MoneyGeek researched the best business insurance options to answer your most common questions about general liability coverage in Hawaii. Our analysis provides clear insights into costs, coverage options and state requirements:

Best General Liability Insurance in Hawaii

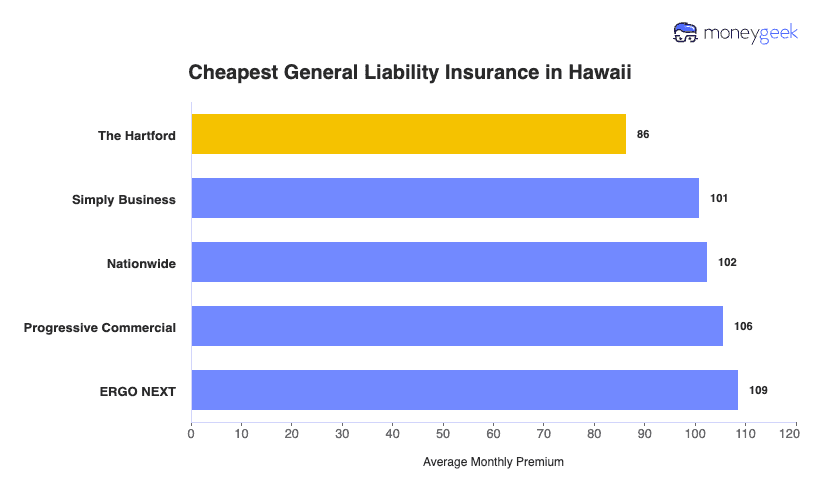

ERGO NEXT is the best general liability insurer in Hawaii, while The Hartford offers the lowest rates starting at $86 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: January 29, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Hawaii: Fast Answers

Which company offers the best general liability insurance in Hawaii?

ERGO NEXT leads as the best general liability insurance company in Hawaii with an overall score of 4.55 out of 5. The provider excels in digital experience and customer service for $109 per month. Simply Business ranks second with strong claims handling and affordable rates at $101 per month.

Who offers the cheapest general liability insurance in Hawaii?

The cheapest general liability insurance companies in Hawaii offer affordable monthly rates:

- The Hartford: $86 per month

- Simply Business: $101 per month

- Nationwide: $102 per month

- Progressive: $106 per month

- ERGO NEXT: $109 per month

Do Hawaii businesses legally need general liability insurance?

Hawaii doesn't legally require most businesses to carry general liability insurance at the state level. However, certain licensed professionals like contractors and electricians may need coverage to maintain their licenses. Local counties can impose their own requirements, and most landlords and clients demand proof of insurance before signing contracts or leases.

How much does general liability insurance cost in Hawaii?

General liability insurance costs between $17 and $945 per month for small Hawaii businesses with two employees. The drone industry sees the lowest rates at $17 per month, while pressure washing businesses land at the highest at $945 per month. Your actual premium depends on your industry, location, coverage limits and business size.

Best General Liability Insurance Companies in Hawaii

ERGO NEXT leads our rankings for general liability insurance in Hawaii, offering excellent customer service and affordable rates for small businesses. Simply Business is a strong choice for its broad coverage options and competitive pricing. Coverdash also performs well as a reliable option for Hawaii business owners seeking quality general liability protection.

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Hawaii General Liability Insurer

Select your industry and state to get a customized Hawaii general liability insurance quote.

General liability insurance covers customer injuries and property damage for Hawaii businesses, but it won't protect against every risk you may encounter. Explore these additional coverage options to build comprehensive financial protection:

Best Hawaii General Liability Insurance Reviews

Finding the best general liability insurance in Hawaii means looking beyond price and considering coverage quality and customer service. Our research highlights the top business insurers based on a detailed review of these important factors.

ERGO NEXT

Best Hawaii General Liability Insurer

Average Monthly General Liability Premium

$109These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first for customer service with responsive support

Leads in digital experience with user-friendly online tools

Maintains A- AM Best financial stability rating

Excels in policy management for easy account handling

consNewer insurer with limited operating history compared to competitors

Online-only platform without local agent support options

Lower stability ranking among surveyed providers

ERGO NEXT leads Hawaii's general liability market with exceptional customer service and comprehensive coverage options. With an A- rating from AM Best, ERGO NEXT excels in serving businesses that value digital convenience and efficient policy management.

The provider is known for its strong coverage offerings and user-friendly digital platform, making it a good fit for tech-savvy business owners in industries like professional services, retail and construction.

Overall Score 4.55 1 Affordability Score 4.26 3 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 4 ERGO NEXT offers general liability coverage in Hawaii at $109 per month, making it one of the more competitive choices in the state. The provider performs well in industries like computer repair, electrical work, manufacturing and professional services, with rates that tend to be especially favorable for tech and service-focused businesses.

Data filtered by:AccountantsAccountants $18 2 Customer feedback highlights ERGO NEXT's exceptional digital experience and policy management capabilities. The provider earns top marks for customer satisfaction, with businesses praising the streamlined online platform and renewal process. While claims processing shows room for improvement, customers consistently recommend ERGO NEXT to other business owners.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT provides flexible general liability coverage with limits up to $2 million per claim and $4 million aggregate. The provider includes contractor E&O insurance and offers specialized endorsements like CG2010 for completed operations coverage. Businesses can customize their protection through various add-ons and digital tools, making policy management straightforward for Hawaii enterprises.

Simply Business

Best Hawaii Commercial General Liability: Runner-Up

Average Monthly General Liability Premium

$101These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.7/5Our Survey: Likely to Be Recommended to Others

4.2/5

- pros

Ranks first in coverage options among state providers

Offers competitive pricing with strong affordability rankings

Provides smooth digital experience for policy management

Maintains second place overall ranking in the state

consClaims processing ranks lowest among major categories

Customer service performance lags behind top competitors

Simply Business is a top option in Hawaii thanks to its wide coverage choices and competitive pricing. It ranks well for both coverage quality and affordability, which makes it suitable for contractors, retail operations and professional services. Business owners in Hawaii who want broad protection and easy-to-use digital tools often gravitate toward Simply Business.

Overall Score 4.47 2 Affordability Score 4.39 2 Customer Service Score 4.15 4 Coverage Score 4.90 1 Stability Score 4.83 3 Simply Business offers general liability coverage in Hawaii at $101 per month on average. The provider shows strong affordability ratings across multiple industries, with competitive rates for contractors, professional services and retail businesses. Construction, cleaning and hospitality businesses often find the most cost-effective coverage through Simply Business.

Data filtered by:AccountantsAccountants $15 1 Customer feedback highlights Simply Business's strengths in digital experience, affordability and policy recommendations. The provider earns high marks for its online tools and policy management features. Business owners appreciate the straightforward digital interface and efficient policy management system.

Overall Customer Score 4.14 7 Claims Process 3.70 8 Customer Service 4.00 6 Digital Experience 4.50 3 Overall Satisfaction 4.10 7 Policy Management 4.10 7 Recommend to Others 4.20 8 Renewal Likelihood 4.10 7 Simply Business offers flexible coverage limits with policies ranging from $500,000 to $2 million per occurrence. Businesses can customize their coverage with add-ons like professional liability and property protection through a business owner's policy. The provider offers industry-specific policy customization options beneficial for contractors, retail operations and professional services.

Cheapest General Liability Insurance Companies in Hawaii

The Hartford offers the cheapest general liability insurance in Hawaii at $86 per month, saving businesses $25 or 22% compared to the state average. Simply Business and Nationwide also provide affordable coverage options.

| The Hartford | $86 | $1,036 |

| Simply Business | $101 | $1,211 |

| Nationwide | $102 | $1,228 |

| Progressive Commercial | $106 | $1,267 |

| ERGO NEXT | $109 | $1,304 |

| Coverdash | $109 | $1,308 |

| Thimble | $113 | $1,355 |

| Hiscox | $120 | $1,441 |

| biBERK | $120 | $1,442 |

| Chubb | $125 | $1,503 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Hawaii by Industry

MoneyGeek's research identifies the five cheapest general liability insurance providers across Hawaii industries based on comprehensive rate analysis.

- ERGO NEXT dominates affordability in 25 industries statewide. The company offers the lowest rates for diverse sectors including cannabis, manufacturing, tech/IT, real estate and trucking businesses.

- biBerk ranks as the most affordable option in 19 industries throughout Hawaii. This provider excels in service-based businesses like contractors, catering, hospitality and veterinary practices.

- Thimble leads affordability in 16 industries across the state. The company shows particular strength in construction trades, HVAC, roofing, software development and food service businesses.

- Simply Business offers the cheapest coverage in 14 Hawaii industries. This provider performs best for professional service companies including accountants, lawyers, consultants and massage therapists.

- Coverdash tops affordability rankings in five industries, specializing in automotive, restaurant and wholesale businesses.

| Accountants | Simply Business | $15 | $182 |

Average Cost of General Liability Insurance in Hawaii

Most small businesses in Hawaii pay around $111 monthly for general liability insurance. The average cost of general liability insurance coverage depends on your industry, business size, location and coverage limits.

Manufacturing companies often pay higher premiums because of their increased risk exposure, while accounting firms see lower costs due to fewer potential claims. Sole proprietors generally pay less than businesses with employees since they have fewer liability exposures.

Average Cost of General Liability Insurance in Hawaii by Industry

General liability insurance in Hawaii ranges from $17 monthly for drone businesses to $945 for pressure washing companies. This wide range reflects different risk levels across industries. Review this table to find typical general liability coverage costs for your specific business type.

| Accountants | $24 | $287 |

| Ad Agency | $44 | $528 |

| Automotive | $58 | $691 |

| Auto Repair | $176 | $2,110 |

| Bakery | $99 | $1,185 |

| Barber | $54 | $653 |

| Beauty Salon | $66 | $796 |

| Bounce House | $74 | $884 |

| Candle | $58 | $699 |

| Cannabis | $70 | $841 |

| Catering | $111 | $1,331 |

| Cleaning | $142 | $1,703 |

| Coffee Shop | $99 | $1,187 |

| Computer Programming | $37 | $440 |

| Computer Repair | $46 | $556 |

| Construction | $213 | $2,561 |

| Consulting | $24 | $284 |

| Contractor | $263 | $3,157 |

| Courier | $202 | $2,429 |

| Daycare | $34 | $414 |

| Dental | $23 | $281 |

| DJ | $31 | $373 |

| Dog Grooming | $66 | $792 |

| Drone | $17 | $209 |

| Ecommerce | $80 | $957 |

| Electrical | $122 | $1,469 |

| Engineering | $48 | $578 |

| Excavation | $500 | $5,995 |

| Florist | $46 | $555 |

| Food | $113 | $1,360 |

| Food Truck | $122 | $1,459 |

| Funeral Home | $66 | $790 |

| Gardening | $121 | $1,455 |

| Handyman | $269 | $3,224 |

| Home-based | $26 | $307 |

| Home-based | $48 | $581 |

| Hospitality | $77 | $921 |

| HVAC | $257 | $3,084 |

| Janitorial | $151 | $1,814 |

| Jewelry | $54 | $643 |

| Junk Removal | $172 | $2,065 |

| Lawn/Landscaping | $144 | $1,728 |

| Lawyers | $25 | $296 |

| Manufacturing | $96 | $1,149 |

| Marine | $29 | $348 |

| Massage | $111 | $1,329 |

| Mortgage Broker | $25 | $300 |

| Moving | $138 | $1,659 |

| Nonprofit | $37 | $448 |

| Painting | $156 | $1,871 |

| Party Rental | $83 | $1,000 |

| Personal Training | $26 | $315 |

| Pest Control | $34 | $405 |

| Pet | $60 | $725 |

| Pharmacy | $69 | $823 |

| Photography | $28 | $336 |

| Physical Therapy | $176 | $2,116 |

| Plumbing | $401 | $4,813 |

| Pressure Washing | $945 | $11,344 |

| Real Estate | $46 | $548 |

| Restaurant | $165 | $1,978 |

| Retail | $72 | $860 |

| Roofing | $398 | $4,774 |

| Security | $142 | $1,703 |

| Snack Bars | $125 | $1,506 |

| Software | $33 | $390 |

| Spa/Wellness | $103 | $1,238 |

| Speech Therapist | $35 | $415 |

| Startup | $32 | $378 |

| Tech/IT | $32 | $384 |

| Transportation | $39 | $465 |

| Travel | $22 | $270 |

| Tree Service | $144 | $1,733 |

| Trucking | $105 | $1,262 |

| Tutoring | $37 | $446 |

| Veterinary | $46 | $547 |

| Wedding Planning | $34 | $414 |

| Welding | $173 | $2,073 |

| Wholesale | $47 | $570 |

| Window Cleaning | $172 | $2,067 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Hawaii General Liability Insurance Costs?

Many important factors influence what Hawaii businesses pay for general liability insurance coverage.

Hawaii Island Economics and Cost of Living

Running a business in Hawaii means dealing with costs that run nearly twice the national average. When someone gets injured at your shop or restaurant, every part of the claim costs more. Hospital stays run longer here than on the mainland, driving up medical bills.

Your employees earn higher wages to afford island living, so lost wage claims hit harder. If you accidentally damage a client's property, repairs cost 40% to 80% more because contractors have to ship materials across the Pacific. Hawaii caps pain and suffering at $375,000, but other damages like disfigurement or reduced quality of life have no ceiling.

Hawaii Tourism-Driven Liability Exposure

Your business likely serves tourists alongside locals, and that changes your liability picture. Hawaii's visitor industry creates more slip-and-fall claims than most mainland states see. Tourists don't know your property layout or local hazards the way regulars do. They're exploring unfamiliar spaces, often distracted by Hawaii's scenery.

If you run a hotel, restaurant or retail shop, you're seeing far more foot traffic than a similar mainland business. Your exposure swings with tourist seasons too. One month you're managing light crowds, the next you're packed with visitors navigating wet pool decks, beach access points, and uneven pathways.

Hawaii Insurance Market Competition

You've probably noticed fewer options when shopping for business insurance. Hawaii's small, specialized market doesn't attract many carriers. Universal Property and Casualty pulled out after the 2023 Maui fires, leaving 1,500 businesses scrambling for coverage.

Mainland insurers often skip Hawaii entirely because writing policies here requires understanding risks they don’t encounter elsewhere, such as volcanic activity on the Big Island, salt air that corrodes equipment and hurricane building codes that differ by island. Less competition means carriers can charge more without losing business. You're choosing from a smaller pool of insurers who know they're one of your few options.

Hawaii Legal and Litigation Costs

Hawaii attorneys charge $150 to $700 per hour, with most billing $254 to $500 for liability cases. If someone sues your business, those hours add up fast. Plaintiff attorneys take 25% to 40% of whatever they recover, giving them strong incentive to push hard. Even bogus claims can cost you $20,000 or more to defend.

Need an expert witness? You're flying them to Hawaii and covering their fees on top of their travel. These high defense costs often make settling cheaper than fighting, even when you've done nothing wrong. Insurers see these patterns and price your premiums accordingly.

How Much General Liability Insurance Do I Need in Hawaii?

Hawaii doesn't require general liability insurance for most businesses by law. Contractors are the main exception. They must carry coverage to obtain and maintain their license. All licensed contractors need the same minimum limits: $100,000 per person and $300,000 per occurrence for bodily injury, plus $50,000 per occurrence for property damage.

Even without legal mandates, clients often require proof of insurance in contracts, and property owners often demand it for leases. Understanding the requirements for commercial general liability helps you meet these expectations.

Note: State insurance requirements change often. Check current requirements with the Hawaii Insurance Division or contact a licensed insurance agent for the latest information.

How to Choose the Best General Liability Insurance in Hawaii

Getting business insurance in Hawaii requires balancing coverage needs with your budget. General liability insurance covers accidents and property damage claims, but comprehensive protection often extends beyond basic liability to safeguard your business financially.

- 1Assess Coverage Needs

Hawaii doesn't legally require general liability insurance for most businesses, but contractors must carry it for licensing, and clients or landlords often demand it in contracts and leases. Standard limits range from $500,000 to $2 million per occurrence depending on your industry and contract requirements.

- 2Prepare Business Information

Gather your annual revenue, employee count, physical location and business classification code for accurate quotes. Hawaii business insurance costs vary based on industry risk, location and company size, so have your EIN, business registration and tax permits ready to streamline applications.

- 3Compare Multiple Quotes

Request at least three quotes from insurers licensed in Hawaii, as business insurance costs can differ by hundreds of dollars annually between companies. Compare premiums, deductibles, coverage limits and whether legal defense costs are included within or separate from your policy limits.

- 4Evaluate Policy Details

Cheap business insurance isn't always the best value if it leaves gaps in protection. Read policy exclusions carefully because common exclusions include professional errors, pollution liability and employee injuries, which require separate policies to cover properly.

- 5Verify Insurer Credentials

Check insurer legitimacy through Hawaii's Insurance Division website at cca.hawaii.gov/ins and call (808) 586-2790 with questions. Review AM Best financial strength ratings and complaint ratios to identify companies with poor claims-handling reputations.

- 6Explore Available Discounts

Hawaii insurers offer discounts for bundled policies, with business owner's policies combining general liability and commercial property coverage often being the most cost-effective option. Safety programs, claims-free histories and annual premium payments can reduce costs by 10% to 25%.

- 7Obtain Insurance Certificate

Request a certificate of insurance as proof of coverage for clients, landlords and contractors in Hawaii. Commercial leases in Hawaii usually require certificates of insurance, and many insurers provide digital certificates instantly while others take up to 48 hours.

- 8Schedule Annual Reviews

Reassess your coverage needs yearly, especially after adding employees, expanding services or increasing revenue. Compare quotes from multiple Hawaii-licensed insurers 60 to 90 days before renewal to find better rates or adjust coverage limits for business growth.

Top General Liability Insurance in Hawaii: Bottom Line

Choosing quality general liability insurance in Hawaii starts with understanding your business needs and researching providers carefully. ERGO NEXT, Simply Business and Coverdash lead the market, but the best provider depends on your industry, business size and budget. Compare multiple quotes and verify each insurer's credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Bureau of Economic Analysis. "Regional Price Parities by State and Metro Area." Accessed February 17, 2026.

- Hawaii Department of Business, Economic Development & Tourism. "Tourism Off to a Positive Start for 2025." Accessed February 17, 2026.

- Hawaii Department of Business, Economic Development & Tourism. "Visitor Industry Grows Again in April 2025." Accessed February 17, 2026.

- Hawaii Department of Commerce and Consumer Affairs. "Universal Property & Casualty to Exit Hawaii Insurance Market." Accessed February 17, 2026.

- Hawaii Revised Statutes § 65-1. "Medical Malpractice Pain and Suffering Cap." Accessed February 17, 2026.

- U.S. Bureau of Labor Statistics. "Consumer Price Index, Honolulu Area — July 2025." Accessed February 17, 2026.

- World Population Review. "Cost of Living Index by State 2025." Accessed February 17, 2026.