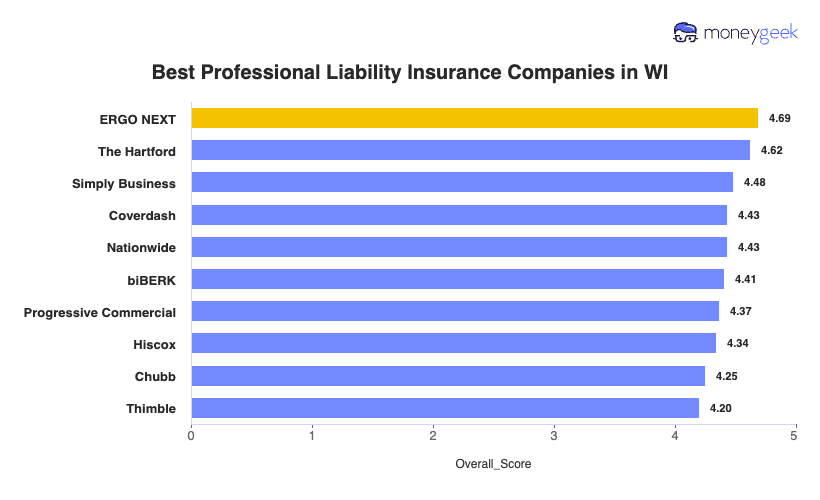

ERGO NEXT leads Wisconsin professional liability insurance with the highest customer service ratings, digital policy management and coverage matching for 79+ industries. The Hartford ranks as the cheapest professional indemnity insurer in Wisconsin at $70 monthly, saving businesses $6 compared to the state average. Simply Business provides access to 16+ carriers for hard-to-insure businesses, while Coverdash and Nationwide offer strong alternatives for top errors and omissions insurance in Wisconsin.

Best Professional Liability Insurance in Wisconsin

Get WI professional liability insurance quotes starting at $25 monthly from MoneyGeek's top companies like ERGO NEXT, The Hartford and Simply Business.

Get matched to the best professional liability insurance in WI for you below.

Updated: January 28, 2026

Advertising & Editorial Disclosure

ERGO NEXT provides the best professional liability insurance in Wisconsin, while The Hartford delivers the most affordable coverage starting at $70 monthly (Read More).

Professional liability insurance costs in Wisconsin average $76 monthly ($916 annually), placing the state among the more affordable options nationwide (Read More).

Professional liability insurance protects Wisconsin businesses from financial losses due to professional mistakes, negligence claims and failures to deliver promised services (Read More).

Wisconsin doesn't mandate professional liability insurance for most businesses, though certain regulated professions like health care providers must carry this coverage (Read More).

Wisconsin business owners should evaluate multiple providers and obtain small business insurance quotes to secure the most suitable professional liability coverage for their specific needs (Read More).

Best Professional Liability Insurance Companies in Wisconsin

| ERGO NEXT | 4.69 | $72 |

| The Hartford | 4.62 | $70 |

| Simply Business | 4.48 | $75 |

| Coverdash | 4.43 | $76 |

| Nationwide | 4.43 | $81 |

| biBERK | 4.41 | $78 |

| Progressive Commercial | 4.37 | $74 |

| Hiscox | 4.34 | $76 |

| Chubb | 4.25 | $87 |

| Thimble | 4.20 | $74 |

How Did We Determine the Best Professional Liability Insurance in Wisconsin?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

Professional liability insurance in Wisconsin covers just one aspect of business protection. Explore these additional state-specific resources for comprehensive coverage:

1. ERGO NEXT: Best Professional Liability Insurance in WI

Ranks first for customer service and digital experience nationally

Second-lowest professional liability rates in Wisconsin at $72 monthly

A+ Superior AM Best rating backed by Munich Re

Purchase coverage and download COIs online in 10 minutes

Less than 10 years in business (founded 2016)

Claims process ranks fourth nationally among competitors

Policy changes require contacting customer service

When a Madison consultant's client claims a missed deadline caused financial loss, ERGO NEXT covers legal defense costs at $72 monthly. Wisconsin consulting, accounting and tech businesses must meet client contract requirements for errors and omissions coverage before signing deals. ERGO NEXT lets you generate certificates instantly, even at 2 a.m. for 8 a.m. client meetings without waiting on agents. With Munich Re's A+ financial backing, ERGO NEXT resolves many claims within 48 hours.

2. The Hartford: Cheapest Professional Liability Insurance in WI

Lowest professional liability rates in Wisconsin at $70 monthly

A+ Superior AM Best rating with strongest risk-adjusted capitalization

Ranks first nationally for claims process and overall satisfaction

Specialized professional liability underwriters with over 200 years experience

Digital experience ranks 10th nationally among competitors

When a Madison accountant's tax advice costs a dairy client $50,000, defense attorneys charge $75,000, which a Hartford policy covers for $70 monthly. You'll pay $841 annually versus $915 average, saving $74 for payroll or other business expenses instead of premiums. Claims resolve faster than competitors (first nationally for claims satisfaction), so you're not paying attorneys out of pocket while waiting months for reimbursement. Small Milwaukee firms get specialized underwriters who understand professional liability, not generalist adjusters learning your industry mid-crisis.

3. Simply Business: Best Professional Liability Insurance Coverage Options in WI

Ranks first nationally for coverage options with access to 16+ carriers

Digital experience ranks third nationally among competitors

Backed by Travelers' A+ Superior AM Best financial rating

Compare multiple professional liability quotes in 10 minutes online

Claims process ranks eighth nationally among competitors

Less likely to be recommended by current customers

When a Madison consultant's recommendation costs a paper mill $100,000, past claims make direct carriers hesitant. Simply Business finds coverage at $75 monthly from carriers willing to insure higher-risk businesses. Compare quotes from 16+ carriers in 10 minutes: a Racine agricultural advisor needing specialized dairy consulting E&O sees options from Travelers, Hiscox and Markel without calling each insurer separately. Download certificates instantly when Appleton clients demand proof before signing, avoiding agent delays that kill deals.

Average Cost of Professional Liability Insurance in Wisconsin

Professional liability insurance costs in Wisconsin vary across industries. Florists pay the least at around $37 per month, while mortgage brokers face the highest rates at approximately $163 per month. The tool below lets you find rates for your industry to get accurate pricing for your Wisconsin business.

| Accountants | $143 | $1,714 |

| Ad Agency | $99 | $1,182 |

| Auto Repair | $82 | $983 |

| Automotive | $73 | $879 |

| Bakery | $53 | $637 |

| Barber | $43 | $513 |

| Beauty Salon | $48 | $573 |

| Bounce House | $58 | $699 |

| Candle | $41 | $489 |

| Cannabis | $119 | $1,425 |

| Catering | $78 | $936 |

| Cleaning | $54 | $643 |

| Coffee Shop | $60 | $716 |

| Computer Programming | $102 | $1,224 |

| Computer Repair | $61 | $734 |

| Construction | $75 | $906 |

| Consulting | $106 | $1,271 |

| Contractor | $61 | $735 |

| Courier | $49 | $583 |

| DJ | $46 | $547 |

| Daycare | $106 | $1,272 |

| Dental | $83 | $998 |

| Dog Grooming | $53 | $638 |

| Drone | $104 | $1,253 |

| Ecommerce | $61 | $731 |

| Electrical | $64 | $765 |

| Engineering | $102 | $1,222 |

| Excavation | $66 | $797 |

| Florist | $37 | $442 |

| Food | $110 | $1,320 |

| Food Truck | $58 | $697 |

| Funeral Home | $79 | $947 |

| Gardening | $39 | $473 |

| HVAC | $79 | $950 |

| Handyman | $52 | $620 |

| Home-based business | $37 | $444 |

| Hospitality | $71 | $857 |

| Janitorial | $49 | $584 |

| Jewelry | $61 | $733 |

| Junk Removal | $66 | $793 |

| Lawn/Landscaping | $52 | $621 |

| Lawyers | $142 | $1,702 |

| Manufacturing | $60 | $718 |

| Marine | $86 | $1,029 |

| Massage | $106 | $1,270 |

| Mortgage Broker | $163 | $1,953 |

| Moving | $81 | $974 |

| Nonprofit | $50 | $600 |

| Painting | $63 | $754 |

| Party Rental | $54 | $643 |

| Personal Training | $69 | $832 |

| Pest Control | $94 | $1,130 |

| Pet | $45 | $540 |

| Pharmacy | $56 | $669 |

| Photography | $63 | $753 |

| Physical Therapy | $92 | $1,099 |

| Plumbing | $90 | $1,077 |

| Pressure Washing | $57 | $683 |

| Real Estate | $122 | $1,465 |

| Restaurant | $81 | $967 |

| Retail | $54 | $651 |

| Roofing | $95 | $1,142 |

| Security | $98 | $1,181 |

| Snack Bars | $48 | $573 |

| Software | $93 | $1,115 |

| Spa/Wellness | $107 | $1,282 |

| Speech Therapist | $97 | $1,165 |

| Startup | $71 | $848 |

| Tech/IT | $96 | $1,156 |

| Transportation | $93 | $1,113 |

| Travel | $96 | $1,157 |

| Tree Service | $75 | $901 |

| Trucking | $109 | $1,311 |

| Tutoring | $59 | $706 |

| Veterinary | $112 | $1,350 |

| Wedding Planning | $75 | $903 |

| Welding | $74 | $892 |

| Wholesale | $62 | $746 |

| Window Cleaning | $61 | $729 |

How Did We Determine These Wisconsin Professional Liability Insurance Rates?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

What Does Wisconsin Professional Liability Insurance Cover?

Wisconsin professional liability insurance protects your business when clients claim you made mistakes or failed to deliver promised services. This coverage pays for damages you owe and handles legal costs when facing these claims.

You might see this same protection called by different names:

- Errors and omissions insurance (E&O)

- Malpractice insurance (specialized type, typically in legal and medical fields)

- Professional indemnity insurance

How Much Professional Liability Insurance Do I Need in Wisconsin?

Most Wisconsin businesses don't need professional liability insurance by law. Physicians and nurse anesthetists must carry $1 million per occurrence and $3 million aggregate annually, plus participate in Wisconsin's Injured Patients and Families Compensation Fund. Licensed clinical social workers, therapists and counselors need identical limits. Even without requirements, Madison consultants need coverage. Clients demand proof of $1 million in errors and omissions insurance before signing contracts.

Who Needs Professional Liability Insurance in Wisconsin?

Wisconsin businesses dealing with contracts or professional services face negligence claims that standard policies won't cover. Client contracts often require proof of coverage before you can bid on projects, a necessity even when state law doesn't mandate it.

Wisconsin is one of only seven states requiring physicians and nurse anesthetists to carry professional liability insurance with $1 million per occurrence and $3 million aggregate limits. You'll also participate in the state's Injured Patients and Families Compensation Fund, which provides unlimited excess coverage beyond your primary policy limits.

Wisconsin's computer and mathematical occupations grow faster than any other sector, according to state workforce projections. A Milwaukee software developer's coding error that crashes a client's e-commerce platform during Black Friday can trigger lawsuits. Tech E&O insurance covers defense costs and damages when your professional services fail to meet contractual obligations.

Wisconsin ranks first nationally for construction business environment with 184,484 industry employees, with 64% working as specialty trade contractors. When a Green Bay HVAC contractor's system design recommendation results in $150,000 in efficiency losses for a dairy processing plant, professional liability insurance covers negligence claims arising from faulty professional advice that standard policies exclude.

Wisconsin's Accounting Examining Board regulates CPAs under strict professional standards while the state's $77 billion manufacturing industry creates complex tax advisory needs. When a Madison accountant's tax strategy advice triggers IRS penalties costing a dairy farm $75,000, accountants' professional liability insurance covers legal defense and settlement costs that standard business policies exclude.

Wisconsin's 480,000+ manufacturing workers and diverse small business landscape create substantial demand for professional consultants. A Racine consultant whose supply chain strategy advice costs a paper mill $200,000 in lost revenue needs professional liability insurance and client contracts typically demand $1 million minimum coverage before engagement.

How to Get the Best Professional Liability Insurance in Wisconsin

Wisconsin's diverse economy, from dairy processing to medical device manufacturing, creates unique professional liability risks that vary by industry and region. Our guide walks you through getting business insurance that addresses real challenges Wisconsin professionals encounter daily.

- 1Assess coverage needs

Identify your worst-case scenario and largest client contract requirements before choosing limits. Wisconsin manufacturing clients often demand $2 million minimum coverage: a Sheboygan consultant's failed recommendation at a paper mill can trigger claims far exceeding standard $1 million policies.

- 2Work with local agent

Wisconsin's Injured Patients and Families Compensation Fund, mandatory CPA requirements and construction bonding rules confuse national agents. Local Brookfield or Wausau agents know which carriers handle Wisconsin regulations properly and how business insurance costs vary between manufacturing and agricultural clients.

- 3Compare multiple quotes

Request quotes from three insurers and examine exclusions, deductibles and coverage triggers, not just price. When a La Crosse developer's code error shuts down a dairy plant during peak production, affordable business insurance with broad exclusions won't help.

- 4Research best providers

Check AM Best ratings and verify insurers actually write professional liability in Wisconsin because some avoid states with mandatory medical funds. Switching carriers mid-year risks coverage gaps since your old policy might deny claims filed after cancellation even for prior work.

- 5Consider bundling discounts

Bundling solves cash flow challenges for Wisconsin's seasonal businesses. An Oshkosh tourism consultant bundles professional liability with general liability and cyber coverage, saving $900 annually ($4,200 vs. $5,100). That's enough to cover winter months when revenue drops but types of business insurance coverage costs continue.

- 6Maintain continuous coverage

Wisconsin's six-year statute of limitations means clients can sue years after you complete work. A retired Janesville accountant faces exposure when a client discovers three-year-old tax advice triggered penalties. Tail coverage (extended reporting coverage) costs 1.5-3 times your annual premium but protects retirement savings.

Get Wisconsin Professional Liability Insurance Quotes

MoneyGeek can get you professional liability insurance coverage in Wisconsin by matching you to top providers for your industry area. Use our tool below to get your top company match and get tailored quotes for your business.

Get Matched to the Best WI Professional Liability Insurer for You

Select your industry and state to get a customized WI professional liability insurer match and get tailored quotes.

Wisconsin Professional Liability: Bottom Line

Wisconsin's unique regulations, from mandatory medical malpractice insurance to strict CPA board standards, make professional liability coverage more complex than most states. ERGO NEXT earns our top ranking, but don't choose based on ratings alone. Your industry, client contract requirements and worst-case claim scenarios should guide your decision. Start by identifying what your largest clients demand and what Wisconsin regulations require, then compare quotes from carriers who understand your sector's specific risks.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.