Our research team compiled answers to common questions about best business insurance and general liability coverage in Missouri. These insights come from MoneyGeek's detailed analysis of policies and providers:

Best General Liability Insurance in Missouri

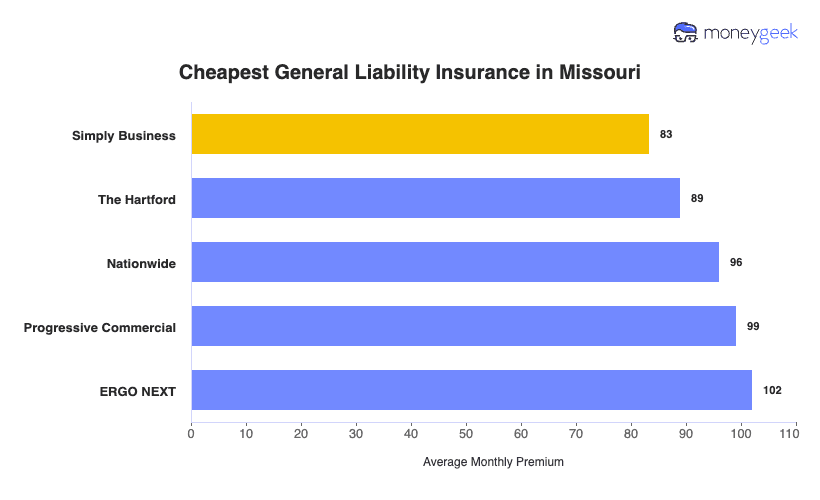

The Hartford leads Missouri general liability insurance, while Simply Business offers the lowest rates starting at $83 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Missouri: Fast Answers

Which company offers the best general liability insurance in Missouri?

The Hartford and ERGO NEXT tie as Missouri's best general liability insurers, both earning 4.55 out of 5 scores. The Hartford charges $89 monthly with fast claims processing. ERGO NEXT costs $102 monthly and provides strong digital tools plus responsive customer service.

Who offers the cheapest general liability insurance in Missouri?

The cheapest general liability insurance companies in Missouri are:

- Simply Business: $83 per month

- The Hartford: $89 per month

- Nationwide: $96 per month

- Progressive: $99 per month

- ERGO NEXT: $102 per month

Do Missouri businesses legally need general liability insurance?

Missouri doesn't require most businesses to carry general liability insurance at the state level. But contractors, electricians and other licensed professionals often need coverage to keep their licenses. Local cities can set their own rules and landlords plus clients usually demand proof of insurance before contracts.

How much does general liability insurance cost in Missouri?

General liability insurance costs between $17 and $911 per month for small Missouri businesses with two employees. Drone businesses see some of the lowest rates, while pressure washing companies often pay the highest premiums. Your actual cost depends on your specific industry, business location, coverage limits and company size.

Best General Liability Insurance Companies in Missouri

The Hartford and ERGO NEXT are our top picks for Missouri general liability insurance. The Hartford combines affordable rates with financial strength. ERGO NEXT ranks highest for customer service. Nationwide offers competitive prices and solid support for small businesses statewide.

| The Hartford | 4.55 | $89 |

| ERGO NEXT | 4.55 | $102 |

| Nationwide | 4.51 | $96 |

| Simply Business | 4.47 | $83 |

| Coverdash | 4.36 | $102 |

| Thimble | 4.35 | $106 |

| biBERK | 4.28 | $113 |

| Progressive Commercial | 4.26 | $99 |

| Chubb | 4.25 | $118 |

| Hiscox | 4.17 | $113 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Missouri General Liability Insurer

Select your industry and state to get a customized Missouri general liability insurance quote.

General liability insurance shields Missouri businesses from customer injury and property damage claims, but comprehensive protection requires additional coverage types. Explore these related insurance guides:

Best Missouri General Liability Insurance Reviews

Finding the best general liability insurance in Missouri requires looking beyond just affordable rates. Coverage quality and customer service matter too. Our research identified the top business insurers based on these important factors.

The Hartford

Best Missouri General Liability Insurer

Average Monthly General Liability Premium

$89These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Holds an A+ AM Best financial strength rating

Processes claims quickly with consistent turnaround times

Offers responsive, knowledgeable customer support

Earns strong overall customer satisfaction scores

consRequires working with an agent rather than fully online purchasing

Digital tools trail behind other major providers

The Hartford ranks at the top of Missouri’s general liability market thanks to its financial stability, reliable pricing and service-focused approach. With an A+ AM Best rating, the company backs its coverage with long-term financial strength and dependable claims handling. Missouri businesses that value personal support and proven reliability often choose The Hartford, especially in construction, retail and professional services.

Overall Score 4.55 1 Affordability Score 4.39 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 Businesses in Missouri pay an average of $89 per month for general liability coverage from The Hartford. The company keeps pricing competitive across industries such as electrical contracting, food service and construction. Consistent rates across business types help owners compare options without large pricing swings.

Data filtered by:AccountantsAccountants $18 3 Missouri policyholders frequently highlight The Hartford’s efficient claims process and hands-on customer service. Reviews point to helpful agents and fair claim outcomes as key strengths. While the online experience feels more limited than some competitors, many businesses prefer the added guidance from a dedicated support team.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford offers general liability limits ranging from $300,000 to $2 million per occurrence, with aggregate limits set at twice the per-occurrence amount. Businesses can add broad form contractual liability or bundle data breach protection through a business owner’s policy. Manufacturers and food service businesses also have access to tailored product liability coverage for added protection.

Nationwide

Best Missouri Commercial General Liability: Runner-Up

Average Monthly General Liability Premium

$96These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.3/5

- pros

Holds the top financial stability score among Missouri providers

Earns an A+ AM Best rating for long-term financial strength

Good customer service with reliable agent support

Maintains high satisfaction for policy management and renewals

consLimited digital tools compared with many competitors

Relies on agent-assisted purchasing rather than full online enrollment

Nationwide appeals to Missouri businesses that value long-term financial stability and dependable customer service. Strong financial backing and a service-first approach make it a solid option for owners who prefer working directly with an agent. Service-based businesses, contractors and retail operations often choose Nationwide for its reliable claims handling and consistent policy support.

Overall Score 4.51 2 Affordability Score 4.36 3 Customer Service Score 4.55 2 Coverage Score 4.61 4 Stability Score 4.98 1 Missouri businesses pay an average of $96 per month for general liability coverage from Nationwide. The company offers competitive pricing for janitorial services, manufacturing and construction. Strong rates also apply to essential services such as electrical work, hospitality and professional services.

Data filtered by:AccountantsAccountants $20 4 Customer feedback from Missouri business owners reflects solid satisfaction with Nationwide’s policy management and customer service. High renewal rates and frequent recommendations point to consistent experiences. The agent network supports businesses with personalized guidance throughout the policy lifecycle.

Overall Customer Score 4.16 6 Claims Process 3.90 5 Customer Service 4.30 3 Digital Experience 4.00 8 Overall Satisfaction 4.20 5 Policy Management 4.30 2 Recommend to Others 4.30 4 Renewal Likelihood 4.20 5 Nationwide offers general liability limits from $300,000 to $2 million per occurrence, with aggregate limits reaching $4 million. Businesses can add product liability coverage or data breach protection based on industry needs. Flexible payment options and the ability to bundle coverage through a business owner’s policy give Missouri businesses room to tailor protection.

Cheapest General Liability Insurance Companies in Missouri

Simply Business offers the cheapest general liability insurance in Missouri at $83 per month, saving businesses $18 or 17.4% compared to the state average. The Hartford and Nationwide also provide affordable coverage options.

| Simply Business | $83 | $1,001 |

| The Hartford | $89 | $1,069 |

| Nationwide | $96 | $1,153 |

| Progressive Commercial | $99 | $1,189 |

| ERGO NEXT | $102 | $1,225 |

| Coverdash | $102 | $1,229 |

| Thimble | $106 | $1,274 |

| Hiscox | $113 | $1,356 |

| biBERK | $113 | $1,357 |

| Chubb | $118 | $1,412 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Missouri by Industry

MoneyGeek's research identifies the top five most affordable general liability insurance providers across Missouri industries.

- Simply Business tops the affordability rankings in 18 industries statewide. The provider excels with professional services like accountants, lawyers and consultants, plus home-based businesses and specialized sectors.

- ERGO NEXT offers the cheapest coverage in 15 industries across Missouri. The company performs well for tech businesses, healthcare services like dental practices and specialized trades including welding and pest control.

- biBerk ranks as the most affordable option in 13 industries. This provider leads in construction and contracting work, plus hospitality, trucking and veterinary services.

- Thimble provides the lowest rates for 11 Missouri industries. The company shows strong results for construction, HVAC, roofing and various service-based businesses.

- Progressive and The Hartford each win six industries for general liability affordability. Progressive dominates retail and food service sectors, while The Hartford leads in electrical work and food-related businesses.

| Accountants | Simply Business | $13 | $150 |

Average Cost of General Liability Insurance in Missouri

General liability insurance costs Missouri small businesses an average of $101 per month. The average cost of general liability coverage depends on your industry, business size, location and coverage limits.

Manufacturing companies often pay higher premiums because of increased risk exposure, while accounting firms usually pay less due to lower liability risks. Sole proprietors generally pay lower rates compared to businesses with employees since they have fewer liability exposures.

Average Cost of General Liability Insurance in Missouri by Industry

Monthly rates for general liability coverage in Missouri vary widely by industry. Drone businesses pay as little as $17 per month, while pressure washing companies can pay up to $911 monthly. Review this table to find typical rates for your specific business type.

| Accountants | $22 | $263 |

| Ad Agency | $35 | $422 |

| Automotive | $53 | $634 |

| Auto Repair | $151 | $1,808 |

| Bakery | $90 | $1,075 |

| Barber | $44 | $529 |

| Beauty Salon | $66 | $797 |

| Bounce House | $70 | $836 |

| Candle | $54 | $647 |

| Cannabis | $66 | $797 |

| Catering | $87 | $1,045 |

| Cleaning | $132 | $1,579 |

| Coffee Shop | $89 | $1,068 |

| Computer Programming | $29 | $346 |

| Computer Repair | $47 | $567 |

| Construction | $174 | $2,086 |

| Consulting | $22 | $262 |

| Contractor | $253 | $3,035 |

| Courier | $194 | $2,327 |

| Daycare | $33 | $391 |

| Dental | $21 | $255 |

| DJ | $25 | $303 |

| Dog Grooming | $63 | $753 |

| Drone | $17 | $198 |

| Ecommerce | $72 | $866 |

| Electrical | $112 | $1,346 |

| Engineering | $39 | $472 |

| Excavation | $460 | $5,519 |

| Florist | $43 | $511 |

| Food | $107 | $1,284 |

| Food Truck | $141 | $1,695 |

| Funeral Home | $60 | $718 |

| Gardening | $112 | $1,340 |

| Handyman | $242 | $2,907 |

| Home-based | $24 | $283 |

| Home-based | $46 | $546 |

| Hospitality | $65 | $776 |

| HVAC | $243 | $2,922 |

| Janitorial | $136 | $1,633 |

| Jewelry | $40 | $481 |

| Junk Removal | $161 | $1,932 |

| Lawn/Landscaping | $120 | $1,436 |

| Lawyers | $23 | $272 |

| Manufacturing | $64 | $762 |

| Marine | $28 | $334 |

| Massage | $95 | $1,142 |

| Mortgage Broker | $23 | $272 |

| Moving | $123 | $1,476 |

| Nonprofit | $36 | $427 |

| Painting | $142 | $1,707 |

| Party Rental | $79 | $944 |

| Personal Training | $24 | $285 |

| Pest Control | $32 | $384 |

| Pet | $55 | $663 |

| Pharmacy | $61 | $735 |

| Photography | $24 | $288 |

| Physical Therapy | $110 | $1,315 |

| Plumbing | $359 | $4,312 |

| Pressure Washing | $911 | $10,933 |

| Real Estate | $53 | $633 |

| Restaurant | $144 | $1,725 |

| Retail | $65 | $776 |

| Roofing | $385 | $4,625 |

| Security | $136 | $1,638 |

| Snack Bars | $116 | $1,397 |

| Software | $26 | $314 |

| Spa/Wellness | $107 | $1,282 |

| Speech Therapist | $31 | $373 |

| Startup | $29 | $342 |

| Tech/IT | $26 | $314 |

| Transportation | $37 | $447 |

| Travel | $21 | $248 |

| Tree Service | $127 | $1,526 |

| Trucking | $102 | $1,220 |

| Tutoring | $30 | $361 |

| Veterinary | $44 | $533 |

| Wedding Planning | $28 | $331 |

| Welding | $163 | $1,960 |

| Wholesale | $44 | $531 |

| Window Cleaning | $158 | $1,898 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Missouri General Liability Insurance Costs?

Many important factors affect what Missouri businesses pay for general liability insurance.

Missouri Severe Weather and Natural Disaster Risk

Missouri saw 120 billion-dollar weather disasters from 1980-2024. Catastrophic events jumped from 2.7 to 8.2 per year. Wind and hail damage cause most insured losses. 2025 losses will likely hit $1.8 billion.

Storm-damaged property exposes you to premises liability. Collapsed structures, debris and unsafe conditions injure customers and visitors. Kansas City, St. Louis and Jefferson City businesses pay more because storms hit these areas harder.

Missouri Legal and Regulatory Environment

Missouri's five-year statute of limitations for personal injury cases keeps claim exposure open longer than most states. Insurers must hold bigger reserves, which adds uncertainty. Non-economic damage caps (§538.210) help control some costs, but multi-million dollar verdicts for economic damages keep pushing rates up.

Social inflation, attorney ads and third-party litigation funding boost both claim numbers and payouts. Electricians and electrical sign contractors must carry $300,000/$600,000 general liability coverage. The state knows these trades carry real risks.

Missouri Geographic and Medical Cost Variations

Kansas City and St. Louis charge much higher rates. More people, traffic and pedestrians mean more claims. Urban medical bills run higher than rural costs, so bodily injury claims cost more when customers get hurt at your business.

Cities also see bigger legal fees and settlements. Missouri has 520,000 small businesses split between urban and rural areas. Each market has different risk levels. Where you're located directly affects what you pay.

Missouri Industry Composition and Economic Profile

Manufacturing makes up 13% of Missouri's $280 billion economy. This sector faces higher product liability, premises liability and operations liability risks. The state's $93.7 billion agriculture sector and $12.4 billion food processing industry add contamination and agribusiness liability concerns. Missouri's spot as a transportation hub means more warehouse and distribution liability.

Construction rules require electricians and electrical sign contractors to carry completed operations coverage. You're liable even after finishing the job. Missouri ranks 3rd nationally for industrial diversity, so insurers handle multiple high-risk sectors at once.

How Much General Liability Insurance Do I Need in Missouri?

Missouri doesn't require most businesses to carry general liability insurance, though certain licensed trades must maintain coverage. Understanding the requirements for commercial general liability insurance helps you determine whether state law mandates coverage for your specific profession. Cities and counties can also impose local insurance requirements beyond state mandates.

Missouri’s state-level requirements include:

Missouri requires minimum coverage of $300,000 per occurrence and $600,000 annual aggregate. Completed operations coverage is mandatory.

Coverage must match electrician requirements at $300,000 per occurrence and $600,000 annual aggregate. You'll also need completed operations protection.

For businesses without mandated requirements, a $1 million per occurrence and $2 million aggregate policy represents the industry standard. This coverage level satisfies most commercial leases and client contracts while providing adequate financial protection.

Note: State insurance rules change often. Check current requirements with the Missouri Department of Commerce and Insurance or talk with a licensed agent before purchasing coverage.

How to Choose the Best General Liability Insurance in Missouri

Get business insurance by first reviewing your liability risks and coverage needs. Compare policy limits, deductibles and premium costs across Missouri insurers to find protection that fits your operations without stretching your budget.

- 1Assess Coverage Needs

Missouri requires licensed electricians and electrical sign contractors to carry minimum business insurance limits of $300,000 per occurrence and $600,000 in annual aggregate coverage. Businesses without state requirements often select $1 million per occurrence and $2 million aggregate to reduce liability exposure.

Check commercial lease agreements and client contracts carefully, as many landlords in Kansas City and St. Louis require proof of coverage before approving a lease or project.

- 2Prepare Business Information

Insurers in Missouri use your business classification code, annual revenue, employee count and physical location to calculate premiums. Industry risk plays a major role, with construction and manufacturing businesses often paying higher rates due to increased liability exposure. Gather your EIN, Missouri business registration and recent tax records before requesting quotes to speed up underwriting.

- 3Compare Multiple Quotes

Request quotes from at least three insurers licensed in Missouri to compare business insurance costs accurately. Premium differences can reach 30% or more for identical coverage because underwriting standards vary by carrier. Compare limits, deductibles and whether defense costs apply separately or reduce your policy limits.

- 4Look Beyond Price

Low-cost business insurance without adequate coverage increases financial risk. Compare insurers based on claims-handling history, customer support and coverage scope rather than monthly premiums alone. Missouri businesses should review exclusions, defense cost terms and financial strength ratings before choosing a policy.

- 5Verify Insurer Credibility

Confirm insurer licensing through the Missouri Department of Commerce and Insurance before purchasing coverage. Check AM Best ratings and target companies with A- or higher financial strength. Review complaint data through state regulators to spot patterns of delayed or disputed claims.

- 6Ask About Discounts

Missouri insurers often reduce premiums when you bundle general liability with commercial property or auto coverage. Claims-free histories, safety programs and annual payment options can also lower costs. Security systems and employee safety training signal lower risk and may qualify your business for added discounts.

- 7Get Certificate of Insurance

Many Missouri leases and client contracts require a certificate of insurance before work begins. Insurers usually issue digital certificates the same day or within 48 hours. Keep agent contact details accessible, as contractors in Kansas City and St. Louis often need certificates quickly for bids and compliance checks.

- 8Review Coverage Annually

Missouri’s weather risks and rising legal costs make annual coverage reviews important. Request updated quotes 60 to 90 days before renewal, especially after adding staff, expanding services or increasing revenue. Keeping coverage current helps avoid compliance gaps and prevents costly premium audits as your business grows.

Top General Liability Insurance in Missouri: Bottom Line

Finding quality general liability insurance in Missouri starts with understanding your specific business needs and researching providers thoroughly. The Hartford, ERGO NEXT and Nationwide lead the market, but your ideal choice depends on your industry, business size and budget. Compare multiple quotes and verify each insurer's licensing and credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Missouri Department of Commerce and Insurance. "DCI Director: Insured Losses From 2025 Catastrophic Weather Events in Missouri Approaching $2 Billion." Accessed March 9, 2026.

- Missouri Department of Commerce and Insurance. "Severe Weather Causes Continued Rise in Homeowners Insurance Premiums." Accessed March 9, 2026.

- Missouri Economic Research and Information Center. "Industry Research." Accessed March 9, 2026.

- Missouri Revisor of Statutes. "Section 516.120 - What Actions Within Five Years." Accessed March 9, 2026.

- Missouri Revisor of Statutes. "Section 538.210 - No Common Law Cause of Action — Limitation on Noneconomic Damages." Accessed March 9, 2026.

- NOAA National Centers for Environmental Information. "Billion-Dollar Weather and Climate Disasters | Missouri." Accessed March 9, 2026.