers, as business insurance costs vary by carrier. General liability coverage in South Carolina averages $44 per month, though pricing can differ widely depending on industry and location. Compare deductibles, coverage limits and whether legal defense costs reduce your policy limits or apply separately.

- 4Look Beyond Price

Cheap business insurance rates alone do not tell the full story. Review exclusions closely, since professional errors, pollution claims and employee injuries require separate policies. Confirm whether your insurer pays legal defense costs outside your policy limits or subtracts them from available coverage.

- 5Verify Insurer Credentials

Use the South Carolina Department of Insurance database to confirm that insurers and agents hold valid state licenses and to review consumer complaint records. Check AM Best financial strength ratings, which serve as a standard measure of insurer stability. Strong financial backing supports an insurer’s ability to pay large claims when needed.

- 6Ask About Discounts

Insurers offer discounts for bundling business insurance policies, maintaining a claims-free history and applying workplace safety programs. Combining general liability with commercial auto or property coverage through a business owner’s policy can reduce costs by 10% to 25%. Professional certifications and employee safety training also signal lower risk and may qualify for additional savings.

- 7Get Certificate Documentation

Clients, landlords and contractors in South Carolina often require a certificate of insurance before work begins or leases are signed. Request your certificate as soon as coverage starts, since proof is commonly required upfront. Many insurers issue digital certificates immediately, while others take up to 48 hours to complete processing.

- 8Review Coverage Annually

Revisit your coverage limits each year after hiring staff, expanding services or increasing revenue. South Carolina businesses also face risks from severe storms, flooding and coastal hurricane activity, which may affect coverage needs over time. Compare quotes 60 to 90 days before renewal to adjust limits or pricing based on your current operations.

Top General Liability Insurance in South Carolina: Bottom Line

The Hartford, ERGO NEXT and Nationwide lead South Carolina's general liability insurance market, but your best choice depends on your industry, company size and budget. Compare quotes from multiple insurers and check their credentials before you buy.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Centers for Medicare & Medicaid Services. "2025 Medicare Parts A & B Premiums and Deductibles." Accessed February 25, 2026.

- Centers for Medicare & Medicaid Services. "NHE Fact Sheet." Accessed February 25, 2026.

- National Oceanic and Atmospheric Administration. "Atlantic Hurricane Season Races To Finish Within Range of Predicted Number of Named Storms." Accessed February 25, 2026.

- National Oceanic and Atmospheric Administration. "Historical Hurricane Tracks." Accessed February 25, 2026.

- South Carolina Department of Employment and Workforce. "Real GDP: Quarter Two 2024." Accessed February 25, 2026.

- South Carolina Department of Insurance. "Affordable Care Act." Accessed February 25, 2026.

- South Carolina Emergency Management Division. "Hurricane Preparedness Month." Accessed February 25, 2026.

- South Carolina Governor Henry McMaster. "Gov. Henry McMaster Signs Landmark Tort Reform and Liquor Liability Bill Into Law." Accessed February 25, 2026.

- U.S. Bureau of Economic Analysis. "Gross Domestic Product by State and Personal Income by State, 1st Quarter 2025." Accessed February 25, 2026.

- U.S. Bureau of Economic Analysis. "Gross Domestic Product by State and Personal Income by State, 2nd Quarter 2024." Accessed February 25, 2026.

- USAFacts. "What Is the Gross Domestic Product (GDP) in South Carolina?." Accessed February 25, 2026.