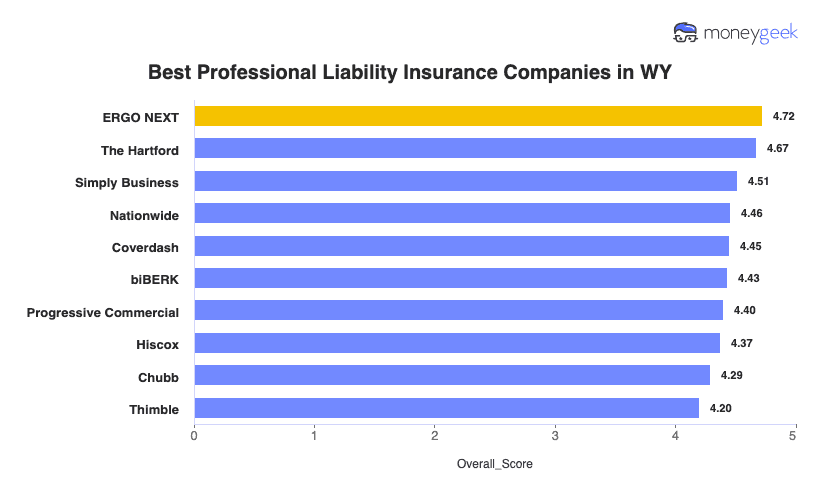

ERGO NEXT earns MoneyGeek's top rating for Wyoming professional liability insurance with competitive rates, excellent customer service and a digital platform that simplifies coverage management. The Hartford ranks as Wyoming's cheapest professional indemnity insurer at $66 monthly ($6 below the state average). Simply Business, Nationwide and Coverdash provide dependable top errors and omissions insurance options protecting you from client claims over missed deadlines or professional negligence.

Best Professional Liability Insurance in Wyoming

Get WY professional liability insurance quotes starting at $24 monthly from MoneyGeek's top companies like ERGO NEXT, The Hartford and Simply Business.

Get matched to the best professional liability insurance in WY for you below.

Updated: January 28, 2026

Advertising & Editorial Disclosure

ERGO NEXT provides the best professional liability insurance in Wyoming, while The Hartford delivers the most affordable coverage starting at $66 monthly (Read More).

Professional liability insurance costs in Wyoming average $72 monthly ($865 annually), placing the state among the more affordable options nationally (Read More).

Professional liability insurance protects Wyoming businesses from financial losses due to professional mistakes, negligence claims and unmet contractual obligations (Read More).

Wyoming businesses face no mandatory professional liability insurance requirements, though health care professionals and other regulated industries must maintain coverage (Read More).

Wyoming business owners should request small business insurance quotes from multiple providers to compare coverage limits, deductibles and pricing for optimal value (Read More).

Best Professional Liability Insurance Companies in Wyoming

| ERGO NEXT | 4.72 | $67 |

| The Hartford | 4.67 | $66 |

| Simply Business | 4.51 | $71 |

| Nationwide | 4.46 | $76 |

| Coverdash | 4.45 | $72 |

| biBERK | 4.43 | $74 |

| Progressive Commercial | 4.40 | $69 |

| Hiscox | 4.37 | $72 |

| Chubb | 4.29 | $82 |

| Thimble | 4.20 | $71 |

How Did We Determine the Best Professional Liability Insurance in Wyoming?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

Professional liability insurance represents just one piece of comprehensive business protection in Wyoming. Explore these additional state-specific guides to build complete coverage for your company:

1. ERGO NEXT: Best Professional Liability Insurance in WY

Ranks first in Wyoming for customer service experience

Highest digital experience rating nationally

Instant certificates of insurance available within 10 minutes

A+ Superior AM Best rating backed by Munich Re's financial strength

Founded in 2016 with less operational history than established competitors

Claims handling ranks fourth lower among professional liability insurers

Wyoming's rural landscape demands insurance you can manage anywhere, from a Cheyenne office to remote Yellowstone job sites. ERGO NEXT removes agent dependency that slows businesses down when clients require proof of insurance before work starts. When your seasonal tourism operation encounters a negligence claim during peak summer, you'll reach support quickly, letting you keep serving customers instead of chasing paperwork. At $67 monthly, you're paying for reliability protecting your business from the lawsuit that could destroy everything you've built.

2. The Hartford: Cheapest Professional Liability Insurance in WY

Lowest professional liability insurance rates in Wyoming at $66 monthly

Ranks first nationally for claims process and overall satisfaction

Second nationally for customer service and likelihood to recommend

A+ Superior AM Best rating with over 200 years of experience

Digital experience ranks last among professional liability insurers in MoneyGeek's research

Not available in Alaska or Hawaii

Wyoming's boom-bust energy cycles make every dollar count when consulting contracts disappear. At $66 monthly, The Hartford keeps your firm insured through lean winters without draining payroll reserves. When a Casper client lawsuit threatens your reputation, first-ranked claims resolution protects you before word spreads through Wyoming's tight-knit business community where one bad story ends referrals statewide. You're getting the state's lowest rate from an insurer customers actually recommend, surviving downturns instead of choosing between insurance coverage and keeping staff employed.

3. Simply Business: Best Professional Liability Insurance Coverage Options in WY

Ranks third nationally overall for professional liability insurance

First for coverage options with side-by-side comparison from 16+ carriers

Third-ranked digital experience with instant certificate of insurance delivery

Backed by Travelers' A++ Superior AM Best rating

Claims process ranks eighth among professional liability insurers

Overall customer satisfaction ranks seventh

Lower likelihood to be recommended by current customers

When Denver insurers reject your environmental consulting work near abandoned mines or hang up hearing "geotechnical engineering," Simply Business stops you from wasting weeks calling agents who won't cover Wyoming's energy sector risks. Its broker model emails instant proof while Casper clients wait on contracts, comparing 16 carriers in 10 minutes instead of you burning three days getting nowhere. At $71 monthly, you're paying more but actually getting covered for specialized work (mine reclamation, methane monitoring, unstable ground analysis) that standard insurers exclude or don't understand.

Average Cost of Professional Liability Insurance in Wyoming

Professional liability insurance costs in Wyoming vary by industry. Home-based businesses pay the lowest rates at around $35 per month, while mortgage brokers face the highest costs at approximately $157 per month. You can find out below how much Wyoming professional liability insurance costs for your business by filtering for your industry.

| Accountants | $133 | $1,600 |

| Ad Agency | $93 | $1,115 |

| Auto Repair | $77 | $927 |

| Automotive | $69 | $831 |

| Bakery | $49 | $587 |

| Barber | $39 | $466 |

| Beauty Salon | $46 | $546 |

| Bounce House | $55 | $657 |

| Candle | $39 | $473 |

| Cannabis | $114 | $1,365 |

| Catering | $72 | $869 |

| Cleaning | $52 | $624 |

| Coffee Shop | $55 | $666 |

| Computer Programming | $98 | $1,176 |

| Computer Repair | $59 | $708 |

| Construction | $71 | $857 |

| Consulting | $101 | $1,209 |

| Contractor | $58 | $693 |

| Courier | $46 | $553 |

| DJ | $42 | $499 |

| Daycare | $99 | $1,187 |

| Dental | $79 | $943 |

| Dog Grooming | $51 | $617 |

| Drone | $101 | $1,213 |

| Ecommerce | $56 | $668 |

| Electrical | $59 | $703 |

| Engineering | $98 | $1,171 |

| Excavation | $62 | $749 |

| Florist | $35 | $423 |

| Food | $102 | $1,229 |

| Food Truck | $56 | $677 |

| Funeral Home | $74 | $890 |

| Gardening | $37 | $442 |

| HVAC | $76 | $907 |

| Handyman | $50 | $600 |

| Home-based business | $35 | $416 |

| Hospitality | $69 | $831 |

| Janitorial | $46 | $551 |

| Jewelry | $57 | $679 |

| Junk Removal | $64 | $766 |

| Lawn/Landscaping | $48 | $570 |

| Lawyers | $132 | $1,589 |

| Manufacturing | $56 | $673 |

| Marine | $82 | $986 |

| Massage | $100 | $1,200 |

| Mortgage Broker | $157 | $1,884 |

| Moving | $75 | $903 |

| Nonprofit | $46 | $557 |

| Painting | $59 | $710 |

| Party Rental | $51 | $611 |

| Personal Training | $64 | $771 |

| Pest Control | $89 | $1,069 |

| Pet | $43 | $516 |

| Pharmacy | $53 | $634 |

| Photography | $60 | $721 |

| Physical Therapy | $85 | $1,017 |

| Plumbing | $83 | $996 |

| Pressure Washing | $53 | $630 |

| Real Estate | $117 | $1,408 |

| Restaurant | $76 | $914 |

| Retail | $50 | $597 |

| Roofing | $90 | $1,085 |

| Security | $93 | $1,118 |

| Snack Bars | $44 | $531 |

| Software | $87 | $1,046 |

| Spa/Wellness | $102 | $1,228 |

| Speech Therapist | $92 | $1,098 |

| Startup | $68 | $817 |

| Tech/IT | $93 | $1,112 |

| Transportation | $88 | $1,053 |

| Travel | $90 | $1,085 |

| Tree Service | $68 | $822 |

| Trucking | $101 | $1,215 |

| Tutoring | $55 | $662 |

| Veterinary | $109 | $1,303 |

| Wedding Planning | $72 | $864 |

| Welding | $70 | $841 |

| Wholesale | $58 | $691 |

| Window Cleaning | $59 | $704 |

How Did We Determine These Wyoming Professional Liability Insurance Rates?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

What Does Wyoming Professional Liability Insurance Cover?

Wyoming professional liability insurance protects your business when clients claim you made mistakes or failed to deliver promised services. This coverage handles liability damages from these situations and pays for legal costs when you face lawsuits. The insurance industry uses several names for this same type of protection:

- Errors and omissions insurance (E&O)

- Malpractice insurance (specialized type, typically in legal and medical fields)

- Professional indemnity insurance

How Much Professional Liability Insurance Do I Need in Wyoming?

Wyoming doesn't mandate professional liability coverage for most businesses, though contract work usually requires $1 million per occurrence and $2 million aggregate limits. Physicians need minimum $50,000 coverage to qualify for Wyoming's Medical Liability Compensation Account, which provides coverage up to $1 million. Real estate licensees must carry $100,000 per claim minimum under state law.

Who Needs Professional Liability Insurance in Wyoming?

If you provide professional services under contracts or face professional negligence risks, you need professional liability insurance in Wyoming. The state's energy-focused economy and expanding consulting sector create liability exposures that shift with oil and gas prices.

Wyoming's mining sector drives the state's economy, creating demand for specialized consulting in oil and gas operations, drilling engineering and support activities. Professional liability coverage provides financial protection against claims from technical recommendations, project delays or service failures, especially important when oil and gas price swings increase your clients' financial stakes.

Wyoming's construction sector, especially large infrastructure projects, exposes you to claims from design errors, project delays and workmanship disputes. Professional engineers and land surveyors need state licensing, and errors and omissions coverage provides financial protection when your project specifications or survey data cause client losses.

Wyoming law requires all real estate licensees to carry minimum $100,000 errors and omissions insurance for real estate per claim to keep your license active. That makes real estate the only business profession besides medicine with state-mandated coverage. This coverage provides financial protection against claims from misrepresentation, incomplete disclosures or contract errors in property sales.

Physicians in Wyoming must carry minimum $50,000 professional liability insurance to participate in the state's Medical Liability Patient Compensation Account, which extends coverage to $1 million annually. Without this required coverage, you're personally responsible for the full amount of any malpractice claim above $50,000.

Wyoming's professional and business services sector grew 6.9% as the state expands beyond energy, creating opportunities for management consultants, IT professionals and tech service providers. You need professional liability coverage providing financial protection against claims from faulty advice, missed deadlines or services that don't meet contract terms.

How to Get the Best Professional Liability Insurance in Wyoming

Our step-by-step guide walks you through how to get business insurance in Wyoming that matches your professional liability insurance needs and budget.

- 1Assess coverage needs

Evaluate both your risks and worst-case scenarios specific to Wyoming's volatile economy. If you're an energy consultant in Casper, consider how a sudden oil price drop could trigger multiple client lawsuits simultaneously when projects fail or get canceled.

- 2Work with local agent

Wyoming's sparse population means fewer insurance agents, so finding one who understands your industry matters more than proximity. An agent experienced with Wyoming's energy sector explains how business insurance costs fluctuate during economic downturns.

- 3Compare multiple quotes

Request quotes from at least three insurers since Wyoming's limited market can create significant price variations. Don't assume affordable business insurance means adequate protection—a Gillette engineering firm discovered its cheapest quote excluded coal-related projects entirely, rendering it worthless for their primary work.

- 4Research best providers

Look beyond price when researching professional liability insurers in Wyoming. Check AM Best ratings, claims handling reputation and experience serving small businesses in rural markets. Prioritize carriers with established relationships with Wyoming's dominant industries like energy, mining and construction, as they'll better understand your specific risks and won't inflate premiums due to unfamiliarity with your sector.

- 5Consider bundling discounts

Bundling becomes especially valuable in Wyoming's small market where standalone policies carry premium surcharges. A Sheridan CPA firm bundling professional liability with types of business insurance like general liability and cyber coverage saved 20% while gaining a single point of contact. That's crucial when the nearest alternative agent sits 90 miles away.

- 6Maintain continuous coverage

Wyoming's long project timelines mean claims can surface years after you complete work. A Laramie architect who designed a university building in 2019 faced a lawsuit in 2024 over structural issues. Without continuous coverage or tail coverage (extended reporting that covers you after your policy ends), she would have been personally liable for the $800,000 claim.

Get Wyoming Professional Liability Insurance Quotes

Get professional liability insurance for your Wyoming business through MoneyGeek's provider matching tool. Select your industry below to connect with insurers who understand your specific risks and get personalized quotes.

Get Matched to the Best WY Professional Liability Insurer for You

Select your industry and state to get a customized WY professional liability insurer match and get tailored quotes.

Wyoming Professional Liability: Bottom Line

Choosing professional liability insurance in Wyoming requires understanding your business risks and selecting the right provider. ERGO NEXT earns our top rating, but your industry, client contracts and budget determine what works best for you. Start by assessing your coverage needs, then work with a local agent to compare options and secure coverage providing financial protection for your business.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.