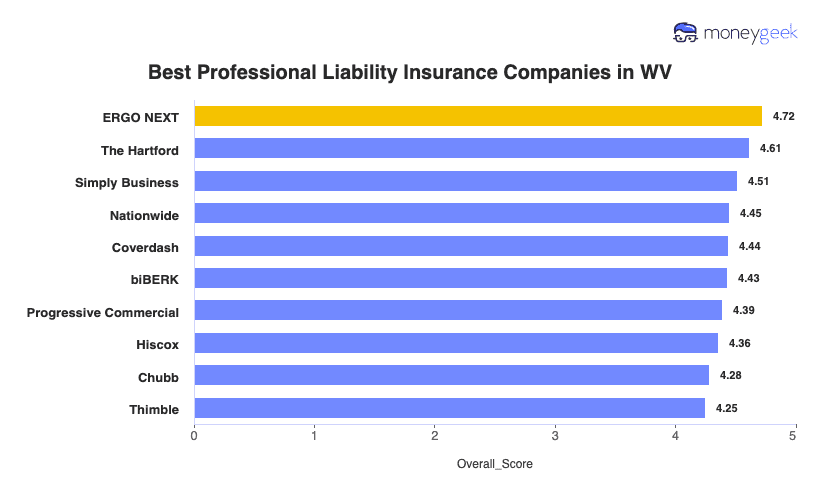

ERGO NEXT ranks first among West Virginia professional liability insurance providers with the state's lowest rates, exceptional digital experience and strong customer satisfaction scores. At $76 monthly, ERGO NEXT ties with The Hartford as the cheapest professional indemnity insurer in West Virginia, $5 below the state average. The Hartford matches this affordable rate but scores slightly lower in overall performance. Simply Business, Nationwide and Coverdash complete our top five rankings for best errors and omissions insurance in West Virginia.

Best Professional Liability Insurance in West Virginia

Get WV professional liability insurance quotes starting at $27 monthly from MoneyGeek's top companies like ERGO NEXT, The Hartford and Simply Business.

Get matched to the best professional liability insurance in WV for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

ERGO NEXT provides the best professional liability insurance in West Virginia, while The Hartford delivers the most affordable coverage starting at $76 monthly (Read More).

Professional liability insurance costs in West Virginia average $81 per month, totaling $978 annually, and rank among the more affordable states (Read More).

Professional liability insurance protects West Virginia businesses against claims from professional mistakes, errors, omissions and failure to deliver promised services (Read More).

West Virginia does not mandate professional liability insurance for most businesses, though health care providers and certain licensed professionals may face industry-specific requirements (Read More).

West Virginia business owners should request small business insurance quotes from multiple providers to compare coverage limits, deductibles and pricing options (Read More).

Best Professional Liability Insurance Companies in West Virginia

| ERGO NEXT | 4.72 | $76 |

| The Hartford | 4.61 | $76 |

| Simply Business | 4.51 | $80 |

| Nationwide | 4.45 | $86 |

| Coverdash | 4.44 | $82 |

| biBERK | 4.43 | $83 |

| Progressive Commercial | 4.39 | $79 |

| Hiscox | 4.36 | $81 |

| Chubb | 4.28 | $93 |

| Thimble | 4.25 | $79 |

How Did We Determine the Best Professional Liability Insurance in West Virginia?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

Beyond professional liability insurance in West Virginia, we've provided the following state-specific resources to get the best coverage for your business:

1. ERGO NEXT: Best Professional Liability Insurance in WV

Ranks first for West Virginia professional liability insurance

A+ Superior AM Best rating backed by Munich Re

Lowest professional liability rates in West Virginia at $76 monthly

Digital experience ranks first nationally among customers

Founded in 2016, less than 10 years in business

Claims process ranks fourth nationally

A Charleston consulting firm can't afford to lose a $50,000 contract because a traditional insurer takes three days to generate certificates. ERGO NEXT eliminates this problem. When a Morgantown client emails at 4 p.m. demanding proof of coverage before tomorrow's project kickoff, you'll send the certificate from your phone within minutes. At $76 monthly, the annual cost runs $912 instead of West Virginia's $972 average, keeping $60 in your operating budget rather than insurance overhead.

2. The Hartford: Cheapest Professional Liability Insurance in WV

Lowest professional liability rates in West Virginia at $76 monthly

A+ Superior AM Best rating with strongest capitalization levels

Claims process and overall satisfaction rank first nationally

Specialized E&O coverage for tech, legal and medical professionals

Digital experience ranks last

Agent-based model means longer quote times than instant online platforms

Your Parkersburg accounting firm can't afford discovering mid-lawsuit your errors and omissions (E&O) policy won't cover tax preparation errors. The Hartford's specialized underwriters match coverage to West Virginia professional risks instead of selling generic policies that leave CPAs exposed during audit disputes. When a Charleston consultant faces negligence claims, you work with agents ranked first nationally for claims handling, not automated systems. Pay $76 monthly instead of $81 while avoiding coverage gaps costing thousands.

3. Simply Business: Best Professional Liability Insurance Coverage Option in WV

Coverage options rank first nationally with 16+ carrier partnerships

Backed by Travelers' A++ Superior AM Best financial rating

Digital experience ranks third nationally among current customers

Broker model finds specialized policies direct insurers reject

Claims process ranks eighth nationally

Overall customer satisfaction ranks seventh nationally

Not available in Alaska or Hawaii

Your Charleston energy consultant loses a $40,000 contract because no single insurer bundles professional liability with pollution coverage, and the client won't accept separate policies. Simply Business shows which of 16 carriers offer combined coverage your contracts require. When Morgantown cannabis compliance advisors get rejected for working in "high-risk" industries, they access specialty carriers understanding West Virginia's medical marijuana regulations. You won't miss contract deadlines waiting for coverage when you compare options and download certificates instantly in 10 minutes.

Average Cost of Professional Liability Insurance in West Virginia

Professional liability insurance costs in West Virginia vary by industry. Home-based businesses pay the lowest rates at around $39 per month, while mortgage brokers pay the highest at approximately $174 per month. The filtering tool below shows exact rates for your specific business type in West Virginia.

| Accountants | $152 | $1,821 |

| Ad Agency | $103 | $1,241 |

| Auto Repair | $87 | $1,046 |

| Automotive | $78 | $941 |

| Bakery | $55 | $660 |

| Barber | $44 | $534 |

| Beauty Salon | $52 | $620 |

| Bounce House | $62 | $740 |

| Candle | $44 | $532 |

| Cannabis | $128 | $1,540 |

| Catering | $81 | $975 |

| Cleaning | $58 | $692 |

| Coffee Shop | $65 | $777 |

| Computer Programming | $109 | $1,303 |

| Computer Repair | $65 | $778 |

| Construction | $81 | $977 |

| Consulting | $114 | $1,371 |

| Contractor | $67 | $807 |

| Courier | $52 | $629 |

| DJ | $47 | $564 |

| Daycare | $115 | $1,384 |

| Dental | $88 | $1,056 |

| Dog Grooming | $57 | $681 |

| Drone | $108 | $1,294 |

| Ecommerce | $65 | $786 |

| Electrical | $68 | $819 |

| Engineering | $110 | $1,323 |

| Excavation | $72 | $861 |

| Florist | $40 | $477 |

| Food | $118 | $1,416 |

| Food Truck | $61 | $728 |

| Funeral Home | $85 | $1,018 |

| Gardening | $42 | $506 |

| HVAC | $86 | $1,030 |

| Handyman | $57 | $688 |

| Home-based business | $39 | $464 |

| Hospitality | $78 | $934 |

| Janitorial | $52 | $627 |

| Jewelry | $64 | $763 |

| Junk Removal | $69 | $826 |

| Lawn/Landscaping | $54 | $644 |

| Lawyers | $154 | $1,849 |

| Manufacturing | $63 | $751 |

| Marine | $93 | $1,122 |

| Massage | $109 | $1,310 |

| Mortgage Broker | $174 | $2,091 |

| Moving | $86 | $1,028 |

| Nonprofit | $52 | $628 |

| Painting | $67 | $807 |

| Party Rental | $58 | $693 |

| Personal Training | $74 | $891 |

| Pest Control | $100 | $1,195 |

| Pet | $49 | $584 |

| Pharmacy | $60 | $721 |

| Photography | $67 | $798 |

| Physical Therapy | $100 | $1,201 |

| Plumbing | $94 | $1,126 |

| Pressure Washing | $60 | $714 |

| Real Estate | $133 | $1,594 |

| Restaurant | $86 | $1,027 |

| Retail | $57 | $687 |

| Roofing | $101 | $1,214 |

| Security | $105 | $1,256 |

| Snack Bars | $51 | $611 |

| Software | $99 | $1,190 |

| Spa/Wellness | $115 | $1,385 |

| Speech Therapist | $105 | $1,263 |

| Startup | $76 | $914 |

| Tech/IT | $105 | $1,254 |

| Transportation | $98 | $1,178 |

| Travel | $103 | $1,233 |

| Tree Service | $79 | $945 |

| Trucking | $116 | $1,395 |

| Tutoring | $64 | $767 |

| Veterinary | $122 | $1,462 |

| Wedding Planning | $81 | $976 |

| Welding | $79 | $947 |

| Wholesale | $65 | $774 |

| Window Cleaning | $66 | $788 |

How Did We Determine These West Virginia Professional Liability Insurance Rates?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

What Does West Virginia Professional Liability Insurance Cover?

Professional liability insurance in West Virginia protects your business when clients claim you made mistakes or failed to deliver promised services. Professional liability insurance covers the costs of defending these claims and any damages you might owe. It also pays for legal fees that can quickly add up during disputes.

This coverage goes by several other names:

- Errors and omissions insurance (E&O)

- Malpractice insurance (used mainly in health care and law)

- Professional indemnity insurance

How Much Professional Liability Insurance Do I Need in West Virginia?

West Virginia doesn't mandate professional liability insurance for most businesses. Contract work requires $1 million per occurrence and $2 million aggregate coverage. Health care professionals aren't legally required to carry coverage, but West Virginia law removes the $250,000 cap on non-economic damages if you don't maintain at least $1 million per occurrence, creating strong financial incentive to carry this minimum.

Who Needs Professional Liability Insurance in West Virginia?

Certain West Virginia professionals dealing with client contracts or professional negligence claims need professional liability insurance. Your exposure increases if your work involves specialized advice, technical services or outcomes affecting clients' financial or physical well-being.

West Virginia's health care sector employs the largest workforce in the state, with WVU Medicine alone serving as the state's largest employer. Medical professionals practicing outside state-employed positions risk significant liability exposure, particularly given WV law removes the $250,000 cap on non-economic damages if you don't maintain at least $1 million per occurrence in malpractice coverage.

West Virginia requires contractor licensing for residential projects exceeding $5,000 and commercial work exceeding $25,000, with the Contractor Licensing Board issuing roughly 29,000 to 30,000 annual licenses across classifications, including electrical, HVAC, plumbing and general construction. Licensed contractors need professional liability insurance when clients require coverage as a contract condition, protecting against claims of defective work, project delays or failure to meet specifications.

West Virginia's emerging technology sector, including cybersecurity firms, cloud services providers and data center operations serving federal agencies and defense contractors, carries unique liability risks concentrated in Charleston and Morgantown. Tech E&O insurance protects IT consultants, software developers and cybersecurity professionals from claims arising from data breaches, system failures or missed project deliverables.

West Virginia's business community relies on certified public accountants and financial advisors across Charleston, Huntington, Morgantown and smaller commercial centers. Accountants' professional liability insurance covers claims stemming from tax preparation errors, audit mistakes or financial advice that causes client losses.

West Virginia's manufacturing sectors, supporting $4.3 billion in annual exports, depend on licensed engineers for chemical plants, automotive parts production, aerospace operations and public infrastructure projects. Engineers working on industrial facilities, energy installations or construction projects need coverage for claims related to design flaws, safety failures or regulatory violations.

How to Get the Best Professional Liability Insurance in West Virginia

Our guide explains how to get business insurance in West Virginia that matches your professional liability needs and budget. These six steps gives you the financial protection your business needs.

- 1Assess coverage needs

Identify your business risks and contract requirements before shopping for coverage. A Charleston tech firm bidding on federal cybersecurity contracts discovers it needs $2 million in coverage because government agencies won't accept the standard $1 million policy that would cover your Morgantown retail consulting work.

- 2Work with local agent

Seek an agent who understands West Virginia's market and knows which insurers actually write policies in rural counties versus those limiting coverage to Charleston and Huntington metro areas. Agents familiar with business insurance costs across the state explain why your Parkersburg engineering firm serving chemical manufacturers pays different rates than a Martinsburg firm working primarily with Maryland clients.

- 3Compare multiple quotes

Request quotes from at least three insurers because your Beckley contractor business lost a Toyota supplier contract last year when the low-cost policy excluded the specific manufacturing work the client required. Compare policy exclusions and coverage limits, not just affordable business insurance premiums, since a claim exceeding your limits costs far more than slightly higher monthly payments.

- 4Research best providers

Check AM Best financial ratings and verify the insurer actually handles claims in West Virginia rather than forcing you to deal with out-of-state adjusters unfamiliar with state regulations. Your Wheeling medical practice needs an insurer experienced with West Virginia's unique malpractice damage cap laws that change based on whether you carry $1 million in coverage.

- 5Consider bundling discounts

Ask insurers about combining professional liability with general liability or property coverage since most offer package discounts. Your Clarksburg accounting firm saved $1,800 annually (18% reduction) by bundling professional liability with cyber coverage after a client's data breach made you realize both risks threatened your practice.

- 6Maintain continuous coverage

Claims-made policies only cover lawsuits filed during active policy periods, creating gaps when you switch carriers without continuous protection. A Morgantown IT consultant switched to a cheaper insurer but got sued six months later for work performed under the old policy. Without tail coverage (extended reporting period), that $40,000 in legal fees came straight out of pocket.

Get West Virginia Professional Liability Insurance Quotes

MoneyGeek matches West Virginia business owners with professional liability insurance providers specialized in your industry. Use our tool below to compare multiple insurers and receive customized quotes for your business.

Get Matched to the Best WV Professional Liability Insurer for You

Select your industry and state to get a customized WV professional liability insurer match and get tailored quotes.

West Virginia Professional Liability: Bottom Line

Professional liability insurance in West Virginia protects your business from costly claims. ERGO NEXT leads our ratings, but your specific needs matter more. Your client contracts, industry requirements and budget shape your coverage decisions. Identify your exposure level, then compare insurers through a local agent to find coverage matching your risk profile.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.