For Louisiana small business owners seeking professional liability coverage, ERGO NEXT ranks as the best provider with competitive pricing, top-rated digital experience and personalized coverage matching. The Hartford offers the cheapest professional indemnity insurance in Louisiana at $83 monthly, saving businesses $5 per month compared to the state average. Simply Business, biBERK and Coverdash complete our rankings as strong alternatives for errors and omissions insurance in the state.

Best Professional Liability Insurance in Louisiana

Get LA professional liability insurance quotes starting at $30 monthly from MoneyGeek's top companies like ERGO NEXT, The Hartford and Simply Business.

Get matched to the best professional liability insurance in LA for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

ERGO NEXT provides the best professional liability insurance in Louisiana, while The Hartford offers the most affordable coverage starting at $83 monthly (Read More).

Professional liability insurance costs in Louisiana average $88 monthly ($1,051 annually), placing the state among the more affordable options nationwide (Read More).

Professional liability insurance protects Louisiana businesses against financial losses from professional mistakes, missed deadlines and errors in service delivery (Read More).

Louisiana doesn't require most businesses to carry professional liability insurance, though health care providers and other regulated professions need coverage (Read More).

Louisiana business owners should request small business insurance quotes from multiple providers to compare coverage limits and find the best professional liability rates (Read More).

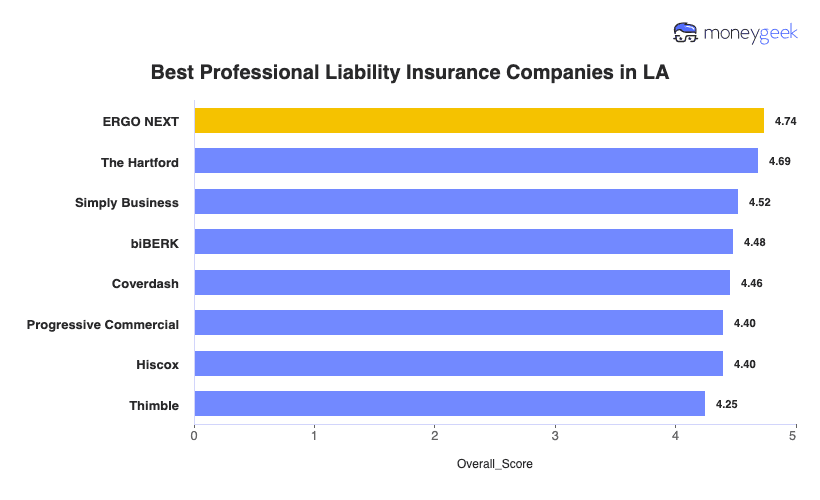

Best Professional Liability Insurance Companies in Louisiana

| ERGO NEXT | 4.74 | $84 |

| The Hartford | 4.69 | $83 |

| Simply Business | 4.52 | $89 |

| biBERK | 4.48 | $90 |

| Coverdash | 4.46 | $90 |

| Progressive Commercial | 4.40 | $88 |

| Hiscox | 4.40 | $88 |

| Thimble | 4.25 | $88 |

How Did We Determine the Best Professional Liability Insurance in Louisiana?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

Professional liability insurance in Louisiana covers just one aspect of protecting your business. We've compiled these additional state-specific guides to help you build comprehensive coverage:

1. ERGO NEXT: Best Professional Liability Insurance in LA

Ranks first for professional liability insurance in Louisiana

Top-rated digital experience with instant certificates of insurance

Best customer service ratings among Louisiana providers studied

Second-lowest rates for professional liability coverage statewide

Personalized coverage matching for both types and limit amounts

Less than 10 years in business

Claims handling ranks fourth nationally among studied providers

ERGO NEXT ranks as Louisiana's best professional liability insurer with competitive rates averaging $84 monthly and the highest customer service scores statewide. Business owners from New Orleans to Shreveport benefit from the company's digital platform, which delivers personalized coverage matching for policy types and limits, plus instant certificates in under 10 minutes. Customers rated ERGO NEXT first nationally for digital experience and policy management, making the insurer ideal for busy professionals needing quick, reliable coverage.

2. The Hartford: Cheapest Professional Liability Insurance in LA

Lowest professional liability insurance rates in Louisiana

Best claims handling and overall satisfaction ratings nationally

A+ Superior financial strength rating from AM Best

Personalized E&O coverage for tech, legal and medical professionals

Digital experience ranks 10th among studied providers

Not available in Alaska and Hawaii

The Hartford offers Louisiana's cheapest professional liability insurance at $83 monthly, saving business owners $51 annually compared to the state average. Professionals from Baton Rouge to Lafayette benefit from The Hartford's 200+ years of experience and agent-guided purchase process. Customers ranked the company first nationally for claims handling and overall satisfaction, making The Hartford ideal for business owners prioritizing affordable rates and personalized service over fully digital experiences.

3. Simply Business: Best Professional Liability Insurance Coverage Options in LA

Ranks first for coverage options with access to more than 16 carriers offering specialized policies

Backed by Travelers' A++ Superior financial rating

Lets you compare multiple quotes in 10 minutes instead of calling individual insurers

Broker model finds coverage for hard-to-insure businesses that other insurers reject

More expensive than other providers in MoneyGeek's study

Claims process ranks eighth nationally, indicating slower resolution times

You'll benefit from Simply Business's broker model in Louisiana if you need specialized professional liability coverage or operate in hard-to-insure industries. You'll pay $89 monthly while gaining access to over 20 carriers instead of calling insurers separately. It's ideal for Louisiana's unique industries like offshore oil and gas contractors, maritime charter operators, environmental remediation businesses and hospitality venues with third-party liability exposure. The broker approach proves valuable for businesses rejected by direct insurers.

Average Cost of Professional Liability Insurance in Louisiana

Professional liability insurance costs in Louisiana vary by industry. Home-based businesses pay the lowest rates at around $42 per month, while mortgage brokers face the highest costs at approximately $184 per month. You can find specific rates for your industry using the filtering tool below to compare options for your business.

| Accountants | $163 | $1,959 |

| Ad Agency | $127 | $1,529 |

| Auto Repair | $94 | $1,127 |

| Automotive | $85 | $1,022 |

| Bakery | $60 | $716 |

| Barber | $47 | $569 |

| Beauty Salon | $56 | $667 |

| Bounce House | $67 | $798 |

| Candle | $47 | $561 |

| Cannabis | $137 | $1,640 |

| Catering | $87 | $1,049 |

| Cleaning | $63 | $756 |

| Coffee Shop | $69 | $829 |

| Computer Programming | $114 | $1,362 |

| Computer Repair | $73 | $881 |

| Construction | $86 | $1,031 |

| Consulting | $121 | $1,454 |

| Contractor | $71 | $855 |

| Courier | $60 | $721 |

| DJ | $50 | $604 |

| Daycare | $120 | $1,446 |

| Dental | $102 | $1,229 |

| Dog Grooming | $62 | $741 |

| Drone | $121 | $1,453 |

| Ecommerce | $71 | $848 |

| Electrical | $80 | $955 |

| Engineering | $114 | $1,374 |

| Excavation | $76 | $911 |

| Florist | $42 | $502 |

| Food | $117 | $1,400 |

| Food Truck | $67 | $800 |

| Funeral Home | $88 | $1,061 |

| Gardening | $45 | $535 |

| HVAC | $93 | $1,117 |

| Handyman | $61 | $735 |

| Home-based business | $42 | $501 |

| Hospitality | $83 | $995 |

| Janitorial | $55 | $663 |

| Jewelry | $69 | $828 |

| Junk Removal | $76 | $914 |

| Lawn/Landscaping | $58 | $697 |

| Lawyers | $165 | $1,975 |

| Manufacturing | $67 | $802 |

| Marine | $101 | $1,206 |

| Massage | $117 | $1,406 |

| Mortgage Broker | $184 | $2,213 |

| Moving | $91 | $1,089 |

| Nonprofit | $57 | $685 |

| Painting | $71 | $852 |

| Party Rental | $61 | $731 |

| Personal Training | $80 | $962 |

| Pest Control | $106 | $1,275 |

| Pet | $53 | $638 |

| Pharmacy | $70 | $846 |

| Photography | $71 | $852 |

| Physical Therapy | $106 | $1,270 |

| Plumbing | $100 | $1,205 |

| Pressure Washing | $66 | $794 |

| Real Estate | $140 | $1,679 |

| Restaurant | $93 | $1,110 |

| Retail | $63 | $752 |

| Roofing | $106 | $1,278 |

| Security | $113 | $1,358 |

| Snack Bars | $54 | $653 |

| Software | $105 | $1,258 |

| Spa/Wellness | $125 | $1,497 |

| Speech Therapist | $112 | $1,343 |

| Startup | $81 | $966 |

| Tech/IT | $109 | $1,309 |

| Transportation | $107 | $1,279 |

| Travel | $108 | $1,299 |

| Tree Service | $85 | $1,017 |

| Trucking | $124 | $1,486 |

| Tutoring | $68 | $812 |

| Veterinary | $133 | $1,592 |

| Wedding Planning | $86 | $1,028 |

| Welding | $87 | $1,042 |

| Wholesale | $69 | $825 |

| Window Cleaning | $69 | $831 |

How Did We Determine These Louisiana Professional Liability Insurance Rates?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

What Does Louisiana Professional Liability Insurance Cover?

Professional liability insurance in Louisiana protects your business when clients claim you made mistakes or failed to deliver promised services. Professional liability insurance covers damages from these claims and pays for legal costs to defend your business. This coverage goes by several different names:

- Errors and omissions insurance (E&O)

- Malpractice insurance (used mainly in health care and law)

- Professional indemnity insurance

How Much Professional Liability Insurance Do I Need in Louisiana?

Louisiana doesn't mandate professional liability insurance for most businesses. Health care providers enrolled in the Patient Compensation Fund must carry $100,000 per occurrence and $300,000 aggregate coverage. Contract work in other industries requires $1 million per occurrence and $2 million aggregate, though state law doesn't mandate these amounts for non-health care businesses.

Who Needs Professional Liability Insurance in Louisiana?

If you handle client contracts or provide services that could lead to professional negligence claims, consider professional liability insurance in Louisiana. Businesses providing specialized services face significant liability exposure.

Louisiana's energy sector drives demand for specialized contractors serving oil refineries, petrochemical plants and LNG facilities. Energy contractors need professional liability insurance because Louisiana's environmental regulations hold them accountable for pollution remediation work, site assessment errors and compliance failures in the state's concentrated industrial corridor along the Mississippi River.

Louisiana's growing technology sector benefits from the state's Digital Interactive Media tax credit program, attracting software developers and digital media companies to New Orleans, Baton Rouge and Shreveport. Tech professionals need tech E&O insurance because Louisiana's program creates contractual obligations with clients that expose developers to claims for software errors, missed deadlines or intellectual property disputes.

The Louisiana State Licensing Board for Contractors requires licenses for commercial projects exceeding $50,000 and residential work over $50,000. Construction contractors need professional liability insurance because Louisiana law holds them liable for design defects, construction management errors and failure to meet building code requirements that can result in costly claims from property owners.

Louisiana's Patient Compensation Fund requires health care providers to carry $100,000 per occurrence and $300,000 aggregate malpractice coverage as a prerequisite for fund enrollment. Medical professionals need this specialized professional liability coverage because Louisiana's medical malpractice system caps total damages at $500,000, with providers liable for the first $100,000 and the fund covering additional amounts.

Louisiana Economic Development's Quality Jobs Program supports consulting firms serving multi-state companies, creating growth in professional services. Financial advisors and consultants need professional liability insurance because Louisiana's civil law system creates unique contractual interpretation risks and these professionals face claims for negligent advice, missed filing deadlines or errors in financial planning recommendations.

How to Get the Best Professional Liability Insurance in Louisiana

Our step-by-step guide helps Louisiana businesses secure professional liability coverage that matches their needs and budget. Understanding how to get business insurance specific to Louisiana's business environment ensures you make informed decisions.

- 1Assess your professional liability insurance coverage needs

Evaluate your business risks based on Louisiana's civil law system, your client contracts and industry-specific exposures like environmental liability in the energy sector or tax credit compliance for digital media firms. A New Orleans software developer serving clients under Louisiana's Digital Interactive Media tax credit program faces different contractual risk than a Lafayette engineer designing petrochemical facilities.

- 2Work with a local agent

Seek an agent who understands Louisiana's regional economic differences, from Baton Rouge's government and university-driven professional services to Shreveport's health care and technology sectors. Local expertise helps explain how business insurance costs vary between serving the Port of South Louisiana's maritime clients versus consulting for Lake Charles refineries.

- 3Get quotes and compare coverage details

Request quotes from at least three insurers and examine policy exclusions relevant to Louisiana industries, such as pollution liability for energy contractors or claims-made triggers for consulting work. When comparing affordable business insurance options, a Metairie financial advisor should verify coverage includes Louisiana's unique civil code contractual disputes beyond standard E&O protection.

- 4Research the best providers

Evaluate insurers based on their experience handling professional liability claims in Louisiana's civil law jurisdiction, where contract interpretation follows codified statutes rather than judicial precedent. Check AM Best ratings and research whether insurers understand Louisiana-specific risks like Patient Compensation Fund requirements for health care providers or LSLBC compliance for contractors.

- 5Consider bundling discounts

Louisiana insurers commonly offer 15% to 25% premium reductions when you package professional liability with other types of business insurance like general liability and cyber coverage, particularly for businesses in growth sectors. A Baton Rouge consulting firm serving Louisiana Economic Development's Quality Jobs Program clients can bundle professional liability with cyber insurance and general liability for comprehensive protection at reduced rates.

- 6Don't let your coverage lapse

Professional liability operates on a claims-made basis, covering lawsuits filed during your active policy period regardless of when the work occurred. A Shreveport architectural firm switching insurers after completing designs for industrial projects should purchase tail coverage (extended reporting coverage) to maintain protection if construction defect claims emerge years after project completion.

Get Louisiana Professional Liability Insurance Quotes

MoneyGeek can help you get professional liability insurance coverage in Louisiana by matching you with top providers in your industry. Use our tool below to get your top company match and get tailored quotes for your business.

Get Matched to the Best LA Professional Liability Insurer for You

Select your industry and state to get a customized LA professional liability insurer match and get tailored quotes.

Louisiana Professional Liability: Bottom Line

Finding the right professional liability insurance in Louisiana comes down to understanding your business risks and working with the right provider. ERGO NEXT earns our top rating, but your industry, client contracts and budget should guide your final decision. Start by assessing your needs, then let a local agent help you compare options and secure coverage that financially protects your business.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.