We researched best business insurance options to answer your most common questions about general liability coverage in New Mexico based on our analysis:

Best General Liability Insurance in New Mexico

The Hartford ranks as both the best and cheapest general liability insurer in New Mexico, with coverage starting at $82 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in New Mexico: Fast Answers

Which company offers the best general liability insurance in New Mexico?

The Hartford tops our list as the best general liability insurance company in New Mexico with a 4.63 overall score. It combines affordable coverage at $82 per month with strong claims handling. ERGO NEXT ranks second with a 4.55 score, providing excellent digital tools and customer service for $104 per month.

Who offers the cheapest general liability insurance in New Mexico?

The cheapest general liability insurance companies in New Mexico are:

- The Hartford: $82 per month

- Simply Business: $96 per month

- Nationwide: $98 per month

- Progressive: $101 per month

- ERGO NEXT: $104 per month

Do New Mexico businesses legally need general liability insurance?

New Mexico doesn't legally require most businesses to carry general liability insurance at the state level. However, certain licensed professionals like contractors and electricians may need specific coverage amounts. Local municipalities can impose their own requirements, and most landlords and clients demand proof of insurance before signing contracts.

How much does general liability insurance cost in New Mexico?

General liability insurance costs between $17 and $925 per month for small New Mexico businesses with two employees. Drone services often pay the lowest rates, while pressure washing companies tend to see the highest premiums. Your actual cost depends on your industry risk level, business location, coverage limits and employee count.

Best General Liability Insurance Companies in New Mexico

The Hartford is our top choice for general liability insurance in New Mexico, thanks to its strong pricing and dependable financial strength. ERGO NEXT also performs well with great customer service, while Nationwide offers steady, reliable protection for small businesses. Together, these three providers give New Mexico business owners solid coverage options depending on their priorities.

| The Hartford | 4.63 | $82 |

| ERGO NEXT | 4.55 | $104 |

| Nationwide | 4.53 | $98 |

| Simply Business | 4.48 | $96 |

| Coverdash | 4.37 | $104 |

| Thimble | 4.35 | $108 |

| biBERK | 4.29 | $115 |

| Progressive Commercial | 4.27 | $101 |

| Chubb | 4.26 | $120 |

| Hiscox | 4.18 | $115 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap New Mexico General Liability Insurer

Select your industry and state to get a customized New Mexico general liability insurance quote.

General liability insurance shields New Mexico businesses from customer injury and property damage claims, but comprehensive financial protection requires additional coverage. Explore these related guides for complete business insurance insights:

Best New Mexico General Liability Insurance Reviews

Finding the right general liability insurance provider in New Mexico requires looking beyond affordable rates to consider coverage quality and customer service. Our research identified the top business insurers based on these important factors.

The Hartford

Best New Mexico General Liability Insurer

Average Monthly General Liability Premium

$82These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Fast claims handling with consistently high processing scores

Customer service earns top satisfaction ratings nationwide

A+ AM Best rating reflects financial reliability

Ranks first overall among general liability providers

consOnline tools lag behind many competitors

Most policies require agent involvement instead of full self-service

The Hartford ranks at the top of New Mexico’s general liability market due to competitive pricing and steady financial backing supported by an A+ AM Best rating. High customer service scores and efficient claims handling make the provider a good fit for construction, professional services and retail businesses that prioritize dependable coverage.

Its agent-driven approach stands out for businesses that prefer direct guidance and ongoing support rather than relying only on digital tools.

Overall Score 4.63 1 Affordability Score 4.61 1 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 Monthly general liability costs in New Mexico average $82 with The Hartford, putting it at the lower end of pricing across many industries. Construction, electrical work, professional services and retail businesses see steady cost advantages. The insurer ranks among the most affordable options in 47 business categories.

Data filtered by:AccountantsAccountants $17 2 Customer feedback highlights reliable claims handling and responsive agent support. The Hartford earns high national rankings for both claims processing and customer service, with many policyholders pointing to clear communication throughout the claims process. While digital tools feel limited, agent involvement often offsets those gaps for businesses that prefer personalized assistance.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford offers general liability limits ranging from $300,000 to $2 million per occurrence, with aggregate limits available at up to twice those amounts. Businesses can add product liability coverage and broad form contractual liability coverage to address contract-related risks. Its business owner's policy allows bundling with data breach protection, creating a more complete coverage package for New Mexico businesses.

ERGO NEXT

Best New Mexico Commercial General Liability Customer Experience

Average Monthly General Liability Premium

$104These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Competitive commercial pricing across many industries

Fully digital platform for policy management

A- AM Best rating

High customer recommendation rates

consLimited operating history

No local agent support

ERGO NEXT has built a strong presence in New Mexico by pairing responsive service with a fully digital policy experience. An A- AM Best rating supports its ability to meet claims obligations, while streamlined tools appeal to business owners who prefer handling coverage online.

The provider focuses on industries such as dental, tech, trucking and professional services, offering coverage structures that align with their operational needs.

Overall Score 4.55 2 Affordability Score 4.25 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 General liability coverage from ERGO NEXT averages $104 per month in New Mexico, keeping pricing competitive across several industries. Dental practices, tech firms and trucking businesses see consistent cost advantages. The insurer ranks well for affordability across 22 business categories, including automotive, daycare and construction services.

Data filtered by:AccountantsAccountants $17 3 Customer feedback centers on ease of use and digital policy management. Business owners often highlight smooth renewals and a high willingness to recommend the provider to others. Claims handling and customer service scores remain solid at the national level.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT offers general liability limits of up to $2 million per claim and $4 million in aggregate coverage. Available add-ons include contractor E&O insurance and completed operations protection through CG2010 endorsements. These options work well for construction and contract-based businesses operating in New Mexico.

Cheapest General Liability Insurance Companies in New Mexico

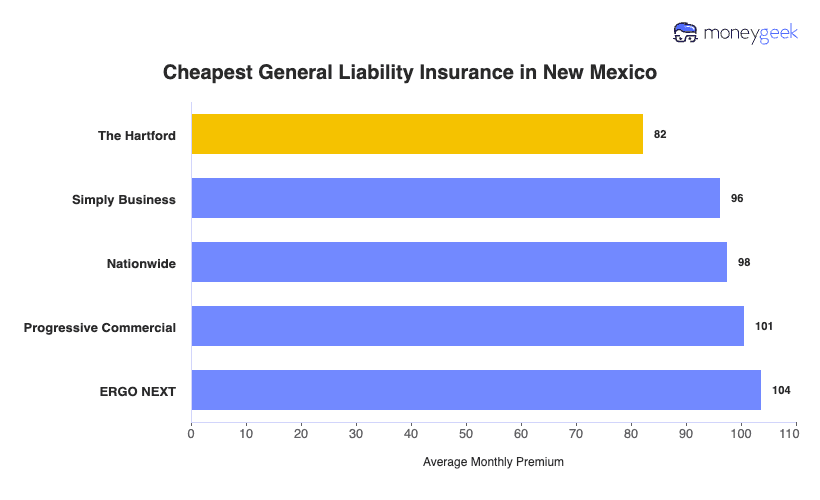

The Hartford offers the cheapest general liability insurance in New Mexico at $82 per month, saving businesses $21 or 20% compared to the state average. Simply Business and Nationwide also provide affordable coverage options for small businesses.

| The Hartford | $82 | $987 |

| Simply Business | $96 | $1,155 |

| Nationwide | $98 | $1,171 |

| Progressive Commercial | $101 | $1,208 |

| ERGO NEXT | $104 | $1,244 |

| Coverdash | $104 | $1,248 |

| Thimble | $108 | $1,293 |

| Hiscox | $115 | $1,376 |

| biBERK | $115 | $1,377 |

| Chubb | $120 | $1,434 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in New Mexico by Industry

MoneyGeek's research identifies the most affordable general liability insurance providers by industry in New Mexico.

- The Hartford offers the cheapest coverage across 22 industries, leading in construction, electrical work, food trucks and transportation businesses.

- Thimble ranks as the most affordable option for 14 industries, with strong performance in service sectors like cleaning, HVAC, roofing and software development.

- Simply Business and biBerk each dominate 10 industries. Simply Business excels for professional services including accountants, lawyers and consultants, while biBerk leads among contractors, engineers and handyman services.

- ERGO NEXT provides the lowest rates for eight industries, with strong pricing for tech companies, photographers and spa businesses.

- Nationwide delivers affordable coverage across seven industries, showing strength in manufacturing, real estate and restaurants.

| Accountants | Simply Business | $15 | $174 |

Average Cost of General Liability Insurance in New Mexico

Most small businesses in New Mexico pay around $103 monthly for general liability insurance. The average cost of general liability coverage depends on your industry, business size, location and coverage limits.

Manufacturing companies often pay higher premiums because of increased liability risks. Accounting firms usually pay less because they have lower exposure to potential claims. Sole proprietors generally pay less than businesses with employees since they have fewer liability exposures.

Average Cost of General Liability Insurance in New Mexico by Industry

New Mexico businesses pay between $17 and $925 monthly for general liability coverage. Drone businesses often get the lowest rates at $17 per month, while pressure washing companies tend to have the highest costs at $925 monthly. Review this table to find rates specific to your industry.

| Accountants | $22 | $267 |

| Ad Agency | $36 | $429 |

| Automotive | $54 | $646 |

| Auto Repair | $154 | $1,843 |

| Bakery | $91 | $1,095 |

| Barber | $45 | $537 |

| Beauty Salon | $68 | $810 |

| Bounce House | $71 | $852 |

| Candle | $56 | $666 |

| Cannabis | $68 | $813 |

| Catering | $89 | $1,063 |

| Cleaning | $134 | $1,606 |

| Coffee Shop | $91 | $1,088 |

| Computer Programming | $29 | $353 |

| Computer Repair | $48 | $578 |

| Construction | $177 | $2,127 |

| Consulting | $22 | $266 |

| Contractor | $258 | $3,091 |

| Courier | $197 | $2,370 |

| Daycare | $33 | $399 |

| Dental | $22 | $261 |

| DJ | $26 | $307 |

| Dog Grooming | $64 | $769 |

| Drone | $17 | $202 |

| Ecommerce | $74 | $887 |

| Electrical | $114 | $1,363 |

| Engineering | $40 | $483 |

| Excavation | $471 | $5,647 |

| Florist | $43 | $519 |

| Food | $109 | $1,305 |

| Food Truck | $143 | $1,719 |

| Funeral Home | $61 | $732 |

| Gardening | $114 | $1,363 |

| Handyman | $247 | $2,960 |

| Home-based | $24 | $288 |

| Home-based | $46 | $555 |

| Hospitality | $66 | $790 |

| HVAC | $248 | $2,975 |

| Janitorial | $139 | $1,663 |

| Jewelry | $41 | $489 |

| Junk Removal | $164 | $1,970 |

| Lawn/Landscaping | $121 | $1,458 |

| Lawyers | $23 | $277 |

| Manufacturing | $65 | $775 |

| Marine | $28 | $340 |

| Massage | $97 | $1,162 |

| Mortgage Broker | $23 | $277 |

| Moving | $125 | $1,504 |

| Nonprofit | $36 | $435 |

| Painting | $145 | $1,744 |

| Party Rental | $80 | $964 |

| Personal Training | $24 | $290 |

| Pest Control | $33 | $391 |

| Pet | $57 | $680 |

| Pharmacy | $62 | $749 |

| Photography | $24 | $293 |

| Physical Therapy | $111 | $1,336 |

| Plumbing | $365 | $4,384 |

| Pressure Washing | $925 | $11,101 |

| Real Estate | $54 | $645 |

| Restaurant | $147 | $1,758 |

| Retail | $66 | $793 |

| Roofing | $392 | $4,705 |

| Security | $141 | $1,687 |

| Snack Bars | $119 | $1,424 |

| Software | $27 | $319 |

| Spa/Wellness | $108 | $1,294 |

| Speech Therapist | $32 | $378 |

| Startup | $29 | $347 |

| Tech/IT | $27 | $320 |

| Transportation | $38 | $456 |

| Travel | $21 | $253 |

| Tree Service | $131 | $1,574 |

| Trucking | $104 | $1,244 |

| Tutoring | $31 | $367 |

| Veterinary | $45 | $544 |

| Wedding Planning | $28 | $336 |

| Welding | $167 | $2,000 |

| Wholesale | $45 | $542 |

| Window Cleaning | $161 | $1,931 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect New Mexico General Liability Insurance Costs?

Many important factors determine what New Mexico businesses pay for general liability insurance coverage.

New Mexico's Legal and Employment Litigation Environment

New Mexico cracks the top five states for employee lawsuit risk. The state's fair employment laws stretch beyond federal requirements, opening more doors for workers to sue. Small businesses face employment charges at a rate of one in five, with legal defense running $125,000 per case on average.

Most general liability policies now bundle Employment Practices Liability Insurance to handle discrimination, wrongful termination and harassment lawsuits. Broader worker protections mean insurers pay out more often and in larger amounts, costs they pass straight through to business premiums.

New Mexico's High-Risk Industry Concentration

Construction companies in New Mexico shell out $500 monthly for general liability versus $50 for consultants. Mining and oil/gas extraction account for 11% of the state's GDP compared to 1% nationwide. These operations rack up third-party injuries and property damage claims at alarming rates.

When dangerous industries dominate your state's economy, everyone's insurance costs climb. Lower-risk businesses still pay elevated rates because insurers calculate premiums based on the statewide claims environment, not just individual business type.

New Mexico's Tourism and Hospitality Economy

Leisure and hospitality pump $6.5 billion into New Mexico's economy through visitor spending. Tourists flock to 5 national forests, 15 national parks and monuments, and 34 state parks throughout the state. All those visitors create serious liability headaches. Businesses deal with injuries from people who don't know the terrain, outdoor accidents miles from medical help, and weather that changes without warning.

Insurance companies see outdoor tourism as high severity risk because backcountry injuries cost more to resolve, which jacks up premiums for hotels, tour companies and recreation outfits.

New Mexico's Extreme Weather and Natural Disaster Patterns

New Mexico battles roughly 1,500 wildfires each year, charring 300,000 to 400,000 acres. Flash floods pound the state from June through September. Wildfires leave behind burn scars that seal the soil, turning gentle rain into dangerous runoff. One disaster triggers another.

Businesses file premises liability claims for customers who slip on debris, suffer smoke exposure, or get caught in sudden floods during monsoon season. Weather volatility makes insurers nervous, so they charge more for coverage in areas where fires and floods strike regularly.

How Much General Liability Insurance Do I Need in New Mexico?

New Mexico doesn't mandate specific coverage limits for most businesses, though requirements for commercial general liability insurance exist for third-party alcohol delivery services. These businesses must hold at least $1 million per occurrence with a liquor liability endorsement under the Liquor Control Act.

Most businesses in New Mexico select $1 million per occurrence and $2 million aggregate limits. The coverage amount you need depends on your industry risk, contract requirements and asset protection goals. Contractors bidding on commercial projects often need higher limits, while service-based businesses might find standard coverage sufficient for client contracts and lease agreements.

Note: State insurance rules change often. Check current requirements with the New Mexico Office of Superintendent of Insurance or talk with a licensed insurance agent before selecting coverage.

How to Choose the Best General Liability Insurance in New Mexico

Match your general liability insurance coverage to your business risks and budget in New Mexico. Getting business insurance starts with understanding your industry's common claims and comparing quotes from multiple insurers to balance protection with cost.

- 1Determine Coverage Needs

New Mexico doesn't require general liability insurance for most businesses, though third-party alcohol delivery services must carry $1 million per occurrence. Contractors often need $1 million to $2 million in coverage to meet client or municipal contract terms.

Review lease agreements, client contracts and industry standards to identify the business insurance coverage that aligns with your operations.

- 2Prepare Business Information

Insurers set general liability rates based on revenue, employee count, business activities and location within New Mexico. Rates in Albuquerque often differ from Las Cruces or Santa Fe due to claim volume and population density. Gather your EIN, business registration details, revenue estimates and clear descriptions of services before requesting quotes.

- 3Compare Multiple Quotes

Request quotes from at least three insurers authorized to sell coverage in New Mexico through the Office of Superintendent of Insurance. Business insurance costs vary between carriers even when coverage limits and deductibles match. Check whether defense costs reduce policy limits or receive separate payment, since this affects your protection.

- 4Look Beyond Premium

Low-cost policies often include exclusions that reduce coverage when claims arise. Review exclusions for professional errors, pollution liability and employee injuries, which require separate policies. Confirm whether legal defense costs fall inside or outside policy limits to avoid unexpected expenses.

- 5Verify Insurer Credentials

Confirm insurer authorization through the New Mexico Office of Superintendent of Insurance and review AM Best financial strength ratings. While state law requires adequate reserves, complaint data highlights claims-handling issues. Focus on insurers with A- or better ratings and an established presence in New Mexico.

- 6Ask About Discounts

Many New Mexico insurers offer discounts when bundling general liability with workers’ compensation or commercial auto coverage, often reducing costs by 15% to 25%. Safety programs, clean claims history and annual payment options also lower rates. Ask about Small Business Development Center resources that support risk management discounts.

- 7Obtain Certificate of Insurance

Clients, landlords and general contractors in New Mexico often require certificates of insurance before work begins or leases are signed. Most insurers issue digital certificates within 24 hours through online portals or agent requests. Keep direct agent contact details available for urgent certificate needs.

- 8Review Coverage Annually

Reassess coverage 60 to 90 days before renewal, especially after revenue changes or service expansion. Compare updated quotes each year since business classification and claims history affect pricing across insurers. Report operational changes promptly to prevent coverage gaps during audits.

Top General Liability Insurance in New Mexico: Bottom Line

Choosing the right general liability insurance in New Mexico starts with a clear view of your business risks and a careful review of available providers. The Hartford, ERGO NEXT and Nationwide perform well in our analysis, but the best fit depends on your industry, company size and budget. Compare quotes from several insurers and confirm their credentials before deciding.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Bureau of Economic Analysis. "Real Gross Domestic Product: All Industry Total in New Mexico." Accessed March 10, 2026.

- Center for Employment Equity, University of Massachusetts Amherst. "Who Files Discrimination Charges?." Accessed March 10, 2026.

- Federal Reserve Bank of Dallas. "New Mexico Draws on Energy, Trade to Spur Economy." Accessed March 10, 2026.

- National Interagency Coordination Center. "Wildland Fire Summary and Statistics Annual Report 2022." Accessed March 10, 2026.

- New Mexico Tourism Department. "New Mexico Sets New Record for Visitor Spending of $8.6 Billion in 2023." Accessed March 10, 2026.

- Office of the Governor - Michelle Lujan Grisham. "New Mexico's Tourism Industry Sees All-Time Record Spending." Accessed March 10, 2026.

- The Pew Charitable Trusts. "Fire, Then Flood? How Some Weather-Related Disaster Types Increase Risk of Others." Accessed March 10, 2026.

- USAFacts. "What Is the Gross Domestic Product (GDP) in New Mexico?." Accessed March 10, 2026.