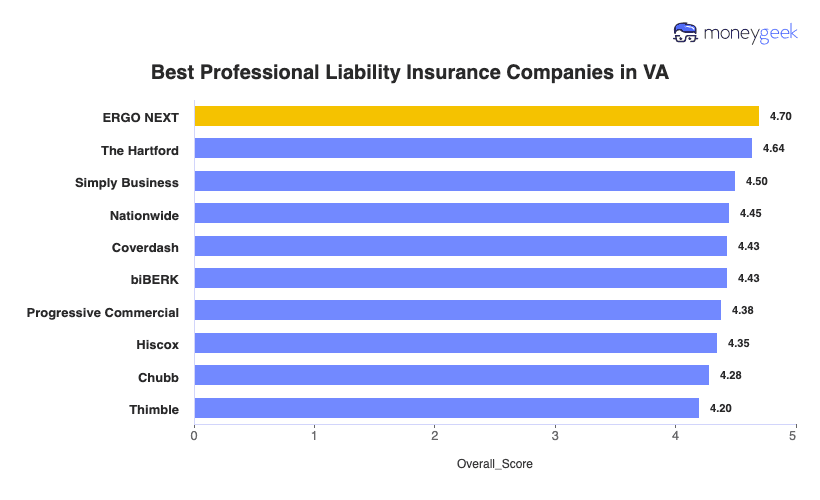

ERGO NEXT ranks first for Virginia professional liability insurance with competitive rates, highly-rated digital tools and customer service that scores high with small business owners. The Hartford provides the cheapest professional indemnity insurance in Virginia at $65 monthly, $6 less than the state average. Simply Business, Nationwide, Coverdash and biBerk also rank highly top errors and omissions insurance providers in Virginia.

Best Professional Liability Insurance in Virginia

Get VA professional liability insurance quotes starting at $23 monthly from MoneyGeek's top companies like ERGO NEXT, The Hartford and Simply Business.

Get matched to the best professional liability insurance in VA for you below.

Updated: January 29, 2026

Advertising & Editorial Disclosure

ERGO NEXT provides the best professional liability insurance in Virginia, while The Hartford has the most affordable coverage starting at $65 monthly (Read more).

Professional liability insurance costs in Virginia average $71 monthly ($850 annually), placing the state among the more affordable options nationwide (Read more).

Professional liability insurance provides financial protection for Virginia professionals when work-related mistakes, negligence claims or missed contractual deadlines lead to lawsuits (Read more).

Virginia doesn't require most businesses to carry professional liability insurance, though health care providers and other regulated professions need coverage (Read more).

Virginia professionals should request small business insurance quotes from multiple providers to get the best coverage and pricing (Read more).

Best Professional Liability Insurance Companies in Virginia

| ERGO NEXT | 4.70 | $66 |

| The Hartford | 4.64 | $65 |

| Simply Business | 4.50 | $69 |

| Nationwide | 4.45 | $75 |

| Coverdash | 4.43 | $71 |

| biBERK | 4.43 | $72 |

| Progressive Commercial | 4.38 | $68 |

| Hiscox | 4.35 | $71 |

| Chubb | 4.28 | $81 |

| Thimble | 4.20 | $70 |

How Did We Determine The Best Professional Liability Insurance in Virginia?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on your business factors. Contact insurers directly for accurate pricing for your business needs.

Professional liability insurance represents just one part of comprehensive business protection in Virginia. These additional state-specific guides can help you build complete coverage:

1. ERGO NEXT: Best Professional Liability Insurance in VA

Ranks first for customer service in Virginia

Highly-rated digital platform with instant certificate access

10-minute online application, no agent required

Second most affordable, offering competitive rates

Less than 10 years in business

Claims handling ranks fourth nationally

Virginia contract work requires proof of insurance before you start. ERGO NEXT delivers same-day certificates without agent calls and makes coverage decisions in minutes. Northern Virginia clients need documentation for project approvals, and ERGO NEXT's mobile app lets you pull certificates on-site or update coverage between client meetings. You'll pay $66 monthly.

2. The Hartford: Cheapest Professional Liability Insurance in VA

Lowest professional liability rates in Virginia at $65 monthly

First-ranked claims handling for professional negligence disputes

Industry-specific E&O coverage for tech, legal and consulting professionals

A++ Superior financial strength rating from AM Best

Digital experience ranks 10th nationally

Not available in Alaska and Hawaii

Your three-person firm pays $65 monthly and saves $816 annually compared to competitors, enough to hire contract help during busy season or upgrade equipment. When a Fairfax client sues claiming your IT consulting advice caused a data breach, The Hartford's tech E&O coverage and first-ranked claims team defend you with lawyers who understand Virginia technology contracts. Richmond accounting firms and Alexandria legal practices choose The Hartford because 200-plus years handling professional negligence claims beats a polished app when your business gets hit with a $500,000 lawsuit.

3. Simply Business: Best Professional Liability Insurance Coverage Options in VA

Coverage options rank first with access to 16+ carriers

Digital quote comparison platform ranked third nationally

Backed by Travelers' A++ Superior financial rating

Broker model finds policies for hard-to-insure professions

Claims process ranks eighth in MoneyGeek's research

Overall customer satisfaction ranks seventh nationally

Higher rates than other insurers

Getting rejected for professional liability coverage puts your contracts at risk. After two insurers turn down your Charlottesville cybersecurity firm for handling government data, Simply Business finds specialized tech E&O with data breach defense, and you sign the contract instead of losing it. When Reston consultants with past claims can't get quotes anywhere, Simply Business covers them for $69 per month. Northern Virginia contractors land $200,000 federal projects because Simply Business delivers the higher limits agencies require without days of agent calls.

Average Cost of Professional Liability Insurance in Virginia

Professional liability insurance costs in Virginia vary widely by industry. Home-based businesses pay the lowest rates at around $34 per month, while mortgage brokers pay the highest costs at about $152 per month. You can find pricing for your industry using the filtering tool below.

| Accountants | $131 | $1,576 |

| Ad Agency | $92 | $1,099 |

| Auto Repair | $76 | $907 |

| Automotive | $68 | $815 |

| Bakery | $49 | $588 |

| Barber | $40 | $481 |

| Beauty Salon | $45 | $541 |

| Bounce House | $55 | $663 |

| Candle | $39 | $462 |

| Cannabis | $111 | $1,334 |

| Catering | $72 | $864 |

| Cleaning | $50 | $604 |

| Coffee Shop | $55 | $659 |

| Computer Programming | $96 | $1,154 |

| Computer Repair | $57 | $687 |

| Construction | $70 | $838 |

| Consulting | $96 | $1,148 |

| Contractor | $57 | $683 |

| Courier | $45 | $545 |

| DJ | $42 | $500 |

| Daycare | $99 | $1,192 |

| Dental | $78 | $930 |

| Dog Grooming | $51 | $610 |

| Drone | $97 | $1,160 |

| Ecommerce | $57 | $678 |

| Electrical | $58 | $699 |

| Engineering | $95 | $1,136 |

| Excavation | $63 | $753 |

| Florist | $34 | $404 |

| Food | $100 | $1,194 |

| Food Truck | $54 | $642 |

| Funeral Home | $73 | $870 |

| Gardening | $37 | $438 |

| HVAC | $74 | $887 |

| Handyman | $49 | $586 |

| Home-based business | $34 | $403 |

| Hospitality | $67 | $808 |

| Janitorial | $46 | $550 |

| Jewelry | $57 | $684 |

| Junk Removal | $60 | $721 |

| Lawn/Landscaping | $46 | $550 |

| Lawyers | $133 | $1,596 |

| Manufacturing | $55 | $659 |

| Marine | $80 | $962 |

| Massage | $95 | $1,141 |

| Mortgage Broker | $152 | $1,827 |

| Moving | $74 | $886 |

| Nonprofit | $45 | $546 |

| Painting | $60 | $715 |

| Party Rental | $50 | $606 |

| Personal Training | $64 | $763 |

| Pest Control | $87 | $1,045 |

| Pet | $43 | $512 |

| Pharmacy | $52 | $626 |

| Photography | $58 | $700 |

| Physical Therapy | $87 | $1,042 |

| Plumbing | $82 | $986 |

| Pressure Washing | $53 | $632 |

| Real Estate | $113 | $1,360 |

| Restaurant | $75 | $902 |

| Retail | $49 | $592 |

| Roofing | $91 | $1,088 |

| Security | $90 | $1,076 |

| Snack Bars | $43 | $519 |

| Software | $88 | $1,060 |

| Spa/Wellness | $99 | $1,193 |

| Speech Therapist | $92 | $1,103 |

| Startup | $67 | $801 |

| Tech/IT | $90 | $1,079 |

| Transportation | $86 | $1,032 |

| Travel | $89 | $1,064 |

| Tree Service | $70 | $834 |

| Trucking | $100 | $1,194 |

| Tutoring | $55 | $657 |

| Veterinary | $105 | $1,265 |

| Wedding Planning | $70 | $835 |

| Welding | $70 | $834 |

| Wholesale | $56 | $667 |

| Window Cleaning | $57 | $686 |

How Did We Determine These Virginia Professional Liability Insurance Rates?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

What Does Virginia Professional Liability Insurance Cover?

Virginia professional liability insurance provides financial protection when clients claim you gave bad advice, made errors or didn't deliver promised services. The coverage pays liability damages and legal defense costs when clients sue.

Professional liability insurance is also called:

- Errors and omissions insurance (E&O)

- Malpractice insurance (for legal and medical professionals)

- Professional indemnity insurance

How Much Professional Liability Insurance Do I Need in Virginia?

Most Virginia businesses aren't required by state law to carry professional liability insurance. But clients usually require $1 million per occurrence and $2 million aggregate coverage before awarding contracts. Health care providers deal with different rules: state law doesn't mandate malpractice insurance, but hospitals require coverage that matches Virginia's $2.7 million damages cap for credentialing.

Who Needs Professional Liability Insurance in Virginia?

Virginia professionals handling client contracts or providing services where negligence claims could arise should consider professional liability insurance. The Commonwealth's concentration of government contractors, tech workers and licensed professionals creates unique exposure that requires specialized coverage.

Virginia hosts the nation's largest data center market and the highest concentration of technology workers. IT consultants serving federal contractors and defense clients need professional liability coverage for data breach risks and failed implementations. Tech E&O insurance addresses Virginia-specific risks like data breaches affecting government clients and failed implementations for defense industry projects where security clearances amplify damages.

With Naval Station Norfolk (the world's largest naval base) and $36 billion in annual defense industry economic impact, Virginia contractors must meet strict federal performance requirements and deal with potential contract disputes worth millions. Professional liability coverage provides financial protection when deliverables don't meet Department of Defense specifications or project delays result in penalty clauses in government contracts.

Virginia doesn't mandate malpractice insurance by state law, but hospitals require coverage matching the Commonwealth's $2.7 million damages cap for credentialing. Medical professionals practicing without this coverage lose hospital privileges and carry personal liability for claims exceeding what they can pay out of pocket.

With Freddie Mac and Capital One headquartered in McLean and the Fifth District Federal Reserve Bank anchoring Richmond's financial sector, Virginia advisors handle complex portfolios requiring professional liability protection. Investment errors, compliance failures or breach of fiduciary duty claims in Northern Virginia's affluent counties regularly exceed $1 million in damages.

Virginia's Department of Professional and Occupational Regulation oversees more than 300,000 licensed construction professionals through 18 regulatory boards, and clients increasingly require professional liability coverage before awarding contracts. Claims for design defects, code violations and project delays can arise even when general liability covers property damage, since contract performance failures need E&O coverage.

How to Get the Best Professional Liability Insurance in Virginia

Our step-by-step guide on getting business insurance helps businesses get coverage that fits their needs. Understanding these Virginia-specific considerations helps you secure coverage that protects your business when clients file claims.

- 1Assess your professional liability insurance coverage needs

Evaluate whether you'll serve government clients requiring security clearances, as federal contracting work in Northern Virginia demands higher coverage limits and cyber liability protection. A Reston IT consultant landing their first Department of Defense contract needs $2 million in coverage to meet agency requirements, while a Winchester retail consultant serving local businesses needs only the standard $1 million policy.

- 2Work with a local agent

Choose agents who know Virginia's federal procurement market. Northern Virginia government contractors pay more than rural businesses, and good agents explain why. Norfolk defense contractors pay 40% more than similar Lynchburg firms, not because of location, but because federal contracts expose businesses to higher liability risks.

Read more: How Much Does Small Business Insurance Cost?

- 3Get quotes and compare coverage details

Don't chase cheap business insurance without examining what you're actually buying. Low premiums often exclude federal contract work or cap technology errors coverage at inadequate limits. An Alexandria cybersecurity consultant discovered her $800 annual policy excluded government clients entirely, forcing her to decline a $200,000 Pentagon contract because getting proper coverage would take three weeks.

- 4Research the best providers

Verify insurers understand Virginia's regulatory requirements, from the State Corporation Commission's insurance standards to professional licensing through the Department of Professional and Occupational Regulation. Check AM Best ratings, but also confirm the carrier has experience with claims involving federal contracts. For example, a Richmond IT firm waited six months for claim approval because its insurer had never handled a government contractor E&O case.

- 5Consider bundling discounts

Virginia businesses serving both commercial and government clients can bundle professional liability with cyber insurance and save 20% while meeting federal security requirements. A Virginia Beach engineering firm reduced annual premiums from $4,200 to $3,360 by bundling coverage, using the $840 savings to fund CMMC compliance consulting. Combining types of business insurance addresses multiple federal contracting requirements at once.

- 6Don't let your coverage lapse

Federal contractors switching insurers risk coverage gaps that disqualify them from bidding on new contracts, since agencies require continuous professional liability coverage. A Fairfax management consultant lost a $500,000 contract opportunity during a two-week gap between policies. Purchasing tail coverage (extended reporting coverage) from your old insurer before switching prevents this expensive mistake.

Get Virginia Professional Liability Insurance Quotes

MoneyGeek's matching tool connects you with top insurers experienced in your industry, whether you're a Northern Virginia government contractor, Richmond financial advisor or Charlottesville consultant. Use our tool below to get your top company match and get quotes for your business.

Get Matched to the Best VA Professional Liability Insurer for You

Select your industry and state to get a customized VA professional liability insurer match and get tailored quotes.

Virginia Professional Liability: Bottom Line

Choosing professional liability insurance in Virginia depends on your industry risks, client contract requirements and whether you'll serve federal agencies or need hospital credentials. ERGO NEXT ranks first overall, but Virginia businesses must match coverage to their specific challenges: government contractors need cyber liability bundled in, while health care professionals need policies meeting the Commonwealth's $2.7 million credentialing standards. Assess your exposure, compare quotes from experienced Virginia agents and get coverage that protects your business when claims arise.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.